January 2025

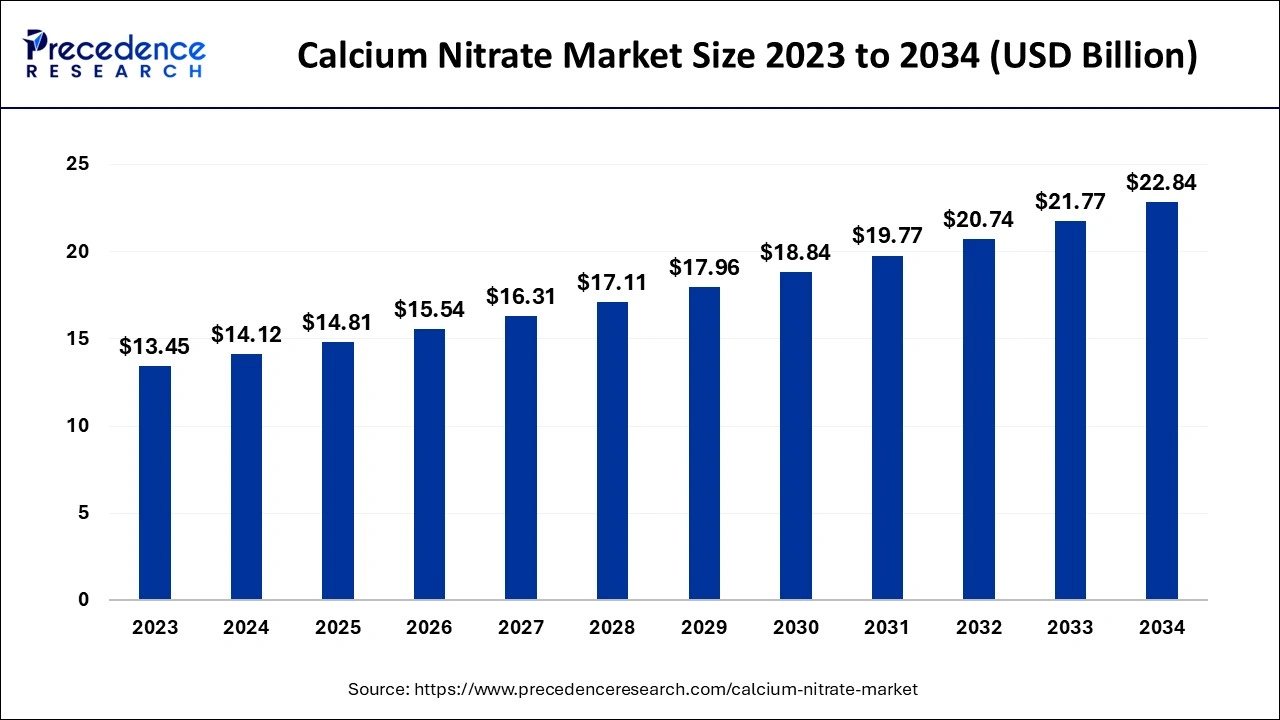

The global calcium nitrate market size accounted for USD 14.12 billion in 2024, grew to USD 14.81 billion in 2025 and is projected to surpass around USD 22.84 billion by 2034, representing a CAGR of 4.93% between 2024 and 2034.

The global calcium nitrate market size is calculated at USD 14.12 billion in 2024 and is predicted to reach around USD 22.84 billion by 2034, expanding at a CAGR of 4.93% from 2024 to 2034. The calcium nitrate market growth is attributed to the increasing demand for efficient and sustainable fertilizers and rising industrial applications of calcium nitrate in construction, water treatment, and explosives.

AI solutions in the calcium nitrate market improve precision farming methods, increase economic efficiency in the use of fertilizers increase the yield of agricultural products, and stimulate the need for nitrates in fertilizers. AI allows for improving the efficiency of manufacturing processes to control quality and minimize losses. This increases the consumption of high-purity chemicals. Furthermore, the technological change increases the reputation of the sector in adopting new technologies through the use of, new applications that open up the market for growth as a result of increased calls for sustainable and efficient production systems.

Increased demand for high-quality fertilizers that encourage plant growth and development in the calcium nitrate market. Calcium nitrate is recognized as a universal fertilizer containing both nitrogen and calcium needed in growing healthier vegetables and fruits besides enhancing the condition of the soil. The market for the calcium nitrate is growing demand for this chemical in the agriculture industry, especially in the horticulture and floriculture industries where there is a keen emphasis on the production of high-quality products.

