August 2024

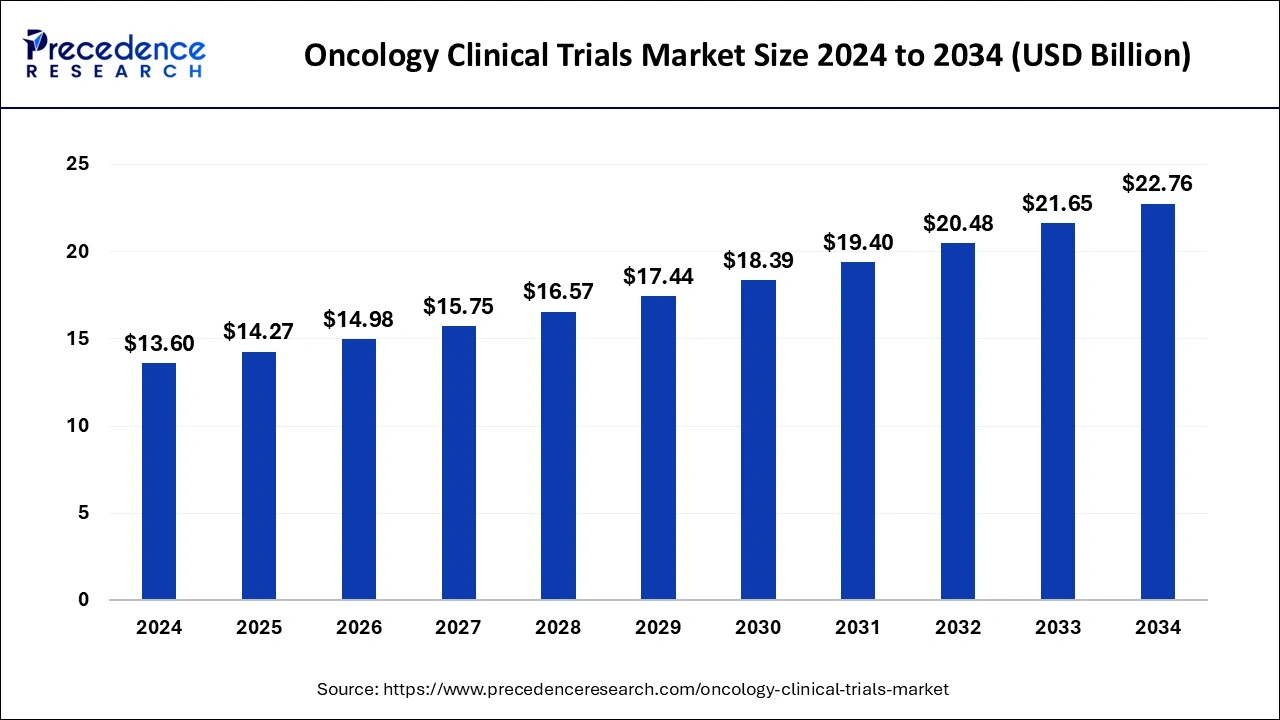

The global oncology clinical trials market size is accounted at USD 14.27 billion in 2025 and is forecasted to hit around USD 22.76 billion by 2034, representing a CAGR of 5.28% from 2025 to 2034. The North America market size was estimated at USD 5.71billion in 2024 and is expanding at a CAGR of 5.41% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global oncology clinical trials market was estimated at USD 13.60 billion in 2024 and is predicted to increase from USD 14.27 billion in 2025 to approximately USD 22.76 billion by 2034, expanding at a CAGR of 5.28% from 2025 to 2034.

