January 2025

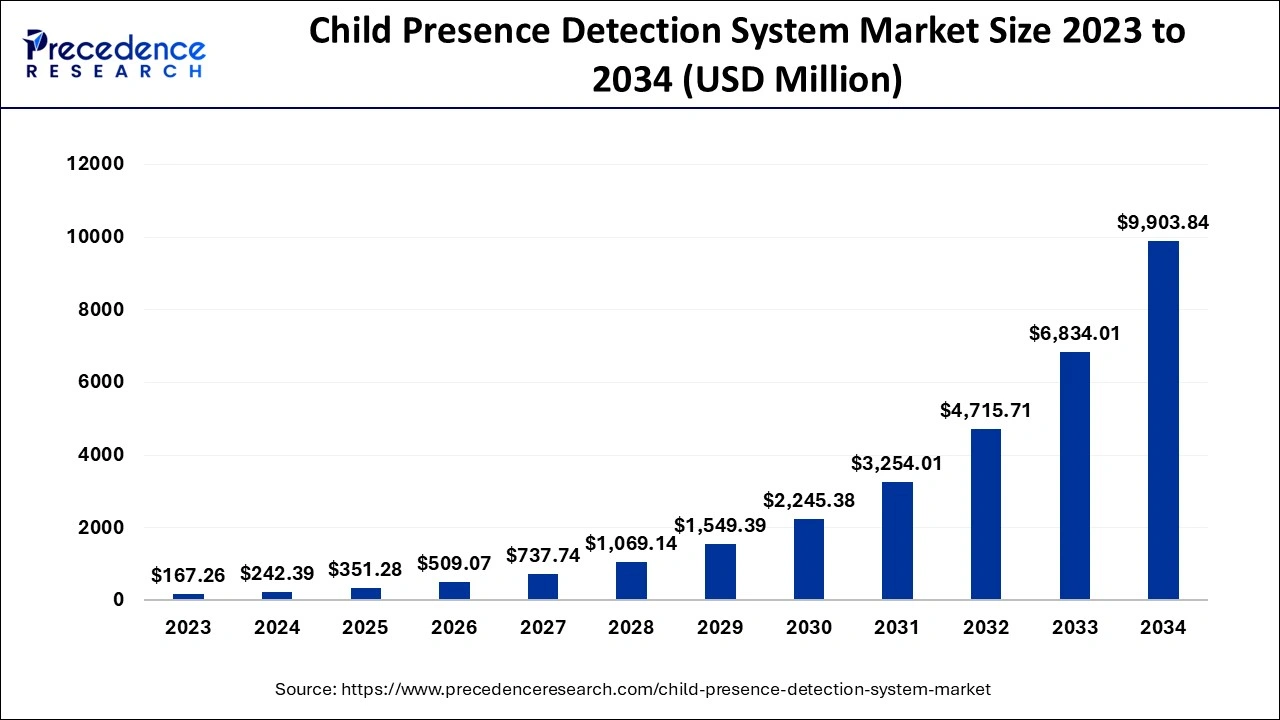

The global child presence detection system market size is calculated at USD 242.39 million in 2024, grew to USD 351.28 million in 2025 and is projected to reach around USD 9,903.84 million by 2034. The market is expanding at a double-digit CAGR of 44.92% between 2024 and 2034.

The global child presence detection system market size accounted for USD 242.39 million in 2024 and is expected to exceed around USD 9,903.84 million by 2034, growing at a notable CAGR of 44.92% from 2024 to 2034. The child presence detection system market is attributed to the increased sales of luxury vehicles and electric vehicles and increased deaths of children trapped in hot vehicles.

The child presence detection system market deals with the industry that provides and develops solutions and technologies aimed at preventing children from being left unattended in vehicles. These systems are designed to detect the presence of an infant or child in the nearby cabin or seat of a vehicle and alert the caregiver or driver to prevent the potential prevalence of vehicular heat hazardous diseases or heat stroke.

Child presence detection systems typically use a combination of sensors such as imaging technologies, motion detectors, and weight sensors to detect the presence of a child in the vehicle. In addition, the increasing integration of connectivity technologies and advanced sensors, technological innovations in the automotive industry, and rising safety consumer demand for advanced safety features have further enhanced the growth of the child presence detection system market.

| Report Coverage | Details |

| Market Size by 2034 | USD 9,903.84 Million |

| Market Size in 2024 | USD 242.39 Million |

| Market Size in 2025 | USD 351.28 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 44.92% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Vehicle Type, Sales Channel, Vehicle Propulsion, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Growing concern for child safety and consumer awareness

The increasing concern for child safety in vehicles is the major factor driving the child presence detection system market. The devastating incidents of child vehicular heatstroke have driven the automotive industry, caregivers, and regulatory bodies to prioritize the implementation and development of advanced safety systems. There is an increasing demand for innovative technologies as awareness of these risks increases, which can safeguard children left unattended in vehicles and prevent such incidents.

