January 2025

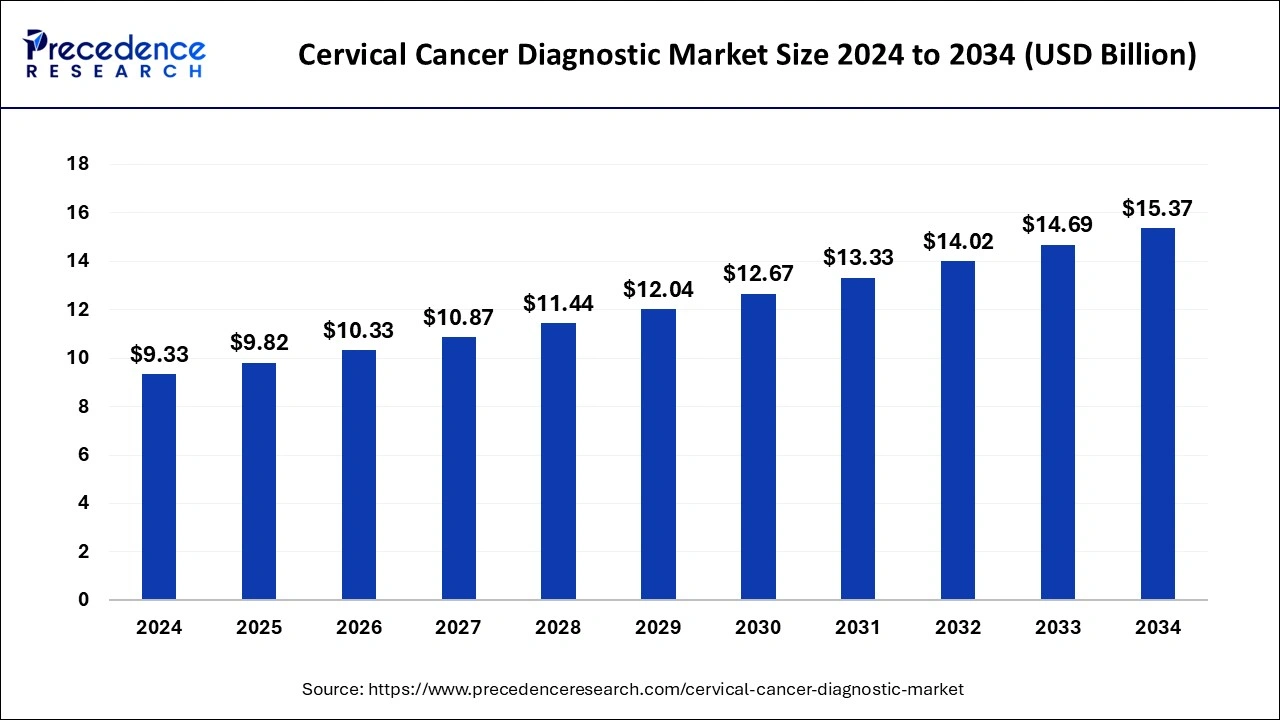

The global cervical cancer diagnostic market size is calculated at USD 9.82 billion in 2025 and is predicted to surpass around USD 15.37 billion by 2034, accelerating at a CAGR of 5.12% from 2025 to 2034. The North America cervical cancer diagnostic market size surpassed USD 4.85 billion in 2024 and is expanding at a CAGR of 5.15% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cervical cancer diagnostic market size accounted for USD 9.33 billion in 2024 and it is expected to hit around USD 15.37 billion by 2034, expanding at a CAGR of 5.12% during the forecast period from 2025 to 2034.

