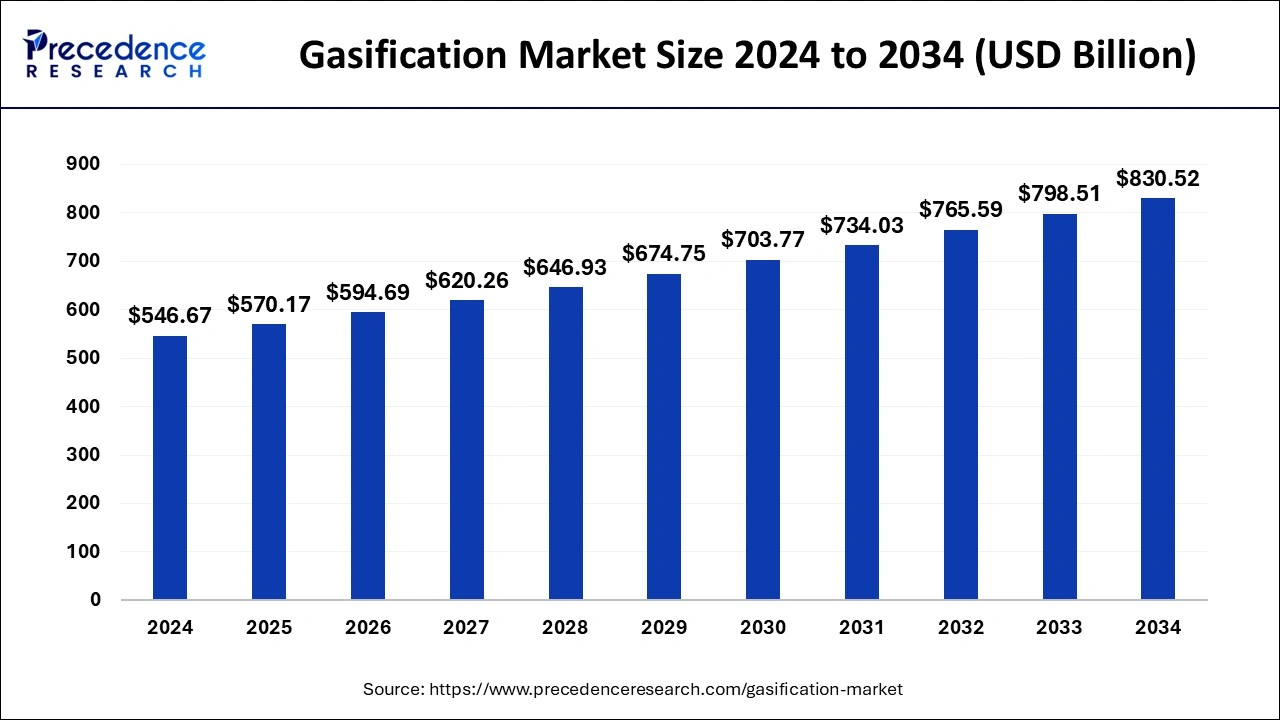

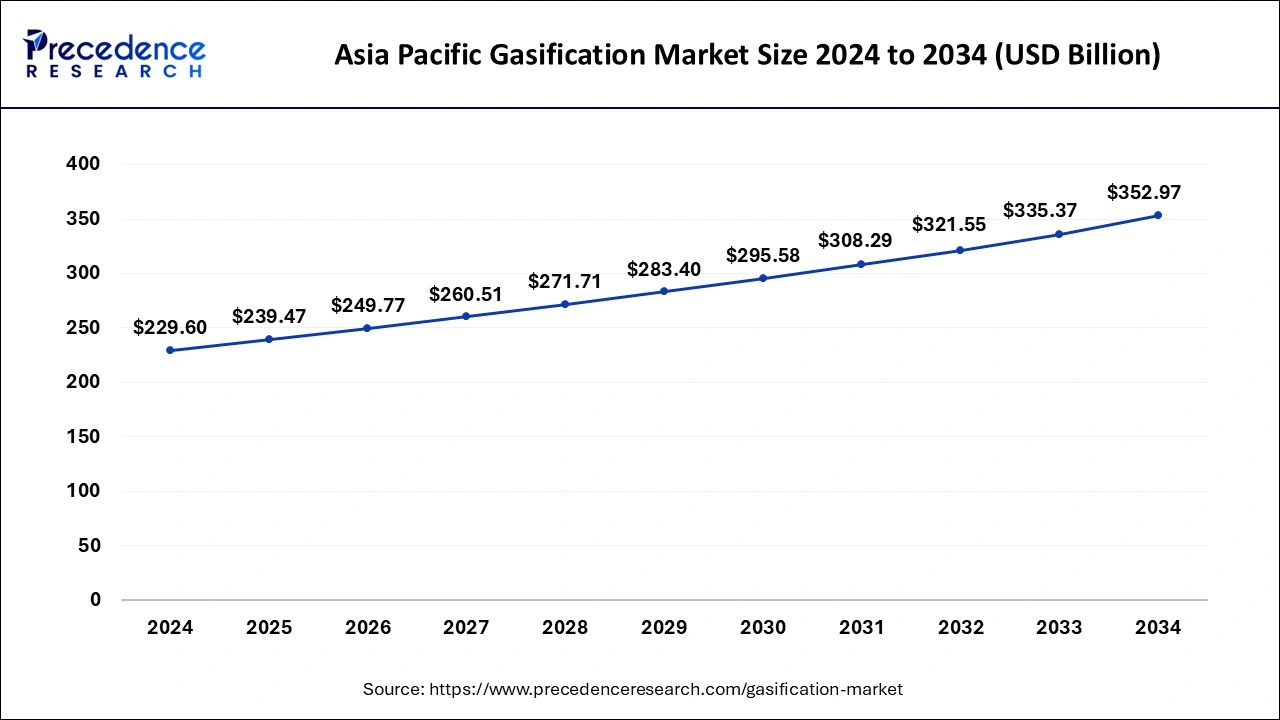

The global gasification market size is calculated at USD 570.17 billion in 2025 and is forecasted to reach around USD 830.52 billion by 2034, accelerating at a CAGR of 4.27% from 2025 to 2034. The Asia Pacific gasification market size surpassed USD 239.47 billion in 2025 and is expanding at a CAGR of 4.39% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global gasification market size was estimated at USD 546.67 billion in 2024 and is predicted to increase from USD 570.17 billion in 2025 to approximately USD 830.52 billion by 2034, expanding at a CAGR of 4.27% from 2025 to 2034.

The Asia Pacific gasification market size was estimated at USD 229.60 billion in 2024 and is predicted to be worth around USD 352.97 billion by 2034 with a CAGR of 4.39% from 2025 to 2034.

