December 2024

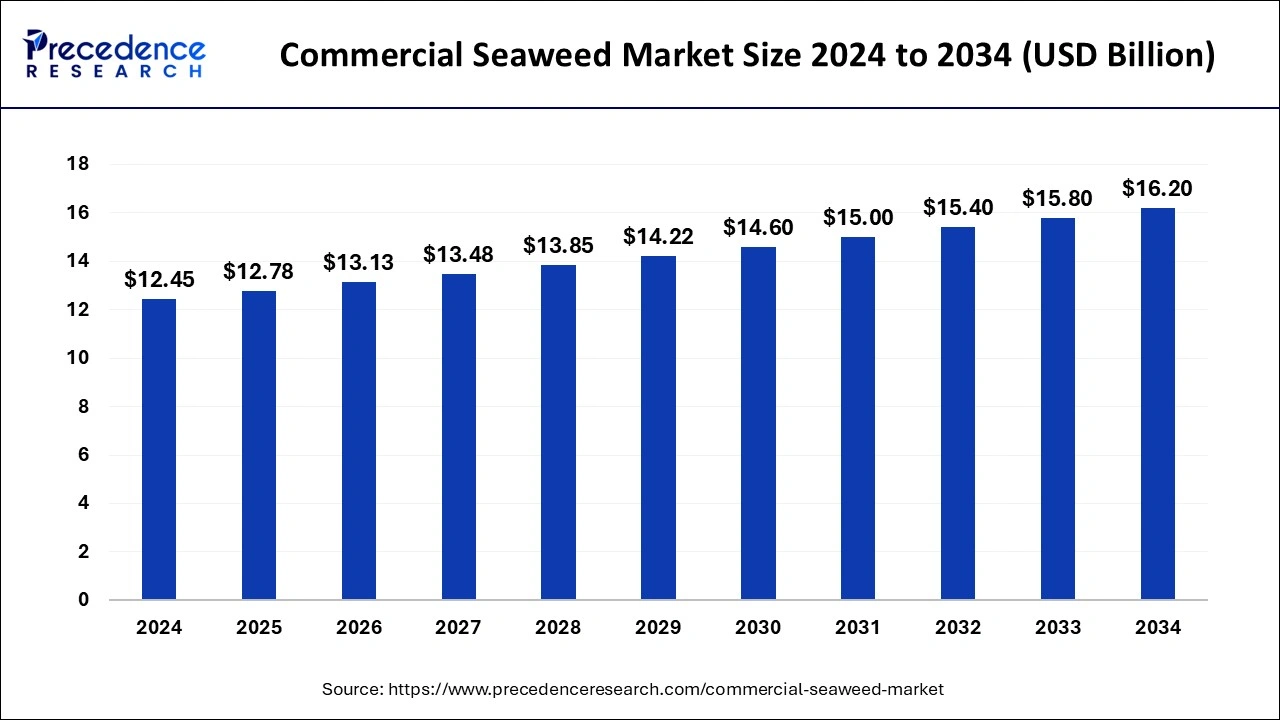

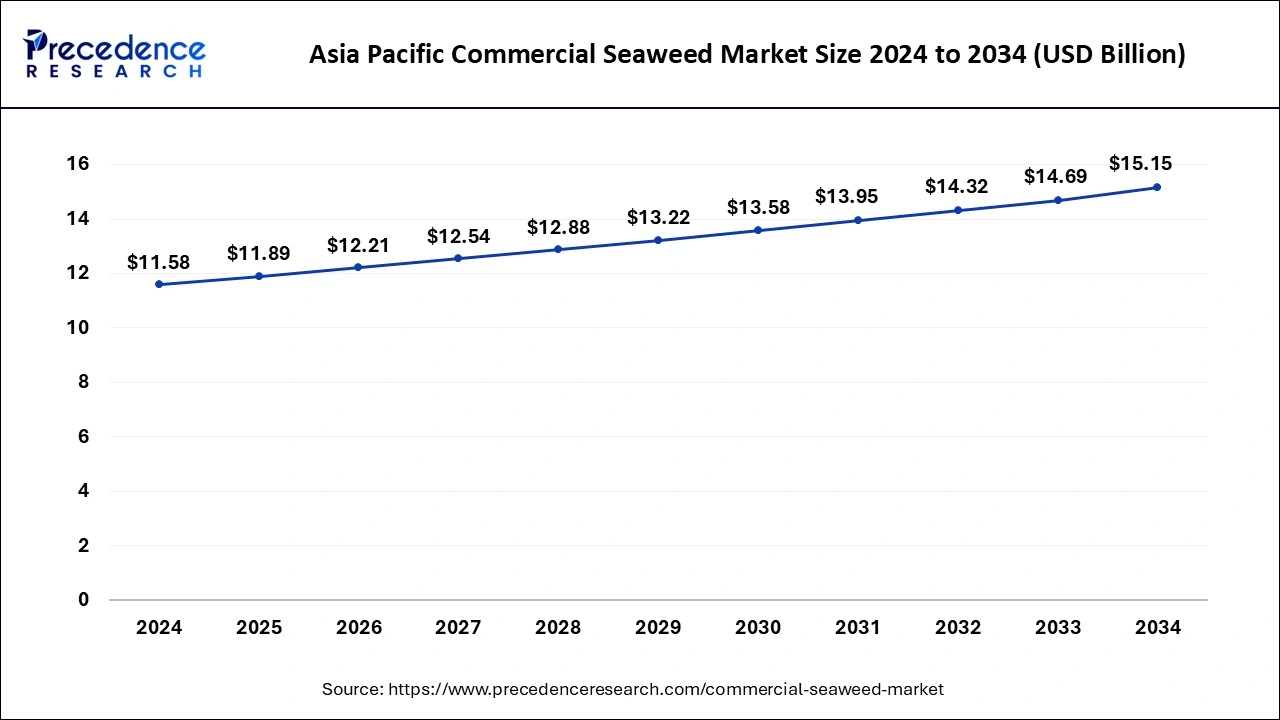

The global commercial seaweed market size is calculated at USD 12.78 billion in 2025 and is forecasted to reach around USD 16.20 billion by 2034, accelerating at a CAGR of 2.67% from 2025 to 2034. The Asia Pacific commercial seaweed market size surpassed USD 11.89 billion in 2025 and is expanding at a CAGR of 2.72% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global commercial seaweed market size was accounted for USD 12.45 billion in 2024, and is expected to reach around USD 16.20 billion by 2034, expanding at a CAGR of 2.67% from 2025 to 2034.

