January 2025

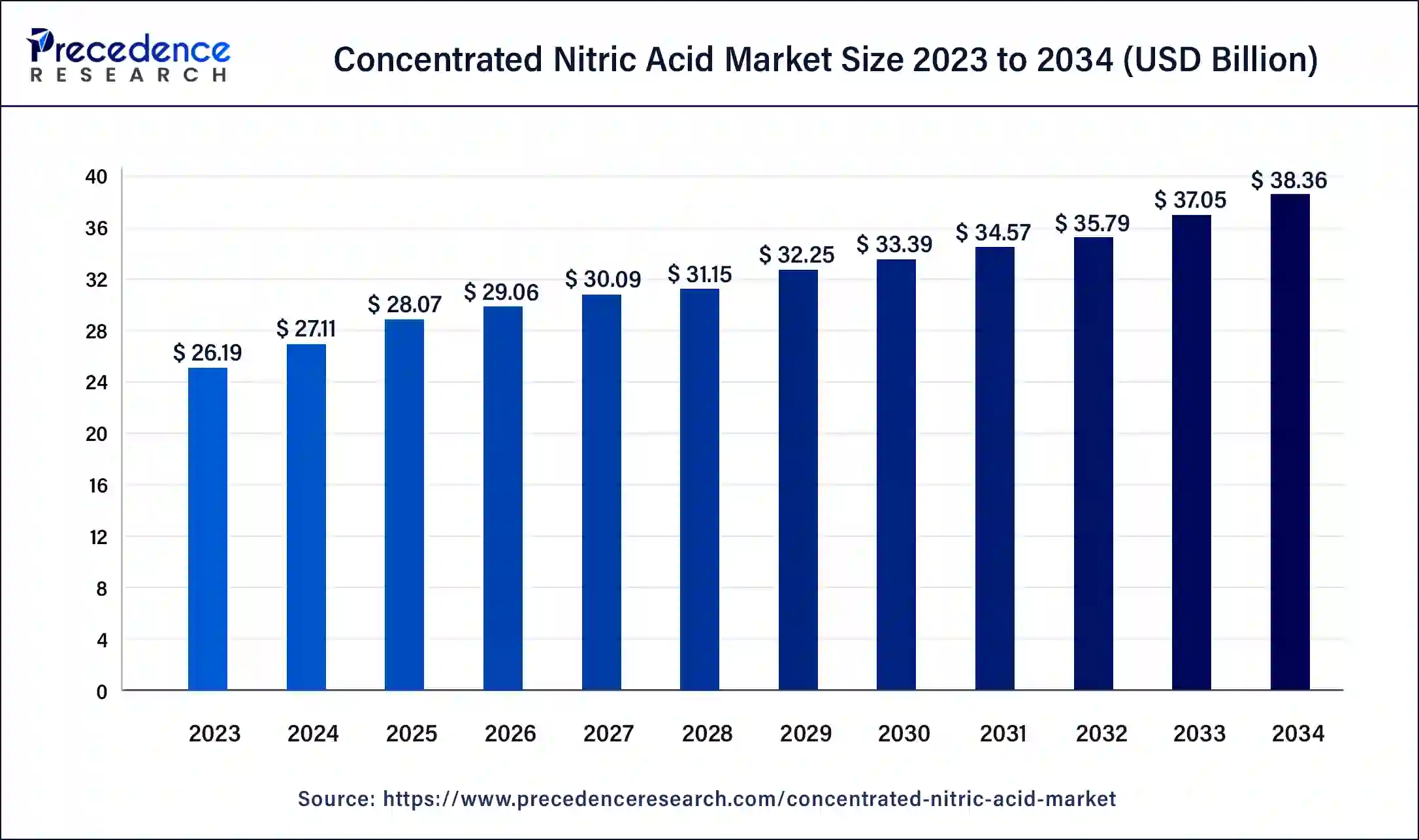

The global concentrated nitric acid market size was USD 26.19 billion in 2023, calculated at USD 27.11 billion in 2024 and is expected to be worth around USD 38.36 billion by 2034. The market is slated to expand at 3.53% CAGR from 2024 to 2034.