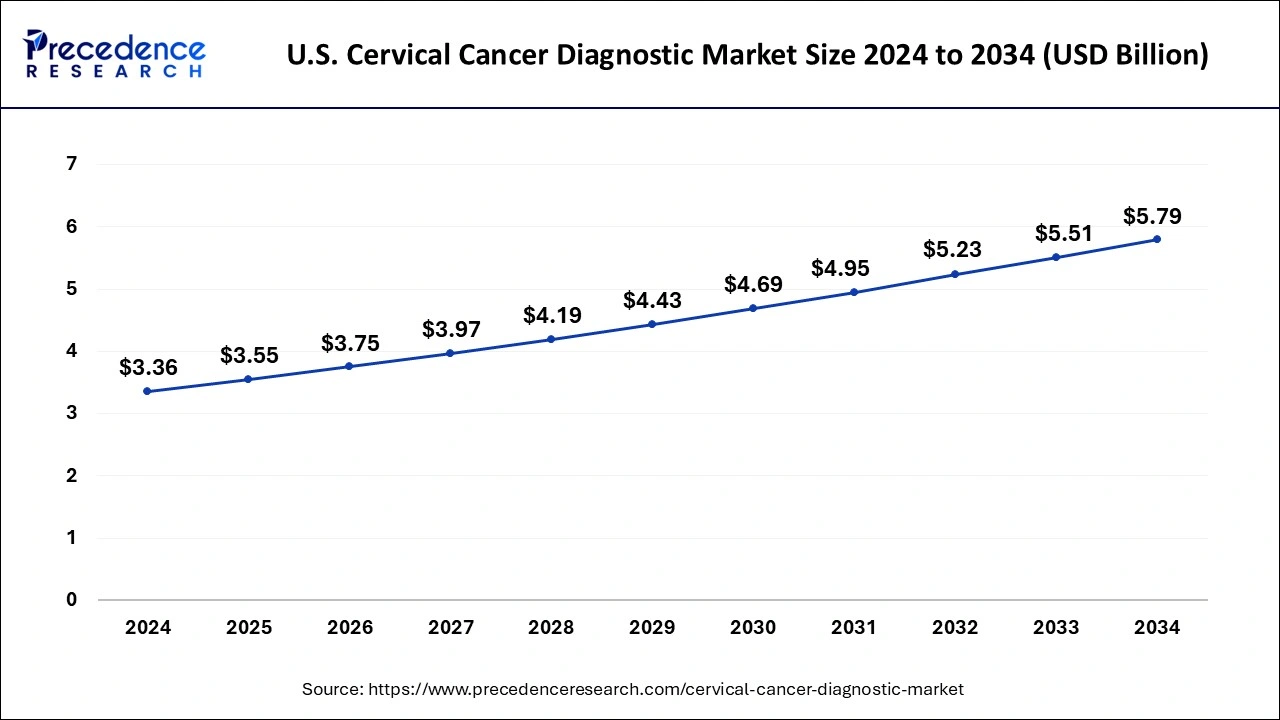

The U.S. cervical cancer diagnostic market size reached USD 3.36 billion in 2024 and is projected to be worth around USD 5.79 billion by 2034, poised to grow at a CAGR of 5.59% from 2025 to 2034.

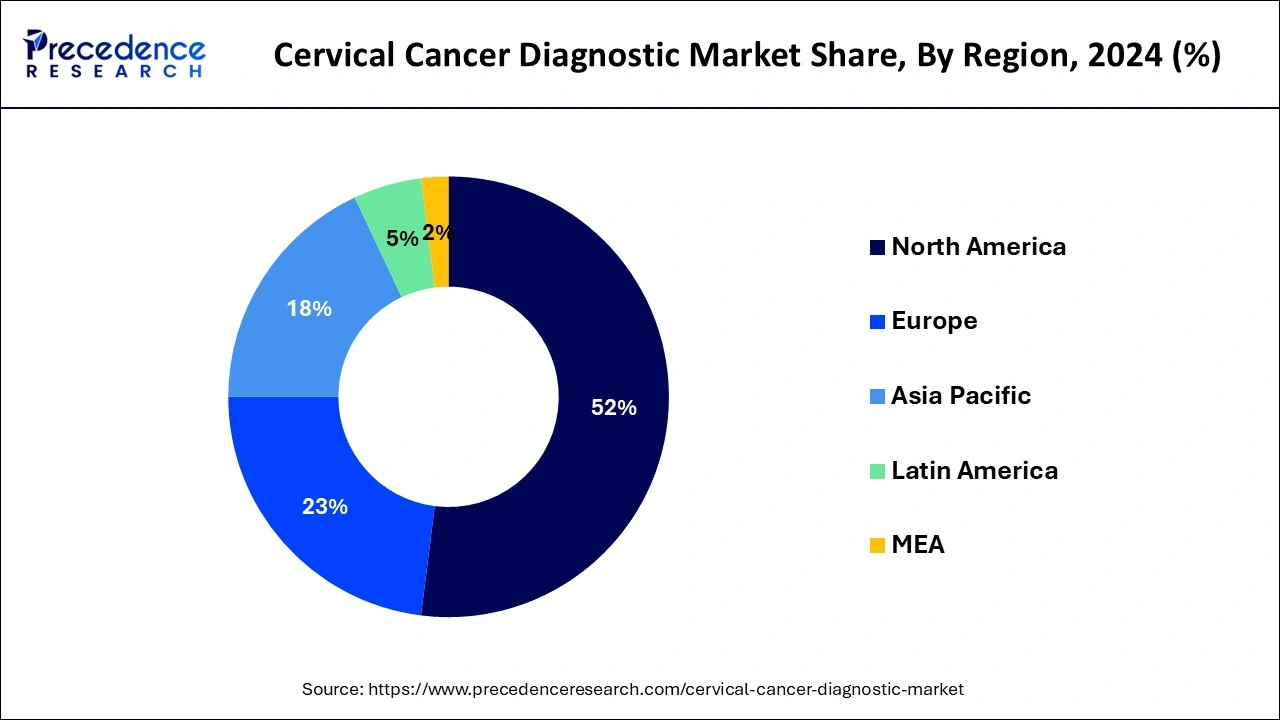

The North American market is projected to be the leading force in the global cervical cancer diagnostic market. This is mainly due to the high occurrence of cervical cancer in the region and the presence of advanced diagnostic technologies. The market growth in this region is expected to be fuelled by the growing adoption of preventive care and regular screening programs.

