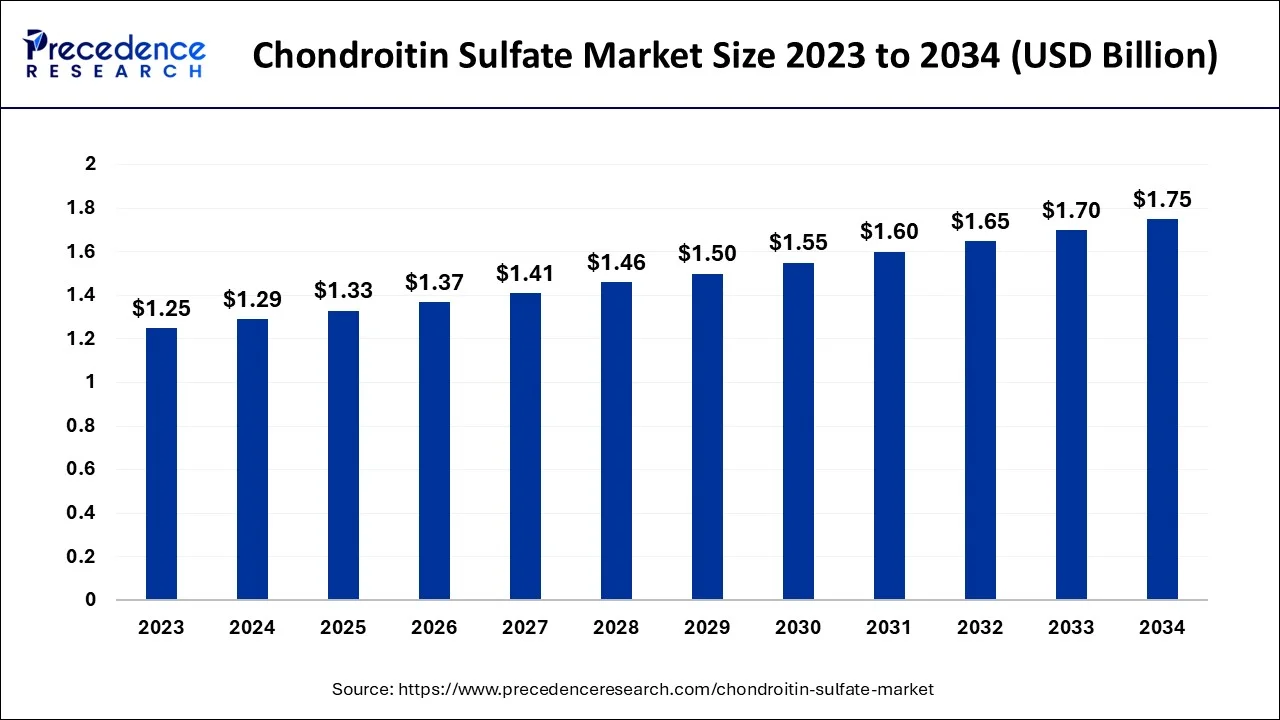

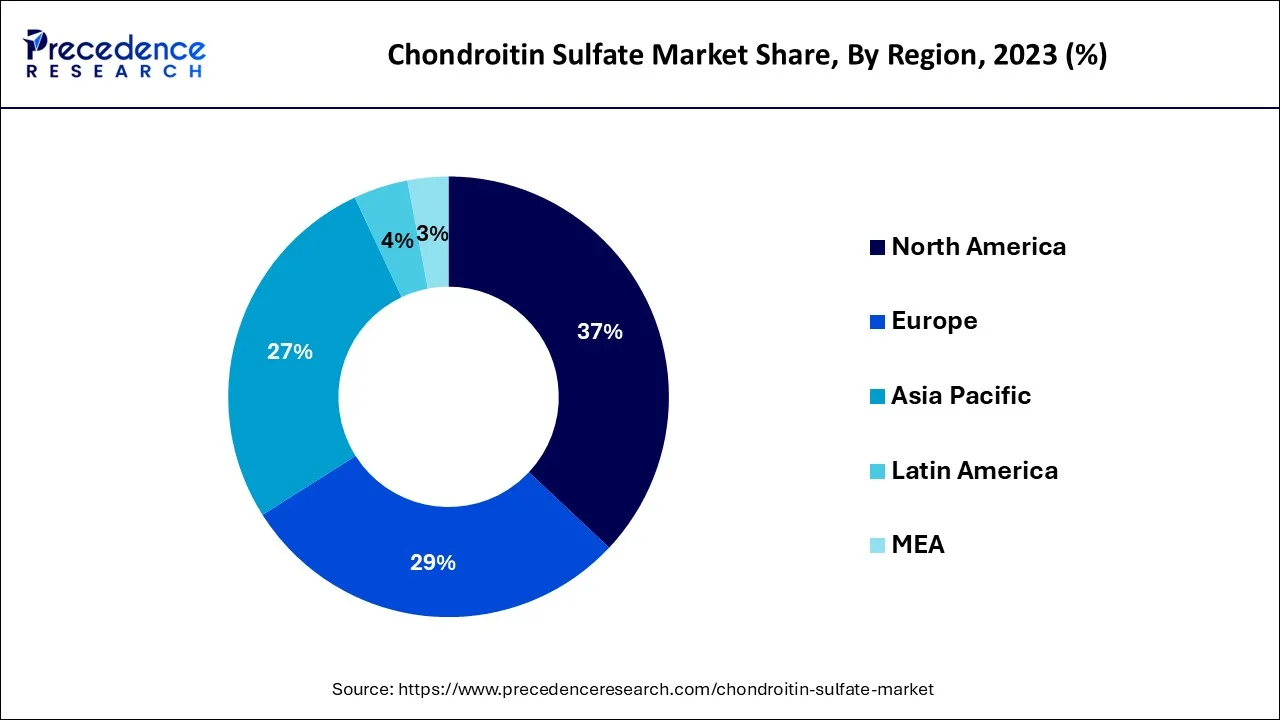

The global chondroitin sulfate market size accounted for USD 1.29 billion in 2024, grew to USD 1.33 billion in 2025 and is projected to surpass around USD 1.75 billion by 2034, representing a healthy CAGR of 3.10% between 2024 and 2034. The North America chondroitin sulfate market size is calculated at USD 480 million in 2024 and is expected to grow at a fastest CAGR of 3.33% during the forecast year.

