January 2025

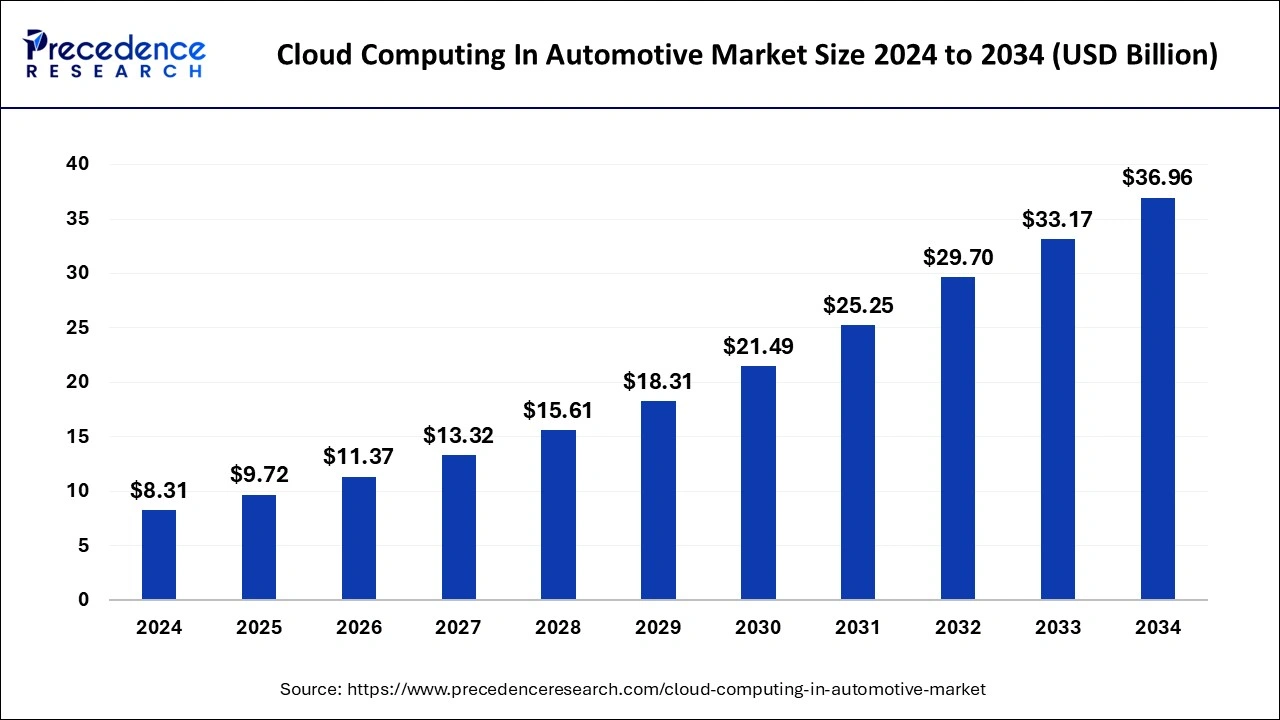

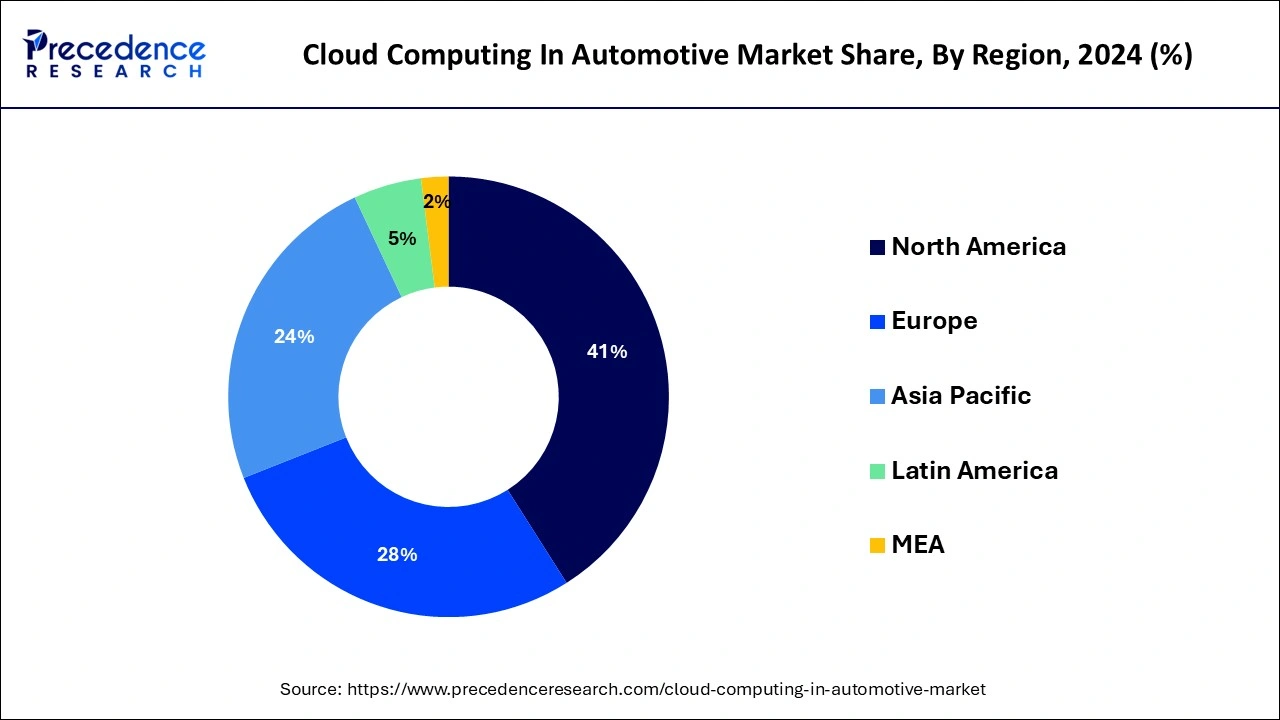

The global cloud computing in automotive market size is calculated at USD 9.72 billion in 2025 and is forecasted to reach around USD 36.96 billion by 2034, accelerating at a CAGR of 16.09% from 2025 to 2034. The North America cloud computing in automotive market size surpassed USD 3.41 billion in 2024 and is expanding at a CAGR of 16.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cloud computing in automotive market size was estimated at USD 8.31 billion in 2024 and is anticipated to reach around USD 36.96 billion by 2034, expanding at a CAGR of 16.09% from 2025 to 2034. The increasing demand for connected vehicles drives the growth of the cloud computing in automotive market.

Artificial intelligence plays a key role in enhancing the interconnected car experience. AI helps in providing customized infotainment systems that can learn consumers' preferences and provide real-time traffic updates. Integrating AI algorithms in ADAS improve the safety of vehicles. AI also detects potential hazards and monitors the vehicle's surroundings, enhancing the overall driving experience. Moreover, AI algorithms efficiently analyze large amounts of data generated by the vehicle on cloud platforms, helping manufacturers and service providers in decision making.

