January 2025

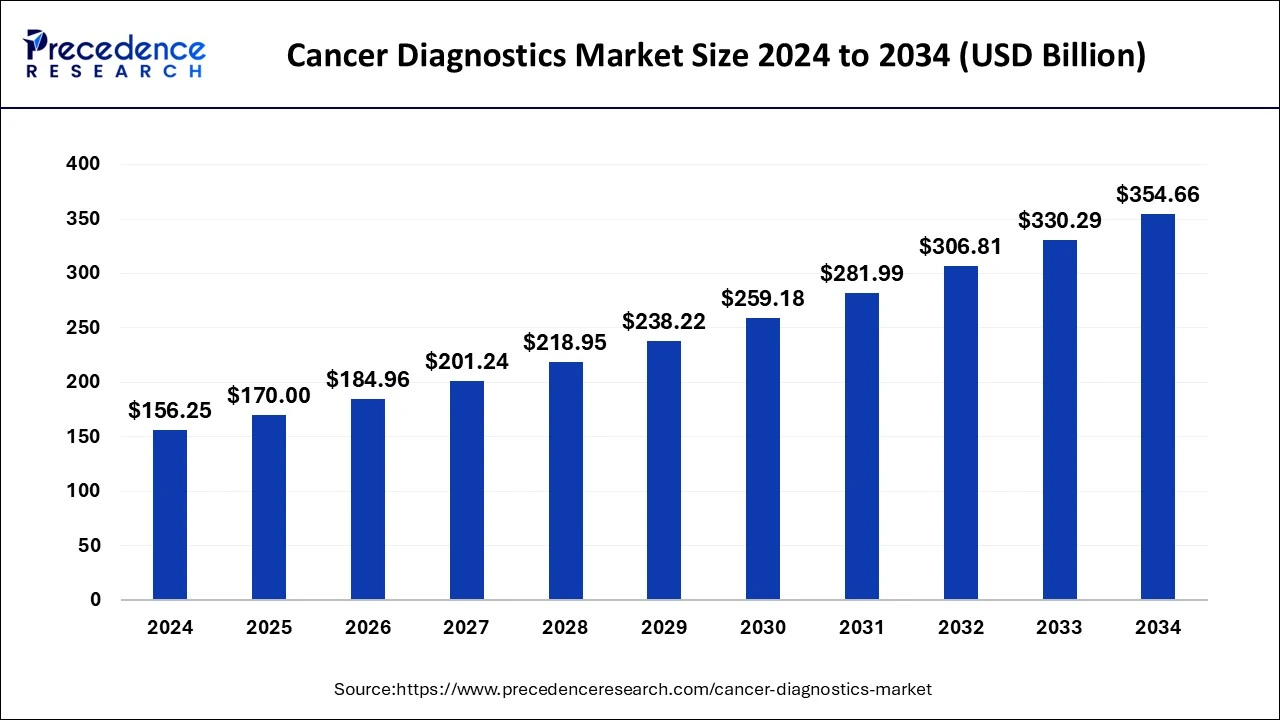

The global cancer diagnostics market size size is calculated at USD 170 billion in 2025 and is forecasted to reach around USD 354.66 billion by 2034, accelerating at a CAGR of 8.62% from 2025 to 2034. The North America market size surpassed USD 53.13 billion in 2024 and is expanding at a CAGR of 8.62% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cancer diagnostics market size accounted for USD 156.25 billion in 2024 and is anticipated to reach around USD 354.66 billion by 2034, growing at a CAGR of 8.62% from 2025 to 2034. A growing number of cancer patients across the world is one of the major driving factors promoting the growth of the cancer diagnostics market.