The global chondroitin sulfate market size is estimated at USD 1.29 billion in 2024 and is anticipated to reach around USD 1.75 billion by 2034, expanding at a CAGR of 3.10% from 2024 and 2034.

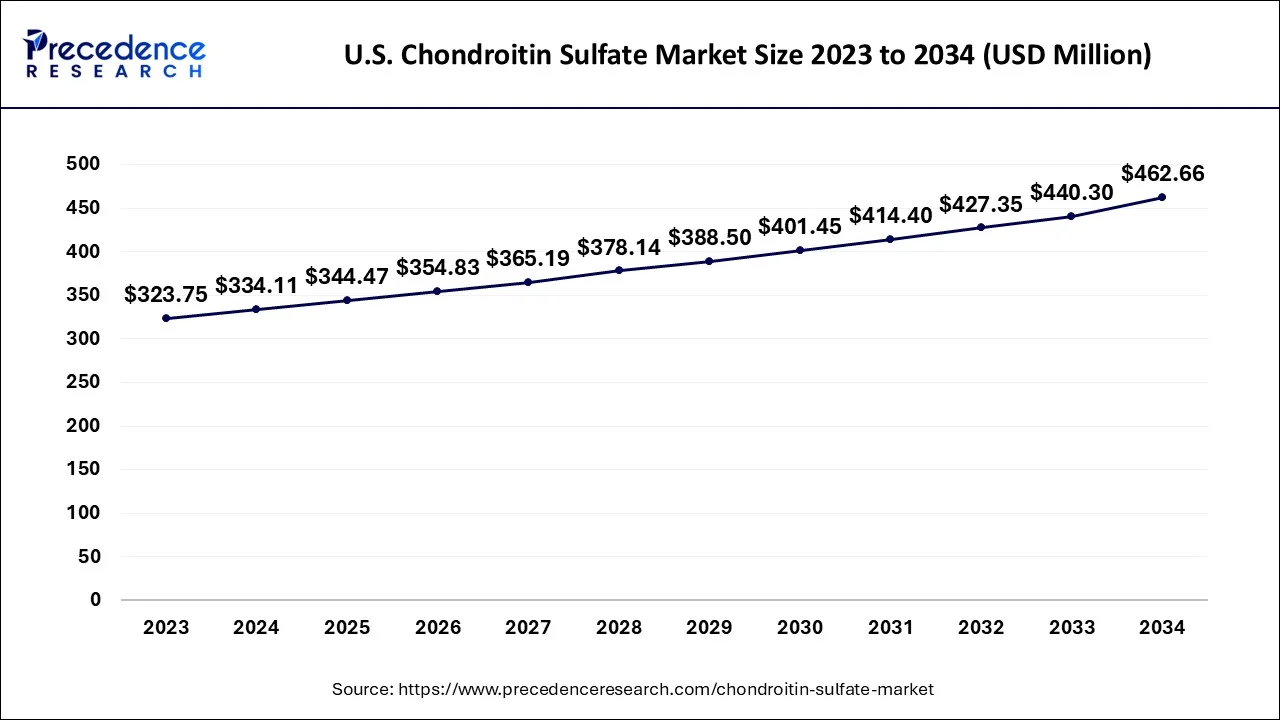

The U.S. chondroitin sulfate market size accounted for USD 334.11 million in 2024 and is expected to be worth around USD 462.66 million by 2034, growing at a CAGR of 3.35% from 2024 and 2034.