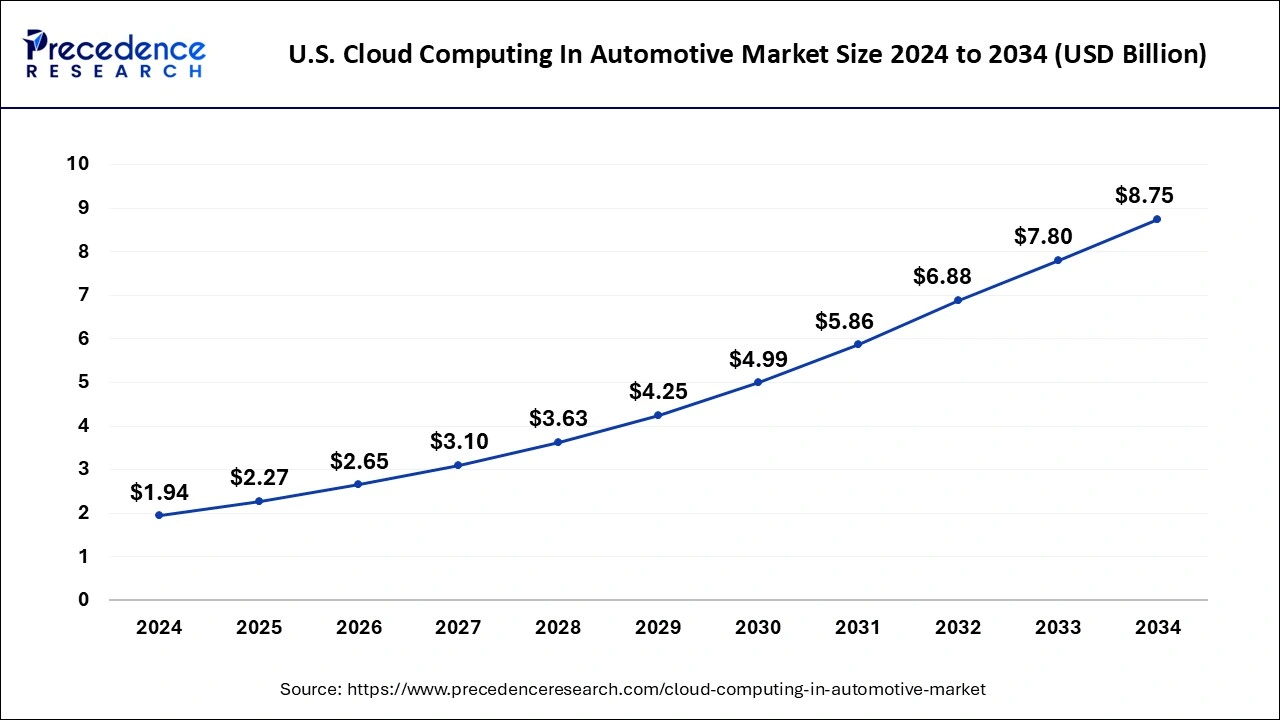

The U.S. cloud computing in automotive market size was evaluated at USD 1.94 billion in 2024 and is predicted to be worth around USD 8.75 billion by 2034, rising at a CAGR of 16.26% from 2025 to 2034.

North America has held the largest revenue share 41% in 2024. North America dominates cloud computing in the automotive market primarily due to its established automotive industry, technological advancements, and robust cloud infrastructure. The region is home to numerous automakers and tech giants investing heavily in cloud-connected vehicles. Additionally, a tech-savvy consumer base and regulatory support for connected car technologies drive adoption. North America's mature IT ecosystem, strong cybersecurity practices, and a high level of disposable income among consumers further fuel the market's growth. These factors collectively position North America as a frontrunner in leveraging cloud computing for automotive innovations and services.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region commands a significant growth in the Cloud Computing in the automotive market due to several key factors. This region boasts a robust automotive industry, with a high demand for connected vehicles and smart mobility solutions. Additionally, the rapid urbanization and increasing tech-savvy population in countries like China and India drive the adoption of cloud-connected automotive services. Furthermore, the presence of leading cloud service providers and a favorable regulatory environment for technology innovation have made Asia-Pacific a hotbed for cloud computing in the automotive sector, solidifying its substantial market growth.

In the automotive sector, cloud computing represents the fusion of cloud-based solutions and technologies with vehicular systems. This convergence empowers vehicles with instantaneous data exchange, remote diagnostics, software upgrades, and advanced driver-assist functionalities. Cloud-connected automobiles gain access to navigation, entertainment, and connectivity services, elevating the overall driving encounter.

Furthermore, cloud computing enables seamless vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications, pivotal for autonomous driving and traffic management. It also empowers automakers to amass and scrutinize copious data volumes, facilitating anticipatory maintenance and perpetual enhancement. In essence, cloud computing is catalyzing a transformative shift in the automotive landscape, fostering connectivity, innovation, and operational efficacy.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 16.09% |

| Market Size in 2025 | USD 9.72 Billion |

| Market Size by 2034 | USD 36.96 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service Model, By Application, and By Deployment Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Connected vehicle demand

The automotive industry is experiencing substantial growth driven by the burgeoning demand for connected vehicles. This upsurge in consumer interest is fueling a transformative shift, with automakers increasingly focusing on delivering cloud-based solutions to cater to this connectivity issues. Connected vehicles, responding to the desires of modern consumers, offer an array of advantages that elevate the driving experience.

They grant real-time access to navigation services, entertainment choices, and invaluable vehicle data, elevating journeys to new levels of convenience and efficiency. Notably, the reliance on cloud computing is magnified in the context of autonomous driving. The continuous need for access to extensive data for immediate decision-making and up-to-the-minute mapping updates makes cloud infrastructure an indispensable component for the development and operation of self-driving cars.

As the demand for connectivity continues to accelerate, substantial investment is coming into the field of connected vehicle solutions from both automakers and technology firms. This surge in investment acts as a catalyst for innovation, fosters a competitive landscape, and ultimately results in a broader spectrum of connected features and services for discerning consumers. Consequently, the soaring demand for connected vehicles not only enriches the driving experience but also ignites growth and augments competitiveness across the automotive sector.

Cybersecurity concerns

Cybersecurity concerns loom as a substantial restraint on the growth of cloud computing in the automotive market. The increasing integration of cloud-based systems in vehicles makes them vulnerable targets for cyberattacks. As vehicles rely on cloud services for critical functions like navigation, remote diagnostics, and over-the-air updates, any breach in cybersecurity could lead to dire consequences, including safety risks and data breaches. Automakers face the daunting task of fortifying their cloud-connected vehicles against ever-evolving cyber threats.

The constant need for rigorous security measures demands significant investments in research, development, and ongoing maintenance. Moreover, the complexity of securing diverse vehicle components and software systems adds to the challenge. Compliance with data privacy regulations, such as GDPR or CCPA, is also a burdensome hurdle. Striking a balance between offering connected services and safeguarding user data while adhering to stringent privacy laws requires meticulous planning and resources.

These cybersecurity concerns not only pose immediate threats but also erode consumer trust, potentially hindering the widespread adoption of cloud computing in the automotive sector. Overcoming these challenges and ensuring robust cybersecurity measures will be imperative to drive the growth of cloud computing in the automotive market.

