January 2025

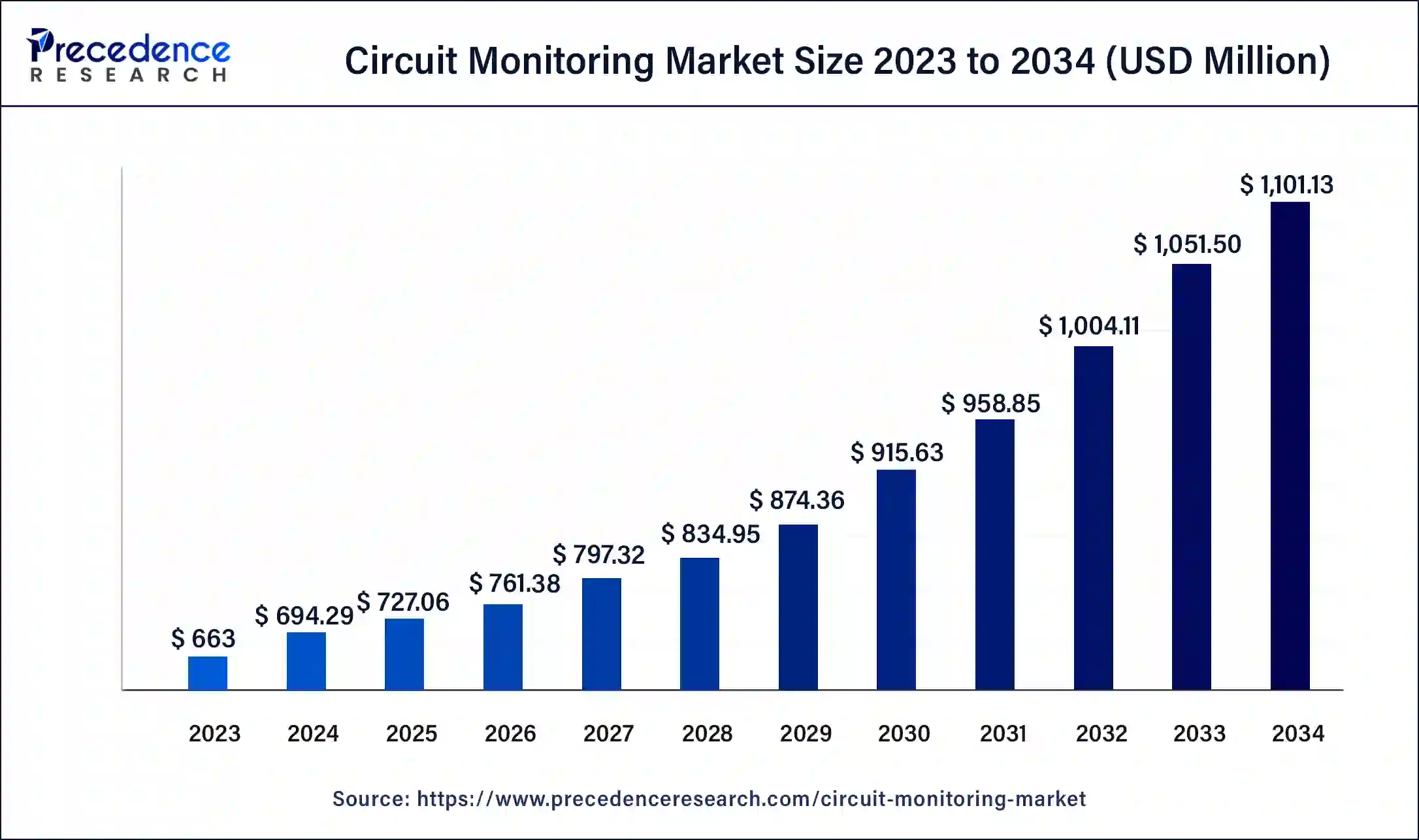

The global circuit monitoring market size was USD 663 million in 2023, calculated at USD 694.29 million in 2024 and is expected to be worth around USD 1,101.13 million by 2034. The market is slated to expand at 4.72% CAGR from 2024 to 2034.

The global circuit monitoring market size is projected to be worth around USD 1,101.13 million by 2034 from USD 694.29 million in 2024, at a CAGR of 4.72% from 2024 to 2034. The rising demand for the modern approach for the power management and monitoring driving the growth of the market.

The circuit monitoring system plays an important role in the daily working operations of many industries such as automotive, healthcare, IT and telecommunications, electronics, and others. Circuit monitoring is a multi-channel measurement system that is used in the electrical installation of the branch monitoring. It can be easily installed within the power distribution units and control cabinets.

