What is the Video Analytics Market Size?

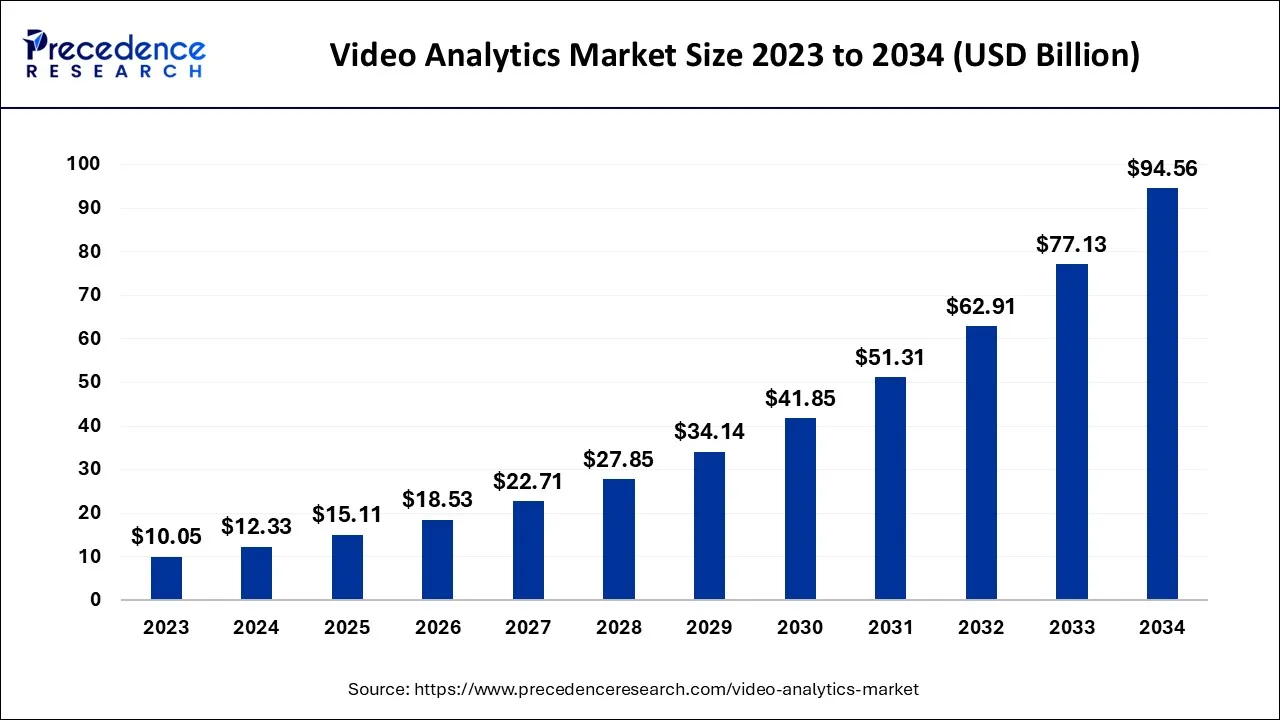

The global video analytics market size is calculated at USD 15.11 billion in 2025 and is predicted to increase from USD 18.53 billion in 2026 to approximately USD 109.85 billion by 2035, expanding at a CAGR of 21.94% from 2026 to 2035.