The Asia Pacific commercial seaweed market size was estimated at USD 11.58 billion in 2024 and is predicted to be worth around USD 15.15 billion by 2034, at a CAGR of 2.72% from 2025 to 2034.

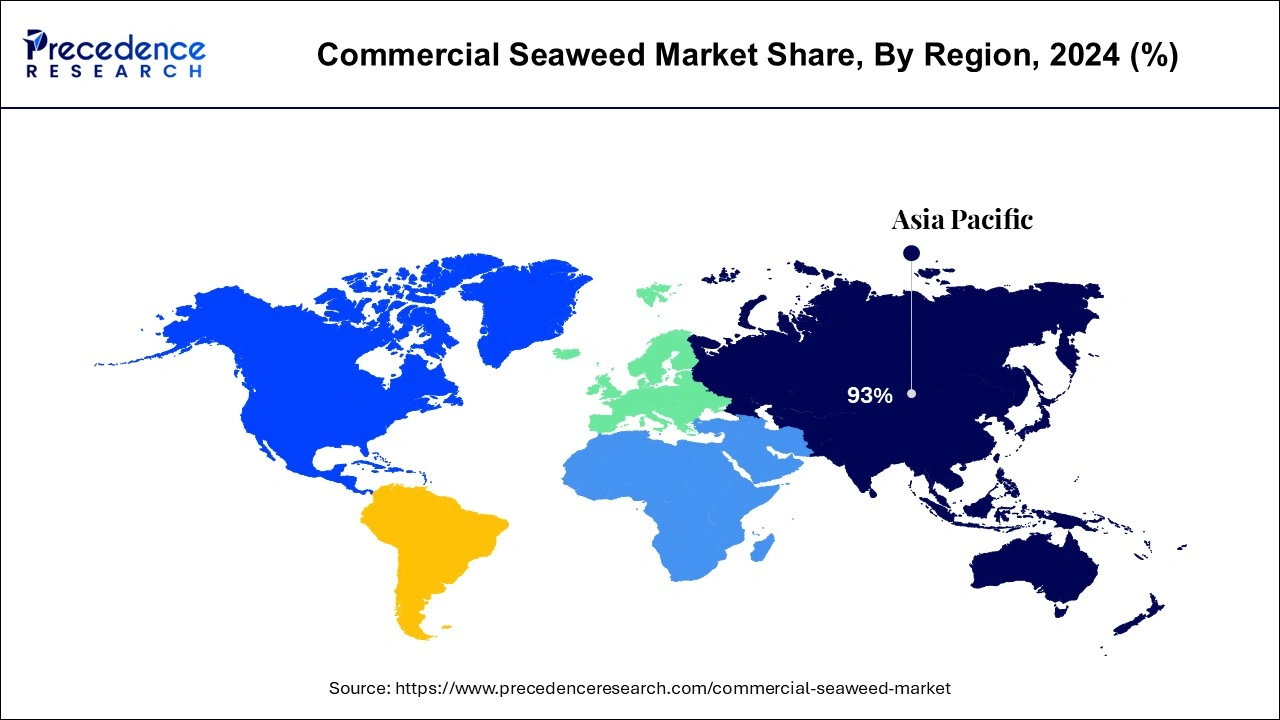

The major share of the market is held by the Asia Pacific region. Traditional cuisines make use of commercial seaweed in the nations like Vietnam, Japan, and China. Macroalgae play a significant role in the growth of the market. Personal care and cosmetic products make use of commercial seaweed, and the popularity of these products has grown significantly in recent times. Considerable growth will be registered by the North American region during the forecast period. This is due to the growing demand for plant-based products.

