February 2025

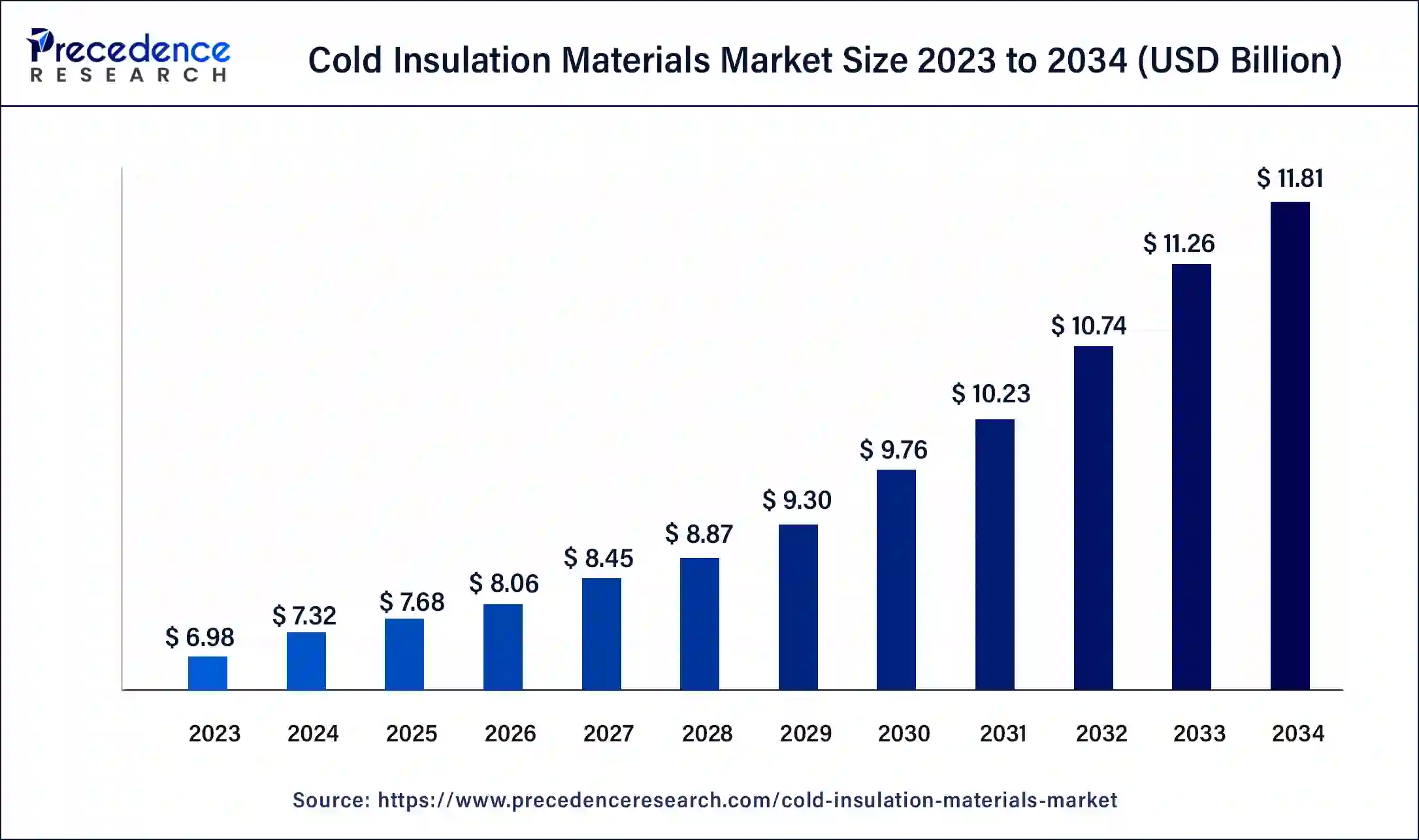

The global cold insulation materials market size surpassed USD 6.98 billion in 2023 and is estimated to increase from USD 7.32 billion in 2024 to approximately USD 11.81 billion by 2034. It is projected to grow at a CAGR of 4.90% from 2024 to 2034.

