November 2024

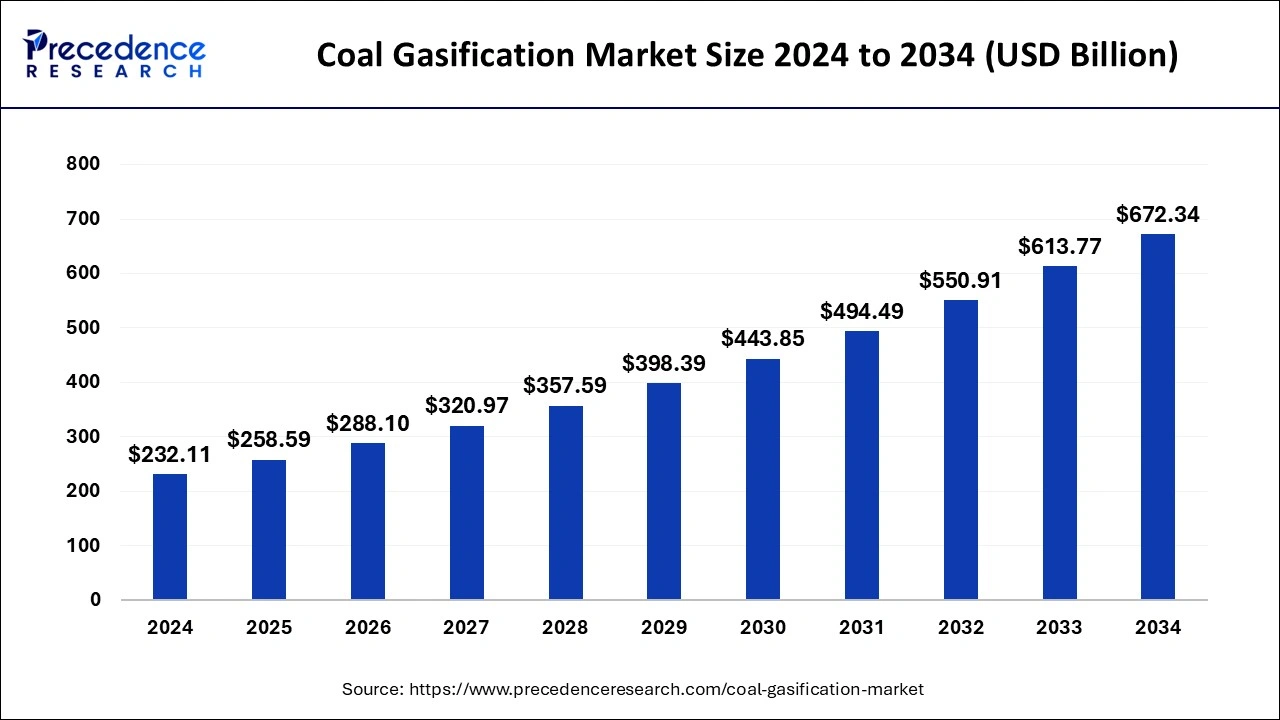

The global coal gasification market size is calculated at USD 258.59 billion in 2025 and is forecasted to reach around USD 672.34 billion by 2034, accelerating at a CAGR of 11.22% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global coal gasification market size was estimated at USD 232.11 billion in 2024 and is predicted to increase from USD 258.59 billion in 2025 to approximately USD 672.34 billion by 2034, expanding at a CAGR of 11.22% from 2025 to 2034. The rising investment in coal gasification projects is expected to drive the growth of the coal gasification market during the forecast period.

Coal gasification is a process used to convert carbonaceous material, such as coal, petroleum, petroleum coke, or biomass, into carbon monoxide and hydrogen. In the coal gasification process, coal is partially oxidized with oxygen, air, steam, or carbon dioxide under controlled conditions to generate fuel gas. Synthesis gas or syngas is used as a fuel gas. Syngas is widely used as a fuel for chemical production, transportation, power generation, and various other industrial applications. Coal gasification facilitates numerous benefits, such as reduced emissions, improved efficiency, and versatility in feedstock utilization, which promotes the growth of the coal gasification market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 11.22% |

| Market Size in 2025 | USD 258.59 Billion |

| Market Size by 2034 | USD 672.34 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Gasifier, By Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for hydrogen gas

The demand for hydrogen gas is expected to propel the growth of the coal gasification market during the forecast period. Hydrogen is increasingly becoming popular as a clean energy carrier with various applications. The market has witnessed the increasing utilization of coal gasification for the production of hydrogen gas. The coal gasification process has the significant potential to produce hydrogen with reduced emissions and contribute to a more sustainable energy system. Hydrogen is widely used to generate electricity, power vehicles, and power industry and heat, as well as reduce dependency on fossil fuels. For instance, in recent years, India has embarked on a massive coal gasification push to combat the climate crisis and reduce reliance on fossil fuels, and lower carbon emission intensity to achieve a net zero by 2070. Thereby spurring the demand for growth in the coal gasification market.

High cost

The high cost involved in setting up a coal gasification plant is anticipated to hamper the growth of the market during the forecast period. A huge amount of capital is required to set up a coal gasification plant, which often discourages middle and lower-income countries with limited budgets. In addition, Countries with water scarcity issues may face challenges in setting up coal gasification plants as a significant amount of water is required for cooling purposes in the coal gasification process, which may restrict the expansion of the global coal gasification market.

Supportive government investment and initiatives

The rising government investment and initiatives are projected to offer a lucrative opportunity for the growth of the coal gasification market during the forecast period. The government is actively engaged in eco-friendly solutions and sustainable solutions for electricity generation. Governments around the world are directing investments in clean energy production, which is likely to boost the adoption of coal gasification technologies for power generation and the industrial sector. Supportive government investment, policies, subsidies, and incentives are positively influencing the growth of clean energy technologies and resulting in the rise in coal gasification plants.

Moreover, the environmental benefit from UCG technology can assist in mitigating the impact of coal utilization on the climate. Underground coal gasification (UCG) has the potential to lower greenhouse gas emissions compared to conventional coal combustion methods. Thereby driving the market’s growth in the coming years.

The fluidized bed segment accounted for the dominant share in 2024. Fluidized bed gasifiers are used for coal gasification owing to their high reaction rates and efficient mixing. Compared to other gasification techniques, these gasifiers produce lower tar and heavy hydrocarbons.

India has created a domestic method for producing methanol from high-ash Indian coal. In order to create syngas and subsequently convert syngas into 99% pure methanol, Bharat Heavy Electricals Limited (BHEL) has developed a fluidized bed gasification method that is appropriate for high ash Indian coals. By encouraging the use of methanol as a transportation fuel (mixing it with gasoline), this technology will assist the nation in implementing clean technology and help cut down on the importation of crude oil.

The entrained flow segment is expected to witness a significant share during the forecast period owing to its excellent efficiency and flexibility in any coal feedstock. Entrained-flow gasifiers can handle practically any coal feedstock and generate clean, tar-free syngas. The fine coal feed can be fed to the gasifier in either dry or slurry form. Thus, these factors are anticipated to propel the entrained flow gasifier market share in the coming years.

The coal gasification market was dominated by the electricity generating segment in 2024. The increasing demand for power generation is fueling the segment's expansion. In comparison to burning coal to produce energy, coal gasification offers a practical and environmentally friendly energy source. The IGCC generates a lot of electricity through the process of coal gasification. Power plants that use the Integrated Gasification Combined Cycle (IGCC) are more efficient. Syngas, a cleaner and more concentrated fuel produced through gasification, is made possible. Hydrogen is present in syngas generated by coal gasification. Several industrial uses for hydrogen-rich syngas exist, such as chemical processing, fuel cell utilization, power utilities, and other uses. Hydrogen is another byproduct of coal gasification, which can be stored and used to produce energy at a later time.

The steel production segment is expected to grow fastest during the forecast period owing to the rise in steel production via coal gasification processes. Coal is converted into a liquid fuel known as syngas, which is then used as fuel for steel production in coal gasification processes. The development of cost-effective coal gasification processes helps steelmakers produce steel substantially.

Asia Pacific held the dominant share of the coal gasification market in 2024. The region is observed to witness prolific growth during the forecast period. The region is the largest coal producer, and the increasing energy demand will likely accelerate the growth of the region’s coal gasification market. In the Asia Pacific region, developing countries such as China, India, Japan, and Indonesia have been actively engaging in numerous coal gasification projects owing to the presence of significant coal reserves. The region’s rapid growth is attributed to the increasing focus on reducing carbon emissions and transitioning to cleaner energy sources, the robust advancements in IGCC power plants, increasing emphasis on reducing dependence on fossil fuels & natural gas, rising demand for chemical products, rising demand for electricity, rise in the number of coal deposits in developing economies, and the increasing demand for clean and efficient energy generation sources in industries and household applications.

Governments are also looking for more sustainable methods to use coal resources, and as coal gasification provides cleaner energy options, they encourage programs and invest more in coal gasification technologies.

China ranks among the top producers of lignite and coal worldwide. India's coal output has also increased significantly, helped by government initiatives to reduce reliance on coal imports and investments.

Conversely, North America is anticipated to grow quickly over the projection period due to the growing focus on lowering carbon emissions, the growing demand for clean hydrogen, and an increase in gasification activities in the syngas and chemical industries. Over the course of the projection period, the U.S.'s active participation in coal gasification projects is anticipated to propel market expansion.

By Gasifier

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

April 2025

May 2024

February 2024