Over-the-air updates

Over-the-Air (OTA) updates stand as a pivotal opportunity within cloud computing in the automotive market, ushering in a new era of innovation and customer engagement. Cloud-based OTA updates allow automakers to remotely deliver software upgrades and enhancements directly to vehicles, offering a multitude of advantages. This capability not only ensures that vehicles remain up-to-date with the latest features and security patches but also opens avenues for continuous revenue streams through subscription-based services.

Moreover, OTA updates enable automakers to swiftly address safety recalls and performance issues, enhancing vehicle reliability and customer satisfaction. This agile approach to vehicle maintenance reduces the need for costly and time-consuming dealership visits, saving both time and money for consumers. As automakers leverage the power of cloud computing for OTA updates, they can foster brand loyalty, streamline operations, and remain at the forefront of technological advancements in the highly competitive automotive market.

The software as a service (SaaS) sector has held a 40% revenue share in 2024. The software as a service (SaaS) segment maintains a prominent position within cloud computing in the automotive market due to its substantial share, primarily attributed to its cost-efficient and scalable solutions. SaaS solutions offer automotive manufacturers the versatility to deploy software updates, telematics, and infotainment services seamlessly, negating the necessity for extensive hardware investments.

Additionally, SaaS enables real-time data analytics, predictive maintenance, and user-friendly interfaces, augmenting vehicle performance and user experiences. Its subscription-based model aligns harmoniously with evolving consumer preferences for on-demand services, rendering SaaS the favored choice for automakers seeking agile, adaptable, and customer-centric cloud solutions.

The platform as a service (PaaS) sector is anticipated to expand at a significantly CAGR of 18.7% during the projected period. The Platform as a Service (PaaS) segment holds significant growth in cloud computing in the automotive market due to its tailored solutions for automotive applications. PaaS provides a development environment that streamlines the creation of cloud-connected vehicle software, enabling automakers to innovate rapidly. It supports functions like data analytics, real-time monitoring, and over-the-air updates crucial for modern vehicles. PaaS also offers scalability, cost-efficiency, and a reduced time-to-market, making it the preferred choice for automakers seeking to leverage cloud computing's capabilities while focusing on developing cutting-edge automotive features and services.

In 2024, the connected cars segment had the highest market share of 35% on the basis of application. Connected cars hold a substantial share in the cloud computing in the automotive market due to their capacity to transform the driving experience. These vehicles leverage cloud technology to provide real-time navigation, infotainment, and remote services, attracting tech-savvy consumers. Cloud connectivity enables over-the-air updates, enhancing vehicle features and security, thereby increasing customer satisfaction and loyalty. Additionally, as the automotive industry moves towards autonomous driving, cloud computing is vital for real-time data processing and communication, further cementing the connected car segment's significance in the market.

The supply chain management is anticipated to expand at the fastest rate over the projected period. The supply chain management segment holds substantial growth in cloud computing in the automotive market due to its critical role in optimizing operations. Cloud-based solutions enhance supply chain visibility, demand forecasting, and inventory management. This is crucial for automakers to streamline production, reduce costs, and efficiently respond to market fluctuations. Additionally, cloud platforms enable real-time collaboration with suppliers and partners, ensuring a resilient and agile supply chain. In an industry where just-in-time manufacturing is paramount, cloud-based supply chain management solutions have become indispensable, contributing significantly to their dominant market growth.

The public cloud segment held the largest revenue share of 44% in 2024. The public cloud segment dominates cloud computing in the automotive market due to its scalability, cost-effectiveness, and accessibility. Automotive companies prefer public cloud solutions as they eliminate the need for extensive on-premises infrastructure, reducing capital expenditure. Moreover, public cloud platforms offer the agility required for handling fluctuating workloads and data-intensive processes in real-time, crucial for connected vehicles and autonomous driving. Additionally, these solutions are readily available, facilitating rapid deployment and enabling automotive manufacturers to focus on innovation and enhancing the overall driving experience.

The hybrid cloud sector is anticipated to grow at a significantly faster rate, registering a CAGR of 19.9% over the predicted period. The hybrid cloud segment holds substantial growth in the cloud computing in the automotive market due to its ability to address diverse industry needs effectively. Automotive manufacturers require a flexible and scalable infrastructure to manage vast amounts of data generated by connected vehicles, yet they also need to ensure data security and regulatory compliance. Hybrid cloud solutions offer a balance by allowing companies to store sensitive data on private servers while utilizing the public cloud for scalability and cost-efficiency. This versatility makes hybrid cloud the preferred choice for automakers, providing a seamless and secure cloud computing environment for their operations.

By Service Model

By Application

By Deployment Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

January 2025