January 2025

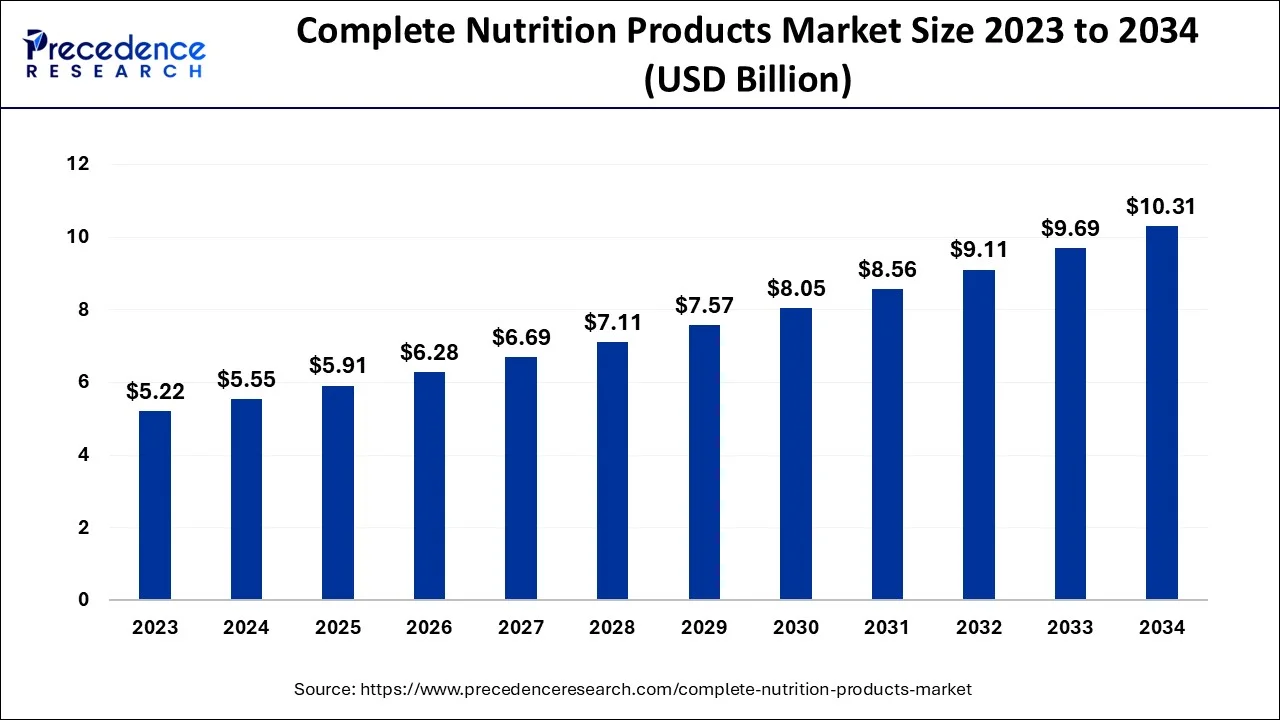

The global complete nutrition products market size accounted for USD 5.55 billion in 2024, grew to USD 5.55 billion in 2025 and is projected to surpass around USD 10.31 billion by 2034, representing a healthy CAGR of 6.38% between 2024 and 2034. The North America complete nutrition products market size is calculated at USD 2.39 billion in 2024 and is expected to grow at a fastest CAGR of 6.50% during the forecast year.

The global complete nutrition products market size is estimated at USD 5.55 billion in 2024 and is anticipated to reach around USD 10.31 billion by 2034, expanding at a CAGR of 6.38% between 2024 and 2034. The rising prevalence of obesity due to sedentary lifestyles all over the world is expected to boost the demand for complete nutrition products for weight management.