Video Analytics Market Key Takeaways

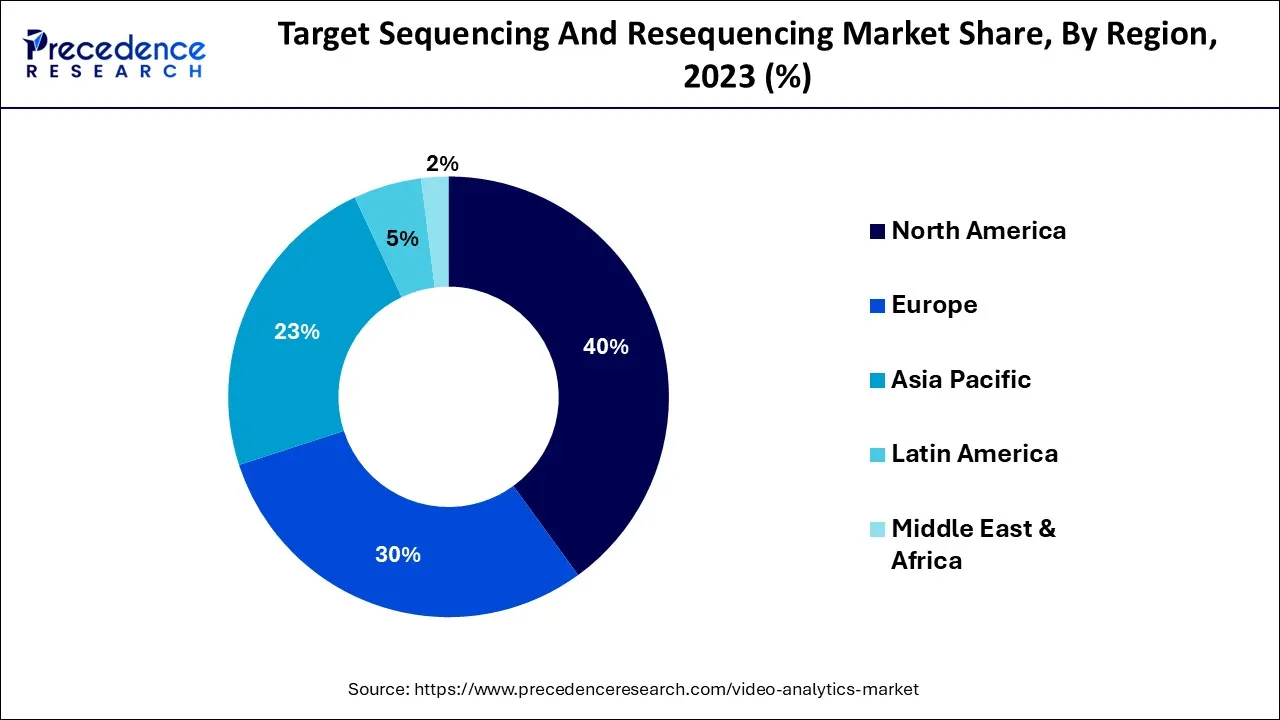

- North America led the global market with the highest market share of 40% in 2025.

- By Type, the software segment generated the highest market share in 2025.

- By Deployment, the on-premise segment dominated the global market in 2025.

- By Application, the crowd management segment contributed the maximum share in 2025.

- By End-use, the retail segment dominated the market in 2023 and is predicted to maintain its dominance between 2026 and 2035.

Market Overview

Video analytics is the automated processing and analysis of video content produced, acquired, or viewed during video surveillance. By ignoring pointless behaviors, the software analyses footage of the environments in order to identify qualities, events, patterns, and attributes of people or things. A substantial amount of unstructured video data is produced by the industries of social networking, municipal monitoring, and video surveillance. Insights from video data can be organized, distributed, and evaluated by users of video analytics software to assist in decision-making.

Video Analytics Market Growth Factors

New developments in technology allow users to view the locations of security cameras mounted on a smartphone or other comparable portable device by using an installed application made available by the solution provider. This enables a user to view the region being watched at any time and from any location. Vendors of hardware components offer electronic and hardware parts such as sensors, processors, SSDs, and cameras. These elements are essential for the real-time observation, detection, and reporting of the actions occurring within the surveillance region.

For instance, sensors help detect intrusions and other movements, and SSDs can be used to access local databases or storage and enable face and license plate recognition, among other things.

Companies including Cisco Systems, Inc., IBM Corporation, Honeywell International, and I2V Solutions Private Ltd., among others, offer video analytics services. They provide cloud-based SaaS as well as applications for on-premises installations. They can also offer real-time video analysis, warnings, and corporate intelligence. Also, it has been observed that these vendors integrate their systems with numerous external systems. The end users can then choose and deploy the best video analytics solutions within their own systems.

Key Factors Influencing Future Market Trends

- AI-based real-time analysis- Artificial intelligence is advancing video analysis that will enable real-time video analysis and faster threat, behavior, or event recognition that does not include human involvement.

- IoT alignment- Video analytics is increasingly being aligned with internet of things IoT ecosystems to create smarter surveillance, automation, and data-driven decision-making for verticals like smart cities, retail, and transportation.

