Computer-Aided Drug Discovery MarketSize and Companies

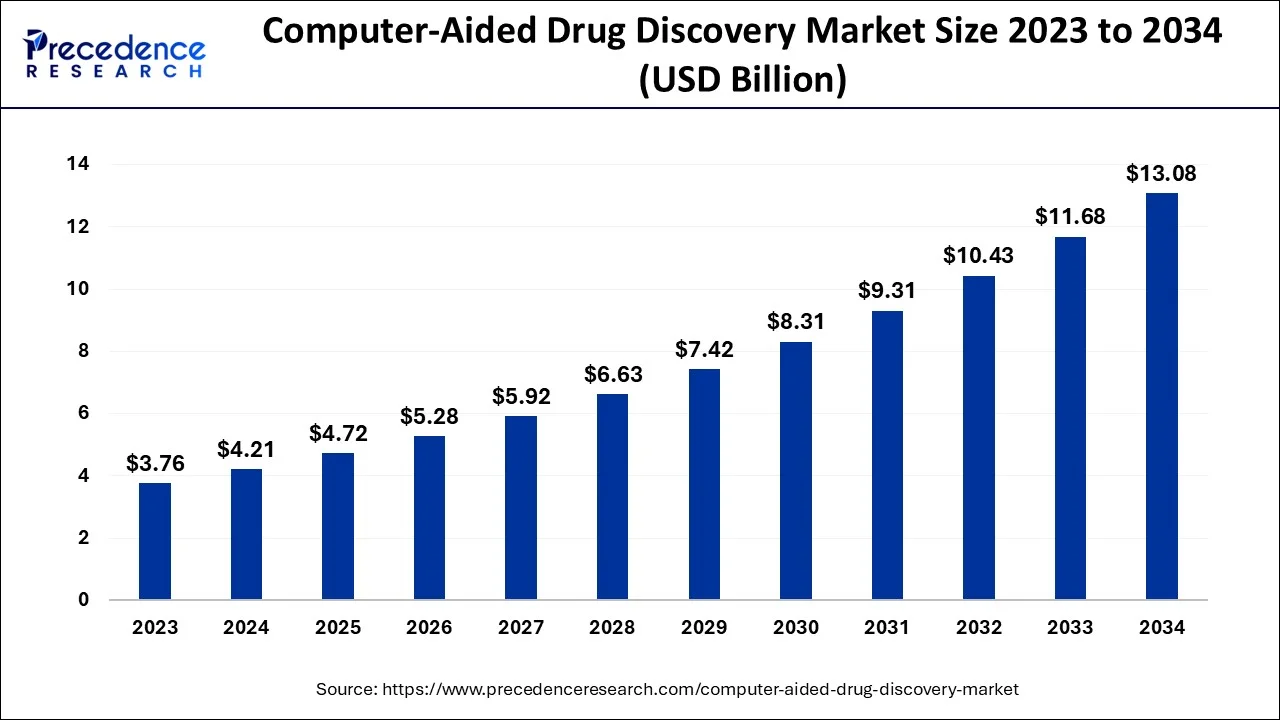

The global computer-aided drug discovery market size accounted for USD 4.21 billion in 2024 and is anticipated to reach around USD 13.08 billion by 2034, expanding at a CAGR of 12% between 2024 and 2034.

Computer-Aided Drug Discovery Market Key Takeaways

- North America is predicted to dominates the global market between 2024 and 2034.

- Asia-Pacific region is expected to expand at the fastest CAGR from 2024 to 2034.