The global cold insulation materials market size is worth around USD 7.32 billion in 2024 and is anticipated to reach around USD 11.81 billion by 2034, growing at a solid CAGR of 4.90% over the forecast period 2024 to 2034. The key drivers of the cold insulation materials market are the increasing demand for energy efficiency, technological improvement, expansions in industrial applications, and increasing construction processes.

Cold insulation materials provide products or substances capable of preventing heat convection at places that require low temperatures to be maintained. These insulation materials are designed to reduce conductive heat transfer, thus enhancing a controlled and stable cold environment. These insulation materials help to maintain a controlled and stable cold environment. The cold insulation materials market products are employed for the cold insulation of air conditioning piping systems, cold room systems, clean rooms, and freezing chambers in the food processing industry, pharmaceutical companies, and hospitals.

Different Types of Cold Insulation Materials

| Polyurethane Foam | It has a low coefficient of heat transmission and is also useful for conditions with below-freezing temperature. Low smoke emission and low water vapor permeability are the properties of Polyurethane Foam. |

| Polystyrene | Polystyrene offers good thermal resistance, and it is often used in the form of expanded polystyrene (EPS) or extruded polystyrene (XPS) for cold insulation and cold room panels. |

| Fiberglass | It has fire resistance and low smoke emission and it is recommended for cold insulation in areas where high fire standard is required. |

| Phenolic Foam | It has good fire resistance and low smoke emission and it is recommended for cold insulation in areas where high fire standard is required. |

| Polyisocyanurate (PIR) Foam | Exhibits a low coefficient of heat transmission and a high fire rating and its typical applications include cold storage and refrigeration where fire safety is a priority. |

| Cellular Glass | Offers high compressive strength and resistance to moisture, making it suitable for cold insulation in areas where moisture infiltration is a concern. |

How is AI Changing the Cold Insulation Materials Market?

AI also provides more than cost-effectiveness to insulation production in the cold insulation materials market. The production line is automated by artificial intelligence, so there's no need for periodic checks and the hiring of additional personnel. AI employs intelligent computations that can determine the right combination of chemicals to be used in the production of Insulation to deliver a certain efficiency value. Introducing AI in insulation production will enable 24/7 working hence reducing insulation costs and increasing production.

As the economy grows and people’s quality of life advances, people require a better living environment to a greater extent. To achieve the human goal of a proper indoor climate, modern architecture has been striving to upgrade the indoor climate through artificial intelligent thermal insulation design.

| Report Coverage | Details |

| Market Size by 2034 | USD 11.81 Billion |

| Market Size in 2023 | USD 6.98 Billion |

| Market Size in 2024 | USD 7.32 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.90% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Application, Insulation Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising energy costs and increasing environmental concerns

The rising energy costs and increasing environmental concerns contribute to the growth of the cold insulation materials market. Energy cost concerns have become a major issue in developed countries, and the indications to developing countries show that energy is expensive. The role of insulation is to provide a thermal resistance that reduces the flow of heat through a building. During the warmer months, the external temperatures are higher than desired inside, and insulation maintains the temperature within a building by preventing heat.

The advantages of insulation to buildings include a comfortable thermal environment, minimized heat loss and energy usage, low energy bills, enhanced environment and climatic conditions through conservation of energy as well as checking on fluctuating daily temperature inside the building during summer.

EPA estimated that homeowners can save an average of 15% on heating and cooling costs (or an average of 11% on total energy costs) by air sealing their homes and adding insulation in attics, floors over crawl spaces, and accessible basement rim joists.

Rising applications in cold chain and refrigeration systems

Cold chain pharmaceutical and food products can transported through an appropriate infrastructure like adequate packing material to regulate the temperature during the transportation process, starting from manufacturing to consumption. This, in turn, enhances the use of insulating packaging materials, especially for heat-sensitive products.

Cold insulating materials are designed for low temperatures and include refrigeration systems, cryogenic storage tanks, cold storage, and air conditioning systems. They help to avoid thermal influx from the external environment and to keep the temperature within the system as low as was set. The cold insulation materials market services are used in refrigeration systems and other low-temperature applications to prevent heat gain and maintain the desired temperature. Cold insulation is used in the food processing sector, drug distribution, and transport, among other fields.