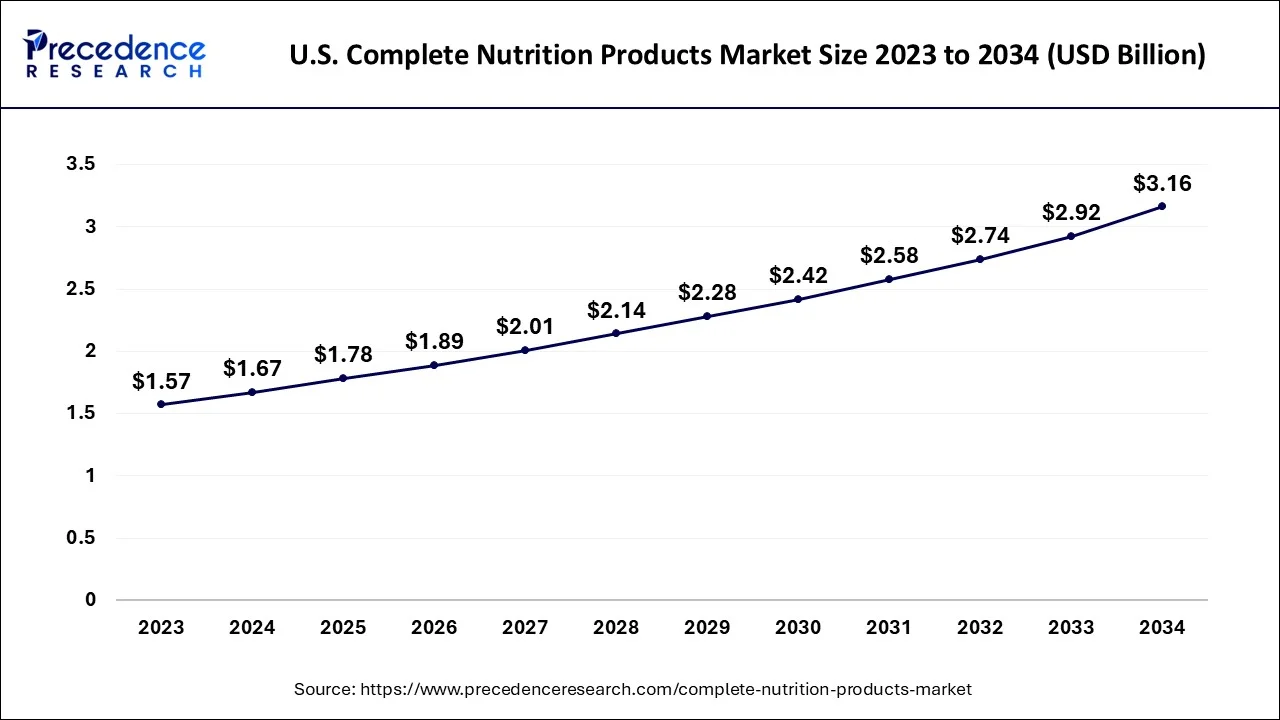

The U.S. complete nutrition products market size accounted for USD 1.67 billion in 2024 and is expected to be worth around USD 3.16 billion by 2034, growing at a CAGR of 6.57% between 2024 and 2034.

