What is the Clinical Trials Site Management Organizations Market Size?

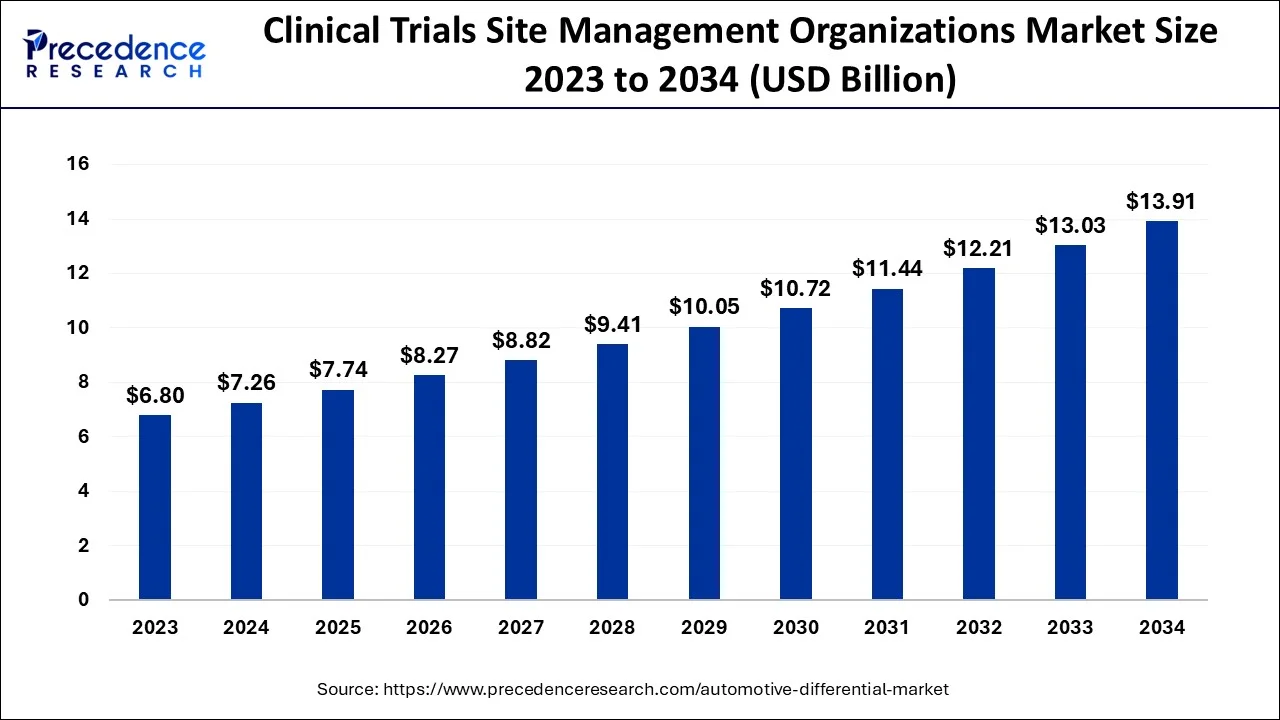

The global clinical trials site management organizations market size is calculated at USD 7.74 billion in 2025 and is predicted to increase from USD 8.27 billion in 2026 to approximately USD 14.75 billion by 2035, expanding at a CAGR of 6.66% from 2026 to 2035.

Clinical Trials Site Management Organizations Market Key Takeaways

- North America dominated computer numerical control (CNC) machine market in 2025.

- By clinical trial services, the project management segment dominated the market in 2025.

- By therapeutic areas, the CNS segment led the market in 2025.

- By phase, the Phase III segment led the market in 2025.

What are Clinical Trials Site Management Organizations?

The market for site management organizations is being driven by rising demand for drug discoveries , high prevalence of chronic diseases, an increase in the number of clinical trials for novel drugs and therapies, booming pharmaceutical industries, and a growing preference for clinical trial outsourcing to CROs (contract research organizations). As drug development processes become more complex, the number of clinical trials and complexities in the clinical trial phases increases and it results in increasing the demand for SMOs in the coming years.

How is AI contributing to the Clinical Trials Site Management Organizations Industry?

AI, or artificial intelligence, is much of a significant support to site management organizations through the automation of routine activities, the optimization of site selection, and the use of predictive analytics in clinical operations. Besides, AI also facilitates patient recruitment, retention, data quality, and monitoring efficiency forecasting. Documentation is also made easier with advanced language tools, while real-time analytics give way to risk-based supervision.

All these features put together lessen the operational burden, speed up study execution, and deliver quality patient-centric research outcomes that are not only very good but also very broad in terms of therapeutic areas and care settings.

Market Outlook

- Industry Growth Overview: The market is very much alive and kicking thanks to the difficulty in research costs, the preference for outsourcing, and the continuous rise in global demand being together.

- Sustainability Trends: Sustainability is all about the technology bringing the paperless and less travel trials closer, thus benefiting the environment and providing quality service at the same time.