The European market is anticipated to experience substantial growth. This can be attributed to the rising awareness about cervical cancer screening and the availability of advanced diagnostic technologies.

The Asia-Pacific market is projected to experience rapid growth due to the rising prevalence of cervical cancer and the increasing demand for advanced diagnostic technologies. The market in this region is expected to be driven by the growing healthcare expenditure and the increasing awareness of the importance of early detection and screening.

The Latin American market is anticipated to witness significant growth due to the growing adoption of cervical cancer screening programs and the demand for advanced diagnostic technologies. The market growth in this region is also expected to be driven by the increasing healthcare expenditure and the rising awareness of the importance of early detection and screening.

Cervical cancer diagnosis usually requires a series of tests and procedures. These diagnostic methods include pap smear tests, human papillomavirus (HPV) tests, biopsies, imaging techniques such as ultrasound, computed tomography, and magnetic resonance imaging scans, and others. During a pelvic exam, the doctor will visually inspect your cervix for any irregularities. The Pap test involves collecting cells from your cervix to detect any abnormal changes. The HPV test is conducted to check for the presence of the virus that can cause cervical cancer. If any of these tests show abnormal results, further examinations like a biopsy or colposcopy may be necessary. It is crucial to undergo regular cervical cancer screenings to detect any potential problems at an early stage.

The market for diagnosing cervical cancer has grown significantly in recent years. This growth can be attributed to several factors, including increased awareness, improved screening programs, and advancements in diagnostic technologies. Cervical cancer is a major global health concern, and detecting it early is crucial for better patient outcomes. One of the main reasons for the growth of the cervical cancer diagnostic market is the increasing prevalence of the disease worldwide. Cervical cancer continues to be a significant cause of illness and death among women, particularly in low- and middle-income countries where access to healthcare resources is limited. As more women become aware of cervical cancer and the importance of early detection, they are seeking regular screenings, leading to a higher demand for diagnostic tests.

The healthcare authorities and organizations have been actively promoting cervical cancer screening programs and vaccination against human papillomavirus (HPV), a major risk factor for cervical cancer. These initiatives have also contributed to the growth of the diagnostic market by encouraging more women to undergo screening and HPV testing.

| Report Coverage | Details |

| Market Size in 2025 | USD 9.82 Billion |

| Market Size by 2034 | USD 15.37 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.12% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Diagnostic Test and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing prevalence of cervical cancer

The rising number of cervical cancer cases is a major issue that is driving the growth of the diagnostics market. Cervical cancer is one of the most commonly diagnosed cancers in women, particularly in developing countries where healthcare and awareness may be lacking. This worrisome trend has led health authorities and organizations to take immediate action in fighting against the disease.

According to the World Health Organization, cervical cancer is the fourth most common cancer in women worldwide. In 2022, there were approximately 604,000 new cases of cervical cancer. Out of the estimated 342,000 deaths from cervical cancer in the same year, about 90% occurred in low- and middle-income countries. Women who are living with HIV are six times more likely to develop cervical cancer compared to women without HIV. Additionally, it is estimated that 5% of all cervical cancer cases are caused by HIV. Furthermore, HIV has a greater impact on younger women in all regions of the world.

The increasing number of cervical cancer cases is now in a stronger focus on raising awareness about the disease, its causes, and the advantages of regular screenings. Public health campaigns and educational programs have been introduced to encourage women, particularly those in vulnerable communities to undergo regular screenings for early detection. Detecting the disease early not only increases the likelihood of successful treatment but also lessens the strain on healthcare systems by avoiding expensive and more extensive treatments in later stages.

Limitations in the accuracy of specific tests

Ensuring the accuracy of cervical cancer screening tests is extremely important for detecting the disease early and providing timely treatment. This has a significant impact on the survival rates of patients. If these tests are not sensitive enough, they may fail to detect pre-cancerous or early-stage cancerous lesions, which can lead to delayed diagnoses and lower the chances of successful treatment. On the other hand, if the tests lack specificity, they may mistakenly identify non-cancerous conditions as cancer, resulting in unnecessary and invasive procedures that cause emotional distress to patients.