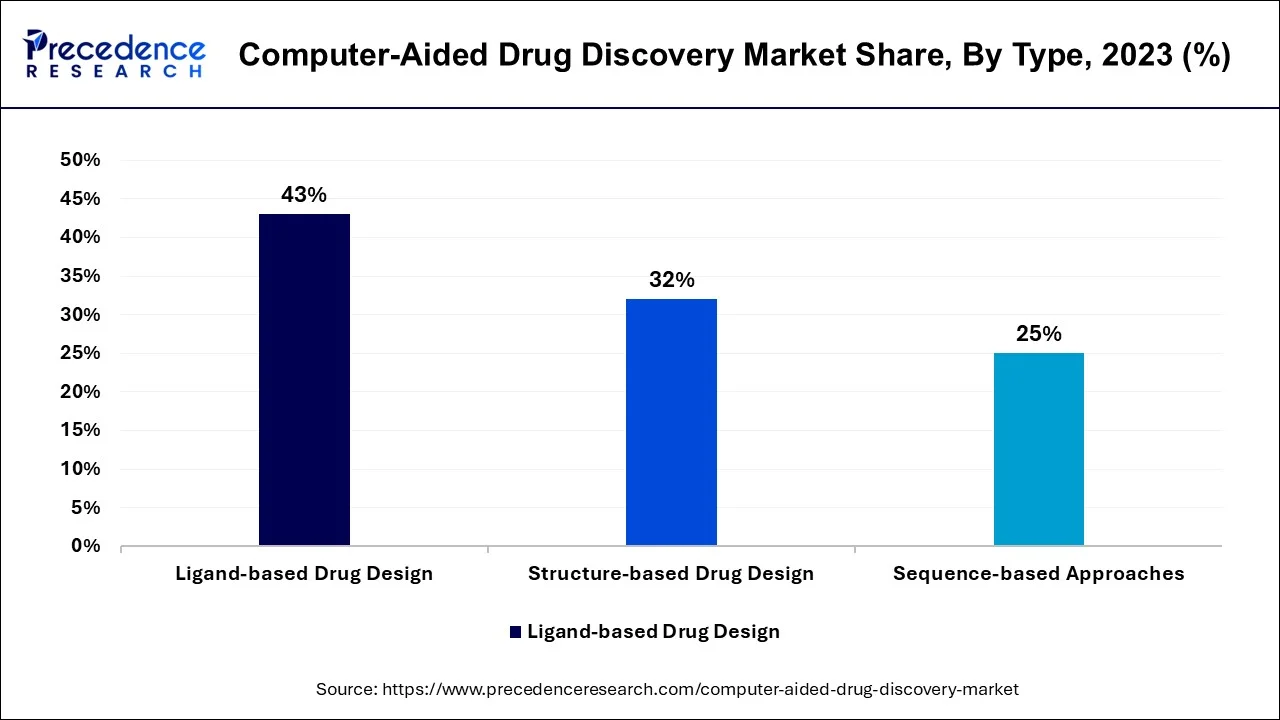

- By Type, the ligand-based drug design segment captured more than 43% of revenue share in 2023.

- By Type, the structure-based drug design subsegment is expected to expand at the fastest CAGR between 2024 and 2034.

- By Therapeutic Area, the oncology segment is dominating the global market from 2024 to 2034.

- By Therapeutic Area, the cardiovascular disease segment is predicted to grow at a remarkable CAGR between 2024 and 2034.

- By End User, the pharmaceutical company's segment is dominating the global market.

Market Overview

Drug discovery is a time-consuming process that can take up to 10-15 years and cost more than 2.558 billion for a drug to reach the market. It is a multi-step process that begins with identifying a suitable drug target, followed by drug target validation, and leads molecule optimization to preclinical and clinical studies. With significant investments and time spent on drug discovery, clinical trial success is only 13%, with a relatively high drug attrition rate. In a clinical trial, drug failure at a later stage has been reported in many cases approximately 40% to 60% due to a lack of optimal pharmacokinetic properties on absorption, distribution, metabolism, excretion, and toxicity. Nowadays, leading pharmaceutical companies and research groups have used computer-aided drug discovery (CADD) techniques in preliminary studies to help accelerate the drug discovery and development process while minimizing costs and failures in the final stage.

Using rational drug design as part of CADD provides valuable insights into the binding affinity and molecular interaction between the target protein and ligand. Moreover, the availability of supercomputing facilities, parallel processing, and advanced programs, algorithms, and tools has aided lead identification in pharmaceutical research and discovery. Furthermore, recent advances in artificial intelligence (AI) and machine learning methods have significantly helped the analysis, learning, and explanation of pharmaceutical-related big data in the drug discovery process.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 4.21 Billion |

| Market Size by 2034 | USD 13.08Billion |

| Growth Rate from 2024 to 2034 | CAGR of 12% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Therapeutic Area, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased incidences of chronic and undiagnosed diseases are driving the market

Globally increasing cases of chronic and unknown diseases are expected to accelerate the need for rapid drug discovery and development propelling the growth of the computer-aided drug discovery market. In recent years, chronic diseases such as cardiovascular disease have become more common due to unhealthy lifestyles and fast food. The number of cardiovascular patients could reach 23 million by the end of 2030, according to the World Health Organization (WHO), Furthermore, according to Premier, Inc., a well-known healthcare improvement company, the COVID-19 crisis has increased demand for novel drugs to treat CVD conditions. According to the facts and figures presented above, the need for developing new drug molecules is expected to grow, which may positively impact the global computer-aided drug discovery market during the analysis period.