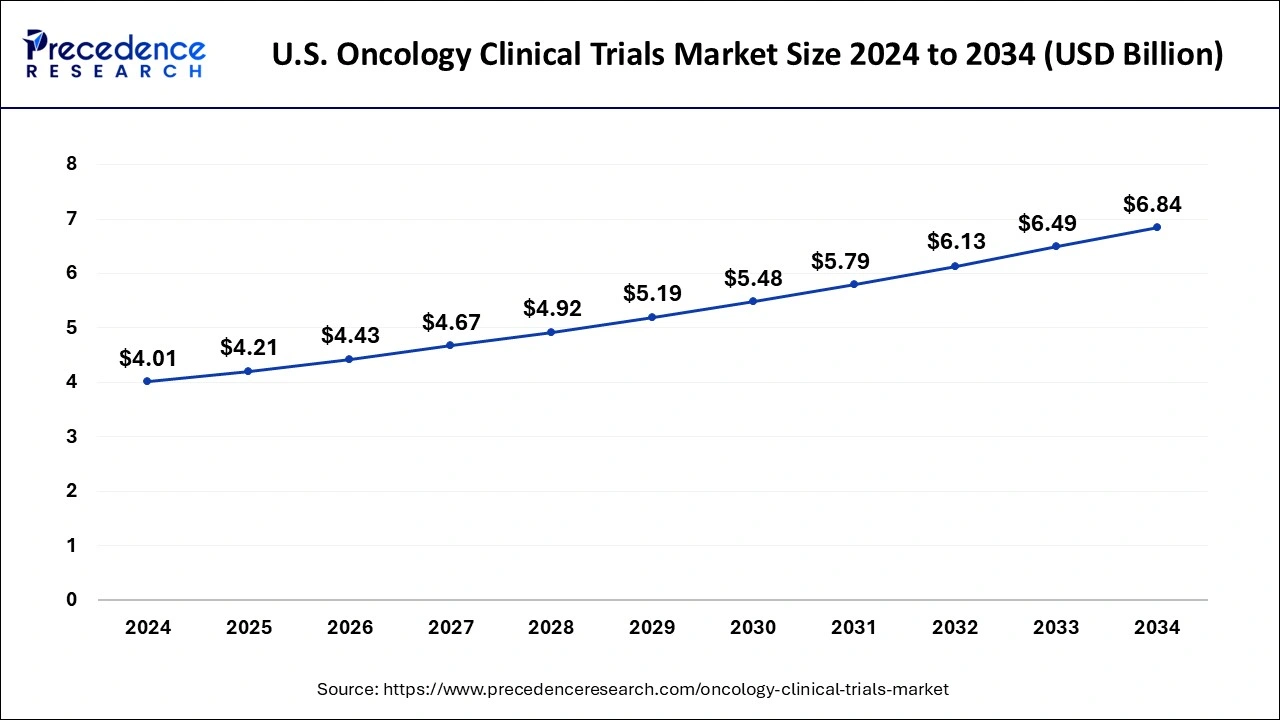

The U.S. oncology clinical trials market size was exhibited at USD 4.01 billion in 2024 and is projected to be worth around USD 6.84 billion by 2034, growing at a CAGR of 5.49% from 2025 to 2034.

North America held the largest share of 42% in the oncology clinical trials market owing to a combination of factors. The region boasts advanced healthcare infrastructure, a robust research ecosystem, and a high prevalence of cancer. Additionally, stringent regulatory standards and a mature pharmaceutical industry contribute to its dominance. Key players and research institutions based in North America actively drive innovation, attracting a significant number of clinical trials. This consolidated environment, coupled with a skilled workforce, facilitates efficient trial execution, making North America a major hub for oncology clinical research and market leadership.

Asia Pacific is positioned for swift growth in the oncology clinical trials market. The vast and diverse population presents an opportunity for extensive participant recruitment, ensuring a more representative sample in trials. Rising cancer cases in the region highlight the demand for novel treatments. Favorable regulations, cost-effective operations, and advanced healthcare infrastructure in key nations enhance the region's appeal for conducting efficient and economical oncology clinical trials. This convergence of factors propels significant expansion in the market for cancer research in the Asia-Pacific region.

On the other hand, Europe is experiencing significant growth in the oncology clinical trials market due to various factors. The region boasts a robust research infrastructure, renowned medical institutions, and a well-established regulatory framework, fostering an environment conducive to clinical research. Increasing collaboration between academia, industry, and research organizations further accelerates trial initiation and completion. Additionally, the rising prevalence of cancer and a proactive approach towards adopting innovative treatments contribute to the surge in oncology clinical trials. This combination of factors positions Europe as a key hub for advancing cancer research and propelling substantial growth in the market.

Oncology clinical trials represent investigative studies designed to explore innovative treatments and interventions for individuals diagnosed with cancer. These trials seek to evaluate the safety and effectiveness of emerging modalities, including pharmaceuticals, immunotherapies, and targeted treatments, with the overarching goal of advancing cancer therapeutics. Diverse participants, spanning various cancer types and stages, enroll in these trials, adhering to meticulous protocols that meticulously document treatment outcomes and potential adverse effects.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.28% |

| Market Size in 2025 | USD 14.27 Billion |

| Market Size by 2034 | USD 22.76 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Phase Type and Study Design |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising cancer incidence

The increasing worldwide occurrence of cancer significantly boosts the demand for oncology clinical trials.