In addition, increasing awareness among consumers about the risks related to leaving children unattended in vehicles is also a major driver of the child presence detection system market. The widespread media coverage and high-profile incidents have sensitized the public, prompting parents and caregivers to seek vehicles combined with child presence detection systems actively.

Rising technological reliability and complexity

The critical need for high reliability and inherent technological complexity is one of the major challenges faced by the child presence detection system market growth. Developing systems that consistently and accurately detect the presence of a child inside a vehicle while reducing false alarms may create engineering challenges. Achieving a balance between dependability and sophistication remains a major challenge as manufacturers aim to generate foolproof solutions that operate effectively in several environmental diseases.

Advancements in sensor technologies

The continuous advancement of sensor technologies is an ongoing trend in the global child presence detection system market. Ultrasonic sensors, pressure sensors, and other innovative sensor solutions are transforming to enhance reliability and accuracy in detecting the prevalence of a child in a vehicle. Various manufacturers are investing in research and development to reduce the likelihood of false alarms, precise monitoring, and introducing more sophisticated sensors.

How is AI Changing the Child Presence Detection System Market?

The prominent trend in the market is the integration of child presence detection systems with advanced driver-assistance systems. This trend highlights the integration of child safety features into wider vehicle safety and supports ADAS capabilities, including machine learning, to improve accident prevention and overall safety. Combining child presence detection with extensive ADAS provides a holistic safety approach as vehicles become more technologically advanced.

The radar sensor segment held the largest share of the child presence detection system market share in 2023. Based on sensor type, the market is segmented into pressure sensors, ultrasonic sensors, radar sensors, and others. The segment growth is attributed to the rising effective technology for detecting the presence of a child. Compared to other sensing technologies, including radar technologies and cameras, privacy concerns may increase. Radar technology has various advantages that make it the ideal choice for child presence detection and cabin monitoring. As a result, radar is rapidly becoming the preferred sensor for in-cabin sensing and left-behind child monitoring.

The sedans segment dominated the child presence detection system market in 2023. Based on the sedans segment, the market is segmented into MUVs, SUVs, sedans, and Hatchbacks. The trunk area is fully separated and enclosed from the main passenger compartment by a fixed package tray beneath the rear window and the rear seat back. A sedan features a distinct enclosed cargo compartment and four doors. It is a type of automobile specially designed for passenger transportation.

The OEMs segment led the global child presence detection system market in 2023. Based on sales channel types, the market is segmented into Aftermarket and OEMs. The market is attributed to the rising installation, procurement, and production of such features in vehicles, which are typically done by original equipment manufacturers (OEMs). Many manufacturers are actively working towards complying with the upcoming and latest child presence detector technology standards, with an increasing emphasis on comfort and safety in the automotive industry.

The electric vehicle segment dominated the child presence detection system market in 2023. Based on vehicle propulsion types, the market is segmented into ICE vehicles and electric vehicles. The electric vehicle segment deals with the category of vehicles that are improved by electricity. It includes three types of vehicles: battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs). HEVs are a type of electric vehicle that combines an internal combustion engine system with an electric system, which enables the vehicle to be powered by both electricity and fuel. This combination offers various advantages, such as improved fuel economy and increased power.

North America dominated the child presence detection system market in 2023. The market growth is attributed to the rising advancements in radar technology are also expected to drive the market growth in the region. In addition, the increasing number of deaths of children trapped in hot vehicles, the increase in the sale of luxury vehicles and electric vehicles, and government regulations and initiatives associated with children’s safety in hot cars. Furthermore, Canada and the U.S. are the major countries driving the market growth.

Asia Pacific is expected to grow at the fastest rate in the child presence detection system market during the forecast period. The market growth in the region is attributed to the increasing implementation of advanced imaging technology, radar technology, detecting machines, and sensing technology across business organizations. In addition, China, India, Japan, and South Korea are the major countries driving the region's market growth. China held the largest market share in the healthcare industry. India was the fastest-growing country in the child presence detection system market in the Asia Pacific during the forecast period.

By Type

By Vehicle Type

By Sales Channel

By Vehicle Propulsion

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

April 2025

April 2025