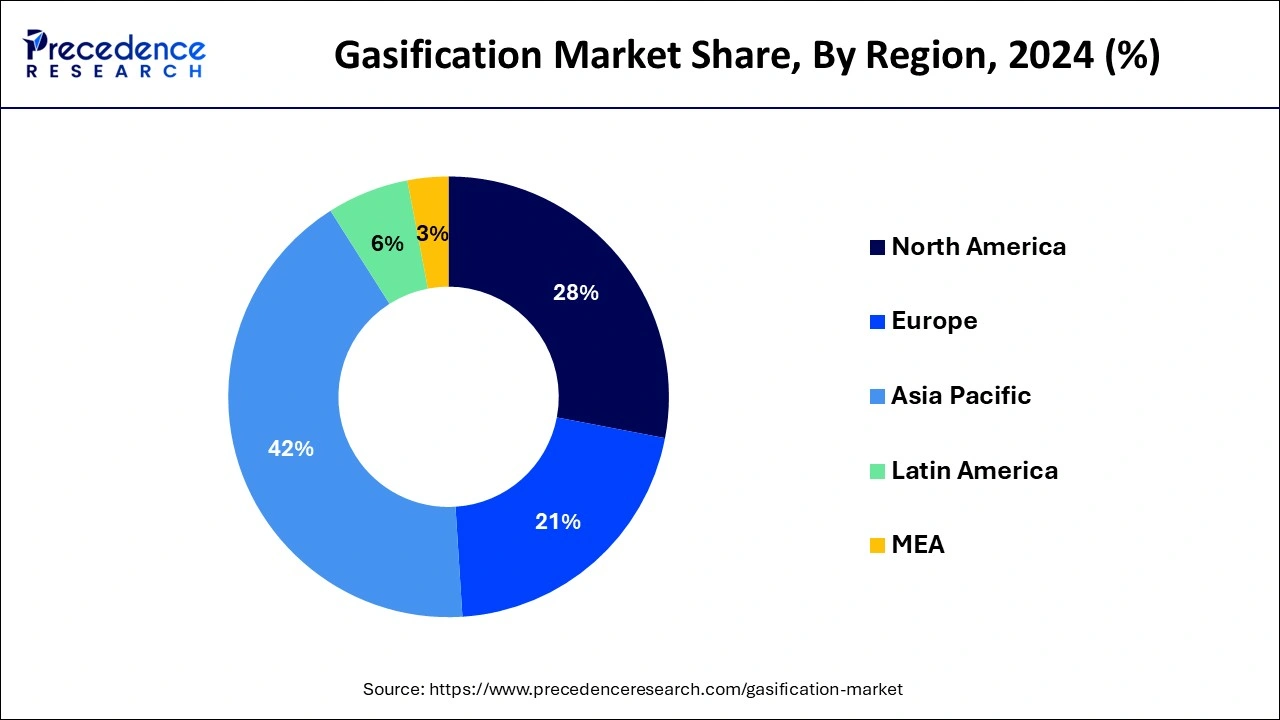

Asia Pacific held the dominant share of the gasification market in 2024. The region is observed to witness notable growth during the forecast period. The rising demand for energy, including cleaner and more efficient sources across the Asia Pacific, especially in developing countries like China, India, and Japan, is bolstering the demand for the gasification process. The region is experiencing robust growth for biomass gasification, particularly in rural areas, due to the growing power demand. The rising use of biomass fuels for electricity and transportation generation is gaining attention in various developing nations to avoid carbon dioxide emissions from using fossil fuels.

China and India have a high accessibility of inexpensive coal in Asia Pacific, which led to increasing production of electricity, heat, and chemicals through the gasification process. Several countries in the region usually depend on imported fossil fuels to meet their energy needs. Gasification plays an active role in diversifying their energy sources and reducing reliance on external suppliers for imports. Moreover, the increasing demand for electricity due to the rise in population, rapid urbanization, and industrialization are likely to drive the growth of the gasification market in the region during the forecast period. Furthermore, the supportive government policies, financial incentives, and initiatives for clean energy projects, as well as actively supporting coal gasification and biomass gasification, are expected to boost the market growth in the region during the forecast period.

Europe is projected to expand at a rapid pace in the global gasification market during the forecast period. The growth of the region is attributed to the increasing significance of sustainable and clean energy sources as an alternative to fossil fuels, resulting in the rising adoption of gasification in Europe. In addition, increasing focus on waste-to-energy and biomass gasification, a rise in the number of coal reserves, and growing demand for syngas and other chemicals in European nations are the key factors that propel the growth of the gasification market in the region.