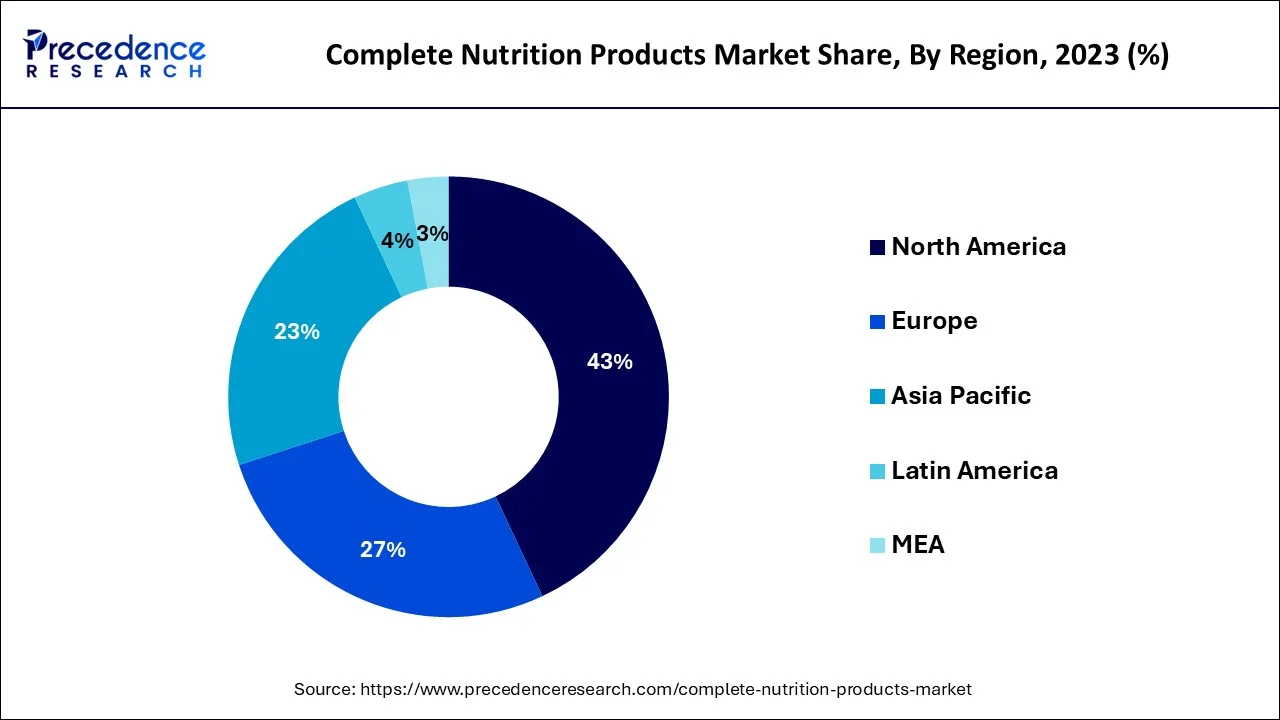

North America dominated the global complete nutrition products market and generated more than 43% of the revenue share in 2023. The region is expected to maintain its dominance during the forecast period due to rising cases of obesity, nutrition deficiencies, calcium deficiencies, and increasing demand for on-the-go and nutritional products.

In terms of product types, protein supplements and meal replacement products are among the most popular in the North American complete nutrition products market. Other popular products include sports nutrition, weight management, and vitamin and mineral supplements.

The US government also provides guidelines for healthy eating and nutrition through agencies such as the Department of Health and Human Services and the US Department of Agriculture. These guidelines emphasize the importance of a balanced diet consisting of nutrient-dense foods while acknowledging that dietary supplements may be useful for individuals who cannot meet their nutritional needs through food alone.

Overall, the US government plays an essential role in regulating and promoting the safety and efficacy of complete nutrition products while encouraging the growth of the complete nutrition products market.

Europe is observed to be the most lucrative marketplace for complete nutrition products during the forecast period. The market is driven by several factors, including increasing health awareness, a growing demand for convenient and personalized nutrition solutions, and a rising interest in sports and fitness activities.

By establishing clear regulations and guidelines, several governments and regulatory bodies in Europe seek to promote the development of high-quality complete nutrition products that can help consumers meet their dietary needs safely and effectively.

Asia Pacific is the fastest-growing region of the global complete nutrition products market, and the rising interest in sports and fitness is observed as a significant factor for the market growth in Asia Pacific. Additionally, the expansion of the nutrition industry with the entry of potential players in the region is accelerating the development of the complete nutrition products market.

Moreover, the LAMEA complete nutrition products market is expected to experience significant growth in the coming years due to increased health awareness, a growing aging population, and technological advancements in the production and delivery of these products.

Complete nutrition products offer a comprehensive and convenient source of essential nutrients, such as protein, vitamins, and minerals, which can be challenging to obtain through a regular diet. The rising concerns of vitamin and calcium deficiencies are observed as the major driving factor for the growth of the complete nutrition products market.

According to the report published by The Biostation, 92% of the United States population is suffering from at least one form of vitamin/calcium deficiency. The same report stated that processed juices and fast-food products have become popular over a standard/ healthy diet.

Moreover, according to the Centers for Disease Control and Prevention and the U.S. Department of Agriculture (USDA), seven out of ten Americans are deficient in calcium, and more than 50% of the population is vitamin D deficient. Whereas eight out of ten are deficient in vitamin E.

Complete nutrition products can be a good source of calcium and vitamins for individuals who may be deficient in these nutrients. Calcium is an important mineral essential for bone health, muscle, and nerve function. Many complete nutrition products are fortified with calcium, making them a convenient source of this crucial mineral.

Overall, vitamin products' availability and popularity have helped drive the market for complete nutrition products. By providing a convenient and accurate source of essential vitamins and other nutrients, complete nutrition products are helping consumers to meet their health preferences.