The global concentrated nitric acid market size is worth around USD 27.11 billion in 2024 and is anticipated to reach around USD 38.36 billion by 2034, growing at a CAGR of 3.53% over the forecast period 2024 to 2034. The benefits of nitric acid include being used in manufacturing explosives, fertilizers, rocket propulsion, wart removal, chemical doping agents, and pharmaceuticals for health benefits, driving the growth of the market.

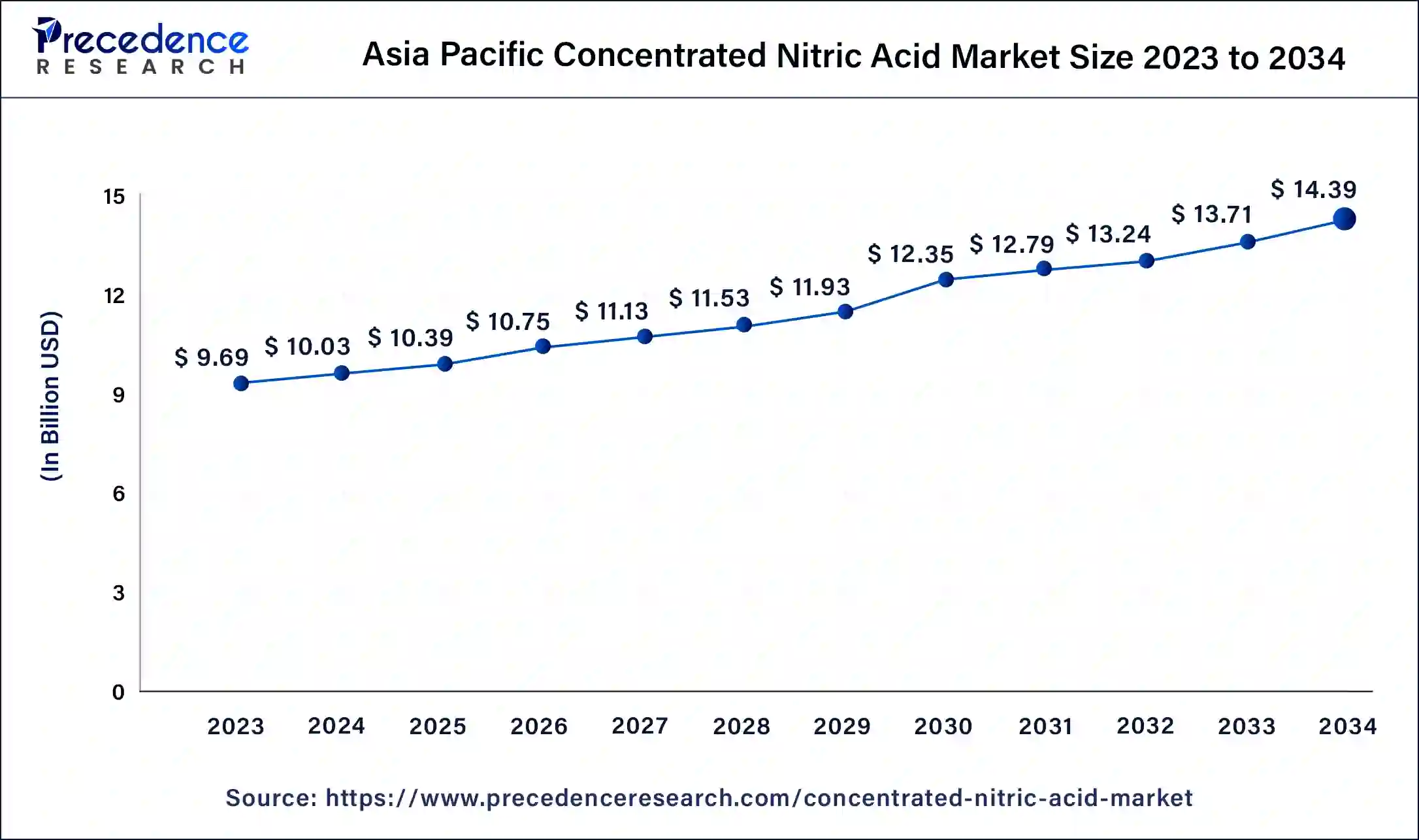

The Asia Pacific concentrated nitric acid market size was exhibited at USD 9.69 billion in 2023 and is projected to be worth around USD 14.39 billion by 2034, poised to grow at a CAGR of 3.66% from 2024 to 2034.