AI intelligence and machine learning boost the market growth

Artificial intelligence (AI) is machine intelligence based on computers' ability to learn from existing data. Various computational modeling methods have used AI to predict drug molecules their biological activities and their toxicity of the drug. Furthermore, AI has numerous applications in drug discovery, including protein folding prediction, protein-protein interaction prediction, virtual screening, QSAR, ADMET property evaluation, and de novo drug design. Moreover, Machine learning (ML) and deep learning are two powerful methods widely used in rational drug design (DL). A support vector machine is an example of a machine learning algorithm commonly used in drug discovery (SVM). In addition, AI methods have been developed to deal with this large volume of multidimensional data to predict drug efficacy and side effects in animals and humans.

Although AI is a unique method for identifying preclinical candidates in a more cost-effective and time-efficient manner, accurately predicting binding affinity between a drug molecule and a receptor using AI remains difficult for various reasons.

Restraints

Lack of technical knowledge restrains the market growth

Computer-aided drug discovery is a new technology. Many professionals need to be made aware of it or are unsure how to apply it to drug discovery. It is also a very complex method that requires advanced skills to operate. People need a lot of time to learn how to use the software. These factors are expected to stifle future market growth. Aside from that, computer-aided drug design necessitates an extensive database of bimolecular structures to study their interactions with ligand molecules. If such a database is unavailable, the CADD technique cannot be performed efficiently, restricting market growth.

If such a database is inaccessible, the CADD technique cannot be performed efficiently, restricting market growth. Other factors, such as a lack of standardization for testing and validation of results, a lack of an accurate scoring function, and a need for a high-quality database for biomolecules, are expected to limit the future growth of the computer-aided drug discovery market.

Opportunities

Advancement in the field of computer-aided drug discovery in the market create massive opportunities

The global computer-aided drug discovery market is rapidly expanding due to the increasing combination of different technologies that speed up research activities while also providing accurate results in a shorter period. The computer-aided drug discovery (CADD) technology is further augmented by some of the most recent emerging technologies, such as machine learning (ML) and artificial intelligence (AI), which drive research programs in the biotechnological and pharmaceutical industries. These are significant market growth-accelerating factors. Drug discovery companies extensively use computer software such as computer-aided drug discovery (CADD). This software technology is augmented by some of the most recent emerging technologies, such as machine learning (ML) and artificial intelligence (AI), which drive research programs in the biotechnological and pharmaceutical industries.

The increasing pace of drug discovery research has created numerous opportunities for key players to invest in CADD technologies. Furthermore, many manufacturing companies have begun to invest a significant portion of their annual budget in technologies to discover new drugs for various chronic diseases. For Instance, a U.K.-based biotechnological company developed a drug discovery platform integrated with quantum computing and artificial intelligence to provide clients with on-demand access to a wide range of biochemical, molecular, and cell-based assays conducted entirely by robots. According to a news article published on August 3, 2020, in Genetic Engineering & Biotechnology news. These factors could result in lucrative market opportunities for key players in the coming years.

Type Insights

Based on type, the computer-aided drug discovery market is categorized into Structure-based drug design, Ligand-based drug design, and sequence-based approaches. The ligand-based drug design segment generated more than 43% of the revenue share in 2022. The growth of ligand-based drug design is primarily driven by its key characteristics, which provide predictive models that are highly suitable for lead compound optimization. Furthermore, ligand-based methods may include substrate analogs and natural products that interact with the target molecule and aid in producing the desired pharmacological effect. During the analysis period, all these factors will contribute to the growth of the computer-aided drug discovery market.