- Global Expansion: The growth is not just limited to Asia Pacific's emerging markets, but also the well-established regions are still considered to be part of the network of global clinical research.

- Major Investors: The list of main actors includes the likes of ICON plc, Parexel, IQVIA, and Syneos Health, to mention just a few, as well as the private equity financiers who are backing the global consolidation strategy.

- Startup Ecosystem: The startup ecosystem is the one that introduces and promotes new ideas in the market using artificial intelligence, advanced analytics, and digital health tools that make the site more effective.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.74Billion |

| Market Size in 2026 | USD 8.27 Billion |

| Market Size by 2035 | USD 14.75Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.66% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Clinical Trial Services, By Phase, and By Therapeutic Area |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics:

Drivers:

Increased use of CTMS software

CTMS software streamlines clinical operations by providing insight into research portfolios and ensuring regulatory and billing compliance. These solutions also centralize and standardize the billing process, which includes sponsor invoicing and tracking of subject visits. CTMS solutions frequently integrate with electronic health records systems to speed up patient data transfer. They also simplify reporting, which is critical for the scientific review committee process. CTMS solutions will become increasingly important as the number of clinical trial sites grows due to the expansion of decentralized clinical trials that allow trial activities to be conducted remotely.

Restrains

Delay in trials

The conduct of clinical trials is frequently fraught with difficulties, including scientific and operational complexities, concerns about recruiting and retaining suitable patients, data handling issues, and increasingly stringent regulatory guidelines. Furthermore, because of the inherent complexity of the overall process and the involvement of multiple stakeholders, clinical trials are prone to delays. More than 80% of clinical trials are delayed by one to six months, with only 10% of studies completed on time. As a result, pharmaceutical industry innovators are constantly working to improve the procedure for conducting clinical trials and managing research sites.

Opportunities

Technological advancement

Site networks and providers of clinical trial services have begun to implement and improve the technological infrastructure on which their systems rely. Technology improves efficiencies at the site level by improving metrics on-site identification, selection, and performance, as well as across the patient spectrum by analyzing recruitment, selection, enrollment, retention, and adherence metrics at sites. Furthermore, technological advancements have resulted in increased biostatistics and data analytics analysis to understand a drug's feasibility earlier in the development process.

To increase data transparency between the patient, clinical trial site, and trial sponsor/CRO, industry leaders have migrated their data management to the cloud. Previously, technology was out of date and required multiple systems for clinical trial management, necessitating the need for automation and integration of multiple systems to track milestones more efficiently, provide better process management, and overall site improvement.

Segment Insights

Clinical Trial Services Insights

The project management segment dominated the market in 2025

In 2023, project management dominated the market for clinical trial site management organizations, accounting for 28% of total revenue. A clinical trial is a lengthy and complicated project. Many complex components and moving parts are involved in project management. Study design, labs, recruiting investigational products, data, materials, and site management are examples of these components.

Before beginning a clinical trial, various project tools and templates can be used to successfully design and execute a clinical trial. Microsoft Access, Excel, Outlook, SharePoint, and Visio are among the tools available, as are Web-based applications. Study start-up, team management, recruiting, clinical evaluation, and intervention are all part of the clinical trial project management life cycle.

During the forecast period, the onsite monitoring segment is expected to grow at the fastest rate of 6.90%. The site monitoring service tracks the progress of clinical trials and ensures that monitoring is carried out and reported by clinical study SOPs. Clinical trial sites must be monitored by GCP guidelines. The growing number of clinical trials has increased the market for clinical trial site management organizations' demand for onsite monitoring services.

Therapeutic areas Insights

CNS segment dominated the market in 2025

In 2022, the CNS segment dominate the market for clinical trial site management organizations, accounting for 17% of total revenue. The high prevalence of CNS-related issues is driving the segment by increasing demand for clinical trials. For example, the WHO reported in 2021 that over 55.0 million people worldwide have dementia. One of the primary causes of dementia's high prevalence is the growing geriatric population. The funding for CNS-related clinical studies from various government agencies is expected to boost demand for site management and support the segmental market.

During the forecast period, the oncology segment is expected to grow at the fastest CAGR of 6.95% in the market for clinical trial site management organizations. Cancer is a leading cause of death worldwide. Cancer Tomorrow estimates that 30.2 million people will be diagnosed with cancer by 2040. The disease's high prevalence contributes to its demand for research, which is the primary reason for the segment's growth. Sedentism is also contributing to an increase in cancer incidence, fueling the research demand for cancer trials.

Phase Insights

The Phase III segment dominated the market in 2025

The phase III segment dominated the market, accounting for 55% of total revenue in 2023. Even during the forecast years, the segment is expected to remain dominant. Clinical studies in phase III are more complicated than those in earlier stages; additionally, this phase includes a larger number of patients than other phases, increasing the demand for site management in this phase of clinical trials. This phase also has the highest failure rate because the sample size and research design require precise dosing at an optimal level. Such complications raise the demand for site management in phase III trials even more.