With busy lifestyles, consumers are looking for convenient and quick ways to get proper nutrition. Complete nutrition products provide an easy and portable way to get a balanced meal or snack, the product convenience is observed as a major driver for the growth of the complete nutrition products market. Along with this, the rising development of RTD shakes or nutritional drinks highlights this driving factor.

The complete nutrition products market is also benefiting from advancements in technology, such as DNA-based nutrition and personalized nutrition apps, which are helping to create more personalized and effective solutions for consumers. Product innovation by utilizing modern technology and rising investment by potential players in the nutrition industry are other significant factors considered for the development of the complete nutrition products market.

Nestle invested an undisclosed amount in German nutrition product start-up FoodY, the European startup company is focused on developing meal replacement bars, powders and drinks. The company already offers eight different flavors in its classic drinks range with a vegan selection.

In March 2023, food-tech company, NotCo launched a new range of products at Natural Products Expo West. The newly launched products are plant-based and created with artificial intelligence technology. The deployment of AI technology in product development has helped the company in producing new and innovative flavors.

As consumers become more health conscious, they are increasingly seeking out products that support their health goals, such as weight management, muscle gain, and improved energy levels, the rising health consciousness is considered a major driver for the growth of the complete nutrition products market. Overall, the complete nutrition products market is expected to continue to grow as consumers seek convenient, healthy, and customizable options to support their nutrition goals.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.55 Billion |

| Market Size by 2034 | USD 10.31 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.38% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising cases of obesity across the globe

According to UNICEF’s World Obesity Atlas 2022, India is expected to have over 27 million obese children by 2030. This represents one child being obese in every ten children in the country.

The latest statistics from the Centers for Disease Control and Prevention (CDC) in 2021, approximately 42.4% of adults in the United States are considered to have obesity. This equates to about 107 million adults in the U.S. who are affected by obesity.

Complete nutrition products, such as meal replacement shakes, bars, or powders, can be used as part of a weight management plan to replace one or more meals or snacks per day. These products are designed to provide balanced and complete nutrition, including a mix of macronutrients (carbohydrates, protein, and fat) and micronutrients (vitamins and minerals).

Additionally, these products are often convenient and portable, making them a convenient option for busy lifestyles. Thus, the rising case of obesity is observed to drive the growth of the complete nutrition products market.

Consumer skepticism

Consumers are skeptical about complete nutrition products, questioning their efficacy and safety. The nutrition industry in many geographical areas is highly self-regulated, which leads to concerns about the safety and efficacy of complete nutrition products. False and misleading or exaggerated advertising/marketing also affects consumer behavior.

Moreover, nutritional science is complex; it can be complicated and confusing for consumers to navigate the scientific importance of ingredients. Negative experiences and side effects of lack of knowledge about complete nutrition products can make consumers hesitant to try new and innovative products. Overall, the skepticism of consumers about complete nutrition products is driven by misleading information, concerns about regulations, conflicting information, and a lack of evidence-based knowledge about products.

Development of vegan complete nutrition products

Considering the rising animal welfare activism, climate change and health concerns, along with increasing awareness about clean eating habits, have boosted the speed of population shifting to veganism across the globe. The emergence of veganism demands product development that is animal-free, sustainable and does not compromise nutritional values. The rising prevalence of veganism presents lucrative opportunities for market players to develop innovative vegan products in the upcoming period. Moreover, the growth of vegan complete nutrition products is leading to a diversification of the market, with more products being developed to cater to a broader range of dietary preferences and requirements.

The powder segment accounts for over 53% of the share in the global complete nutrition products market. Powder nutrition products are comparatively affordable and easy to consume; these advantages have fueled the growth of the segment. According to a survey by Council for Responsible Nutrition, protein powders were the most popular dietary supplements among adults in the United States.

Moreover, the massive availability and enormous demand of powder protein shakes, weight management powder, and nutritional powder, along with the continuous development of products, are observed to maintain the dominance of the powder segment during the forecast period.

The ready-to-drink (RTD) shakes is the fastest-growing global complete nutrition products market segment. RTD shakes come in single-serving containers, making them easy to consume and travel-friendly. Additionally, the availability of various flavors in the RTD shakes is grabbing consumer attention. The rapid product development is supplementing the growth of RTD shakes in the global complete nutrition products market.

In October 2022, a globally leading brand in the nutrition industry, Myprotein, announced the launch of a new clear whey protein drink in ready-to-drink form. The drink is available in the market in 500ml bottles in multiple flavors.