There are several reasons why certain tests for diagnosing cervical cancer may have limited accuracy. One reason is that it can be challenging to detect cervical cancer in its early stages, making it difficult to accurately diagnose using these tests. Additionally, some tests may have a higher rate of false positives, meaning they may incorrectly suggest the presence of cancer when there is none. This can result in unnecessary follow-up tests and treatments, which can be expensive and stressful for patients.

Another factor contributing to the limited accuracy of these tests is that cervical cancer can be influenced by various factors, such as age, activity level, and overall health. As a result, the accuracy of a test may vary depending on the individual patient and their specific circumstances.

HPV vaccination and screening programs

The increasing recognition of the importance of HPV vaccination and screening programs has created a significant opportunity for the market of cervical cancer diagnostics. HPV vaccination programs aim to prevent HPV infection, which is the main risk factor for cervical cancer. By combining HPV vaccination efforts with effective screening initiatives, the incidence of cervical cancer can be further reduced, creating a sustainable market for diagnostic products.

Regular screening is crucial for preventing and detecting cervical cancer at an early stage. Cervical cancer screening usually involves HPV tests, Pap tests, or a combination of both. By aligning HPV vaccination programs with regular screening initiatives, healthcare providers can enhance the effectiveness of their cervical cancer prevention efforts. This can result in a decrease in the occurrence of cervical cancer and an increase in the demand for diagnostic products such as HPV tests, Pap tests, and colposcopes. Furthermore, the combination of HPV vaccination and screening programs can help reduce the costs associated with cervical cancer treatment. Early detection of cervical cancer often leads to less invasive and more effective treatment.

The growth of HPV testing is being driven by the increasing awareness of the connection between HPV infection and cervical cancer. Healthcare providers and public health campaigns are emphasizing the importance of early detection through HPV testing, which is leading to higher rates of screening. The expansion of HPV vaccination programs is also contributing to the growth of HPV testing. As more people receive HPV vaccinations, there is a need for regular screening to detect other strains of HPV that are not covered by the vaccine but can still cause cervical abnormalities and cancer.

Pap smear, also known as cervical cytology, remains one of the most commonly used methods for cervical cancer screening. Despite the introduction of newer technologies, the Pap smear continues to be an important diagnostic tool for many healthcare providers and systems. The growth in the Pap smear segment is driven by ongoing efforts to improve and standardize the quality of the tests. Implementing quality assurance programs ensures more accurate and reliable results, leading to better outcomes for patients. In regions with limited resources or healthcare infrastructure, Pap smears may be the more accessible and cost-effective option, which is contributing to the growth in this segment.

The growth in the colposcopy and cervical biopsy segment is mainly due to the need for further evaluation and confirmation of abnormalities detected through initial screening tests like HPV testing or Pap smear. Colposcopy allows for a detailed examination of the cervix and guides biopsy procedures to obtain tissue samples for a definitive diagnosis. The increasing use of colposcopy for targeted biopsies is contributing to the growth in this segment. Technological advancements in colposcopy, such as the integration of digital imaging and computer-assisted analysis, are improving the accuracy and efficiency of the procedure, further driving market growth.

The global market report on cervical cancer diagnostic tests is divided into different end-user types to allow for a more focused analysis of the entities that use these tests. The main end-user segments in the market are hospitals, cancer, radiation therapy centers, and specialty clinics.

Hospitals are one of the main users of cervical cancer diagnostics. They have advanced medical technologies and facilities that allow them to provide comprehensive diagnostic services for cervical cancer. Hospitals often have dedicated oncology departments that offer screening, diagnostic tests, and treatment options for cervical cancer patients. The adoption of cervical cancer screening programs in hospitals is increasing due to government initiatives and awareness campaigns. There is a growing demand for advanced diagnostic technologies in hospitals to ensure accurate and early detection of cervical cancer.

Cancer and radiation therapy centers are specialized facilities that focus on the diagnosis and treatment of various cancers, including cervical cancer. These centers have state-of-the-art diagnostic equipment and experienced medical personnel who specialize in different stages of cancer. They offer more specialized and targeted treatment options for cervical cancer patients. Collaborating with research institutions and conducting clinical trials to enhance diagnostic techniques and treatment options. Providing access to a diverse range of resources and expertise in cancer care, which attracts patients seeking specialized care for cervical cancer.

Specialty clinics that focus on women's health or gynecology also play a significant role in cervical cancer diagnostics. These clinics are equipped to perform basic diagnostic tests like Pap smears and HPV testing, which are crucial in detecting early signs of cervical cancer. They may also refer patients to larger medical facilities for further evaluation and treatment. There is a growing recognition and desire for proactive healthcare and routine check-ups in specialized medical facilities.

By Diagnostic Test

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

September 2024

October 2024