November 2024

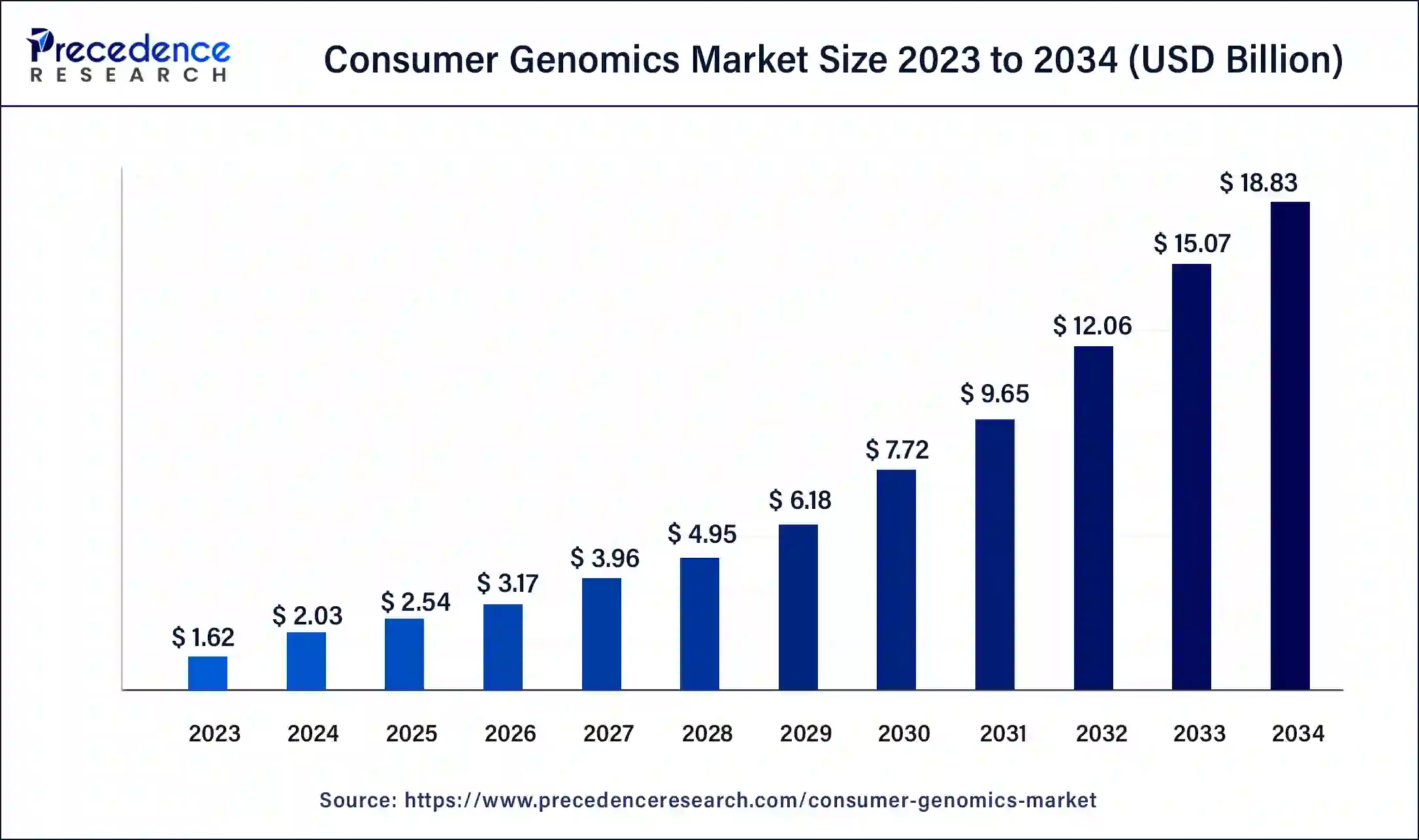

The global consumer genomics market size was USD 1.62 billion in 2023, calculated at USD 2.03 billion in 2024 and is projected to surpass around USD 18.83 billion by 2034, expanding at a CAGR of 24.9% from 2024 to 2034.

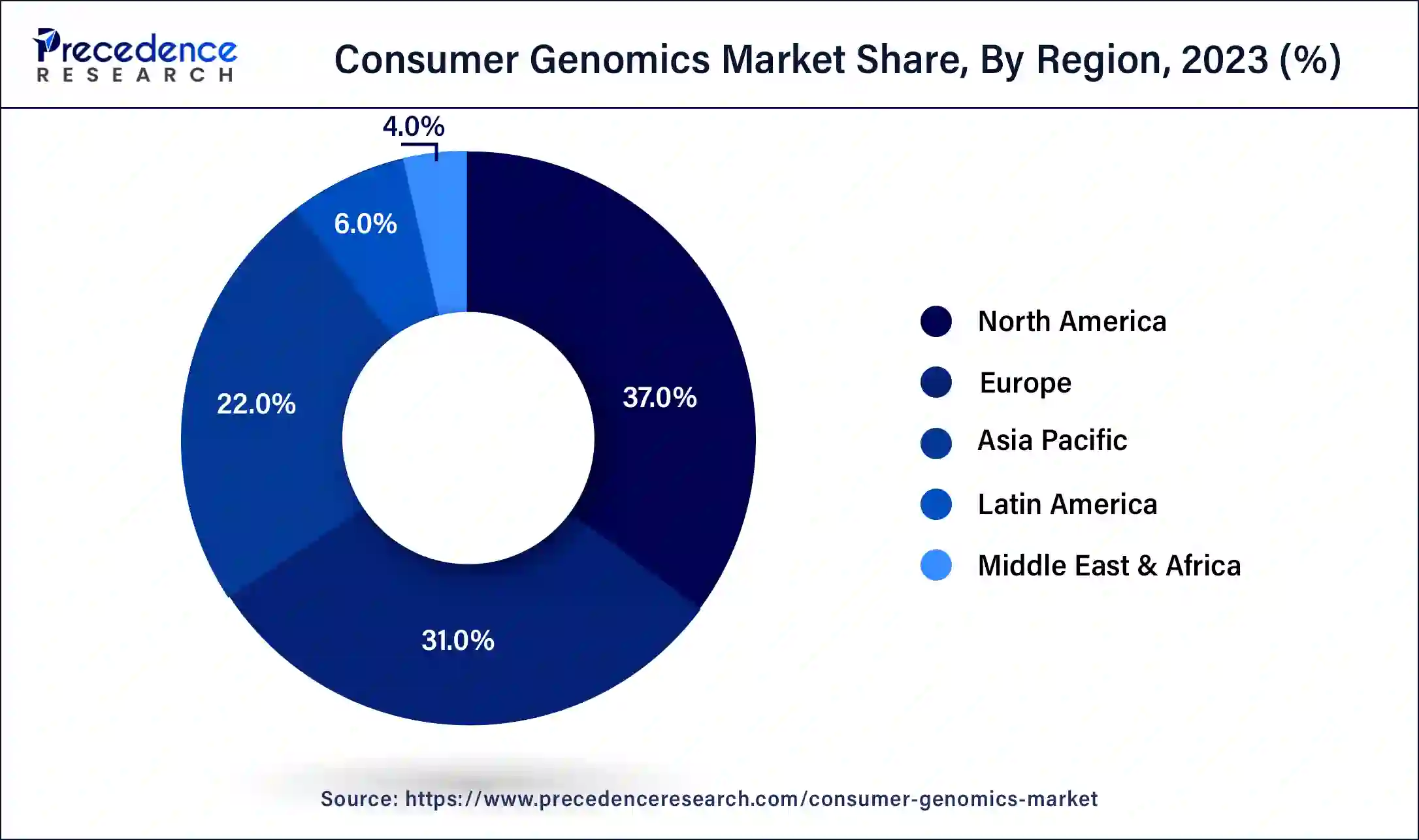

The global consumer genomics market size accounted for USD 2.03 billion in 2024 and is expected to be worth around USD 18.83 billion by 2034, at a CAGR of 24.9% from 2024 to 2034. The North America consumer genomics market size reached USD 600 million in 2023.