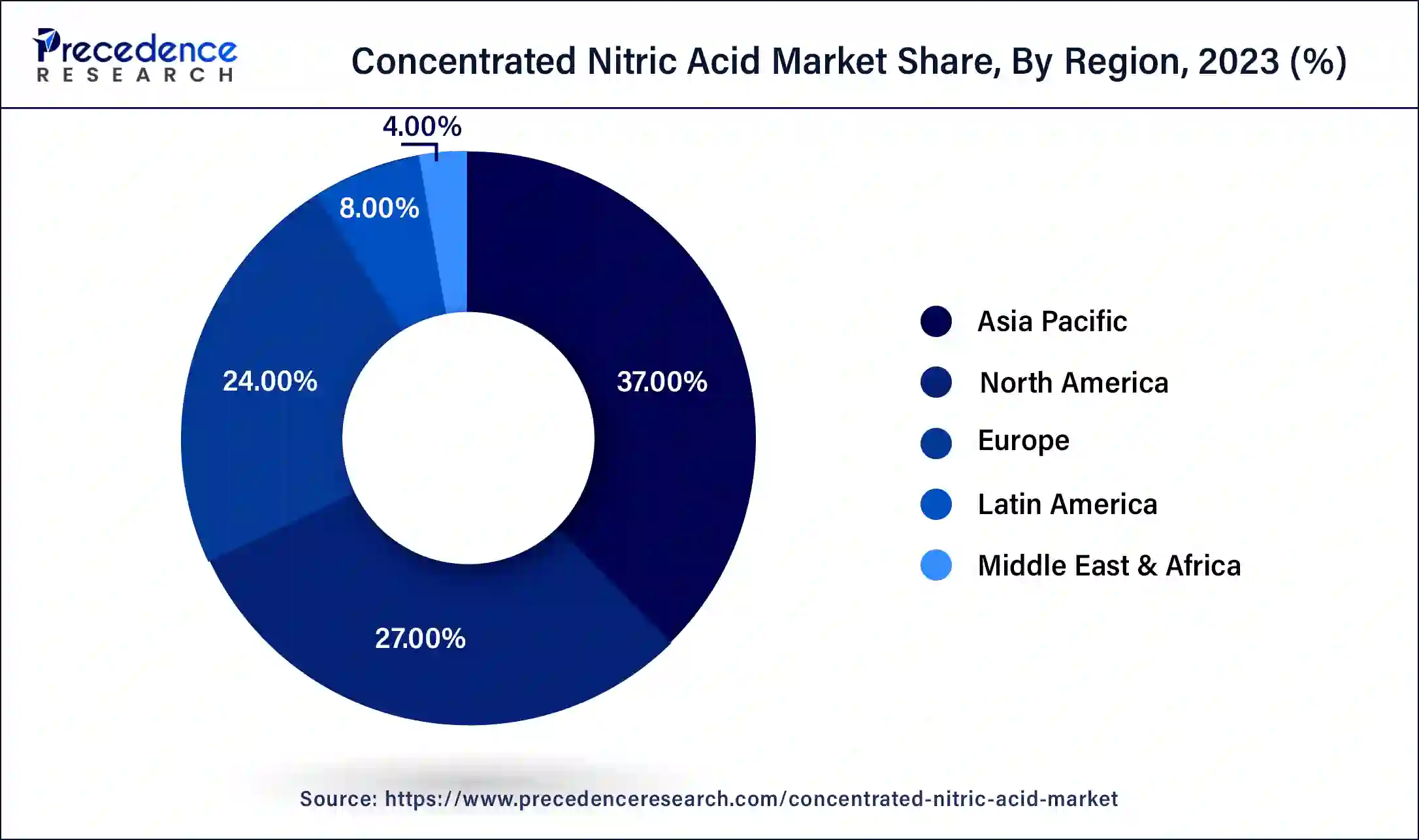

Asia Pacific dominated the concentrated nitric acid market in 2023 and is expected to be the fastest growing during the forecast period of 2024-2034. India and China are the leading countries for the growth of the market in the Asia Pacific region. China and India are the most populated countries, and there is a need for food, which leads to rising concentrated nitric acid demand. In India, nearly 50% of the area is agriculturally based. In the Asia Pacific region, the number of concentrated nitric acid manufacturing units is increasing. Increased demand for concentrated nitric acid is due to industrialization in the Asia Pacific region.

North America is estimated to be significantly growing during the forecast period of 2024-2034. Rising industrialization with established manufacturing facilities of polyurethane foams, explosives, fertilizers, agrochemicals, etc. Many industrial applications like agrochemicals, automotive, building, and construction are the main factors that boost the concentrated nitric acid market in the North American region. Increasing use in chemical industries led to its use in many polymer manufacturing processes, including polyamides and polyurethane, contributing to the market flow.

The concentrated nitric acid market refers to sellers and buyers of concentrated nitric acid, which is a colorless acid in its pure form that gets a yellowish shade on long storage. Concentrated nitric acid is a solution of 68% nitric acid by mass in aqueous solution. Concentrated nitric acid is commercially available and has a boiling temperature of 249°F (120.5°C) at 1 atm. It is a versatile and powerful chemical with many applications. The chemical and industrial applications of concentrated nitric acid (HNO3) are key components in the manufacturing of explosives like trinitrotoluene (TNT), fertilizer production, plastic and dye manufacturing, passivation of metals, etc.

How is AI changing the Concentrated Nitric Acid?