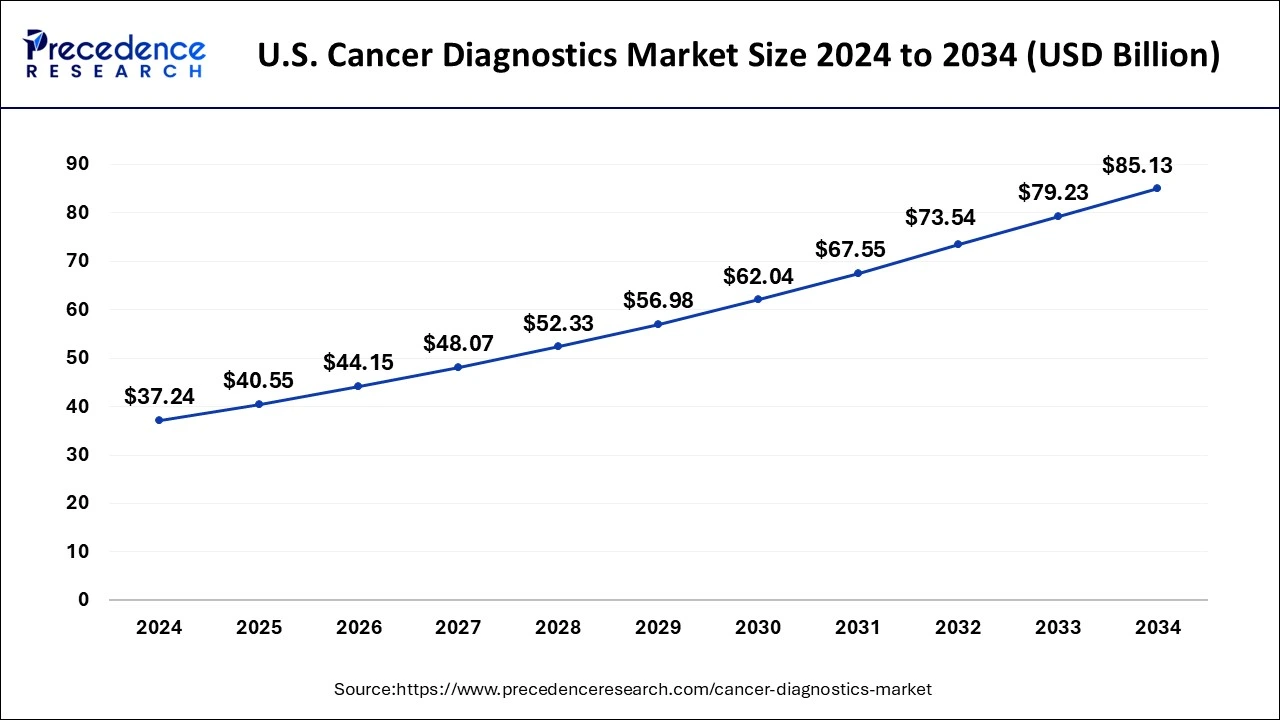

The U.S. cancer diagnostics market size was valued at USD 34.24 billion in 2024 and is estimated to reach around USD 85.13 billion by 2034, growing at a CAGR of 8.62% from 2025 to 2034.

