August 2024

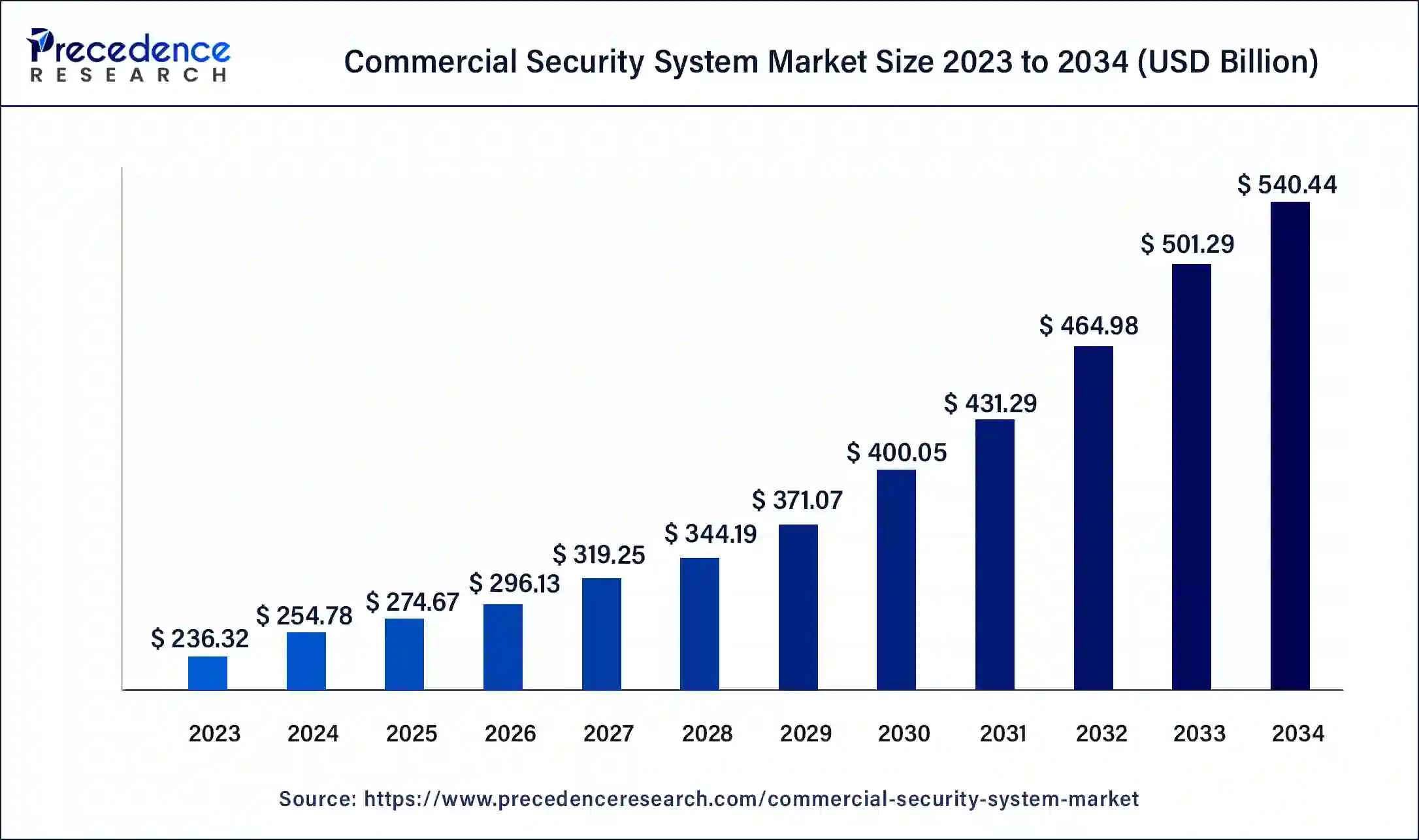

The global commercial security system market size was USD 236.32 billion in 2023, calculated at USD 254.78 billion in 2024 and is expected to be worth around USD 540.44 billion by 2034. The market is slated to expand at 7.81% CAGR from 2024 to 2034.

The global commercial security system market size is projected to be worth around USD 540.44 billion by 2034 from USD 254.78 billion in 2024, at a CAGR of 7.81% from 2024 to 2034. Rapid urbanization and industrialization and growing apprehensions over safety and security are driving growth in the commercial security system market.

Commercial security systems are a combination of hardware and software components designed to protect commercial properties from threats of theft, vandalism, break-ins, and emergencies. Commercial security systems are usually made up of video surveillance cameras and sensors for smoke, fire, sound, movement, and alarms. Commercial security systems also use technologies such as biometric verification, keycard access controls, intercom systems, and vehicle tracking and monitoring systems.