The bars segment is expected to witness significant growth during the projected timeframe. With tremendously busy lifestyles, people have started adopting the on-the-go nutritional products option; nutritional bars are one of these on-the-go options. Moreover, the rising development of sugar-free, gut-friendly, and vegan dietary bars is expected to drive the growth of the bars segment in the upcoming years.

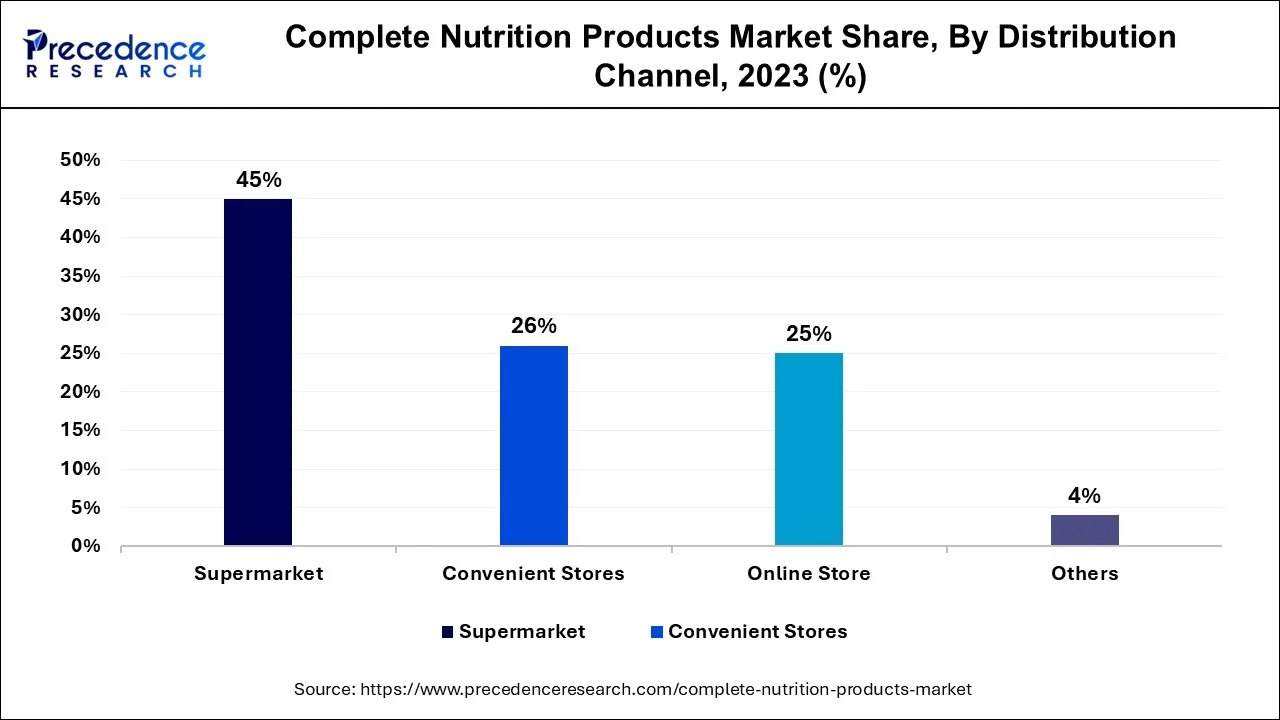

The supermarket segment holds the largest share of around 45% in 2023. The rising penetration of separate sections for nutrition and wellness products in supermarkets, especially in urban areas, is fueling the growth of the supermarket segment. Accessibility of supermarkets and accountability regarding products boost the sales of complete nutrition products in supermarkets. Moreover, purchasing nutritional products from supermarkets offers consumers convenience, variety, availability, and trust.

The online store segment is expected to register the fastest growth during the forecast period owing to the comfort offered by online shopping and the rising e-commerce industry. Many major key players in the complete nutrition products market have released products in online stores by providing more excellent selections and competitive prices; this factor is propelling the segment’s growth. Moreover, the availability of product information, subscription options, and customer reviews are supporting the segment’s growth.

The complete nutrition products market is a rapidly growing sector, with several key players in the market. Some of the leading companies in the market include:

Segments Covered in the Report:

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

November 2024

November 2024