- Edge computing- Edge computing enables data to be processed at the camera or local device nodes, reducing latency and bandwidth while increasing response time and system capacity.

- Privacy-compliant analytics- Increasing data protection regulations are pushing vendors to solve key privacy-first analytics where data will be anonymized while ensuring compliance without compromising security functions.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 109.85 Billion |

| Market Size in 2025 | USD 15.11 Billion |

| Market Size in 2026 | USD 18.53 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 21.94% |

| Largest Market | North America |

| Second Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Deployment, Application, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Burgeoning requirement across transport and logistics

The use of video monitoring is becoming more pervasive in the logistics and transportation sector. The decrease of crowding, behaviour analysis, increased safety measures, incident recording, and blind spot detection are just a few of the numerous advantages of video analytics for the transportation and logistics vertical. This market for commuters may be improved and expanded while also increasing safety with the use of video analytics.

The various capabilities of video analytics, including facial recognition, object tracking, unidentified object detection, cargo and train carriage recognition, and intelligent traffic monitoring, can aid logistics and transportation businesses in preventing disasters and spotting emerging threats that could cause infrastructure destruction or deadly car accidents.

Also, factors like the expanding urban population would hasten the market's overall expansion during the projection period. Additionally, it is anticipated that the market for video analytics systems would grow more quickly as more businesses, like retail and the public sector, adopt video analytics. Smart city adoption will increase, which will accelerate the market's growth rate over the course of the projected year.

Restraint

Government regulations related to CCTV surveillance & high cost

Businesses, governments, and organisations are incorporating video analytics into their video surveillance systems as a result of the wide range of possibilities for this technology. These tools capture and analyse video in real-time. It is used for many different things, such as ANPR, population estimation, and facial recognition. Notwithstanding its advantages, worries about residents' privacy have repeatedly been expressed.

As a result, nations like the US and UK are mandating the use of video analytics to prevent anti-social behaviour only in restricted regions and with limited capability. For instance, in October 2021, the European Parliament adopted a non-binding resolution that forbids the creation of personal facial recognition databases and the application of facial recognition technology by police enforcement in public areas.

Facial recognition technology and other remote biometric surveillance equipment are expected to be subject to similar restrictions in Oakland and Somerville. Guidelines for the information obtained by CCTV cameras have also been set by the General Data Protection Regulation (GDPR). Companies and organisations are not permitted to install CCTV without a valid cause, under the GDPR requirements. As a result, it is anticipated that severe rules will restrict the growth of the global market for video analytics.

The optimal performance of the video analytics system requires a solid IT foundation and reliable connections, both of which come at a major financial and maintenance cost. The infrastructure necessary for constant surveillance is lacking in underdeveloped nations and public spaces. As a result, regular maintenance is required to make the system more dependable.

It is projected that suppliers engaged in the global video analytics market would find it difficult to compete given the high cost of maintenance and other responsibilities. Additionally, the video analytics systems demand significant investments. Thus, it is anticipated that throughout the course of the projection period, the high costs and the necessary expenditures will further restrain market expansion.

Opportunity

Predictive information using video analytics

Predictive analytics is used to make predictions about future events. It uses techniques from data mining, ML, AI, statistics, and modelling. The video system captures significant and valuable signals, such as social media data streams that are unstructured, video, and audio that contain critical client behavioural features. The placement of security cameras in public areas allows for the collection of atmospheric data. While predictions can be formed using all these factors together, they can be difficult.

The development of predictive information could be hampered by factors including storage requirements, time constraints, and watching each video clip. As a result, there may be a business opportunity in the generation of predictive information through video analytics.

Segment Insights

Type Insights

The largest revenue contributor to the video analytics market in 2025 was the software industry. This was attributed to the increased need to monitor structures or other facilities for any physical threats or shady activity. Moreover, factors like precise image analysis, real-time processing, various visual inputs, and better accuracy are driving demand for video analytics software.

However, the service category is predicted to develop at the greatest rate throughout the projection period due to the increased adoption of digital technology across numerous industries and the need to offer better services. Video analytics services help businesses by providing project guidance, configuration, installation, security monitoring, and other essential security services.

