What is Chromatography Data Systems Market Size?

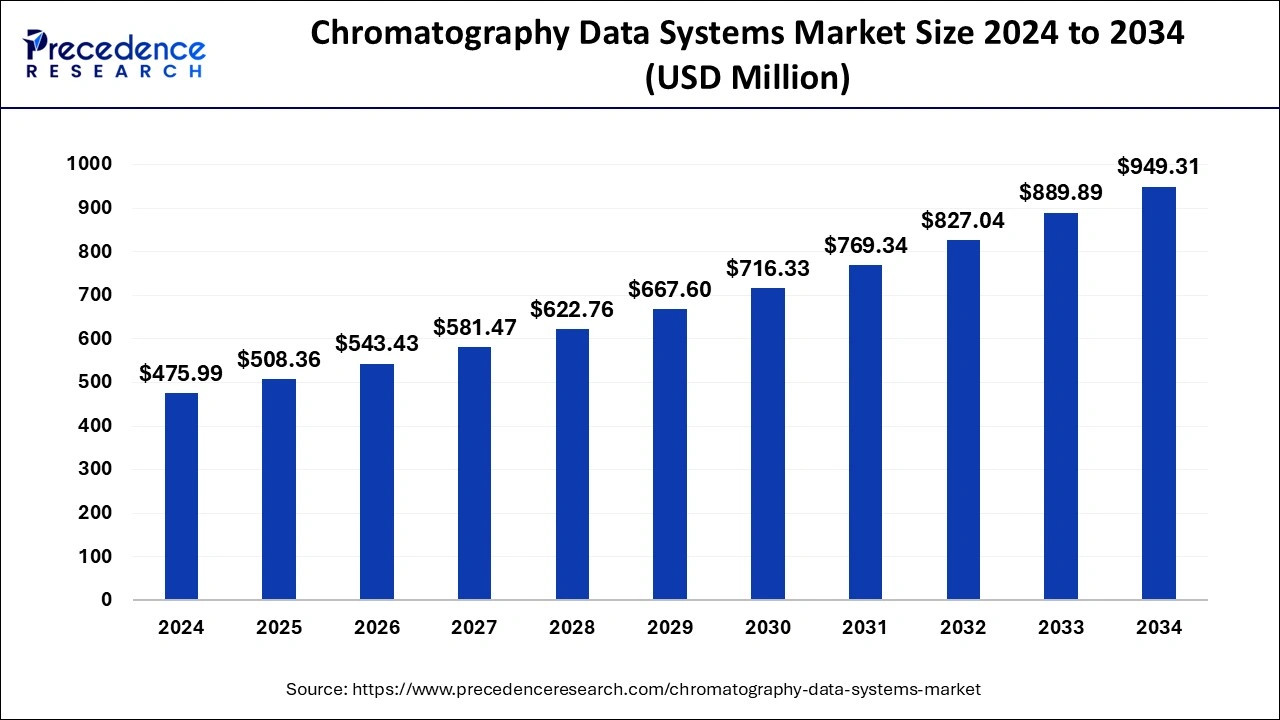

The global chromatography data systems market size is estimated at USD 508.36 million in 2025 and is predicted to increase from USD 543.43 million in 2026 to approximately USD 1011.02 million by 2035, expanding at a CAGR of 7.12% from 2026 to 2035.