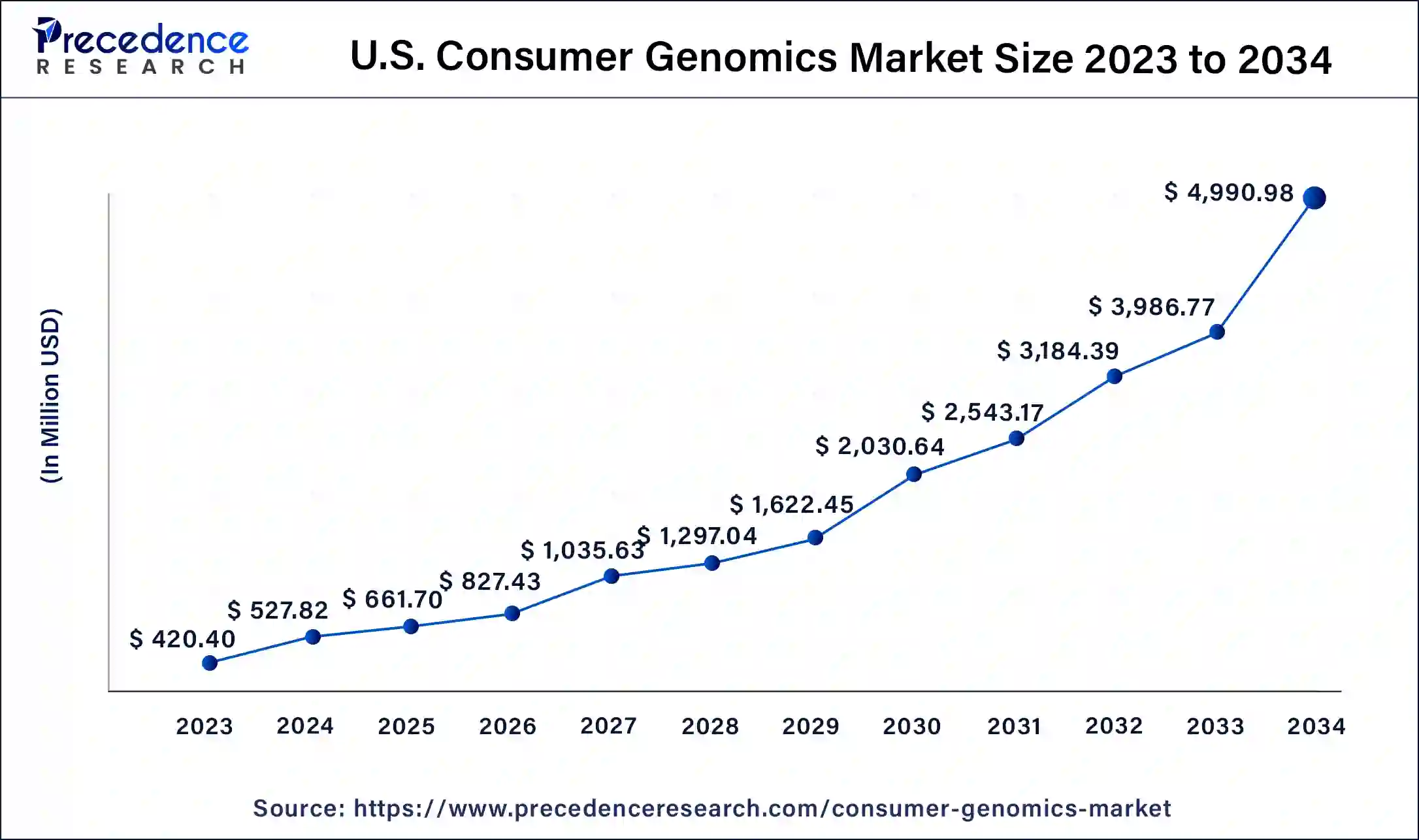

The U.S. consumer genomics market size was estimated at USD 420.40 million in 2023 and is predicted to be worth around USD 4,990.98 million by 2034, at a CAGR of 25.2% from 2024 to 2034.

North America dominated the global consumer genomics market in 2023, the region is expected to continue its dominance throughout the forecast period. The willingness of people to spend on healthcare services, rising awareness about DNA testing and increasing prevalence of target disorders have been supplementing the market’s growth for the region. With a well-established healthcare infrastructure, the United States is expected to be the largest contributor to the market’s development, followed by Canada. The expansion of the market in North America is due to the increasing prevalence of chronic disorders and rising emphasis on the treatments of chronic disorders. According to the Centers for Disease Control and Prevention, chronic disorders were the main cause of mortality in the United States in 2022.

Moreover, the presence of large-scale gene mapping services and major key players headquartered in the United States and Canada will continue to support the market’s growth in the region.

North America is a home to several major consumer genomics companies such as Ancestry DNA, 23 and Me, Helix and MyHeritage, the strong presence of such players in the region plays an active role in the market development. Additionally, the growing interest in understanding genetic risks for any health conditions is supplementing the market’s growth in North America. In the end, the supportive regulatory guidelines, government support, rising number of research and innovation along with the boom in business activities, especially in the healthcare sector propel the growth of the consumer genomics market in North America.

On the other hand, Asia Pacific is expected to witness a significant growth during the forecast period. The rising focus on research and development activities and a rise in public awareness for DNA testing are expected to boost the growth of the market during the forecast period. Countries in Asia Pacific such as China, India, South Korea and Japan are observed to be the largest contributors to the market’s growth. Rising disposable incomes, growing interest in health-related information, and improving healthcare infrastructure in these countries fuel the market’s growth in the Asia Pacific.

