March 2025

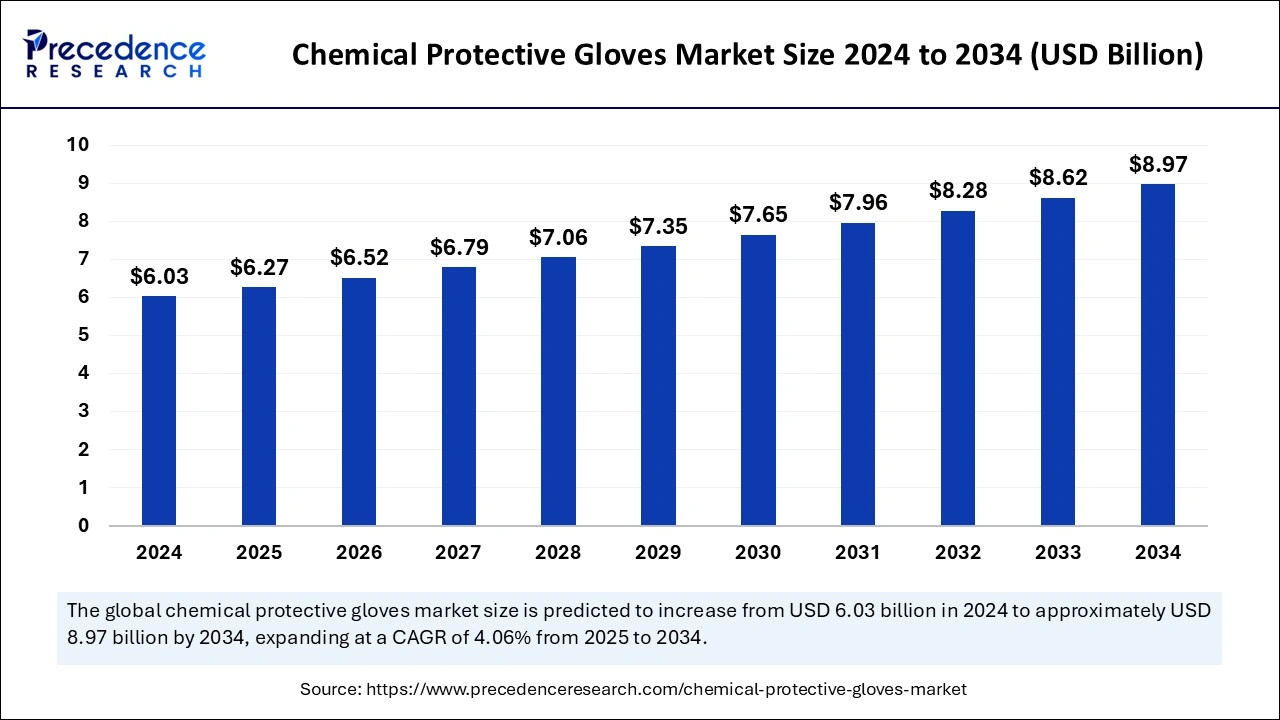

The global chemical protective gloves market size is calculated at USD 6.27 billion in 2025 and is forecasted to reach around USD 8.97 billion by 2034, accelerating at a CAGR of 4.06% from 2025 to 2034.

The global chemical protective gloves market size accounted for USD 6.03 billion in 2024 and is expected to exceed around USD 8.97 billion by 2034, growing at a CAGR of 4.06% from 2025 to 2034. The demand for protective gloves has increased in various industries like chemical, pharmaceutical, and healthcare, leading to a boost in the global chemical protective gloves market. The rising awareness of safety in the workplace is fuelling the market growth. Additionally, growing industrial concerns for compliance with safety regulatory standards are expected to boost the market in the forecast period.

The implementation of Artificial Intelligence technologies in the manufacturing and design of chemical protective gloves is significantly transforming the global chemical protective gloves market. Due to increased safety concerns and awareness in workplaces, the demand for protective gloves has top surged. The rising demand for customized gloves is emerging in the market. AI integration is making such development easier.

AI is acutely aware of the rising demand for sustainable and eco-friendly chemical protective gloves. The ability of AI to reduce cost, improve quality, and comply with regulatory standards is the key factor behind its integration into production industries. With the help of AI integration, the chemical protective gloves market is likely to witness novel room for improvements and growth.

Chemical protective or chemical resistance gloves are made with various raw materials, including rubber, natural butyl, neoprene, nitrile, and fluorocarbon. The rising awareness of safety and hazardous contamination in workplaces is driving a significant impact on the global chemical protective gloves market. The utilization of such gloves has witnessed growth in healthcare, hospitals, and pharmaceutical industries. Manufacturing industries are focusing on complying with safety regulatory standards to overcome regulatory compliance and improve quality assurance.