Artificial intelligence (AI) has many applications in handling and using concentrated nitric acid, mainly in the industrial and research sectors. AI is helpful in safety monitoring and process optimization for nylon precursors, fertilizers, and explosives. In predictive maintenance, preventing accidents, automation, quality control to ensure the concentration and purity of nitric acid, and analysis of samples. These factors help to the growth of the concentrated nitric acid market.

| Report Coverage | Details |

| Market Size by 2034 | USD 38.36 Billion |

| Market Size in 2024 | USD 27.11 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.53% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand in many industries

In many industries, there is an increased demand for concentrated nitric acid in pharmaceutical and laboratory applications. It is used in the pharmaceutical industries for the synthesis of many drugs and pharmaceutical intermediates. In dyes, colorants, and pigments, it is used, which helps the growth of the concentrated nitric acid market. It plays an important role in the metal refining and etching process. Concentrated nitric acid plays an important role in explosives and fertilizers. Electrochemists use it as a chemical doping agent.

Toxic effects of concentrated nitric acid

Concentrated nitric acid can be harmful if absorbed, inhaled, or ingested through the skin, which can hamper the growth of the concentrated nitric acid market. It is highly destructive to upper respiratory tract tissues and mucus membranes. It causes severe skin and eye burns and can cause permanent eye damage and blindness. Inhalation of concentrated nitric acid may cause inflammation, spasms, and edema of the larynx and bronchi. Concentrated nitric acid is highly corrosive in the presence of oxides, aluminum, and copper. Concentrated nitric acid burns can also turn the skin yellow because of a reaction with protein in the skin.

