August 2024

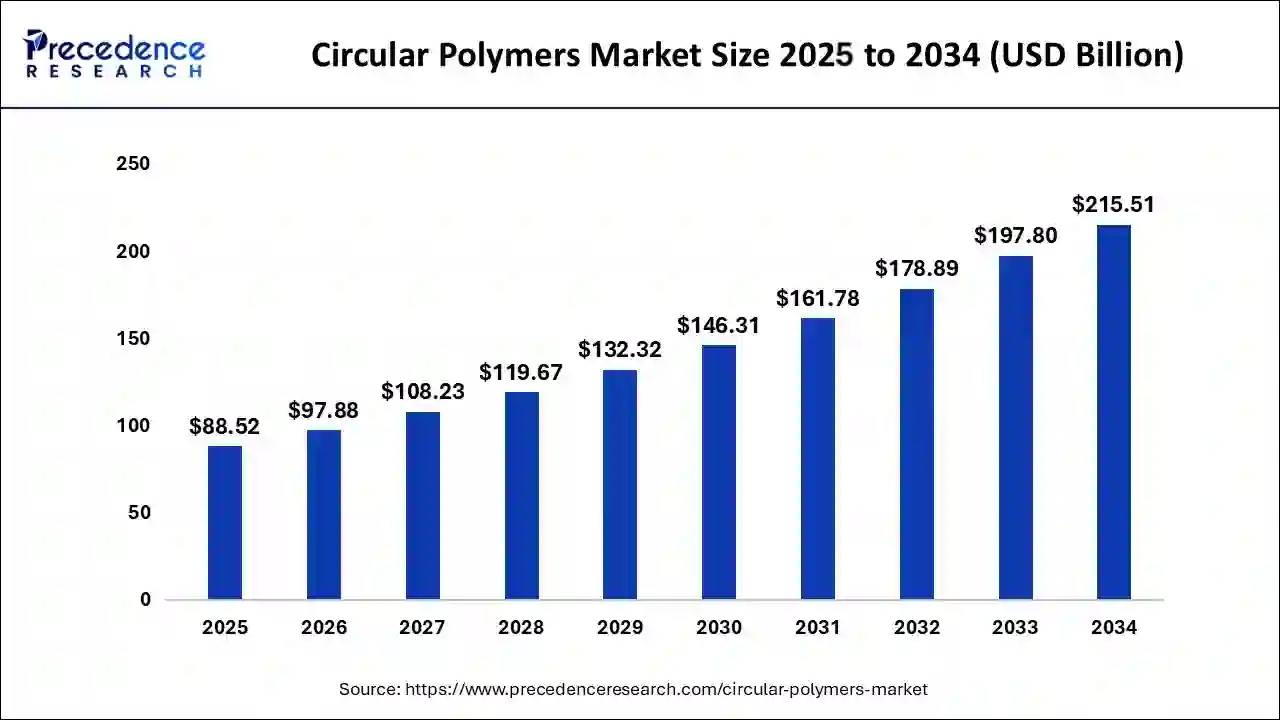

The global circular polymers market size is calculated at USD 88.52 billion in 2025 and is forecasted to reach around USD 215.51 billion by 2034, accelerating at a CAGR of 10.41% from 2025 to 2034. The Asia Pacific circular polymers market size surpassed USD 41.60 billion in 2025 and is expanding at a CAGR of 10.53% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global circular polymers market size was estimated at USD 80.05 billion in 2024 and is predicted to increase from USD 88.52 billion in 2025 to approximately USD 215.51 billion by 2034, expanding at a CAGR of 10.41% from 2025 to 2034. This market is experiencing propulsive growth owing to increasing strategic initiatives such as new product launches, production expansions, and mergers and acquisitions, among others.

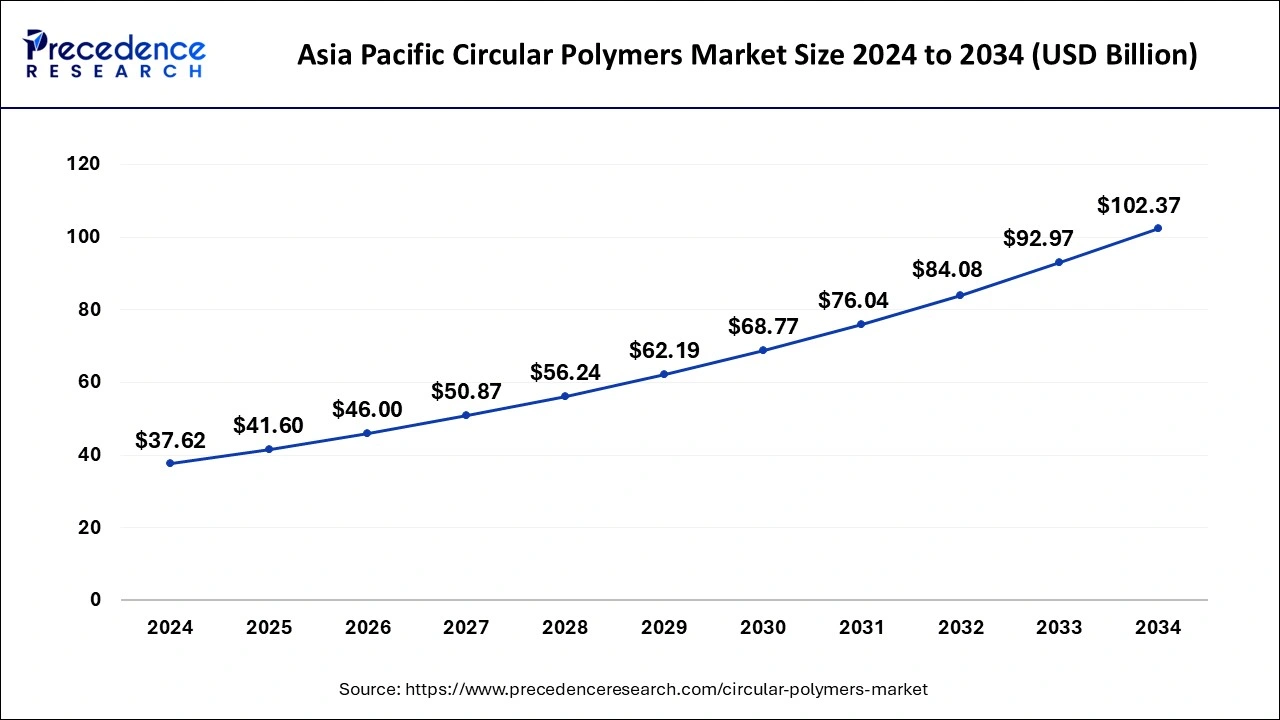

The Asia Pacific circular polymers market size was estimated at USD 37.62 billion in 2024 and is projected to surpass around USD 102.37 billion by 2034 at a CAGR of 10.53% from 2025 to 2034.