The rising industrialization has increased the need for such gloves. Additionally, the government has made the completion of wearing personal protective gloves, including chemical protective gloves, mandatory in certain industries. The rising demand for customized and sustainable gloves is holding significant market potential. Additionally, technological advancements are helping to overcome skin irritation and allergic challenges, opening chances for more adoption. Furthermore, with rising initiatives and investments in R&D by key companies, governments, and regulatory frameworks, the market is expected to witness the development of innovative products in the upcoming period.

| Report Coverage | Details |

| Market Size by 2024 | USD 6.03 Billion |

| Market Size in 2025 | USD 6.27 Billion |

| Market Size in 2034 | USD 8.97 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.06% |

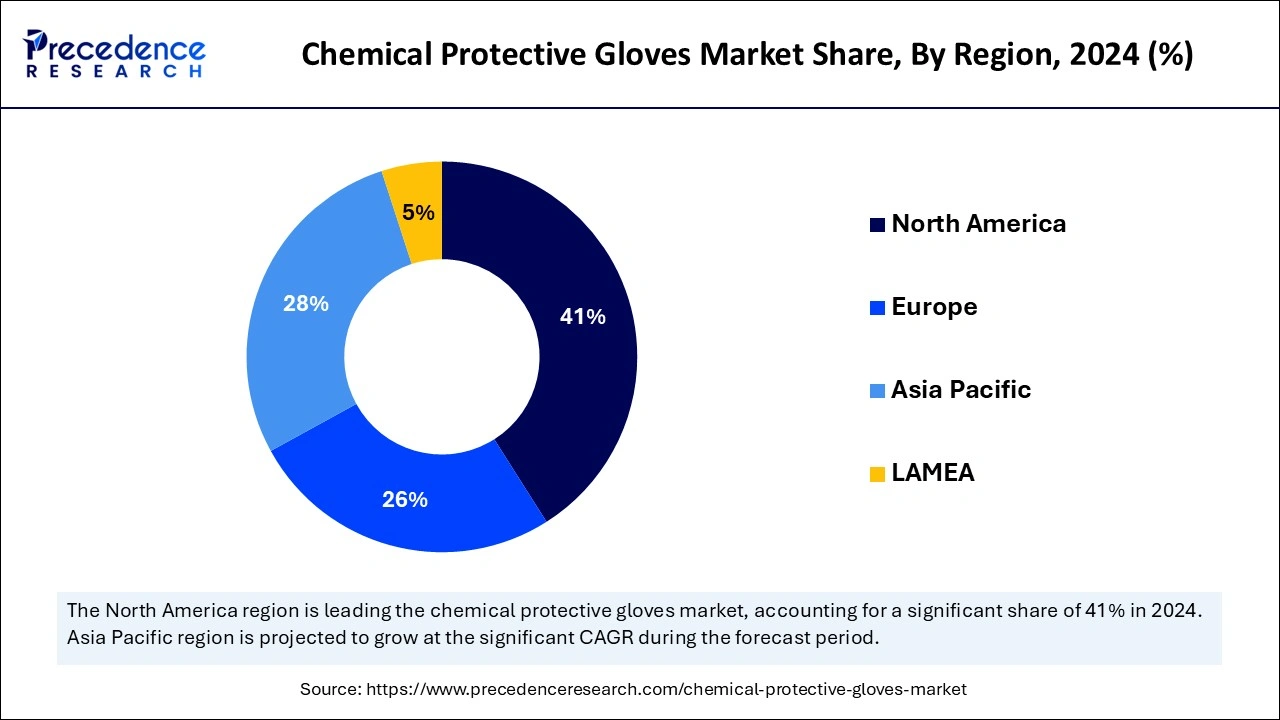

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Material, Application, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Rising industrialization

The rising chemical industries are driving demand for protective gloves worldwide, leading to the expansion of the chemical protective gloves market. The increased industrialization has led to a vast amount of manufacturing, which certainly requires workplace safety. The rising petrochemical industries involve hazardous chemicals, which have enhanced demand for chemical protective gloves. To comply with regulatory safety standards, the need for safety alliances, including protective gloves, is highlighting the industries. The adoption of advanced manufacturing technologies in manufacturing industries requires high-quality chemical protective gloves.

High cost and skin allergies

The chemical protective gloves are made of several raw materials, including nitrile, butyl, neoprene, PVC, latex, and Viton, which are costly. Additionally, the price of raw materials is fluctuating, which impacts the overall cost of chemical protective gloves. Additionally, skin allergies can also hamper the adoption of the chemical protective gloves market. Chemical protective gloves can cause skin allergies and irritation in people sensitive to latex, butyl, and nitrile.