Deployment Insights

The on-premise segment dominated the global market for video analytics in terms of deployment in 2025 and is anticipated to continue doing so over the anticipated timeframe. This is because industries that handle sensitive data and are vulnerable to cyberattacks or data breaches, such as banking, financial services & insurance (BFSI), education, and healthcare, have adopted the on-premise deployment approach.

Application Insights

For big events and festivals, governments and police departments must perform time-consuming chores of crowd control and surveillance. In these situations, integrating intelligent surveillance systems with video analytics offers real-time, crucial situational alerts.

Crowd management uses video analytics extensively for tasks including estimating crowd size, identifying prominent patterns and statistics in the crowd, and spotting suspicious activity. As a result, the crowd management segment had the largest share.

The facial recognition market is anticipated to grow at the quickest rate over the projected period.

End-Use Insights

Due to shifting consumer preferences, there has been a paradigm shift in the global demand for video analytics. Retail end-use dominated the market The category is anticipated to maintain its dominance over the course of the forecast period due to the rising application breadth of video analytics in the retail industry.

BFSI, government, education, transportation, cities, and vital infrastructure are further end-use segments. End users now lay more emphasis on analysing crowd dynamics and deciphering human behaviour than on basic security surveillance and monitoring. As a result, video analytics have been increasingly used in industries like retail, government, and cities.

Regional Insights

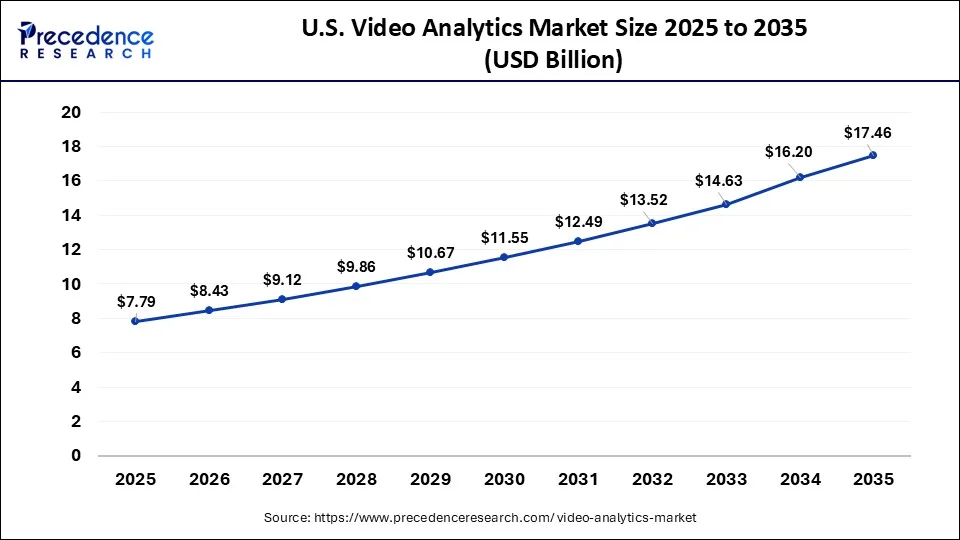

What is the U.S. Video Analytics Market Size?

The U.S. video analytics market size is exhibited at USD 7.79 billion in 2025 and is projected to be worth around USD 17.46 billion by 2035, growing at a CAGR of 8.41% from 2026 to 2035.

North America led all other regions in 2025 due to the widespread presence of major companies in the sector. Currently, the United States is the country that uses video analytics the most. Strong economic growth in the nation fosters rapid technical advancement. Additionally, by integrating analytics, organizations have been refocusing operations on security and safety. Due to changing customer needs, there has been a shift from traditional on-premise implementation of video analytics to cloud deployment.

Asia Pacific surpassed Europe as the second-largest market in terms of revenue share, which can be credited to the region's robust economic expansion in nations like India, China, and Indonesia. To guarantee the safety of their citizens, these economies have been investing in sophisticated security surveillance systems. The market is anticipated to be driven by rising industry solution usage and rising cloud-based technology adoption, particularly in China, Japan, and India.

European Rapidly Growing Video Analytics Industry

Europe is expected to grow significantly over the forecast period. This growth is due to the increasing adoption of advanced surveillance technologies and a rising focus on public safety. The region is witnessing rapid development in communication networks, which also facilitates the deployment of Internet Protocol (IP)-based security systems. These systems help to enhance monitoring capabilities, which further propels market growth and innovation.