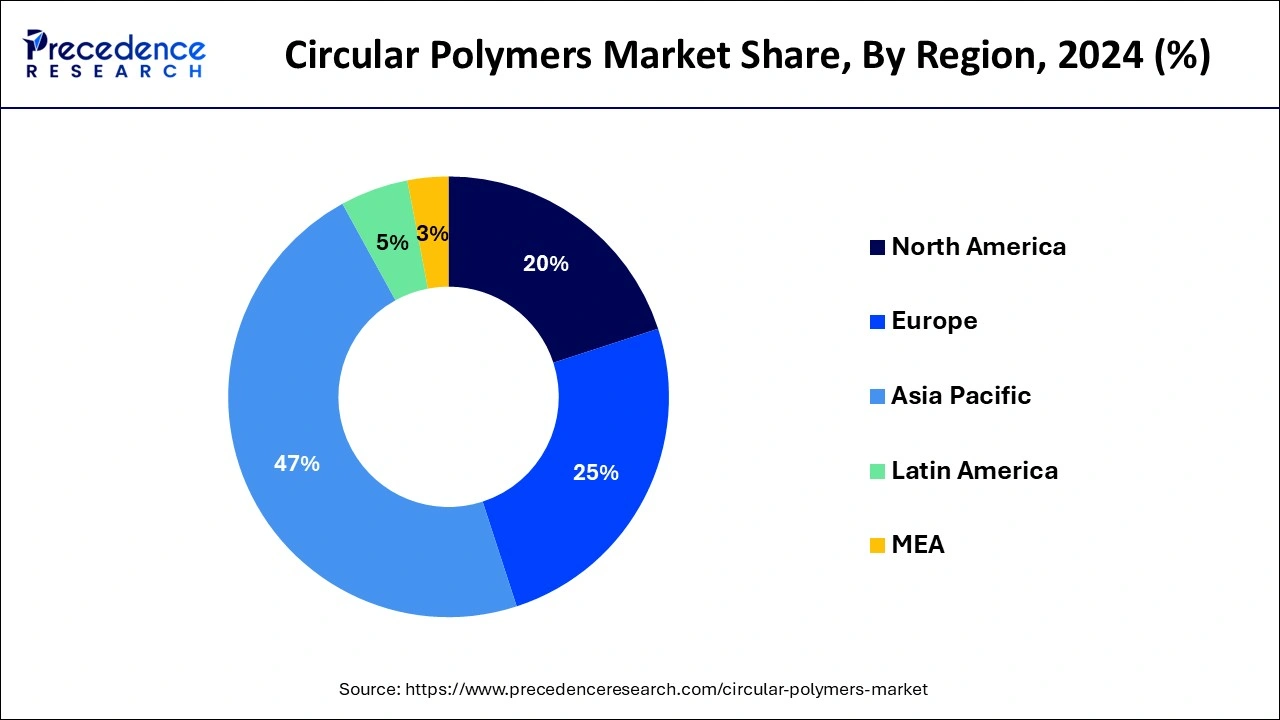

Asia Pacific dominated the circular polymers market and is expected to maintain its position throughout the forecast period. The region's growth is anticipated to be steady, driven by rising disposable incomes in emerging economies, which spur demand for convenient products and contribute to the global expansion of circular polymers. Furthermore, the consumer goods sector has experienced significant growth in recent years, emerging as a key market for circular polymers, particularly in packaging applications. Companies like Jindal Films play a crucial role in producing plastics, especially for packaging purposes.

North America has accounted for 20% of revenue share in 2024 and is expected to secure a significant portion of its revenue in the upcoming years. The growing recognition of the harmful environmental effects of plastic pollution has prompted both businesses and consumers in North America to explore alternative plastic materials that diverge from traditional practices. Circular polymers, sourced from recycled materials, align with initiatives aimed at tackling plastic waste problems. These factors are expected to drive increased demand within North America.

Circular polymers are unique polymers that can be collected, recycled, and transformed into new polymers without any degradation. They are essential in the circular economy, which aims to minimize waste and maximize resource efficiency. By using circular polymers, we can reduce the need for virgin resources, such as petroleum and natural gas, which promotes resource conservation. Furthermore, recycling plastic waste to create circular polymers produces fewer greenhouse gas emissions than producing virgin polymers, which helps conserve energy and reduce emissions.

Additionally, recycling plastic waste into circular polymers requires less energy and produces fewer greenhouse gas emissions than producing virgin polymers. This makes circular polymers an environmentally preferable option, which further aids in energy conservation and emissions reduction. Using circular polymers also promotes a more sustainable approach to polymer production and waste management by reducing environmental impact and conserving resources.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 10.57% |

| Market Size in 2025 | USD 80.05 Billion |

| Market Size by 2034 | USD 197.80 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Polymer Type, By Form, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The persistent rise in consumer product consumption

The packaging industry is experiencing a rise in demand for circular polymers market because of the increasing consumption of consumer products. With consumers buying more and their spending power growing, there's a greater need for sustainable packaging solutions.

Companies like Patagonia and Danone are leading the way by using recycled materials, including circular polymers, in their packaging. Danone aims to have all its packaging recyclable, reusable, or compostable by 2025 and is exploring the use of circular polymers in its packaging. Coca-Cola is also joining the movement by introducing bottles made from recycled PET in various markets worldwide.

Quality and performance requirements

Circular polymers often struggle to meet the quality and performance standards required for certain applications. This is because their mechanical, thermal, or chemical properties may not match those of virgin polymers, limiting their suitability for specific uses. Additionally, circular polymers can face challenges in cost competitiveness compared to traditional linear polymers.

The recycling and processing of plastic waste into circular polymers often involves additional steps and technologies, increasing production costs. Consequently, the higher price of circular polymers may restrict their adoption, particularly in the circular polymers market, which is sensitive to pricing.

Plastic growth

In the packaging industry, a ‘circular economy’ involves reusing and recycling plastic in a closed-loop system instead of producing single-use plastic that is discarded after one use. The demand for products made from recyclable plastic has spurred growth in the circular polymers market, driven by customers in the plastic, polymer, and packaging industries in developed countries. The rising volume of plastic waste generated by the food and beverage sectors has led to a greater need for recycling old food packaging, which is projected to increase polymer demand. The use of circular polymers in the packaging sector is expected to be twice the forecast period.

The polyethylene (PE)segment dominated the circular polymers market in 2024. This is due to the increasing environmental awareness regarding plastic usage and pollution that the demand for products containing recycled plastics has risen. Polyethylene is a popular polymer among market players and is a key contributor to the market. This factor will fuel segment demand in the future.

The polypropylene (PP) is predicted to be the fastest-growing segment over the projected period. Polypropylene is mainly used in the packaging industry's manufacturing sheets and films because its high resistance to abrasion, chemicals, and thermal bonding is expected to drive the demand for polypropylene throughout the packaging industry.

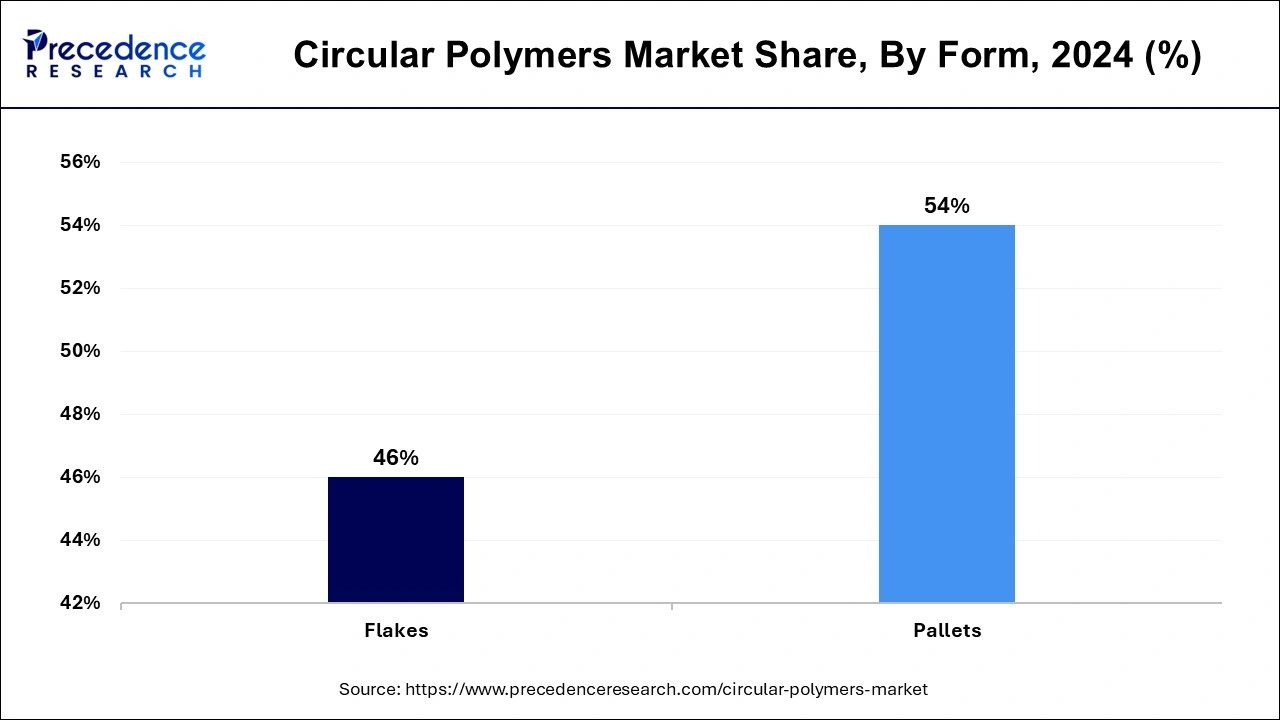

The pellets segment dominated the global circular polymers market in 2024. Pellets are convenient to manage and use in manufacturing processes like injection molding and extrusion. Circular plastics in pellet form are also simpler to transport in large amounts compared to plastics in resin or liquid form.

The flakes segment is expected to grow significantly during the period studied. Improvements in recycling infrastructure, such as better collection and sorting systems, can boost the availability of top-notch plastic flakes. Reliable recycling systems ensure a steady supply of raw materials for manufacturing circular polymers. These developments are expected to drive growth in the segment.

The food packaging segment dominated the market of circular polymers in 2024. This is because consumer preferences are shifting more towards eco-friendly and sustainable products, including food packaging. Circular polymers derived from recycled materials are aligned with these preferences, and brands are adopting them to meet customers' demand for eco-friendly packaging. This factor will help to boost the demand for a segment of the market.

The packaging segment captured the dominant share of the circular polymers market in 2024, driven by increasing demand for luxury personal care and cosmetic products. These premium items rely on exceptional packaging to attract consumers. Research indicates that appealing packaging plays a crucial role in captivating the target audience, serving as the initial impression, particularly for high-value cosmetics and personal care goods.

By Polymer Type

By Form

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

December 2024

November 2024