Market Highlights

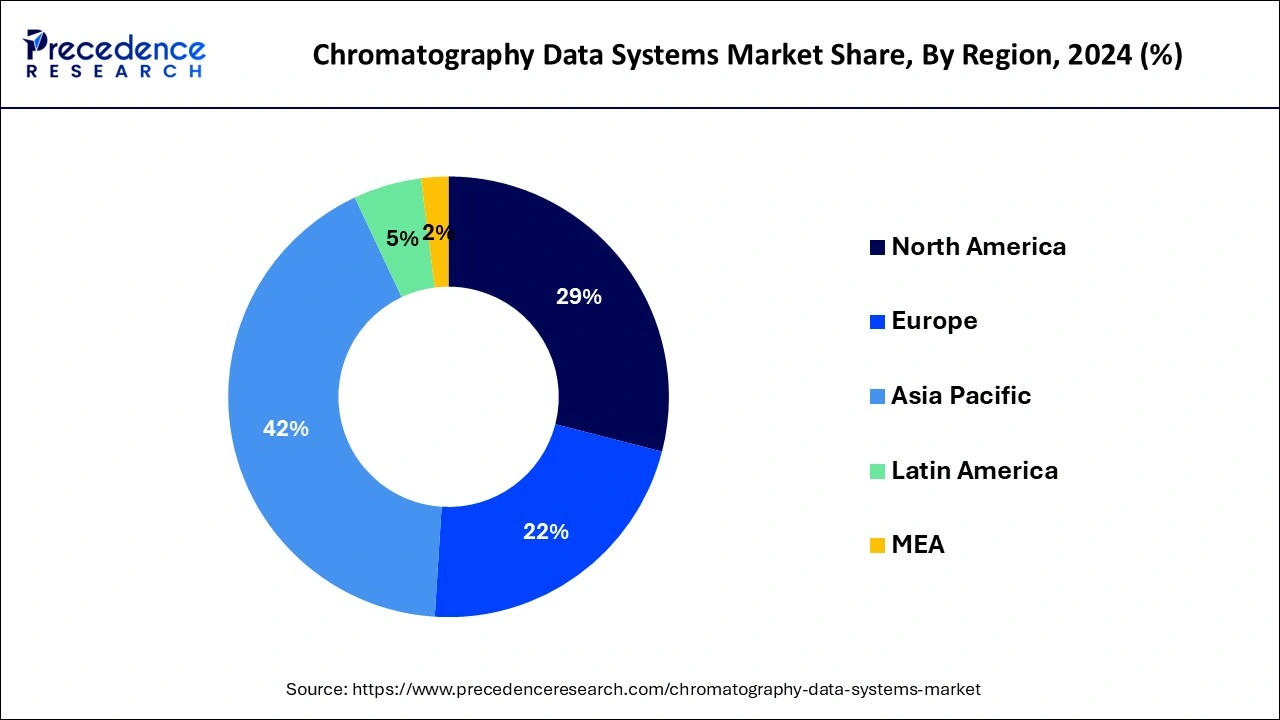

- Asia-Pacific dominated the chromatography data systems market with the largest market share of 42% in 2025.

- North America is estimated to expand at the fastest CAGR between 2026 and 2035.

- By type, the on-premise segment has held the biggest market share of 46% in 2025.

- By type, the cloud-based segment is anticipated to grow at a remarkable CAGR of 8.3% between 2026 and 2035.

- By application, the pharmaceutical segment generated the major market share of 36% in 2025.

- By application, the environmental testing segment is expected to expand at the fastest CAGR over the projected period.

What are Chromatography Data Systems?

The chromatography data systems market offers solutions in the form of a tool used in analytical chemistry to manage and interpret data obtained from chromatographic techniques. These techniques separate and identify components within a mixture for various applications, like drug testing or environmental analysis. CDS helps scientists and researchers by automating the process of data acquisition, analysis, and reporting, ensuring accuracy and efficiency. It allows users to visualize and interpret complex chromatographic data, facilitating the identification of substances in a sample. With user-friendly interfaces, the chromatography data systems market plays a crucial role in enhancing the productivity of laboratories, ensuring the reliability of results, and simplifying the overall workflow in chromatography experiments.

How is AI contributing to the Chromatography Data Systems Industry?

Artificial intelligence is a game-changer for chromatography data systems as it automates peak analysis, method development, compound identification, predictive maintenance, real-time monitoring, and data management, respectively, thereby leading to faster workflows, higher accuracy, improved consistency, and more efficient analytical decision-making in the lab and production areas.

Chromatography Data Systems Market Data and Statistics

- In a study released in June 2020, researchers employed liquid chromatography in conjunction with mass spectrometry to quantify Remdesivir levels in the blood plasma of a COVID-19-infected patient.

- As per the World Health Organization (WHO), approximately 420,000 individuals succumb to illnesses caused by contaminated food each year, leading to the forfeiture of 33 million healthy life years (DALYs).

- Growth Factors

- The increasing complexity of drug development processes necessitates advanced analytical tools for precise data interpretation, boosting the growth of the chromatography data systems market.

- Growing concerns about environmental pollution drive the need for accurate testing and monitoring, leading to an increased adoption of chromatography data systems in environmental analysis.

- Continuous advancements in chromatography technologies and data system features enhance efficiency and accuracy, attracting users seeking state-of-the-art solutions and contributing to market growth.

- Stringent regulatory standards in industries such as pharmaceuticals, food safety, and healthcare necessitate the use of sophisticated chromatography data systems for compliance, ensuring the reliability and traceability of analytical results.

- The growth of research and development activities across various industries, including pharmaceuticals, biotechnology, and academia, fuels the demand for chromatography data systems to analyze and interpret complex data sets.

- The worldwide expansion of the life sciences industry, encompassing areas such as genomics, proteomics, and bioinformatics, contributes significantly to the increasing adoption of chromatography data systems for advanced analytical capabilities.