Germany Video Analytics Market Trends: The region is also witnessing a rising demand for smart city initiatives, thus pushing municipalities to implement video analytics solutions that are able to optimize urban infrastructure. Retail, transportation, and industrial sectors are leveraging analytics for customer insights, loss prevention, and process optimization.

Latin America's Video Analytics Industry Analysis

Latin America is witnessing substantial growth in the market. This growth and development are closely linked to the adoption of robotics and automation in manufacturing and logistics. Countries in this region, such as Brazil and Mexico, are increasingly investing in smart factories that are equipped with advanced automation systems, as it helps to enhance productivity and safety.

Brazil Video Analytics Market Trends: Governments and industry bodies in the region are driving innovation through incentives and regulatory support, aligning with global trends toward Industry 4.0. These shifts are propelling the market and optimizing market efficiency. Retail and logistics firms use analytics to improve customer insights and supply chain operations. Data privacy, regulations, and skilled labor shortages are influencing adoption and investment decisions.

What are the Advancements for the Video Analytics Industry in the Middle East and Africa?

The Middle East and Africa region is expected to grow at a steady rate throughout the forecast period. This growth is due to increasing security concerns and the rapid urbanization in the region. Governments and organizations in the region are investing heavily in advanced surveillance technologies in order to enhance public safety and manage growing populations in an effective manner.

Saudi Arabia Video Analytics Market Trends: In addition, there is also a rising adoption of smart city initiatives, which integrate various technologies for improved urban management, thus driving demand for advanced video analytics solutions. Commercial industries including retail, logistics, oil and gas, and transportation are increasingly adopting analytics to improve operational safety, compliance monitoring, and customer insights.

Video Analytics Market Companies

- Avigilon Corporation (Canada)

- Axis Communications AB (Sweden)

- Cisco Systems, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Agent Video Intelligence Ltd. (U.S.)

- AllGoVision Technologies Pvt. Ltd (India)

- Earth Water Limited (U.S.)

- Genetec Inc., (Canada)

- Intellivision (U.S.)

- Intuvision Inc., (U.S.)

Recent Developments

- In January 2025, NEC combines video analysis technology with generative AI to generate advice for improving work quality. NEC developed a video analysis technology to identify subtle differences in movements when compared to model actions, and a technology to generate appropriate advice to match the model action by generative AI based on the differences.

- In April 2025, Vidopix, a trailblazer in Video Intelligence Solutions, officially launched its groundbreaking AI-powered video analytics platform in India. Featuring InstaVidIQ and SurveyCine, Vidopix is set to transform the way businesses extract and leverage insights from video content, delivering unparalleled accuracy, efficiency, and depth of analysis

- In April 2024, Lumana AI Inc., maker of a cloud-based security platform with image recognition capabilities, launched with AI-powered video surveillance system. The company's video security platform includes the AI engine and video processor, video management software accessible through a web browser or mobile application, and security cameras, although any internet-connected camera will work.

- In December 2024, Fujitsu announced the development of a video analytics AI agent for frontline workplaces. The AI agent uses spatial video and image data from workplace camera footage, as well as written information, to draft reports and make recommendations for workplace improvements.

- In June 2021,Ipsotek was a maker of AI-enhanced video analytics software, and Atos SE's acquisition of the company added Ipsotek's software powers to its line-up of Edge AI and Computer Vision solutions.

- Senstar Corporation collaborated with IPVideo Corporation to integrate its Senstar Symphony Common Operating Platform into the HALO IoT Smart Sensor in December 2021. Senstar Corporation is a supplier of perimeter intrusion detection systems (PIDS), video analytics, and management software. This integration is expected to make it simpler for HALO users to get notifications when Senstar Symphony Common Operating Platform data shows that vaping, chemicals, sounds, gunshots, air quality, or health are above or below normal ranges or levels.

Segments Covered in the Report

By Type

- Software

- Services

By Deployment

- Cloud

- On-premise

By Application

- Crowd Management

- Facial Recognition

- Intrusion Detection

- License Plate Recognition

- Motion Detection

- Others

By End-Use

- BFSI

- City

- Critical Infrastructure

- Education

- Government

- Retail

- Transportation

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting