January 2025

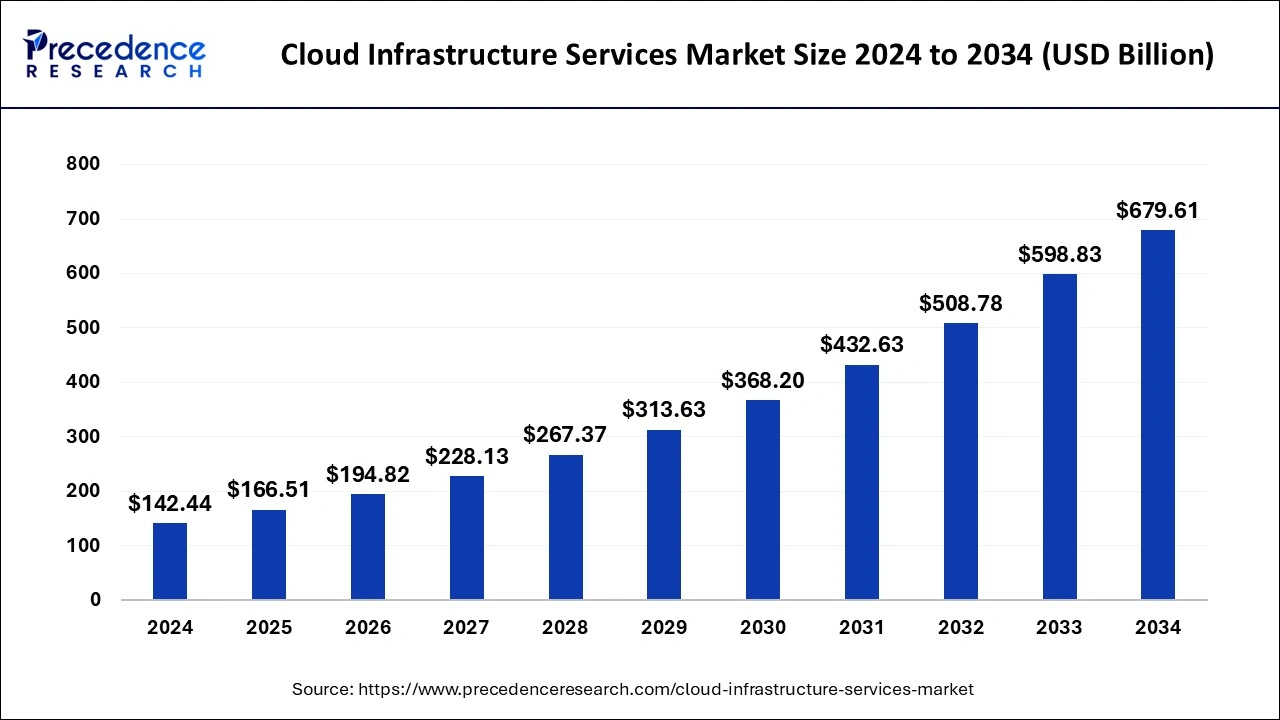

The global cloud infrastructure services market size is accounted at USD 166.51 billion in 2025 and is forecasted to hit around USD 679.61 billion by 2034, representing a CAGR of 16.91% from 2025 to 2034. The North America market size was estimated at USD 62.67 billion in 2024 and is expanding at a CAGR of 16.94% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cloud infrastructure services market size accounted for USD 142.44 billion in 2024 and is predicted to increase from USD 166.51 billion in 2025 to approximately USD 679.61 billion by 2034, expanding at a CAGR of 16.91% from 2025 to 2034.