Chromatography Data Systems Market Outlook: Predicting the Next Analytical Data Innovations

- Industry Growth Overview: The increasing need for laboratory automation and stringent regulatory requirements are contributing to the industry growth. Additionally, rising R&D expenditure and adoption of integrated or cloud-based software solutions are also enhancing the growth.

- Sustainability Trends:The sustainability trends focus on the use of cloud-based platforms to reduce paper-based workflows and energy consumption, along with instrument miniaturization and the use of greener solvents to minimize hazardous waste generation.

- Major Investors:Large publicly traded life science and analytical instrument companies are the major investors in the market. Some of the major investors include Agilent Technologies, Waters Corporation, Thermo Fisher Scientific, Shimadzu Corporation, and PerkinElmer Inc.

- Startup Ecosystem: The development of specialized, agile software solutions to enhance data integrity, automate workflow, and offer flexible integrations is the focus of the startup ecosystem. Panome Bio, Volatile AI, Precision Chromatography, etc, are some of the startups actively participating in the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 508.36 Million |

| Market Size in 2026 | USD 543.43 Million |

| Market Size by 2035 | USD 1011.02 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.12% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By Application, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing analytical needs in pharmaceutical research

The rising demand for advanced analytical tools in pharmaceutical research significantly boosts the market for chromatography data systems (CDS). In drug development, scientists require precise methods to analyze complex compounds and ensure the safety and effectiveness of pharmaceuticals. Chromatography techniques play a crucial role in this process, separating and identifying components in a mixture, generating large amounts of data that need efficient management. Chromatography data systems meet this demand by providing a comprehensive solution for data acquisition, analysis, and reporting.

As pharmaceutical research becomes more intricate and focuses on intricate analyses, the need for reliable and sophisticated systems for managing and interpreting chromatographic data continues to grow. The market for chromatography data systems is experiencing a surge as these tools become indispensable in enhancing the accuracy and efficiency of pharmaceutical research and development processes.

Restraint

Complexity and learning curve

The complexity and learning curve associated with chromatography data systems (CDS) can act as a significant restraint on the chromatography data systems market's growth. These systems, while advanced and powerful, may pose challenges for users unfamiliar with their intricate functionalities. Laboratories and facilities might encounter difficulties in the initial stages as staff members need to undergo training to effectively operate the software.

The learning curve not only requires time but also resources for training programs, potentially slowing down the adoption rate. Laboratories, particularly those with limited budgets or smaller teams, may find complexity a barrier to entry. Simplifying user interfaces, providing comprehensive training, and offering ongoing support are essential strategies to mitigate these restraints and encourage broader adoption of chromatography data systems in diverse laboratory settings.

Opportunity

Integration with Laboratory Information Management Systems (LIMS)

The integration of chromatography data systems (CDS) with laboratory information management systems (LIMS) is opening new and significant opportunities in the chromatography data systems market. This integration enables a seamless flow of data and enhances overall laboratory efficiency. By connecting CDS with LIMS, laboratories can achieve a unified platform for sample tracking, data analysis, and comprehensive reporting, streamlining workflows and reducing manual errors.

The collaborative power of CDS and LIMS offers laboratories a holistic solution, ensuring better data management and compliance with regulatory standards. This integrated approach not only improves operational efficiency but also provides a more cohesive and centralized system for researchers and analysts. As the demand for integrated laboratory solutions continues to grow, the synergy between chromatography data systems and LIMS creates a compelling opportunity for companies in the market to offer enhanced, end-to-end solutions that address the evolving needs of modern laboratories.

Segment Insights

Type Insights

The on-premise segment held the highest market share of 46% in 2024. The on-premise segment in the chromatography data systems market refers to software installations hosted and managed within a user's physical location rather than on cloud-based servers. Organizations opting for on-premise solutions have direct control over their data security and system customization. Despite the trend toward cloud-based solutions, some industries, particularly those with strict data privacy concerns, prefer on-premise setups for enhanced control and compliance. This segment continues to find relevance, especially in regulated sectors, where local infrastructure management aligns with specific industry standards and requirements.

The cloud-based segment is anticipated to witness rapid growth at a significant CAGR of 8.3% during the projected period. The cloud-based segment in the chromatography data systems market refers to systems that operate on cloud infrastructure, allowing users to access, manage, and analyze chromatographic data remotely. This type offers flexibility, scalability, and collaborative features, enabling real-time data sharing and accessibility. Recent trends indicate a growing preference for cloud-based chromatography data systems due to their advantages in remote work settings, data centralization, and cost-effectiveness. This trend aligns with the broader industry shift towards cloud technologies, enhancing the overall efficiency and accessibility of chromatographic data solutions.