Stringent safety regulations

The rising safety regulation focus and encouragement for the use of personal protective gloves, including chemical protective gloves, are holding market potential. The expanding chemical, healthcare, and pharmaceutical industries are focusing on complying with regulatory standards, which leads to the adoption of chemical protective gloves. Additionally, regulatory initiatives and investments in R&D are encouraging manufacturers to develop innovative and high-performance materials for chemical protective gloves. The rising safety awareness in workplaces is further driving a surge to comply with stringent safety regulations.

The disposable gloves segment generated the largest share of the chemical protective gloves market in 2024. This is attributed to the easy and convenient use of disposable gloves. The growing demand for disposable and cost-effective chemical protective gloves in healthcare and laboratories is the key contributor to segment growth. Additionally, disposable gloves are recyclable, which increased their popularity among sustainability-conscious users. Users are continuously seeking efficient and cost-effective gloves for maintenance.

On the other hand, the reusable gloves segment is expected to witness significant growth over the forecast period. Reusable gloves allow extended use of gloves to protect from hazardous chemicals. It provides extreme durability as well as comfort. The major reason behind segment expansion is the growing shift toward sustainability and reducing environmental impacts.

The nitrile segment captured the biggest chemical protective gloves market share in 2024 due to its durability and versatility. Nitrile materials are excellently resistant to chemicals, oils, and fuels and are affordable compared to other materials. The segment growth is also highlighted due to increased innovations in nitrile materials. The affordability and durability of nitrile have made it a priority in manufacturing companies, and ongoing research and development of the segment is projected to continuously dominate the market.

On the other hand, the latex gloves segment is expected to grow at a significant CAGR from 2025 to 2034 due to its comfort and flexibility. Latex materials are flexible, which provides great comfort and mobility. The ability of chemical resistance and cost-effectiveness have made the material popular in glove manufacturing. Additionally, ongoing innovations to reduce the allergic characteristics of latex materials are expected to generate future potential for the segment.

The laboratory use segment contributed the highest chemical protective gloves market share in 2024 due to increased demand for chemical protective gloves in research activities. The rapid research activities performed in laboratories, including pharmaceuticals and chemicals, require protective and safety gloves. Additionally, stringent safety regulations to comply with laboratory protocols contribute to the segment's growth.

However, the industrial use segment is expected to grow rapidly over the forecast period due to growing industrialization and expanding industrial activities, including manufacturing in oil, gas, and chemical productions. The demand for durable and disposable gloves is high in many industries. The rising employee concern for safety in workplaces has enhanced the demand for chemical protective gloves in the industries.

The healthcare segment held the largest chemical protective gloves market share in 2024. The segment growth is derived from the increased number of healthcare professionals, rising concern for infectious disease, the need for protection and compliance with regulatory standards, and increased incidences of hazardous exposures. The increased knowledge and understanding of personal safety in the healthcare sector.

On the other hand, the chemical industry segment is expanding rapidly due to increased chemical manufacturing industries. The rising construction, automotive, and R&D activities have enhanced chemical activities, which are demanding extreme safety gloves. The increased awareness of hazardous chemicals and regulatory safety standards in chemical industries is expanding the segment.

North America dominated the global chemical protective gloves market due to the presence of well-established industrialization in the region. The government and regulatory initiatives for workplace safety standards are contributing to this growth. The United States is leading the regional market due to several reasons, like stringent regulations, growing safety awareness of workplaces, the presence of key competitors, and a large industrial base in the country.

The continuous innovation of cutting-edge features with customization. The availability of high disposable income in the country further fuels the adoption of personal protective gloves, including chemical protective gloves. The growing shift toward sustainability is further emerging in the market. In addition, stringent safety regulations are playing a crucial role in the U.S. market.

Asia Pacific is projected to expand at a notable CAGR during the forecast period due to rapidly growing industries and increased utilization of chemicals. The expanding healthcare and pharmaceutical companies in the region are driving the need for chemical protective gloves. Moreover, government initiatives and investments in industrial developments are allowing for the affording of cutting-edge technologies and appliances in the industries, including chemical protective gloves.

China is leading the regional market due to the rapidly growing industrialization and urbanization of the country. The growing construction sector is playing a major role in this growth. Additionally, rising hazardous manufacturing industries and awareness of employees regarding safety matters have enhanced the adoption of personal protective gloves, including chemical protective gloves, in the country. China is the major supplier of gloves in Asia. However, with growing government initiatives and investments in industrialization and technology advancements, Asia is witnessing significant growth in Southeast Asian countries, including India, Vietnam, Myanmar, and the Philippines.

By Product Type

By Material

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

September 2024

September 2024

November 2024