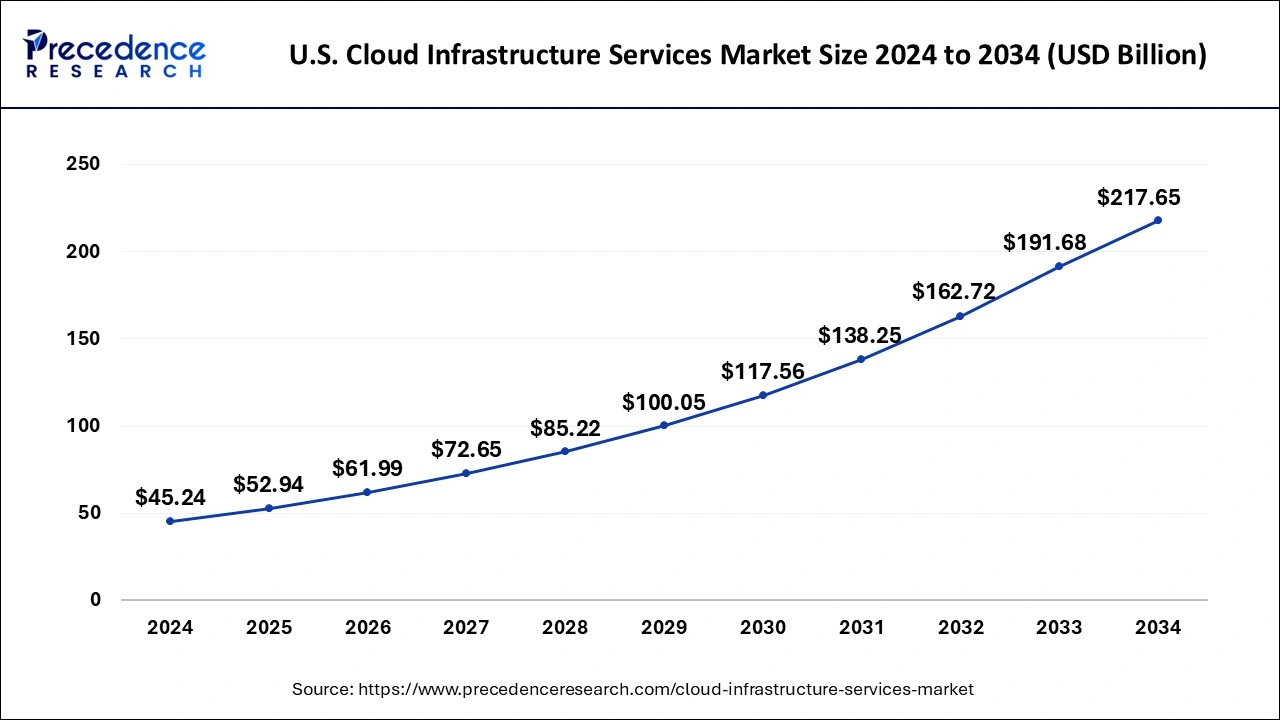

The U.S. cloud infrastructure services market size was exhibited at USD 45.24 billion in 2024 and is projected to be worth around USD 217.65 billion by 2034, growing at a CAGR of 17.01% from 2025 to 2034.

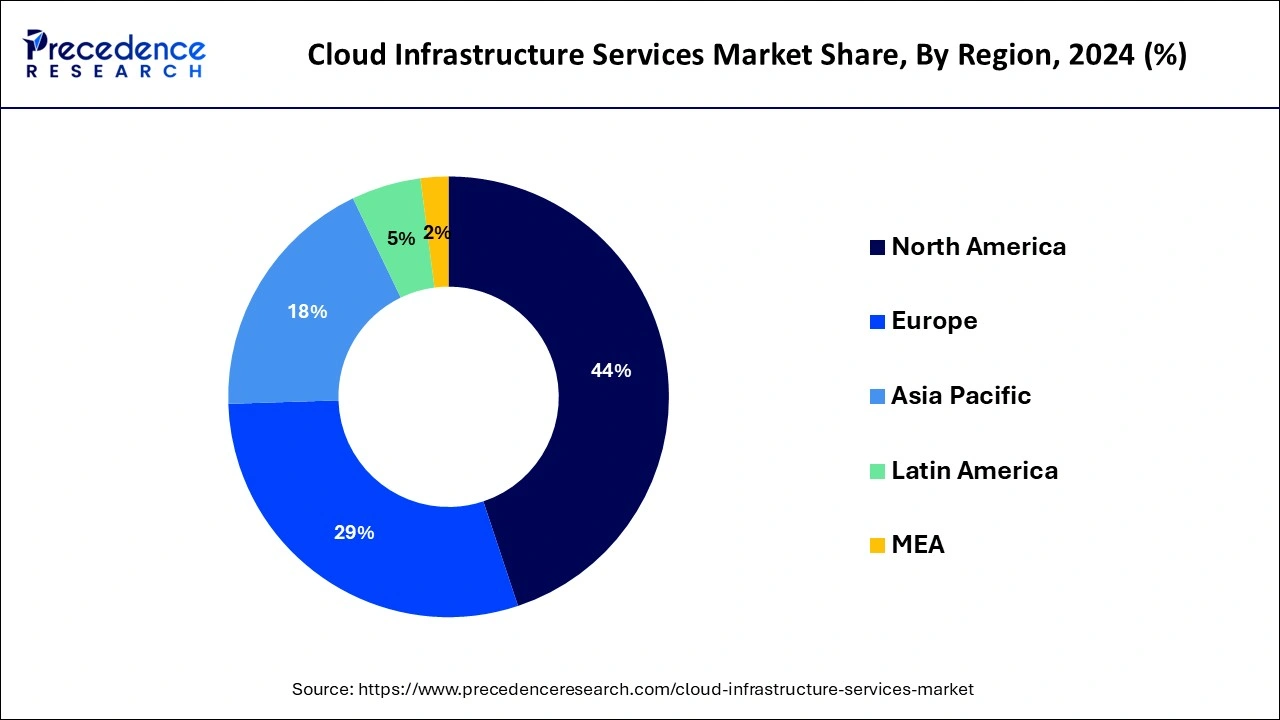

North America held a share of 44% in the cloud infrastructure services market in 2024, primarily attributable to its advanced technological ecosystem, resilient IT infrastructure, and widespread adoption of cloud solutions. The region's early commitment to digital transformation, coupled with a dense concentration of technologically adept enterprises, propels a considerable demand for cloud services. Key industry players such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform play pivotal roles, contributing to North America's predominant market position. Furthermore, the region's proactive stance toward innovation, favorable regulatory frameworks, and substantial investments in cloud technologies collectively reinforce North America's leadership in the global cloud infrastructure services landscape.

Asia-Pacific is gearing up for substantial growth in the cloud infrastructure services market, driven by the surge in digital transformation endeavors, widespread internet accessibility, and a rising preference for cloud-based solutions. The dynamic technological landscape in the region sees businesses increasingly embracing cloud services to bolster flexibility, scalability, and cost-efficiency. The escalating need for data storage and processing capabilities, coupled with the emergence of edge computing, adds significant impetus to the flourishing potential of the Asia-Pacific cloud infrastructure services market, positioning it prominently in the global digital landscape.

Meanwhile, Europe is witnessing significant growth in the cloud infrastructure services market due to a surge in digital transformation initiatives across industries. The region's businesses are increasingly embracing cloud solutions to enhance scalability, agility, and cost-efficiency. Factors such as the rising demand for remote work solutions, increased data generation, and a focus on cyber security are driving this adoption. Additionally, strategic collaborations and expansions by major cloud service providers contribute to the region's robust cloud infrastructure market growth, positioning Europe as a key player in the global digital economy.

Cloud infrastructure services involve the flexible provision of computing resources, including virtualized hardware, storage, and networking, accessible on-demand via the internet. This approach liberates both businesses and individuals from the burdens of maintaining physical infrastructure, providing seamless access to computational capabilities. Noteworthy for its scalability, adaptability, and cost-effectiveness, these services empower users to modify their infrastructure according to changing demands. The pivotal role of cloud infrastructure in contemporary IT architectures is unmistakable, alleviating organizations from the complexities of hardware management. It ensures a dependable and secure channel for accessing computational resources, creating an environment conducive to innovation and development.