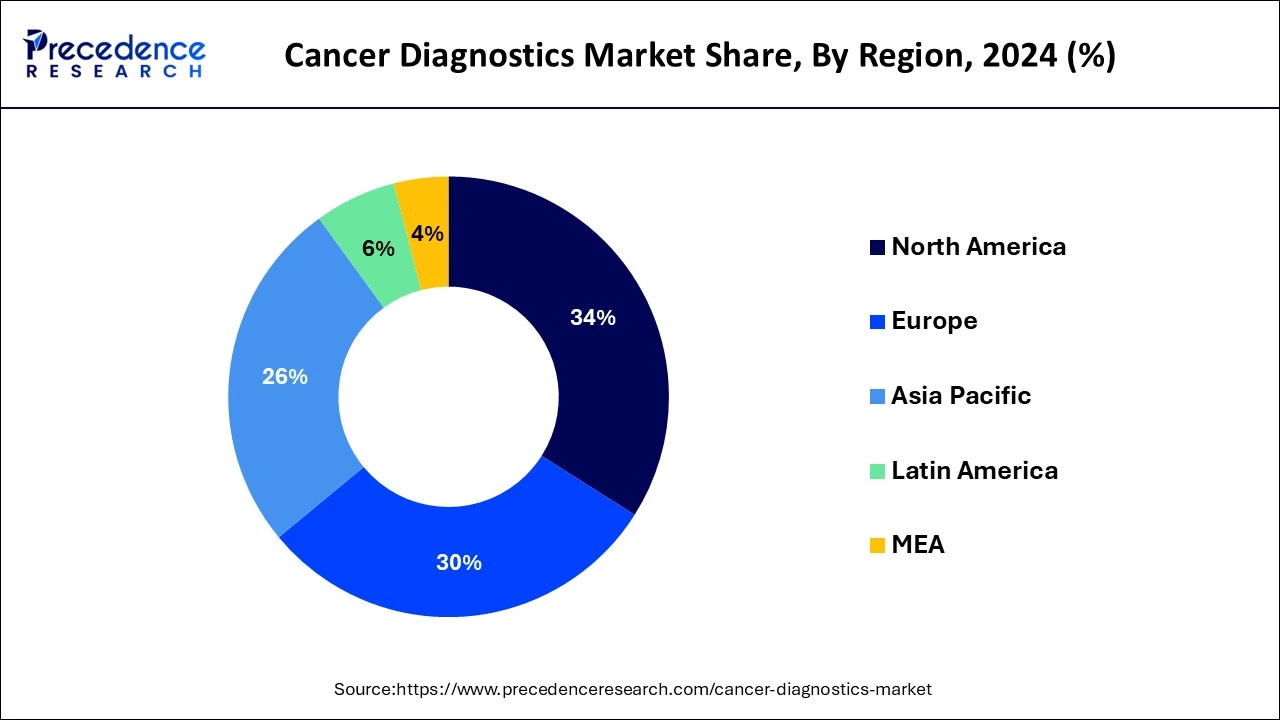

North America held leading position in the global cancer diagnostics market owing to the focused oncology research efforts for the development of early tumor detection techniques, together with grants from government healthcare organizations, are helping to build a robust medical environment in this region to battle cancer. In addition, the increasing presence of several biotechnology and medical device businesses, increased financing available for research & development initiatives, and high adoption of new technologies in this region have further supplemented the market growth.

North America holds the largest market share followed by Europe on account of well-developed healthcare care infrastructure, per capita healthcare expenditure, high awareness, and literacy rate. Mortality rate of cancer patients is declining in the U.S. and early diagnosis is one of the major factors responsible for such cause. Large presence of medical device and bio-technology firm in and presence of skilled technician are some of the major influencers for the market growth in the region. High research and development, large funding options are also the few other factors for boosting the market growth. Intensifying geriatric population in Europe supports the growth of the market.

Asia Pacific is anticipated to witness rapid growth in the forecast period, driven by increased prevalence of cancer, a large geriatric population, expanding healthcare expenditure, adoption of advanced technologies, and government initiatives. The Government of Asia is focusing on promoting awareness of cancer and the importance of treatment solutions. Additionally, government investments in research & development support the innovation and development of novel advanced diagnostic technologies and treatment options. Medical tourism in Asia is witnessing spectacular growth.

Japan is the major leader in the Asian market, driven by the country's efforts in reducing the cancer burden in Asia. Japan has committed approximately $75 million from FY2019 to FY2023 in the Indo-Pacific to combating cancer, including cervical cancer, through the Japan International Cooperation Agency and other organizations.

Cancer diagnostics is a process of discovering biomarkers, proteins, and other indicators that lead to the detection of a cancerous tumor. Diagnostic testing is used to confirm or rule out the presence of sickness, track disease progression, and schedule and analyze treatment outcomes. Imaging, tumor biopsy, laboratory tests (including tumor marker tests), endoscopic examination, surgery, and genetic testing are all possible cancer diagnostic techniques.

The process of detecting numerous proteins, biomarkers, and certain symptoms that lead to the discovery of the presence of malignant tumor in a patient is known as cancer diagnostics. The diagnosis process is aided by the detection of particular proteins and biomarkers that are common in cancer illnesses. The method of identifying cancer entails the use of specific technologies and gadgets designed for cancer diagnostics.

As per the national cancer institute estimation, the number of new cases is expected to rise to 29.5 million per year. Increasing mortality rate due to cancer also lead to public awareness which promote the growth of the market. In addition, high per capita health care expenditure of the countries like USA, Germany, and Japan is considered as a one of the major driving factors for the growth of cancer diagnostics market. Technological advancement in the field of screening of cancer is another factor which further promotes the growth of the market. Advanced screening which further decrease the mortality rate of the patients finds its importance in the field of cancer diagnostics.

Large number of screening procedures are carried out by the governments of several nations for the early detection of the stages of the cancer. Heavy investment by the private firm in the diagnostic centers is also considered one of the boosting factors particularly in the developing countries. Many developing countries like India, Indonesia, and Bangladesh are looking for the refurbish diagnostic imaging device which create the huge demand in the global market.

Cancer like prostrate, colorectal, lungs accounts for more than 43% of overall cancer diagnosed in the men in the year 2020. Three most common cancer associated with women are breast, Lungs and colorectal. These three cancer accounts for more than 50% of total cancer in the women in 2020. Technological advancement in the diagnosis and screening method is considered as one of the major upcoming opportunities within prediction period. Despite of growing awareness, high cost per visit to the center followed by less urbanization is often considered as one of the major factors which hinders the growth of the market. High cost and lack of availability of trained professionals in the field of oncology is considered as one of other factors which restrict the growth of the market. High Illiteracy rate in the developing countries also associated with restricted growth.Furthermore, recent, pandemic of COVID-19 delayed the development of cancer diagnostics market.

Cancer is one of the most common causes of death in the world.

Cancer today is one of the most common causes of mortality worldwide. As per the World Health Organization (WHO), it is estimated thataround 10 million people died due to cancer in 2020. The escalated death numbers were due to the factors such as excessive alcohol use, tobacco use, an unhealthy lifestyle, a lack of physical fitness, and other disorders such as diabetes can all lead to numerous cancer forms. If cancer is identified early, the mortality rate can be reduced. As a result, early detection, screening, and precise cancer diagnosis are critical. Cancer diagnostics is one such method that aids in the identification of various proteins and biomarkers that assist in the detection of cancer. Imaging, laboratory tests, genetic tests, biopsy, and endoscopy are some of the most commonly utilized cancer diagnostic tests. The increasing volume of tests performed further add boost to the market growth.

Early detection and good treatment are critical in the fight against cancer.

The market is being driven by the constant development of new products, as well as the growing need for early diagnosis of different cancers. Furthermore, the penetration of technologically advanced laboratory equipment has enhanced oncological screening in providing accurate results, resulting in significant growth of the healthcare and diagnostics sector. As the prevalence of cancer rises, so does the demand for these screening tests and imaging modalities used to track disease development.Early detection has been shown to save lives when it comes to cancer. Some people with cancer who are diagnosed and treated early may have a greater long-term survival rate than those who are not diagnosed until symptoms arise. Therefore, cancer diagnostics market is highly influenced by the elevated number of early diagnosis procedures worldwide.

| Report Highlights | Details |

| Market Size in 2024 | USD 156.25 Billion |

| Market Size in 2025 | USD 170.00 Billion |

| Market Size by 2034 | USD 354.66 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 8.62% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Application, End Use and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Rising prevalence of cancer

Cancer has a significant social impact all around the world. It is one of the top causes of death worldwide, with established and emerging markets having a higher prevalence. The disturbing trend of rising cancer prevalence encourages healthcare providers to reconsider their treatment aims and place a greater emphasis on prevention. This would necessitate cancer diagnostics that are not only specific and sensitive, but also capable of early detection and treatment. As the global prevalence of various types of cancer rises, the global cancer diagnostics market is predicted to grow at rapid pace during the forecast period.

Introduction of novel diagnostic biomarkers

The increased understanding of certain cancer biomarkers is creating a huge commercial opportunity for treating cancer patients through improved detection technology and equipment. The identification of prospective cancer biomarkers has been made possible by technological developments in the field of biotechnology, and some of these biomarkers have been marketed. As a result, the introduction of novel diagnostic biomarkers is creating lucrative opportunities for the growth of the cancer diagnostics market.

Surge in the use of rebuilt diagnostic imaging

Due to high costs and budgetary constraints, many hospitals in developing nations are unable to invest in diagnostic imaging equipment. However, due to the high demand for diagnostic imaging procedures in these countries, the hospitals that can’t afford to purchase new and advanced imaging systems prefer to use rebuilt imaging systems. Thus, this factor is huge challenge for the cancer diagnostics market growth during the forecast period.

KEY HIGHLIGHTS OF THE STUDY

Imaging Segment Appeared as Largest Segment and Occupied Remarkable Market Share

This research study segments the global cancer diagnostics market into test type and application. In terms of test type, the market is classified into genetic tests, laboratory tests, imaging, biopsy, endoscopy, and others (barium enema). Among all, imaging segment emerged as largest segment and occupied the significant market share in the year 2024. The same segment will grow at a highest CAGR within the forecasted year. Different imaging techniques used for diagnosis of the cancer are X-rays, ultrasound, Computed tomography, Single-photon emission computed tomography (SPECT), magnetic resonance imaging (MRI), positron emission tomography (PET) and optical imaging. MRI and computed tomography scan are used commonly for diagnosis purpose. These tests are fast, non-invasive, higher efficacy and pain less diagnostic method.

Breast Cancer Application is Predicted to Advance at Rapid Rate During Estimate Period

Different application segment covered in this research study include colorectal cancer, breast cancer, cervical cancer, prostate cancer, lung cancer, blood cancer, skin cancer, kidney cancer, pancreatic cancer, ovarian cancer, liver cancer and others. The rise in alcohol and tobacco consumption promotes the liver and throat cancer. Out of different application segments, breast cancer held the largest market share in the year 2024. According to NHS analysis, in UK 1 in every 8 women are suffering from breast cancer. The recovery rate is far better than expected which make it important for the diagnosis segment. A screening test called mammography is commonly used for such purpose. The National Breast Cancer Foundation, Inc. took an important role to create awareness among the public.

The breast cancer category, depending on application, is the largest segment in the cancer diagnostics market, owing to an increase in older women population and rise in breast cancer prevalence among the women. In the near future, the cancer diagnostics market will gain traction due to an increase in the number of initiatives conducted by various groups.

This research report estimates revenue growth at global, regional, and country levels and offers an analysis of present industry trends in every sub-segment from 2020 to 2032. This research study analyzes market thoroughly by classifying global cancer diagnostics market report on the basis of different parameters including type of test type, application and region as follows:

By Product

By Technology

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

October 2024

January 2025