Consumer genomics are direct-to-consumer genetic testing which refers to the practice of individuals accessing and exploring their own genetic information using commercial genetic testing services. Consumer genetics is gaining significant importance as they become increasingly popular with the advent of affordable and accessible DNA testing kits.

The consumer genomics market is a segment of the industry that plays around the commercialization of genetic testing services and other associated products. The global market for consumer genomics is fragmented with multiple players that are involved in the distribution of genetic testing kits, analysis of genetic data, and the interpretation of the results for individuals.

Factors that drive the market growth of these sectors are mainly increasing consumer and healthcare interest in DTC kits, as well as in technological improvements and the expansion of the application of consumer genomics. Expansion of consumer genomics and governmental regulatory support also help accelerate market expansion. The campaigns that raise awareness of genealogical testing are launched by the organization for consumer gene testing. Thus, the primary key application of the consumer genomics sector is genealogy testing, which came into being to capture the biggest part of the customer and healthcare markets.

Moreover, the advancements in DNA testing services and the increasing public awareness about testing options along with the convenience of such testing services act as growth factors for the growth of the consumer genomics market.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.62 Billion |

| Market Size in 2024 | USD 2.03 Billion |

| Market Size by 2034 | USD 18.83 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 24.9% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising focus on personalized healthcare

Consumer genomics enables individuals to understand their genetic predispositions to various diseases and health conditions. By analyzing their DNA, consumers can gain insights into their susceptibility to certain conditions such as cancer, cardiovascular diseases, or genetic disorders. This information empowers individuals to take proactive measures to prevent or manage these conditions, leading to rising demand for consumer genomics services.

Consumer genomics offers insights into various wellness factors, such as nutrition, exercise, and sleep patterns, that are influenced by an individual's genetic predispositions. Understanding how genetic variations affect one's response to different lifestyle factors enables individuals to make informed choices and adopt personalized wellness strategies. The rising focus on holistic health and wellness has contributed to the demand for consumer genomics services.

Personalized healthcare focuses on tailoring medical treatments to an individual's specific genetic makeup. By analyzing genetic data, consumer genomics allows healthcare providers to make more informed decisions about the most effective treatments and medication dosages for each individual. The growing interest in precision medicine has led to increased adoption of consumer genomics, as it provides the necessary genetic information for personalized treatment plans.

Privacy concerns

A few severe privacy and security concern act as significant restraints to the growth of the consumer genomics market. Consumers may be concerned about losing control over their genetic information after getting shared with the healthcare provider. The lack of transparency and control over data practices in the consumer genomics industry has contributed to privacy concerns. Consumers worry about the security of their genetic information, as it contains sensitive and personal data. Breaches or unauthorized access to this data can lead to identity theft, discrimination, or misuse.

These concerns make individuals reluctant to share their genetic data, hindering the growth of the consumer genomics industry. Privacy breaches and unethical data handling practices in other sectors have eroded consumer trust. The fear of potential misuse of genetic data, such as discrimination in employment or insurance, has made people hesitant to engage with consumer genomics companies. The lack of trust limits the number of individuals willing to participate and inhibits the market's expansion.

Rising adoption of genealogical services across the globe

Recent technological developments have reduced the cost of sequencing as well as the cost of genomics as a whole. Sequencing is a crucial and insignificant task in genomics and affected populations and an increase in chronic disease prevalence is also included. Growing genomics applications and favorable government policy in developing nations would offer market participants various opportunities. In addition to other genetic skills, CGH, FISH, microarray, karyotyping and gene-editing techniques have significantly changed healthcare systems and fundamental biological research. The market is expanding as a result of increased demographic pressure and an increase in the prevalence of chronic diseases.

By application, the genetic-relatedness segment had significant growth in the market; the segment will continue to show noticeable growth during the forecast period. The rise in demand for prenatal testing and parenting testing across the globe has boosted the significance of the genetic relatedness segment in recent years.

Moreover, the rising interest in understanding the hereditary or ancestral traits among people supports the development of the segment.

The lifestyle, wellness, and nutrition segment will experience rapid growth during the forecast period. As multiple key players start offering tests to analyze the pattern of wellness and diet will promote the development of the segment. In addition, the rising emphasis on personalized nutrition recommendations will continue to support the segment’s growth. With the help of consumer genomics, it has become uncomplicated to understand nutrient metabolism and dietary requirements. This element promotes overall nutrition as well as the healthcare industry to offer proven and improved outcomes for patients. In addition, considering the importance of consumer genomics in nutrigenomics research will help the segment grow.

Segments Covered in the Report

By Applications

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

January 2025

October 2024