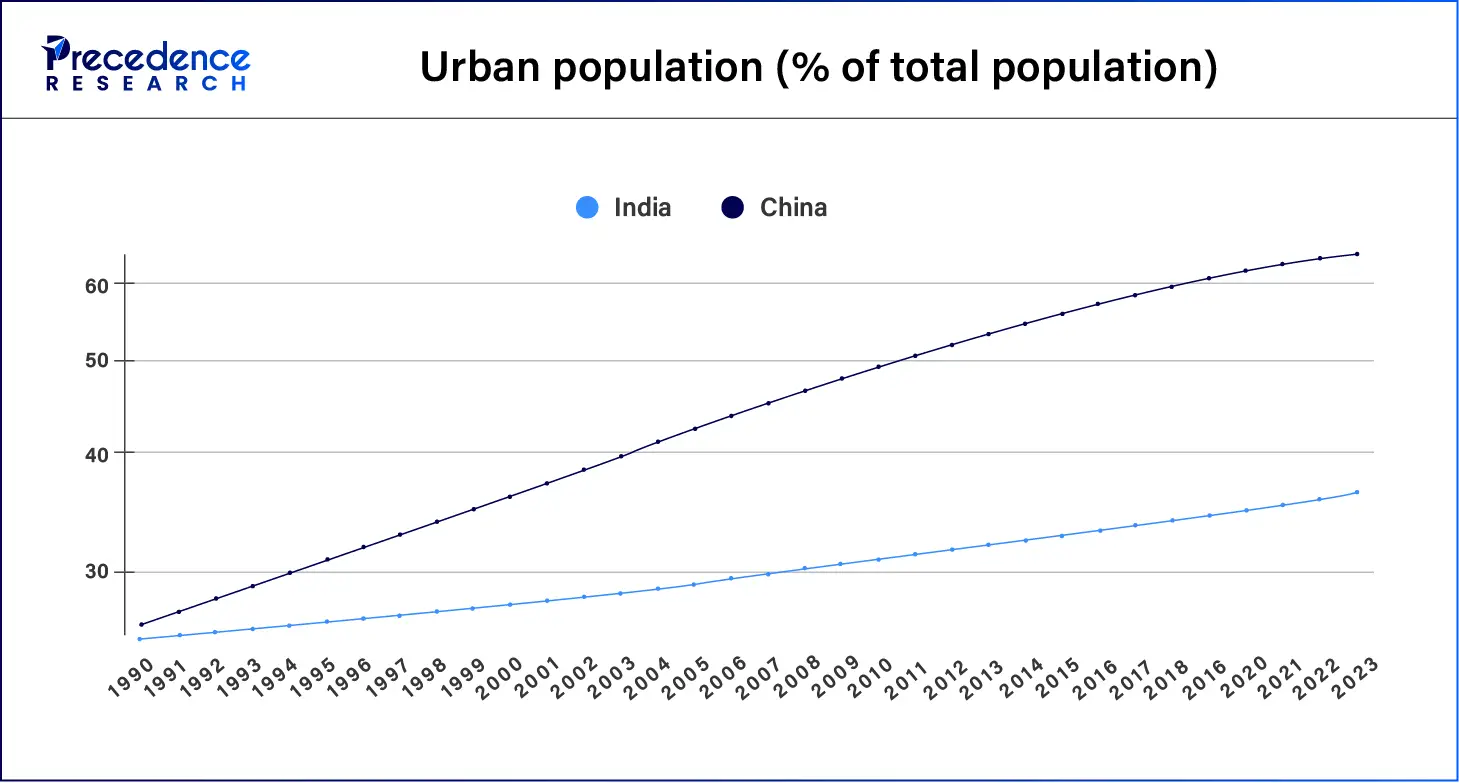

Rapid urbanization and industrialization in emerging economies such as China and India are driving the construction and development of cities and spurring demand for commercial security systems. However, the initial investment required for commercial security systems is high. The complexity of integrating new technologies into existing security systems and the prohibitive cost pose challenges to growth in the market. The advent of artificial intelligence and robotics provides opportunities for businesses in the commercial security system market.

How artificial Intelligence is transforming the commercial security systems industry

The application of artificial intelligence in commercial security system markets has led to the development of technologies such as advanced intrusion detection systems, better facial recognition systems, and behavior analytics platforms. AI-powered video surveillance can now analyze recorded video footage in real-time. AI-based biometric authentication methods use fingerprints and facial recognition to grant access, eliminating the need for physical access cards, keys, and pin codes, which can be lost or stolen or increase the risk of unauthorized access. Routine monitoring is now done by AI-based systems, reducing the burden on human security teams.

| Report Coverage | Details |

| Market Size by 2034 | USD 540.44 Billion |

| Market Size in 2023 | USD 236.32 Billion |

| Market Size in 2024 | USD 254.78 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.81% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Hardware, Software, Services, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Rapid urbanization and construction of commercial spaces

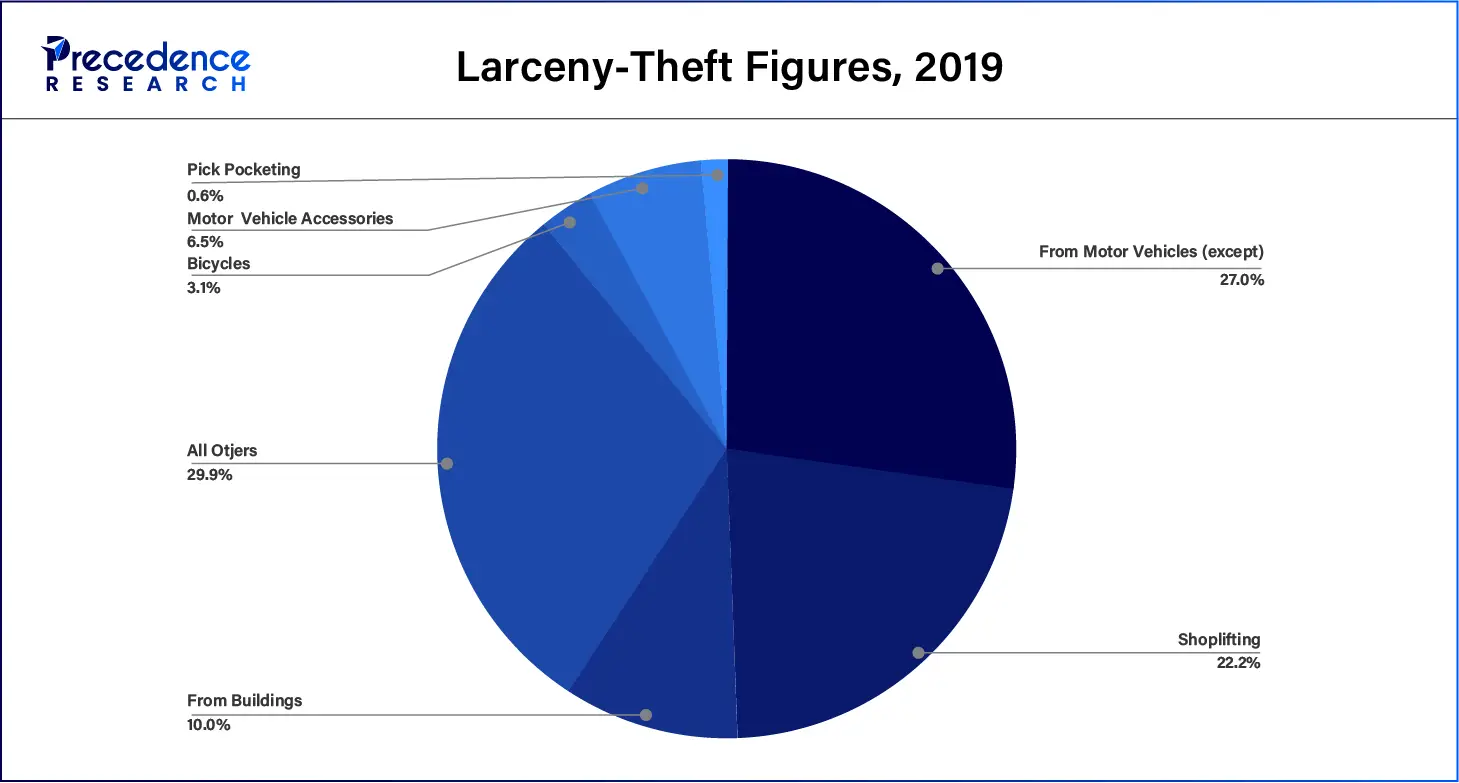

Economic growth has led to rapid urbanization in emerging economies such as India and China. With a growing urban population, the level of economic activity and number of businesses establishing themselves continues to rise, generating demand for commercial spaces. This has led to a growing demand for commercial security systems to safeguard against crimes, including theft, trespassing, and vandalism. The installation of commercial security systems provides a deterrent against crime. Installing security systems also helps prevent losses for businesses, especially in the retail sector. These factors have led to increased demand in the commercial security system market.

A rise in population growth and expansion of infrastructure is also driving expectations for greater safety and security measures, particularly linked to critical national infrastructure projects. Governments, especially in emerging economies such as India, are steadily increasing their budget allocation for security and safety initiatives. With the deployment of surveillance and smart city projects in several Indian cities, the adoption of video surveillance systems is expected to increase. Significant investment in safety and security projects is also driving growth in the commercial security system market.