The circuit control monitoring system is compact in size, which is ideal as a retrofit solution for the existing solutions. Circuit monitoring systems have several benefits with the installation, including required minimum space due to their compact size, easy installation, easy and expandable retrofitting, and user-friendly commissioning. Thus, the rising demand for circuit monitoring systems by various end-users drives the growth of the circuit monitoring market.

How can AI impact circuit monitoring?

Artificial intelligence is transforming industrial operations with better accuracy and productivity. AI is adopted by several industries, such as automotive, healthcare, electronics, and others. The AI helps transform and maintain the electrical assets that help organizations sustain themselves in the market competition and leverage the monitoring of data that is used to reduce downtime, make data-driven decisions, optimize resources, and enhance operational effectiveness. The rise in the adoption of artificial intelligence and digitization is aimed at achieving more efficient and sustainable goals.

The increasing demand for electrification in the leading industries and ensuring reliability, optimal operations, proper maintenance, and personal safety is driving the demand for the adaptation of AI into the industries. The increasing adaptation of AI instead of the traditional approach to asset maintenance and monitoring reduces the higher maintenance costs and downtime. AI plays a significant role in electric circuit monitoring through predictive maintenance, increased risk and security mitigation, improved reliability and efficiency, data-driven decision-making, and cost reduction. Hence, the adoption of AI could positively influence the circuit monitoring market.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,101.13 Million |

| Market Size in 2023 | USD 663 Million |

| Market Size in 2024 | USD 694.29 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.72% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising automotive industry

The rising population and industrial development in economically developing and developed countries are driving the per capita income in the population and the demand for automobiles for mobility. The rising manufacturing of the automobile industry is driving the electronic component and the intelligent circuit monitoring system that drive the growth of the circuit monitoring market. The automotive industry plays an important role in the higher demand for semiconductors and electronic components, which boosts the growth of the circuit monitoring market.

Shortage of professionals

The shortage of skilled labor force for the effective handling of the complex and challenging operations of energy and circuit monitoring and the regional regularity standards associated with electrical safety and energy are collectively restraining the growth of the circuit monitoring market.

Rising demand for power generation

The increasing demand for electrification and the modern compact electric component for the efficient transmission of power into industries are driving the opportunity for growth in the market. Additionally, the rising government initiatives in industrial development across the leading countries and the ongoing research and development activities in the expansion of electric monitoring over the traditional approach are driving the opportunity in the growth of the circuit monitoring market.

The others segment is expected to capture the largest share of the circuit monitoring market during the forecast period. The other segment includes multi-circuit monitoring and branch circuit monitoring. The growth of the segment is attributed to the rising adoption of multi-circuit and branch circuit monitoring in various end-use applications due to the easy installation and connectivity with the easy installation and connectivity with better access to data with user-friendly handling.

This circuit monitoring is designed to reduce the complexities and costs of the operations. They are mostly used for consumption in premises used in commercial and industrial applications. The brand circuit monitoring is used to track the effectiveness of power usage. Branch circuit monitoring is essential for IT and facilities equipment because it allows capacity planning, risk reduction, load balancing, and accurate billing. It helps track load and available capacity in real-time for every cabinet. It provides real-time load monitoring and balancing across the A and B sides to guard against cascading failure.

The data center segment is expected to have the dominant share of the circuit monitoring market during the anticipated period. The increasing adoption of circuit monitoring in the data centers for the rising remote working culture is driving the growth of circuit monitoring in the data center segment. Data centers are one of the important factors in the efficient operations of the business. The data centers are the essential component for monitoring and managing remote workers. Data center monitoring is the continuous tracking of IT metrics.

It is used to monitor the different operations in the business, including task management, operational, and monitoring processes. Circuit monitoring is one of the essential tools for operating overall facility initiatives. It plays a significant role in the effectiveness of the DCIM and BMS systems and facilities. The increasing remote work culture of many leading organizations is driving the demand for data center monitoring to maintain network bandwidth requirements, speed or upload network, and others. Thus, the increasing adoption of the remote working culture is driving the growth of data center monitoring.

North America dominated the market with the largest market share in 2023. The growth of the market is attributed to the rising industrial and commercial infrastructure, and the increasing presence of IT and telecommunication companies is driving the demand for the circuit monitoring market. The increasing demand for circuit monitoring in various leading industries such as automotive, manufacturing, healthcare, utilities, and data centers is accelerating the growth of the market. Additionally, rising technological advancements in the electrical infrastructure and the rising adoption of electric vehicles are driving the growth of the circuit monitoring market in the region.

Asia Pacific is expected to have the fastest growth during the forecast period. The growth of the market is attributed to the rising IT and telecommunication infrastructure in regional countries like China, India, and Japan. And the rising industrial infrastructure is boosting the growth of the market. Countries like China and Japan have a strong base of circuit monitoring systems in the different industrial sectors that drive the growth of the circuit monitoring market across the region.

Segments Covered in the Report

By Type

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

August 2024

June 2024