Gasification is a process that converts carbonaceous raw materials such as coal, biomass, and waste into fuel gas, known as synthesis gas or syngas. Synthesis gas or syngas is the by-product of this process. Syngas produced via gasification have numerous applications such as power generation, as fuel in industrial processes, reduction in carbon emissions, and production of various chemicals and fuels. Generally, gasification occurs in a gasifier at a high temperature without combustion, with a controlled amount of oxygen and/or steam.

| Report Coverage | Details |

| Market Size in 2025 | USD 570.17 Billion |

| Market Size by 2034 | USD 830.52 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.27% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Feedstock, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for clean and sustainable energy sources

The rising demand for clean and sustainable energy sources is expected to boost the growth of the gasification market during the forecast period. Gasification is increasingly being used as the need for clean and sustainable energy sources to reduce reliance on fossil fuels. Gasification provides a cleaner and eco-friendly alternative to conventional fossil fuel combustion by efficiently converting biomass, coal, or waste into syngas or synthesis gas, which is widely used for power generation and as a feedstock for chemicals, fertilizers, and fuels.

Additionally, electrification through biomass gasifiers in rural areas is increasingly becoming popular in rural areas and aims to provide electricity by converting biomass, such as crop wastes, wood, and agricultural residues like wheat straw, rice husks, or corn stalks into a combustible gas known as producer gas. The producer gas is extensively used to fuel a gas engine or generator for electricity generation. Thereby bolstering the gasification market growth.

High initial investment

The high initial investment involved in setting up a gasification plant is anticipated to hinder the global gasification market. The gasification plant requires a substantial initial investment for the installment of gasifiers and a high cost involved in designing and manufacturing gasifiers and other gasification parts and units, which can be expensive for many potential market entrants. In addition, increasing usage of bio-fuels for power generation may restrict the expansion of the global market in the coming years.

Rising investment in coal gasification

The increasing investment in coal gasification is projected to offer an immense opportunity for the coal gasification market. Coal gasification is a widely used process to convert carbonaceous material, including coal, petroleum, or biomass, into carbon monoxide and hydrogen. Thus driving the gasification market growth.

Syngas are commonly used for power generation, chemical production, transportation, and other industrial applications. It requires reduced reliance on limited resources, which significantly drives the growth of coal gasification as alternative fuels. Additionally, governments are encouraging the use of sustainable and clean energy sources through investment, financial incentives, and various other incentives.

The coal segment accounted for the dominating share of the gasification market in 2024, owing to the increasing number of coal reserves in countries such as the U.S., China, Russia, and India. Coal is the most abundant energy resource globally and economically feasible in many countries, which leads to a surge in several gasification plants and reduces dependence on imported fuels. The syngas produced via coal gasification are most commonly used to generate electricity in various industrial and chemical processes. Additionally, the growth of the segment is driven by increasing energy demand, economic benefits of coal gasification, and rising government support for coal gasification.

The biomass waste segment is expected to witness significant growth in the gasification market during the forecast period. Biomass gasification is a technology that uses a controlled process involving heat, oxygen, and steam to convert biomass into hydrogen and other valuable eco-friendly products without combustion. The market has witnessed the increasing use of biomass gasification to generate electricity in several developing countries, especially in rural areas, to reduce carbon dioxide emissions. Biomass is organic matter obtained from animals and plants and is widely used to produce heat and energy for industrial and residential applications. The rapid growth of the segment is majorly driven by the rise in harmful greenhouse gas emissions, which has led to the use of sustainable energy sources.

The chemical segment held the largest share of the gasification market in 2024. The syngas produced via gasification assist in generating various valuable chemicals, including methanol, dimethyl ether, ammonia, synthetic natural gas, and others. These chemicals are most commonly used across various industries, such as fertilizers, fuels, plastics, and others.

The power segment is expected to grow at a robust rate during the forecast period. The growth of the segment is majorly driven by the rise in power generation due to rapid industrialization and urbanization. Since carbon emissions have increased significantly, the demand for clean and sustainable energy sources has risen. Market players and the government are actively participating and investing in eco-friendly options to reduce dependence on fossil fuels and lower carbon emissions.

By Feedstock

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client