During the forecast period, the chondroitin sulfate market in the Asia-Pacific region is anticipated to expand at a CAGR of roughly 9%. The market is primarily driven by the expanding demand for supplements made with chondroitin sulfate from the healthcare and food & beverage industries. Furthermore, the region's market is anticipated to grow as more people become conscious of the health benefits of chondroitin sulfate.

Chondroitin sulfate market share in the Asia-Pacific region is divided into application, source, and country segments. The market is divided into three groups based on the source: bovine, marine, and porcine. Due to the expanding demand for supplements containing chondroitin sulfate obtained from bovines in the healthcare industry, the bovine segment is anticipated to maintain the highest share of the market among these.

The market is divided into three categories based on application: functional foods & beverages, pharmaceuticals, and dietary supplements. The dietary supplements market is further divided into segments for joint health, skincare, and other products.

Due to the expanding demand for dietary supplements containing chondroitin sulfate from the healthcare industry, China is predicted to be the largest market for chondroitin sulfate among the nation's major countries. Moreover, the country's chondroitin sulfate market will continue to expand as more people become aware of its beneficial health effects. Due to the rising demand for dietary supplements containing chondroitin sulfate from the healthcare industry, India is another significant market for chondroitin sulfate in the county.

The expansion of the chondroitin sulfate market is related to rising healthcare costs and consumer demand for pharmaceuticals and personal care products. The solution is also used to protect the cornea during cataract surgery, and it is used in medications to treat inflammation, joint pain, and eye dryness. The chemical formula of chondroitin sulfate and the glucuronic acid typically found in cartilage around joints is similar.

Chondroitin sulfate is also consumed and is accessible as capsules and tablets. The tablets are frequently used as food additives for animals as well. Additionally, the substance increases joint lubrication to support healthy cartilage function.

The market is expanding due to the growing use of chondroitin sulfate for the treatment of joint pain, acidity, heart disease, anaemia, and HIV. Chondroitin sulfate is increasingly used in personal care products, and its inclusion in cosmetics and hair care products, along with rising customer expenses, has caused the market for the substance to expand quickly over the foreseeable future.

For instance, animal glands and organs are used medically in several nations, including Japan, China, and India. Tallow, fertilizer, meat meal, and pet food are all products made from animal intestines. As a dietary supplement and a supplier of vitamin B12 for the prevention and treatment of different kinds of anemia, liver extract from pigs and cows are also used.

Fish waste with excessive bones or high oil content is converted into industrial sources and feed. Additionally, collagen and chondroitin sulfate, which are components used in pharmaceutical, cosmetic, nutraceutical, and food products, are derived from cartilage.

More animals are being killed due to increased demand for meat and meat-based products. The fact that the source of chondroitin is cartilage obtained after slaughter has been highly advantageous to the substance's producers. Osteoarthritis occurs as one of the musculoskeletal conditions that affect the elderly most frequently.

The joints are affected, motion is limited, and pain is experienced. Chondroitin sulfate is used to cure osteoarthritis to reduce pain, stop the disease's progression, and cure its symptoms. As osteoarthritis grows increasingly widespread in developed countries like the U.S. and the U.K., among many others, it is likely to gain popularity.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.29 Billion |

| Market Size by 2034 | USD 1.75 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3.1% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Source and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market growth for nutraceutical products is expected to drive expansion over the forecast period

Sodium chondroitin sulfate is used as a thickener in health food, forming agents, additives, preservatives, and in animal feed. It is also used in dietary supplements and food products. Because it is effective in treating canine arthritis and joint pain, including conditions like osteoarthritis, hip dysplasia, and elbow dysplasia, it is widely used. Applications for food- and feed-grade materials are anticipated to drive market expansion during the projection period.

Additionally, it is used to enhance liver function, improve digestion, lower blood sugar, and prevent tumour metastasis. Its use in the treatment of osteoarthritis and several other conditions is becoming more and more popular, which is anticipated to help the market expand overall.