Additionally, new methods of modern agricultural production based on hydroponics, and organic farming, have led to an increase in the popularity of calcium nitrate owing to its ability to dissolve in water and release nutrients. Factors such as environmental turnover and customer inclinations towards eco-friendly farming methods are present as the key influencing factors that contribute to the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 22.84 Billion |

| Market Size in 2024 | USD 14.12 Billion |

| Market Size in 2025 | USD 14.81 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.93% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Process Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for high-quality fertilizers

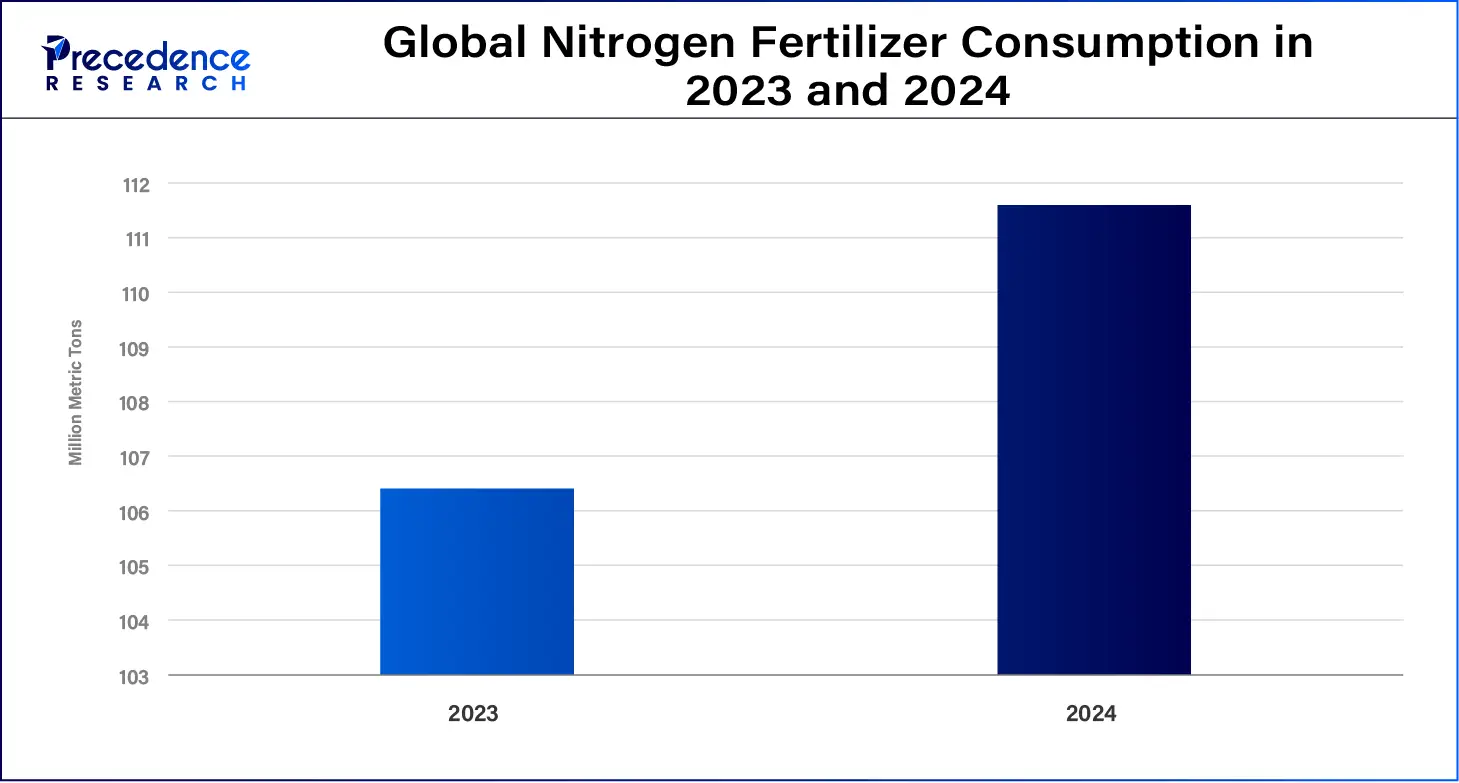

Increasing demand for high-quality fertilizers is projected to drive the adoption of the calcium nitrate market in agriculture. Farmers are focusing on improving crop yield and quality to meet the growing global food demand, particularly in regions with nutrient-deficient soils. World nitrogen fertilizer consumption is expected to reach 108 MMT in 2024 despite the global food demand increasing in the future. This compound is of great importance given its ability to supply demands by providing nitrogen and calcium to fruits and vegetables, thus feeding the plants while reducing incidents of diseases, such as blossom-end rot. Furthermore, precision agriculture has been on the rise creating the need for enhanced plant nutrients, especially in that geographical location with depleted soil nutrient status.