Application Insights

The pharmaceutical segment has held a 36% market share in 2024. In the chromatography data systems market, the pharmaceutical segment involves the use of these systems in drug development and analysis. Chromatography data systems play a crucial role in pharmaceutical research by separating and analyzing complex compounds, ensuring the safety and efficacy of drugs. A key trend in this segment is the increasing demand for advanced data systems to handle the growing complexity of pharmaceutical analyses, streamline regulatory compliance, and enhance the overall efficiency of drug development processes.

The environmental testing segment is anticipated to witness rapid growth over the projected period. In the chromatography data systems market, the environmental testing segment focuses on analyzing air, water, and soil samples to detect pollutants. This application aids in monitoring and ensuring environmental safety. A notable trend in this segment is the increasing demand for chromatography data systems to manage and interpret complex data generated during environmental testing. As environmental regulations become more stringent, the adoption of advanced systems for accurate and efficient analysis is on the rise, driving growth in the chromatography data systems market for environmental testing applications.

Regional Insights

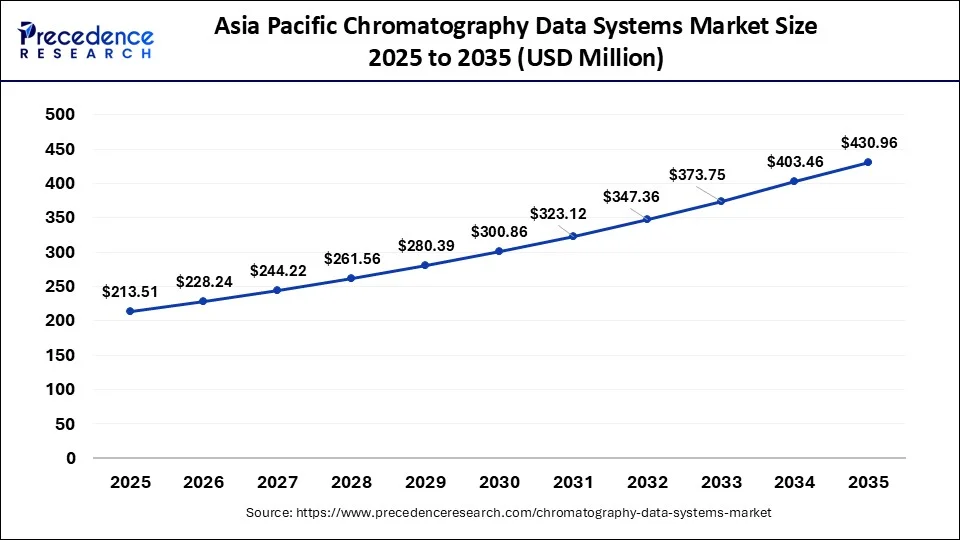

Asia Pacific Chromatography Data Systems Market Size and Growth 2026 to 2035

The Asia Pacific chromatography data systems market size is valued at USD 213.51 million in 2025 and is anticipated to reach around USD 430.96 million by 2035, poised to grow at a CAGR of 7.28% from 2026 to 2035.

Burgeoning Industries Drive Asia Pacific

Asia-Pacific held the largest market share of 42% in 2024 in the chromatography data systems market due to several factors. The region's burgeoning pharmaceutical and biotechnology industries, coupled with increasing investments in research and development activities, contribute to the high demand for advanced analytical tools like Chromatography Data Systems. Additionally, the expanding focus on environmental testing and stringent regulatory requirements in countries like China, India, and Japan further drive the adoption of these systems. The dynamic growth in various industries across the Asia-Pacific region positions it as a major player in the market.

Expanding Industries Enhance China

The expanding pharmaceutical and biotechnology industries in China are increasing the demand for chromatography data systems for various applications. The growing investments are also enhancing their innovations. The growing digitalization is also increasing their acceptance rates.

North America Driven by Advanced Healthcare Infrastructure

North America is poised for rapid growth in the chromatography data systems market due to the region's advanced healthcare infrastructure, substantial research and development activities, and stringent regulatory standards. The demand for precise analytical tools in pharmaceutical and biotechnology industries is on the rise. Additionally, increasing investments in research, the presence of key market players, and a focus on technological advancements contribute to the favorable environment. The region's commitment to innovation and high-quality research positions North America as a key driver for the expanding chromatography data systems market.

Advanced Industries Fuels U.S.

The presence of advanced industries is increasing their use in the drug development and testing process. Moreover, the stringent regulations are also increasing their adoption rates. This, in turn, is driving their development and adoption, promoting the creation of digital labs.