Increasing demand in the chemical industry

Concentrated nitric acid is a powerful chemical that has advantages in the chemical industry. It is a good oxidizing agent and is used in many chemical processes, including the production of dyes, fertilizers, and explosives. It can donate protons, which makes it effective in redox reactions. It is crucial for nitrating organic compounds and is used in many chemicals like trinitrotoluene (TNT) and nitrobenzene. These factors help to the growth of the concentrated nitric acid market.

The strong nitric acid segment dominated the concentrated nitric acid market in 2023. Concentrated nitric acid is a strong acid. It completely ionizes into nitrate (HNO3-) and hydronium (H3O+) in aqueous solution. It is highly toxic, corrosive, and soluble in water. Concentrated nitric acid is a colorless fuming liquid that turns yellowish because of nitrogen oxide collection. It is a powerful oxidizing agent. It is also used in pharmaceuticals for dental care and digestive health. It is a frequent remedy for dental problems like painful cavities and sensitive teeth. Nitric acid effectively addresses digestive diseases like painful stomach ulcers, heartburn, and indigestion. It helps to relieve the sensation of burning or rawness in the digestive tract and sharp, cutting pains.

The fuming nitric acid segment is expected to grow at a significant rate during the forecast period. Fuming nitric acid, also called nitrogen pentoxide or oleum, is a heavyweight in the chemical arena. Fuming nitric acid is a highly concentrated form of nitric acid that contains a significant amount of NO2 (dissolved nitrogen dioxide). There are 2 types of fuming nitric acid, including white fuming nitric acid (WFNA) and red fuming nitric acid (RFNA). WFNA contains more than 95% of nitric acid and is more concentrated than RFNA.

It is used in specific applications like explosives manufacturing and rocket propellants. RFNA contains about 84% nitric acid, 1-2% water, and 13% dinitrogen tetroxide (N2O4). It is used as a storable oxidizer in rocket propellants and in producing toxic fumes with a suffocating odor. Properties of fuming nitric acids include nitration reagent, oxidizing power, corrosiveness, etc., which help the growth of the concentrated nitric acid market. Application of fuming nitric acid also includes Maruti fine chemicals contribution, detergent industry, sulfonation reactions, etc.

The fertilizers segment dominated the concentrated nitric acid market in 2023. Nitric acid is a versatile and powerful chemical with a wide range of applications, including in the production of fertilizers. Concentrated nitric acid is a highly used component in fertilizer production. Fertilizers like calcium nitrate, ammonium nitrate, and other nitrate-based fertilizers use concentrated nitric acid.

The explosives segment is expected to grow at a significant rate during the forecast period. Concentrated nitric acid is used in explosives because it can donate a NO2 (nitro) group to an organic molecule, making it more unstable and prone to detonation, which helps the growth of the concentrated nitric acid market. Concentrated nitric acid is the main component for nitration, a chemical process that produces explosives like nitrocellulose, nitroglycerin, and TNT. Explosives are developed to be not only powerful but also safer to use.

The agriculture segment dominated the concentrated nitric acid market in 2023. Concentrated nitric acid is used in agriculture in many ways. In the production of ammonium nitrate fertilizer, which is a highly used fertilizer with a high nitrogen concentration. As a source of nitrogen, it contributes to the healthy plant’s growth and fuller crops. When concentrated nitric acid is used with water to lower the pH, increased awareness about fertilizers leads to an increasing demand for concentrated nitric acid in the agriculture industry, which helps achieve a high yield.

The chemical segment is expected to grow significantly during the forecast period. Concentrated nitric acid is used in many chemical industries, such as chemical synthesis, metal refining, and the production of fertilizers, which help the growth of the concentrated nitric acid market. Concentrated nitric acid remains a cornerstone in many scientific research and industrial processes. It has unique properties as a versatile reagent and a strong oxidizing agent. Concentrated nitric acid is a heavily used and very common chemical in the world and is manufactured on a large scale by global manufacturers.

Segments Covered in the Report

By Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

March 2025

December 2024