High cost of initial investment

The high initial cost of investment to install commercial security systems including all the required equipment can discourage smaller businesses from investing in the commercial security system market. As new security technologies are developed, integrating older systems with new security solutions can become complex and challenging. Operating new security systems may require businesses to invest in training current staff or hiring professionals, making the cost prohibitive.

Data privacy concerns

As security systems become more advanced, the threat of cyber security becomes more prevalent. Businesses now collect and store sensitive data such as fingerprints for their new systems, increasing the risk of hacking and DDoS attacks leaking private information. The use of certain security solutions can clash with the regulatory obligations and privacy laws of a country. The use of 24/7 surveillance also brings up privacy and mental health concerns. Constant surveillance can cause negative psychological effects, such as surveillance-related stress, and aggravate pre-existing mental health conditions, such as anxiety and paranoia. This hampers the growth of the commercial security system market.

Technological developments lead to better security systems.

Developments in artificial intelligence, machine learning, and cloud computing have led to the emergence of more sophisticated security systems and, when properly commercialized, will lead to an overall reduction in the cost of updating existing systems. Advances such as automating video analysis leave security personnel more time to focus on critical events and respond accordingly. Developments in fire safety, such as camera detection, can substantially improve response time in emergencies. Camera systems use video-based fire detection to quickly identify fires and alert the appropriate personnel without having to wait for the smoke to physically reach sensors. Thus aiding the development of the commercial security system market.

The fire protection system segment made up the largest share of the commercial security system market in 2023. Fire protection systems detect, control, and suppress fires effectively. They consist of various components, such as alarm-initiating device circuits, fire alarm control panels, heat and flame detectors, and smoke detectors. These systems are crucial for preventing fire-related injuries and property damage and maintaining a safe environment. The implementation of stricter government regulations around fire safety worldwide is driving growth in the sector.

The video surveillance segment is expected to grow rapidly in the commercial security system market during the forecast period. The installation of CCTV cameras deters crime in commercial spaces. The effects of CCTV in deterring crimes have prompted businesses to increasingly adopt video surveillance, driving demand in the commercial security system market.

The video surveillance software segment dominated the commercial security system market in 2023. Video surveillance software such as network video recorders and management software are gaining traction over traditional DVR recording. Network video recorders provide better image quality, cloud storage, and video analytics that can be used to identify and track people and objects, helping organizations improve their security setup.

The access control software segment is set to grow at the fastest rate in the commercial security system market during the forecast period. Access control is an important component of commercial property security, helping monitor and restrict access to different parts of a building. The access control software gives businesses a central database and file manager to record system activity and distribute information to and from the field panels in the building. As commercial spaces become more sophisticated, the demand for access control software continues to grow in the commercial security system market.

The fire protection services segment held a significant share of the commercial security system market in 2023. Fire Protection service providers deal with all aspects of fire safety, including prevention, fighting or suppression, investigation, and information dissemination. In many countries, governments are implementing regulations to regulate fire safety. Businesses are outsourcing fire protection services to third-party entities, driving growth in the segment.

The security system integration services segment will expand notably in the commercial security system market over the studied period. The advent of sophisticated security systems such as AI-powered surveillance is prompting businesses to update their existing setups and integrate different kinds of security protocols. The rising popularity of cloud storage and internet of things (IoT) devices is leading to the development of new technologies, such as network access control, to restrict access to a specific network and parts of it.

The commercial segment dominated the commercial security system market in 2023. Incidences of theft and property damage to commercial buildings have led to businesses investing in security systems to safeguard their assets. Businesses are increasingly adopting commercial security systems to combat incidences in commercial spaces and ensure customer safety and security.

The healthcare segment is set to see significant growth in the commercial security system market in the coming years. Most hospitals are considered soft targets in terms of security, high-density locations with multiple points of entry, and limited security personnel. These factors make them targets for theft of medical equipment, personal belongings and disturbances. Hospitals also store a large amount of personal patient information, creating the need for robust security systems.

Asia Pacific dominated the commercial security system market in 2023. Large-scale urbanization in emerging economies has prompted significant infrastructure development, leading to demand for security systems. Both public and private entities are investing heavily in creating proper commercial security infrastructure. Malaysia has implemented the Safe City Program to create a crime-free environment using strategies such as increasing security measures, target hardening and management, and public awareness. Such programs are also being implemented in India, China, the Philippines, and Japan.

North America is expected to host the fastest-growing commercial security system market in the forecast period. Public safety and security measures in the United States are particularly robust, with several fire protection regulations (fire codes), electrical codes, and organizations like the Occupational Safety and Health Administration and National Fire Protection Association governing the provision of safety and security in the workplace. In Canada, the Canadian Centre for Occupational Health and Safety regulates workplace safety, supplemented by a variety of local regulations in provinces across the country.

Segments Covered in the Report

By Hardware

By Software

By Services

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

September 2024

November 2024

October 2024