On the Other hand, the structure-based drug design subsegment is expected to grow the fastest. Structure-based drug design is the traditional method of drug discovery, which employs NMR, cryo-EM, and X-ray crystallography for compound optimization and design. Furthermore, technological advancements and rising demand for new drugs for various diseases are driving factors in the global market for structure-based drug design type of computer-aided drug discovery over the forecast period.

Therapeutic Area Insights

Based on the therapeutic area, the computer-aided market is categorized into Oncology, Neurology, Cardiovascular diseases, respiratory diseases, and Diabetes. The oncology sub-segment is dominating the global market. Drug discovery can be accomplished in various ways, including laboratory testing of multiple compounds to better understand their effects on cancer. Despite extensive research, cancer treatment remains one of the world's major concerns due to medication resistance. As a result, there is an increasing demand for efficient, cost-effective, and successful cancer drugs, which may drive the growth of the computer-aided drug discovery market during the analysis period.

On the other hand, the global computer-aided drug discovery market's cardiovascular disease sub-segment is expected to grow at the fastest rate during the forecast period. This significant market growth can be attributed primarily to the rising prevalence of heart disease worldwide. Another factor expected to drive sub-segment growth by 2032 is the growing importance of monitoring work and obtaining data during the development of CVD drugs.

End User Insights

Based on the end user, the global computer-aided market is categorized into pharmaceutical companies, biotechnology companies, and research laboratories. the pharmaceutical company's sub-segment is dominating the market. The growing R&D investments, as well as significant technological innovations, are primarily responsible for the growth of the pharmaceutical company's sub-segment. Furthermore, in September 2019, AstraZeneca, a global pharmaceutical company, announced an official collaboration with Schrodinger, a scientific leader in developing cutting-edge chemical simulation software. According to the terms of the agreement, AstraZeneca will use Schrodinger's advanced computing platform to accelerate drug discovery. Such corporate developments will have a positive impact on the growth of the subsegment in the coming years.

Moreover, 5,000-10,000 drugs have been subjected to laboratory testing in recent years before being approved for human use. The protocol for developing or discovering new drugs can take up to ten years. Such factors are expected to boost computer-aided drug discovery adoption in the pharmaceutical company's sector during the analysis timeframe.

Regional Insights

North America dominates the computer-aided drug discovery. The rising number of cancer cases in the United States is expected to boost revenue in the computer-aided drug discovery market. Cancer is one of the few most dangerous medical conditions with no cure, and the disease's prevalence is increasing at an alarming rate in the United States. According to the American Cancer Society, 1918030 new cancer cases will be diagnosed in 2022, with nearly 609360 people dying from the disease in the United States. In the search for a cancer cure, the use of computer-aided drug discovery has grown.

The Asia-Pacific region is expected to grow in the forecast period. The market expansion is due to the increased research and innovation and healthcare firms in the Asia Pacific region. Furthermore, the growing number of patients suffering from multiple diseases such as CVD and diabetes, particularly in China and India, may positively impact the market throughout the forecast period. For Instance, according to the World Health Organization, Asia-Pacific is home to more than 60 percent of the world's diabetics.

Computer-Aided Drug Discovery Market Companies

- Albany Molecular Research Inc. (AMRI)

- BOCSCI Inc.

- AstraZeneca

- Bioduro-Sundia

- Schrödinger, Inc.

- Bayer AG

- Aragen Life Sciences Pvt. Ltd.

- Charles River Laboratories

- Aris Pharmaceuticals

- Albany Molecular Research Inc.

Recent Development

- In 2021, Mydecine Innovations Group, a US-based emerging biopharma, and life sciences firm, will officially launch its in-silico drug discovery program. In collaboration with a team of researchers from the University of Alberta. The program focuses primarily on AI and machine learning (ML)-based drug screening and development. Such novel innovations may present appealing investment opportunities in the global computer-aided drug discovery industry.

- In 2020, Bristol Myers Squibb and Schrödinger, Inc., announced that they are in a research collaboration to discover, commercialize, and develop therapeutics for multiple diseases.

Segments Covered in the Report:

By Type

- Structure-based Drug Design

- Ligand-based Drug Design

- Sequence-based Approaches

By Therapeutic Area

- Oncology

- Neurology

- Cardiovascular diseases

- Respiratory diseases

- Diabetes

By End User

- Pharmaceuticals companies

- Biotechnology companies

- Research Laboratories

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344