As different types of cancer become more prevalent, there is a growing necessity for groundbreaking therapeutic options. This surge in demand propels pharmaceutical firms, research institutions, and healthcare entities into actively participating in extensive clinical research efforts. This surge in cancer incidence fuels a parallel rise in the need for diverse and targeted treatment options, propelling the oncology clinical trials market forward.

The trials become essential mechanisms for evaluating the safety and efficacy of emerging therapies, providing a crucial avenue for patients to access cutting-edge treatments while advancing the broader understanding of cancer biology and treatment modalities. In essence, the mounting global cancer burden underscores the pivotal role of oncology clinical trials in addressing the unmet medical needs of patients and steering the course of cancer care toward more effective and personalized solutions.

Patient recruitment and retention challenges

Patient recruitment and retention challenges present significant restraints for the oncology clinical trials market. The meticulous criteria for enrolling eligible participants in oncology trials, given the specific characteristics and medical backgrounds required, often lead to prolonged recruitment periods. This delay not only extends the overall trial duration but also increases operational costs, hindering the timely progression of research initiatives. Additionally, the competitive landscape and the limited pool of eligible patients further exacerbate recruitment difficulties, as multiple trials vie for the same participant demographic. Retaining patients throughout the trial duration poses another formidable challenge.

Factors such as the demanding nature of oncology treatments, potential side effects, and logistical issues can contribute to patient dropout rates. High dropout rates not only impact the reliability of trial results but also necessitate additional recruitment efforts to maintain adequate sample sizes. Effectively addressing these patient recruitment and retention challenges is crucial for ensuring the successful execution of oncology clinical trials, expediting the development of new cancer therapies, and meeting the evolving demands of the market.

Patient-centric trial designs

Patient-centric trial designs are revolutionizing the oncology clinical trials market by placing the patient experience at the forefront, creating significant opportunities for innovation and efficiency. Embracing decentralized and virtual trial models enables greater patient participation by reducing the burden of frequent site visits. This approach not only enhances overall patient satisfaction but also broadens the pool of potential participants, improving trial diversity and representation. Furthermore, patient-centric designs prioritize outcomes that matter most to patients, fostering increased engagement and adherence.

By incorporating patient-reported outcomes and leveraging digital health technologies for remote monitoring, these designs provide a more holistic understanding of treatment effects. As the industry continues to shift towards a patient-centric paradigm, there is a unique opportunity to enhance the success and speed of oncology clinical trials, ultimately accelerating the development of novel cancer therapies that resonate with patient needs and preferences.

The Phase III segment had the highest market share of 49% in 2024. In the oncology clinical trials market, phase III represents the advanced stage where experimental treatments undergo rigorous testing in a large patient population. This phase aims to confirm the effectiveness and safety of the investigational therapy compared to standard treatments. Trends in Phase III oncology clinical trials include an increasing focus on personalized medicine, with trials designed to identify biomarkers for targeted therapies. Additionally, collaborative efforts between industry and regulatory bodies aim to streamline processes and expedite the translation of promising treatments from research to clinical application.

The phase I segment is anticipated to expand at a significant CAGR of 5.14% during the projected period. In oncology clinical trials, the phase I segment is the initial stage of testing novel therapies in humans. Phase I trials focus on assessing the safety and tolerability of experimental drugs, determining the appropriate dosage, and identifying potential side effects. A trend in Phase I oncology trials involves an increased emphasis on biomarker-driven approaches, personalized medicine, and the exploration of innovative drug combinations. This trend aims to optimize treatment efficacy while minimizing adverse effects, aligning with the broader industry shift toward precision oncology and targeted therapies.

The interventional studies segment has held 88% market share in 2024. Interventional studies in the oncology clinical trials domain actively examine the impact of specific treatments on cancer outcomes. Frequently carried out through randomized controlled trials, these studies evaluate the safety and effectiveness of emerging therapies or treatment combinations. A noteworthy trend in this segment is the increasing focus on personalized medicine, tailoring treatments to individual patient characteristics. This shift towards customized interventions aims to enhance treatment outcomes and propel the field of precision oncology forward in a patient-centered approach.

The observational studies segment is anticipated to expand fastest over the projected period. Observational studies in the oncology clinical trials market involve the systematic collection and analysis of real-world data to understand the natural history of diseases, treatment outcomes, and patient characteristics. These studies observe participants in their everyday settings, providing valuable insights into the effectiveness and safety of cancer treatments outside controlled trial conditions. The trend in oncology clinical trials reflects an increasing reliance on observational studies to complement traditional trial data, offering a more comprehensive understanding of treatment patterns, long-term outcomes, and real-world patient experiences in diverse oncology settings.

By Phase Type

By Study Design

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

August 2024

September 2023

November 2024