Cloud Infrastructure Services Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 16.91% |

| Market Size in 2025 | USD 166.51 Billion |

| Market Size by 2034 | USD 679.61 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Deployment Model, y Organization Size, and End-user Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for digital transformation

The escalating demand for digital transformation has become a driving force behind the surging market demand for cloud infrastructure services. As organizations increasingly prioritize adopting digital-first strategies, cloud services play a pivotal role in facilitating this transformative journey.

Cloud infrastructure services provide the scalable, flexible, and innovative foundation necessary for businesses to modernize their operations, enhance agility, and stay competitive in rapidly evolving markets. Businesses leveraging cloud infrastructure witness streamlined processes, enhanced collaboration, and improved customer experiences, all of which are central to successful digital transformation efforts.

The ability of cloud services to offer on-demand computing resources, cost-efficiency, and a platform for rapid development positions them as a fundamental enabler of digital initiatives across various industries. As the demand for digital transformation continues to intensify, the cloud infrastructure services market is poised to expand further, providing the essential technological backbone for organizations navigating the complexities of the digital age.

Limited customization for certain workloads

The limitation of customization for certain workloads acts as a notable restraint on the market demand for cloud infrastructure services. In industries with highly specialized computing needs, the one-size-fits-all nature of some cloud offerings may fall short of meeting specific requirements. Organizations engaged in niche sectors, such as scientific research or complex simulations, often demand customized configurations that may not be easily accommodated within standardized cloud infrastructures. This limitation hampers the adoption of cloud services in sectors where tailored solutions are integral for optimal performance and efficiency.

The reluctance of businesses to migrate workloads to the cloud due to inadequate customization options can impede the overall growth of the cloud Infrastructure services market. To address this restraint, cloud service providers need to enhance flexibility and offer more tailored solutions to cater to the diverse and unique demands of industries requiring specialized computing configurations, ensuring broader market acceptance and accelerated adoption.

Edge computing expansion

The expanding landscape of edge computing is creating significant opportunities for the cloud infrastructure services market. As edge computing gains prominence, there is a growing need for decentralized infrastructure that brings computational power closer to data sources. Cloud infrastructure services can capitalize on this trend by developing solutions tailored to edge environments. Offering scalable and flexible resources for processing data at the edge allows businesses to optimize performance, reduce latency, and enhance overall efficiency. Cloud providers that strategically position themselves to meet the demands of edge computing scenarios can unlock new revenue streams and cater to industries requiring real-time data processing capabilities.

Moreover, the integration of cloud infrastructure services with edge computing enables a seamless and interconnected computing ecosystem. This collaboration not only enhances the capabilities of edge devices but also ensures a cohesive infrastructure that spans from the edge to centralized cloud resources. The synergy between cloud infrastructure and edge computing presents an opportunity for service providers to offer comprehensive solutions, addressing the evolving needs of businesses across various sectors, from manufacturing and healthcare to smart cities and IoT applications.

The compute as a service segment had the highest market share of 33% in 2024. Compute as a service (CaaS) is a facet of cloud infrastructure services that delivers instant access to computing resources like processing power and storage. This eliminates the necessity for organizations to manage physical servers. Current trends in CaaS involve the rising popularity of serverless computing, enabling users to pay solely for actual compute usage and enhancing cost-effectiveness. Furthermore, the growth of containerization technologies, notably Kubernetes, is fostering the creation of more adaptable and scalable compute solutions within the cloud infrastructure services landscape.

The networking as a service segment is anticipated to expand at a significant CAGR of 18.9% during the projected period. This approach allows businesses to access scalable networking resources without the burden of extensive physical infrastructure, encompassing virtualized routers, switches, and related components. Trends in NaaS involve the increasing adoption of Software-Defined Networking (SDN) and Network Functions Virtualization (NFV), enhancing network agility. This evolution enables businesses to efficiently manage and optimize their networking resources, fostering improved scalability and responsiveness in the rapidly changing cloud infrastructure landscape.

The public cloud segment has held a 36% market share in 2024. In the cloud infrastructure services market, the public cloud segment refers to services provided by third-party vendors over the internet, accessible to multiple users.

Public cloud adoption continues to surge due to its cost-effective, scalable, and on-demand nature. Organizations increasingly leverage public cloud services for applications, storage, and computing resources. Key trends include a focus on multi-cloud strategies, emphasizing workload distribution across multiple public cloud providers for enhanced resilience and flexibility. Additionally, the integration of advanced technologies such as artificial intelligence and machine learning within public cloud offerings is driving innovation and efficiency.

The hybrid cloud segment is anticipated to expand fastest over the projected period. Hybrid cloud deployment in the cloud infrastructure services market involves a combination of on-premises infrastructure and cloud services. This model allows businesses to leverage the benefits of both environments, maintaining sensitive data on-premises while utilizing the scalability and flexibility of the cloud for other workloads. A notable trend in the hybrid cloud segment is the increasing adoption of multi-cloud strategies, where businesses use services from multiple cloud providers. This approach provides redundancy, avoids vendor lock-in, and optimizes performance, reflecting a dynamic shift in how organizations architect their IT infrastructure for enhanced efficiency and resilience.

The small and medium-sized enterprises (SMEs) segment held 56% market share in 2024. Within the cloud infrastructure services market, Small and Medium-sized Enterprises (SMEs) represent businesses with modest employee and revenue figures. A discernible trend is the growing embrace of cloud services by SMEs to bolster operational efficiency, scalability, and cost-effectiveness. SMEs are increasingly utilizing cloud infrastructure for functions such as data storage, application hosting, and collaborative tools, positioning themselves competitively alongside larger enterprises. This trend underscores the acknowledgment among SMEs of the strategic benefits inherent in leveraging cloud infrastructure services to facilitate their expansion and digital transformation endeavors.

The large enterprises segment is anticipated to expand fastest over the projected period. In the cloud infrastructure services market, large enterprises, characterized by their extensive operations and substantial IT needs, form a crucial segment. These organizations demand scalable, secure, and reliable cloud solutions to support their complex infrastructure requirements. Trends indicate a growing preference for hybrid and multi-cloud strategies among large enterprises, allowing them to maintain critical workloads on-premises while leveraging the cloud for flexibility. Additionally, there is an emphasis on specialized solutions catering to industry-specific demands, reflecting the nuanced requirements of diverse large-scale enterprises in their cloud adoption strategies.

The IT & telecommunications segment has held a 21% market share in 2024. In the cloud infrastructure services market's IT & Telecommunications segment, businesses within the Information Technology and Telecommunications sectors leverage cloud services for scalable and agile infrastructure. This involves cloud-based storage, computing resources, and networking solutions. A notable trend in this segment is the increasing adoption of hybrid cloud models, allowing IT and Telecom companies to balance performance and security by integrating on-premises and cloud infrastructure. This strategic approach enhances flexibility, supporting the dynamic nature of IT operations and the evolving demands of the telecommunications industry.

The retail segment is anticipated to expand fastest over the projected period. In the context of the cloud infrastructure services market, the retail segment refers to businesses involved in the sale of goods and services to consumers. Retailers leverage cloud infrastructure to enhance customer experiences, optimize supply chain operations, and facilitate e-commerce platforms. A growing trend in this sector is the adoption of cloud-based solutions for inventory management, personalized marketing, and seamless omnichannel experiences. Cloud services enable retailers to scale resources based on demand, improve operational efficiency, and stay agile in a rapidly evolving digital retail landscape.

By Service Type

By Deployment Model

By Organization Size

By End-user Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

January 2025