Growing Demands for Advanced Analytical Tools Boost Europe

Meanwhile, Europe is witnessing notable growth in the chromatography data systems market due to increasing demands for advanced analytical tools in pharmaceutical, biotechnology, and environmental sectors. Stringent regulatory standards drive the adoption of sophisticated systems for compliance. Additionally, a focus on research and development activities in the region, coupled with the expansion of the life sciences industry, contributes to the rising demand. The region's emphasis on precision medicine and a robust healthcare infrastructure further propels the adoption of chromatography data systems, fostering significant market growth in Europe.

Stringent Regulations Shape the UK

Due to stringent regulations, the demand for chromatography data systems in the UK is increasing. The presence of advanced pharma industries is also increasing their use. Moreover, the growing R&D activities in the industries and CDMO are also increasing their demand.

Growing Manufacturing Process Propels South America

South America is expected to grow significantly in the chromatography data systems market during the forecast period, driven by the growing manufacturing sector. This is increasing the demand for systems for consistent QC testing and data management, and adherence to the stringent regulations. Rising investor activity is also driving adoption and innovation, promoting market growth.

Argentina's CDS Market: A Growing Hub for Innovation

Argentina's chromatography data systems (CDS) market is expanding rapidly. Increased investment in pharmaceutical, food safety, and environmental research is fueling demand for advanced data management solutions. This growth trajectory highlights a maturing scientific community focused on efficiency and data integrity, attracting key market players.

Chromatography Data Systems Market-Value Chain Analysis

- R&D: discovery research, experimentation, and establishing analytical foundations for the development of new drugs and chemicals.

Key Players: Agilent, Thermo Fisher Scientific, Waters - Clinical Trials and Regulatory Approvals: producing safety and efficacy data, and making sure that the company meets the health authority's requirements.

Key players: Waters, Agilent, PerkinElmer - Formulation and Final Dosage Preparation: pharmaceutical forms that are stable and usable for combining active ingredients.

Key players: Thermo Fisher Scientific, Shimadzu, DataApex - Packaging and Serialization: enclosing products, assigning identifiers, ensuring traceability, compliance, and supply security.

Key players: Waters, Agilent, Thermo Fisher Scientific - Distribution to Hospitals, Pharmacies of Chromatography Data Systems: logistics that are secure and of quality control data management supported.

Key players: VWR (Avantor), Thermo Fisher Scientific, Merck KGaA

Key Players in Chromatography Data Systems Market and Their Offering

- Waters Corporation: Empower is the product provided by the company.

- Agilent Technologies: The company offers OpenLab CDS.

- Shimadzu Corporation: LabSolutions CDA is provided by the company.

- Thermo Fisher Scientific: The company provides Chromeleon CDS.

- PerkinElmer Inc.: TotalChrom and TIBCO Spotfire are provided by the company.

- Bruker Corporation: The company develops Compass CDS.

- DataApex: ClarityChrom is the product provided by the company.

Recent Developments

- In December 2025, Thermo Fisher Scientific launched Chromeleon 7.4, a chromatography and mass spectrometry data system for enterprise-level operations and regulatory compliance. It integrates functionality for various instruments, focusing on targeted quantitative workflows, evolving since its system release to support diverse platforms. (Source: https://www.chromatographyonline.com )

- In October 2024, Agilent Technologies launched the next-generation InfinityLab LC Series, including 1290 Infinity III LC, and 1260 Infinity III systems, featuring biocompatible versions. The new systems include the InfinityLab Assist Technology for improved system assistance and operational efficiency. (Source: https://www.biospectrumasia.com )

- In January 2020, Bruker Corporation (based in the United States) completed the acquisition of Prolab Instruments GmbH, a Swiss technology company known for its expertise in low-flow, high precision liquid chromatography technology and systems.

- Around the same time, in January 2020, Waters Corporation (headquartered in the United States) expanded its technology portfolio by acquiring Andrew Alliance, a Swiss software company.

- In February 2020, SCION Instruments, operating from Scotland, established a new factory and warehouse facility in the Netherlands. This move aimed to enhance capabilities in laboratory demonstration testing, manufacturing operations, and local procurement processes.

- Back in April 2019, Restek Corporation, a prominent independent chromatography product developer and producer based in the United States, collaborated with LECO Corporation on strategic initiatives in the field.

Segments Covered in the Report

By Type

- On-premise

- Cloud-based

- Remotely Hosted

By Application

- Pharmaceutical

- Biotechnology Industry

- Life Sciences

- Environmental Testing

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content