High investment and installation costs

High investment and installation costs are the major challenges that hinder the growth of the cold insulation materials market. New-generation insulating materials that are effective thermally demand a high initial cost. That can prove to be challenging for several businesses, particularly small- to medium-sized enterprises or organizations in sectors where costs are considered a critical factor. Also, the application of special types of insulating materials has complicated processes, and the costs of labor are relatively high, adding up to the total cost of ownership.

Increasing construction activities

The rising commercial building and construction activities are an opportunity for the growth of the cold insulation materials market. Commercial insulation plays a crucial role in minimizing heat flow between the interior and exterior of a building. The enhanced energy conservation will involve a substantial reduction of energy costs for heating and cooling.

By insulating a house, one can reduce the heat loss in buildings in cold weather or climates and reduce the heat surplus in warmer weather or climate. Cold insulation materials are being used more frequently in the building and construction details of floor and wall constructions, roofs/ceilings for new building constructions, and for retrofitting existing building constructions to keep the required temperature inside the building.

The fiberglass segment accounted for the biggest share of the cold insulation materials market in 2023. Fiberglass insulation functions by capturing air trapped in its fibers reducing the rate of transfer of heat between the interior and the exterior spaces of the building. This makes it effective to keep the home or office warm in the winter and cool in the summer. This material is easily available and also offers good thermal insulation for cold climates, common use is in the form of a blanket, board, or pre-fabricated pipe section.

The polyurethane foam segment is expected to witness significant growth in the cold insulation materials market during the forecast period. Polyurethane is a thermoset foam insulation material that possesses a low-conductivity gas within its cellular structure. Polyurethane rigid foam insulation can be utilized in construction and building applications. Due to its low thermal conductivity, lightweight, and insulating capability against heat, cold as well as sound it is used by most businesses. Also, it is accessible to install compared to other forms of roofing since it is cheap to install. Therefore, due to the enhanced characteristic of polyurethane foam over other materials.

The HVAC segment held the biggest share of the cold insulation materials market in 2023. Effective insulation helps ensure the correct operating temperatures are achieved throughout a system, ranging from piping to air conditioning insulation. Insulating HVAC systems improves efficiency, reduces carbon emissions, and cuts operating costs. It helps keep indoor temperatures stable with minimum energy consumption. HVAC insulation is useful for systems on large-scale commercial and residential buildings, offices, apartment houses, airports, hospitals, commercial and industrial warehouses, and many other industries.

The chemicals segment is expected to grow significantly in the cold insulation materials market during the forecast period. Insulation works, maintenance, and modification services within the chemical and petrochemical industry. Insulation is either material or system that possesses the capability of retarding the flow of heat or sound. Insulation plays a major role in conserving the heat energy of a refinery or process plant.

The fibrous segment dominated the cold insulation materials market in 2023. Fibrous insulation functions by trapping air inside the fibers and does not allow heat to transfer through convection. Fibrous materials are usually flexible but can be made rigid, utilizing additives, into desired shapes. Furthermore, because of their structure, fibrous materials exhibit good acoustic insulation and are hence used in sound absorption. Examples of this are fiberglass, mineral wool, plastic fiber or also bubbles of considerable size. Fibrous insulations such as fiberglass are used for industrial pipe and tank insulation wraps as well as insulation blankets.

Asia Pacific led the global cold insulation materials market in 2023. The factors boosting the growth of cold insulation materials are the growth of the automotive industry, construction, and telecommunication industries by Industrialization and digitization. Additionally, insulation material has been integrated majorly by residential and non-residential construction manufacturers because of the increasing usage due to climate change, less energy consumption required, and soundproof buildings.

There has been an increase in the size of the transportation industry due to industrialization. The automotive & telecommunication industries of China, Japan, and India have grown significantly in terms of both growth and demand and this has in turn positively influenced the market of insulation materials in this region.

North America is anticipated to grow notably in the cold insulation materials market during the forecast period. The increase in technological growth is enabling the release of efficient, high-performance, and eco-friendly insulation materials that meet the set regulations and sustainability standards. The United States and Canada's demand for insulating materials for various industries, such as pharmaceuticals, food and beverages, petrochemical industries, and ventilation and air conditioning systems, is increasing.

Segments Covered in the Report

By Material

By Application

By Insulation Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

August 2024

September 2024