Vegetarian diets and vegan diets are gaining popularity in the North American region due to which the need for commercial seaweed will grow. Functional beverages and functional foods are also gaining popularity in the North American region due to which the use of commercial seaweeds like algae has grown. Technological advancements and developments will play an important role in the harvesting and cultivation of algae.

Steady growth will be registered in the European market. Natural supplements and high-quality supplements have a greater demand in these nations. A vegan diet will also increase the use of seaweed. The oceanic geographical area of South America will play an instrumental role in the growth of the market. Remarkable opportunities will be provided by these nations for the development of the market.

Commercial seaweed is a marine plant food that has prevalent use in the medicine and food industry. Commercial seaweed is green, brown, and red in color and it's also called marine algae. It comes in spherical, broad, and delicate finger shapes. For many centuries, commercial seaweed is being used across the globe. For the coastal community, seaweed is a source of food. The extensive use of commercial seaweed in the beverages and food industry has increased in recent times.

The presence of micronutrients and macronutrients in commercial seaweed makes it extremely desirable. Nutrients like chlorine, phosphorus, sulfur, sodium, potassium, calcium, zinc, magnesium, and copper are present in commercial seaweed. Commercial seaweed is available in about 221 species around the world. Brown and red-colored seaweed are extensively used for commercial purposes. Carrageenan is a seaweed that is widely used in the food and beverages industry as it has hydrocolloid properties.

Commercial seaweed is used as an emulsifying agent and particle suspension due to which it is expected to have promising growth during the forecast period. Commercial seaweed is also used in the agricultural sector as a fertilizer which helps in increasing cultivation. To increase food security and increase yield, the demand for such fertilizers has grown extensively. Technological advancements will increase the use of commercial seaweed in various industries.

The use of commercial seaweed in the cosmetic industry has also grown in recent times. Several policies regarding the cultivation of seaweed have also played an instrumental role in the growth of the market. Environmental sustainability and economic sustainability are the focus of new policies enacted by the government. Commercial seaweed is also extremely effective in treating diabetes and thyroid dysfunctions. The consumption of commercial seaweed increases the amount of fiber intake of a person without increasing the number of calories.

| Report Coverage | Details |

| Market Size in 2025 | USD 12.78 Billion |

| Market Size by 2034 | USD 16.20 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 2.67% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, and By Form |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased use of commercial seaweed in processed food

Commercial seaweed in drug delivery

There are many digestive benefits of commercial seaweed

Changing lifestyle of the consumers

Natural calamities of the coastline and ocean

Government initiatives will drive the market growth

Strict regulations

Based on the product, the green seaweed segment generated a maximum revenue share of around 50% in 2024. Green algae play an important role in preventing cancer. Dietary supplements that comprise green algae have a greater demand in the market and these supplements are available in tablet and capsule form.

The brown seaweed segment will also generate a significant amount of revenue. In many industries like the animal feed industry, agricultural industry, and the food and beverages industry brown seaweed is used extensively. It is used as a thickener and an emulsifier in different syrups.

The protein and vitamin content in red seaweed is high which is a great alternative for proteins. Red seaweed provides numerous health benefits as it helps in lowering bad cholesterol and it also helps in controlling blood sugar levels. It helps in providing nourishment to the skin, enhancing immunity, and providing ample antioxidants. All these factors will drive market growth in the coming years. Ongoing research for the use of alginic acid which is derived from brown seaweeds in the manufacturing of lithium-ion batteries will increase the demand for brown seaweeds during the forecast period.

Based on application, the human consumption segment generated the highest revenue share of over 77% in 2024. Health benefits and nutrient-enriched food are the properties of commercial seaweed and these two factors play an important role in the growth of the market. In the nations like Philippines, Japan, Malaysia, South Korea, China, and Indonesia the need for seaweeds has grown due to numerous cultural factors.

The other applications segment will also grow at a CAGR of 3.7% during the forecast period. Commercial seaweed is used in botanical research, chemical research, preparation of biofuel, and coloring additives. All these applications are expected to show successful growth in the coming years. Constant research and development in the field of commercial seals will increase their applications in many industries.

The leaf segment has generated a maximum revenue of around 42% in 2024. In the nations like Indonesia and China, these leaves are used in many local cuisines. Commercial seaweed is also used in the preparation of local cuisines of Iceland, Ireland, and Norway. Seaweed is also used in pickles, salad, and as a vegetable additive.

The powdered seaweed will register a significant compound annual growth rate of 2.4% as its use in the food industry and the cosmetic industry has grown. This format has a greater use as it is easy for transport and storage. The cost of spoilage and the operational cost has been reduced to a great extent. As vegan products are gaining popularity the use of the powdered form of commercial seaweeds will grow.

By Product

By Application

By Form

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

February 2025

November 2023