Increasing efforts of major market participants to create chondroitin sulfate

Chondroitin sulfate development efforts by major pharmaceutical market players are projected to drive market growth. For example, in July 2021, Bioiberica introduced a new brand image for its investment in healthcare-branded ingredients. The patented CS Bioactive chondroitin sulfate and hyaluronic acid matrix ingredient Mobilee was part of this investment. Such actions will help the market expansion during the anticipated period.

Product reactions may affect growth

There is some concern about the health of chondroitin sulfate since it comes from animal sources, even though clinical examinations have not revealed any clinical symptoms or overdoses of the substance. Some chondroitin tablets may contain excessive amounts of manganese, which could be harmful when used over an extended period.

Alternative reactions include loose stools, male pattern baldness, blockage and stomach pain, swelling, clogging, cerebral pain, leg swelling, swollen eyelids, skin rash, and unpredictable pulse. These reactions can vary from person to person. These factors will likely constrain the expansion of the worldwide chondroitin sulfate market. Additionally, social and religious restrictions in some developing nations may threaten the global chondroitin sulfate market.

Increasing pharmaceutical necessities are generating numerous opportunities for the global chondroitin sulfate industry growth

Firms that manufacture pharmaceutical-grade chondroitin sulfate should have a lot of business opportunities due to the expanding pharmaceutical industry worldwide. The market for dietary supplements is anticipated to be driven by osteoarthritis and an expanding population of older people worldwide, which will probably drive chondroitin sulfate demand. The United States now allows chondroitin sulfate in food and nutritional supplements. The nutraceutical market is likely to expand as more people become aware of how chondroitin in sulfate can aid in joint health issues.

Additionally, the rising demand for dietary supplements containing chondroitin sulfate in the country may present opportunities for vendors and manufacturers in the market. Synthetic chondroitin sulfate will be produced by Gnosis S.p.A. in Italy, which should reduce the product's operating costs and enable it to avoid complicated manufacturing procedures. This should also help the market dispute. Credit goes to these kinds of product innovations, and producers should have many opportunities to produce synthetic goods that are both high quality and affordable.

Directly ingestible chondroitin B Sulfate-containing nutraceuticals are exempt from veterinary inspection. To ensure the quality of the product and adhere to the standard production processes, they must be manufactured in accordance with United States and GMP standards. A trend of opportunities is coming to the chondroitin sulfate market due to all these factors.

COVID-19 Impact:

Millions of people and businesses are impacted by the COVID-19 pandemic, which has become both an economic and humanitarian crisis. The funding for chondroitin sulfate-related R&D activities has been cut back due to the medical community's focus shifting to the treatment of COVID-19, and this market segment is now forced to deal with neglect.

To succeed in the rapidly shifting chondroitin sulfate market environment, aspiring businesses and their astute leaders must maintain constant vigilance for any indications of a potential new global order following the COVID-19 crisis.

The global market was dominated by the bovine source segment in 2023. This results from the source being used more frequently across a wide range of application companies, personal care, and cosmetics, including pharmaceutical and nutraceuticals, on a global scale. Several industries that use shark-derived chondroitin sulfate are in the nutraceutical, pharmaceutical, and animal feed industries. Sharks are currently thought to be an extinct species, which might prevent the sector from growing.

The shark-derived product is the predominant form due to its ability to treat people with rheumatoid arthritis, HIV, and gut inflammation; during the forecast timeline, demand is expected to increase due to this preference. Production of synthetic sodium chondroitin sulfate involves a two-stage fermentation-based process. There is little chance of contamination or adulteration because animal cartilage is not used in the procedure. The straightforwardness of the extraction procedure also contributes to low sourcing costs. It can also be used as a substitute by vegetarians and others who have dietary or religious restrictions, so its demand is expected to rise in Asian and Middle Eastern countries.

The industry was dominated by the nutraceuticals sector in 2023. Its high market share is credited to the sector's increasing investments due to the requirement to create new and more potent dietary supplements. It is commonly used as a dietary supplement to cure osteoarthritis and joint discomfort in the nutraceutical industry. They are consumed to reduce the pain of arthritis and to strengthen the bones, joints, and cartilage. The source is categorized, considering each country's national laws.

To treat arthritis pain, it is recommended as a dietary supplement along with glucosamine in the US. The market is expected to grow as dietary supplement intake rises in countries like the United States. Moreover, chondroitin sulfate and glucosamine hydrochloride are frequently found in animal feed additives. Pet diets, especially those for cats and dogs, comprise chondroitin sulfate from bovine sources to enhance joint health and mobility. The medication is also used to treat chronic pain brought on by patellar luxation and intervertebral disc disease, osteoarthritis, hip dysplasia, and intervertebral disc disease.

Segments Covered in the Report:

By Source

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client