Environmental and regulatory concerns

Stringent environmental regulations on nitrogen fertilizers are projected to limit the widespread adoption of the calcium nitrate market products. Higher nitrogen rates impact negatively soil acidity and water pollutes the environment. The European Commission is the authority that sets rules to limit the release of nitrogen and supports ecologically friendly policies. Adherence to these regulatory provisions translates into higher manufacturing expenses and modifications to formulation, thus, slow implementation across some sub-sectors. They impose this restraint to a large extent on the small-scale producers and niche markets relying heavily on high-density farming.

Growing emphasis on sustainable agriculture

Growing emphasis on sustainable agriculture is projected to create immense opportunities for the calcium nitrate market. Calcium nitrate fertilizers are expected to replace other nitrogen sources in principle because of the outstanding advantages of sustainable agriculture on global practices. Calcium nitrate has the capability of cutting down nitrous oxide emissions in acidic land, in addition to decreasing nitrogen leaching which is used for organic farming. Furthermore, there is a growing availability of novel and advanced calcium nitrate compounds.

The limestone with nitric acid segment held a dominant presence in the calcium nitrate market in 2023, due to its effectiveness and easy availability. This method guarantees high-purity calcium nitrate for fertilizers which is important in increasing yield in agriculture to cater to increased world demands. Calcium nitrate is a requirement in the production of major fertilizers, such as ammonium nitrate, potassium nitrate, and ammonium phosphate as a source of calcium and nitrogen. Limestone is mainly a raw material reflecting its high acceptance in the market. Furthermore, Indian and Chinese governments supported the limestone method in their agriculture plans for cheap and environmentally friendly sources of fertilizer.

The ammonium nitrate with calcium hydroxide segment is expected to grow at the fastest rate in the calcium nitrate market during the forecast period of 2024 to 2034, owing to its effectiveness in responding to contemporary agriculture requirements and comparatively small influence on ecology. Phosphate-based practices while thereby responding to the international drive to de-pollute agriculture. Additionally, the method of formulating individual nutrient(s) has contributed to the increased use of the method in precision farming, especially in North America and Europe.

The fertilizer segment accounted for a considerable share of the calcium nitrate market in 2023. Calcium nitrate-based fertilizers are commonly used and hence play a very crucial role, especially in areas where the fertility of the soil is a hardship to providing for plants nutrients. The goal setting of the Europe Green Deal prompted the uptake of efficient fertilization, where calcium nitrate became a common fertilizer in the EU. Moreover, initiatives, such as India’s ‘Soil Health Card Scheme 2023’ further propagated the use of calcium nitrate for improved yield practices and also to further strengthen its market status.

The water-treatment segment is anticipated to grow with the highest CAGR in the calcium nitrate market during the studied years, owing to the ability of calcium nitrate to help reduce water pollution and improve the treatment of wastewater. Calcium nitrate finds application in odor control and prevention of the formation of hydrogen sulfide in water treatment plants. Furthermore, wastewater, in the same countries such as China and the United States, has been tightened with strict legislation thereby increasing the demand for calcium nitrate in this sector.

Asia Pacific dominated the calcium nitrate market during the forecast period, due to the strong presence of farm industry in the region and growing levels of industrial output. Major consumers such as China and India also presented a high proportion of the world's demand. The use of calcium nitrate fertilizers in these countries has been occasioned by the increasing demand for food production to feed the ever-increasing population. Furthermore, calcium nitrate participates in industrial processes such as concrete production and water treatment across the Asia Pacific.

North America is projected to host the fastest-growing calcium nitrate market in the coming years, owing to the rural fulfilments in agriculture, enhancement of legislation on the environment, and knowledge improvement in precision agriculture. It is expected that the well-established agriculture industry in the region especially the United States further facilitates the use of calcium nitrate for the nutritional needs of crops. Furthermore, the global shift to precision agriculture of nutrient-efficient fertilizers in the U.S. and Canada.

By Process Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

February 2025

October 2024