During the forecast period, the phase I segment is expected to grow at the fastest CAGR of 6.95% in the market for clinical trial site management organizations. The increase in R&D spending and demand for innovative treatments is increasing the demand for phase I trials, promoting the need for site management services. The high global disease burden, which contributes to the demand for new research, is expected to have a positive impact on segment growth.

Regional Insights

Asia Pacific is expected to grow in the forecast period

Asia Pacific is expected to grow at a 7% CAGR during the forecast period. Because of the ease of regulatory compliance, low study costs, a growing patient population, and the presence of a few elite clinical institutions serving as sites, the region has become a hotspot for conducting clinical trials. These factors are driving up demand for site management services, which is driving up the market for clinical trial site management organizations.

Site management organizations that operate as independent contract research organization (CRO) divisions provide some significant benefits in the changing Asian clinical trial market, where rapid recruitment of large patient numbers is critical. They are commonly used as investigators by district and hospital physicians. The patient's doctor oversees most study visits, who are assisted by research/practice nurses. SMOs of this type would oversee site training and assistance and would be part of a regional coordination framework. Because patients are recruited through database searches and doctor visits, the model is suited for enrolling many people.

North Clinical trial site management in North America involves the coordination and management of all activities related to clinical trials conducted in North America, including the United States and Canada.

The United States is one of the largest and most important markets for clinical research in the world, with a large and diverse population, a well-established regulatory framework, and a strong infrastructure for clinical trial site management. Canada also has a well-developed clinical research infrastructure and a supportive regulatory environment for clinical trials.

What Are the Driving Factors of the Clinical Trials Site Management Organizations Market in Latin America?

Latin America is coming up as a very good market for site management organizations because of the increase in clinical research activities and the variety of patients. The area backs up global trial strategies by providing operational flexibility and better infrastructure, and at the same time luring sponsors who want to recruit patients easily.

Brazil Clinical Trials Site Management Organizations Market Trends:

Brazil is the best country in Latin America when it comes to providing clinical trial site management. The country has the advantage of great research activity, a variety of patient pools, and investment interest, which all together make a perfect environment for the organizations that are focusing on operational efficiency, navigating regulations, and improving recruitment performance.

Clinical Trials Site Management Organizations Market Companies

Mergers, acquisitions, and partnerships, among other strategies, are used by prominent players to maintain their market share. ClinChoice, for example, partnered with clinical research and development solution provider Cloudbyz in April 2022. Cloudbyz provided its clinical research management technology platform to help ClinChoice with clinical studies, including site identification, site feasibility, and clinical monitoring, as part of the partnership. Similarly, Elligo Health paid USD 135 million for ClinEdge in September 2021 to expand its clinical trial service offerings. Among the key players in the clinical trials site management organizations market are:

- ClinEdge: ClinEdge helps with patient recruitment, providing retention programs, facilitating decentralized trial programs, and offering home health services that all together make up a diversity-boosting and study efficiency-improving outcome on a global scale.

- WCG: WCG's global network capabilities make it possible to offer integrated solutions for study planning, site enablement, ethical review, and participant recruitment by utilizing the extensive data networks' strengths.

- ClinChoice: ClinChoice is your partner for global clinical development services that include site selection, operations management, data integrity, and safety oversight, as well as being globally integrated.

Other Major Key Players

- Access Clinical Research

- FOMAT Medical Research INC.

- SGS

- KV Clinical

- SMO-Pharmina

- Xylem Clinical Research

- Aurum Clinical Research

Recent Development

- In December 2025, three international nuclear medicine organizations endorsed a unified accreditation framework for PET/CT and PET/MR scanners. This framework aims to standardize and harmonize quantitative PET imaging globally.

(Source: itnonline.com ) - In October 2025,LyfeSci Research & Innovation is a physician-led CRO emphasizing site-first approaches and patient outcomes. The company offers comprehensive services from pre-clinical studies to Real-World Evidence and Data research.

(Source: businesswire.com ) - In 2021,Trialbee (Sweden) worked with Castor, a leading provider of decentralized and hybrid clinical trial solutions, to increase patient enrollment, improve patient engagement, and reduce the burden on clinical trial sites around the world.

- In 2021, Worldwide Clinical Trials, Inc. (US), a global full-service contract research organization (CRO), partnered with Triumph Research Intelligence (TRI), a leader in risk-based quality management (RBQM) technology, to improve clinical trial quality worldwide.

- In 2020, As a CRO (Contract Research Organization), CMIC Group (Canada) began providing monitoring services for "Avigan Tablet" (an influenza antiviral drug for novel influenza virus infections) in Japan. As a CDMO, the company also supported the product's manufacturing (Contract Development & Manufacturing Organization)

Segment Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and analyses the most recent industry trends in each sub-segment from 2022 to 2032. Precedence Research has segmented the global clinical trials site management organizations market report based on clinical trial services/components, phase, therapeutic areas, and region for this study:

By Clinical Trial Services

- Site Management

- Project Management

- Regulatory

- Onsite monitoring

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Therapeutic Area

- Oncology

- Cardiology

- CNS

- Pain management

- Endocrine

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting