November 2024

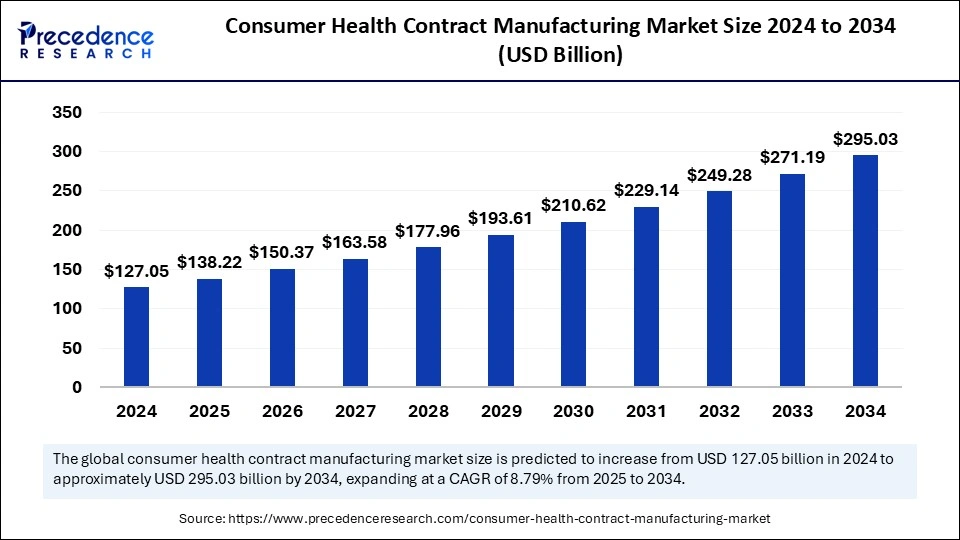

The global consumer health contract manufacturing market size is calculated at USD 138.22 billion in 2025 and is forecasted to reach around USD 295.03 billion by 2034, accelerating at a CAGR of 8.79% from 2025 to 2034. The North America market size surpassed USD 43.20 billion in 2024 and is expanding at a CAGR of 8.99% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global consumer health contract manufacturing market size accounted for USD 127.05 billion in 2024 and is predicted to increase from USD 138.22 billion in 2025 to approximately USD 295.03 billion by 2034, expanding at a CAGR of 8.79% from 2025 to 2034. The increasing demand for consumer healthcare products and the rising awareness about health and wellness are expected to drive the growth of the market during the forecast period.

Artifical Intelligence is revolutionizing the market for consumer health contract manufacturing by enhancing operational efficiency, product quality, and fostering innovation through advanced automation, comprehensive data analysis, and predictive modeling. AI technologies accelerate product development, enhance quality control, and streamline operations. AI-driven systems excel at automating mundane and repetitive tasks such as data entry, conducting quality assurance checks, and managing inventory. By relieving human personnel of these routine duties, organizations can allocate their workforce toward high-level strategic initiatives, ultimately leading to a substantial reduction in operational costs. Furthermore, AI's capability to process and analyze large datasets enables manufacturers to predict equipment failures, fine-tune production schedules, and anticipate consumer demand, which fosters proactive decision-making and minimizes production downtime.

AI contributes to more efficient resource allocation by empowering companies to make informed choices regarding raw material sourcing, production timelines, and inventory management. This not only minimizes waste but also helps in achieving lower production costs. AI systems help ensure that the product quality consistently meets predefined specifications. By analyzing the extensive data generated during manufacturing, AI identifies bottlenecks and inefficiencies, revealing areas ripe for improvement.

The automation of various tasks leads to reduced labor costs, enhanced quality control, and overall process optimization. Moreover, AI plays a crucial role in minimizing material waste. Productive maintenance strategies enabled by AI can lead to fewer unexpected equipment breakdowns and associated repair costs. Additionally, AI systems are capable of real-time monitoring of production processes and ensure compliance with regulatory standards, which is critical in the highly scrutinized health product sector.

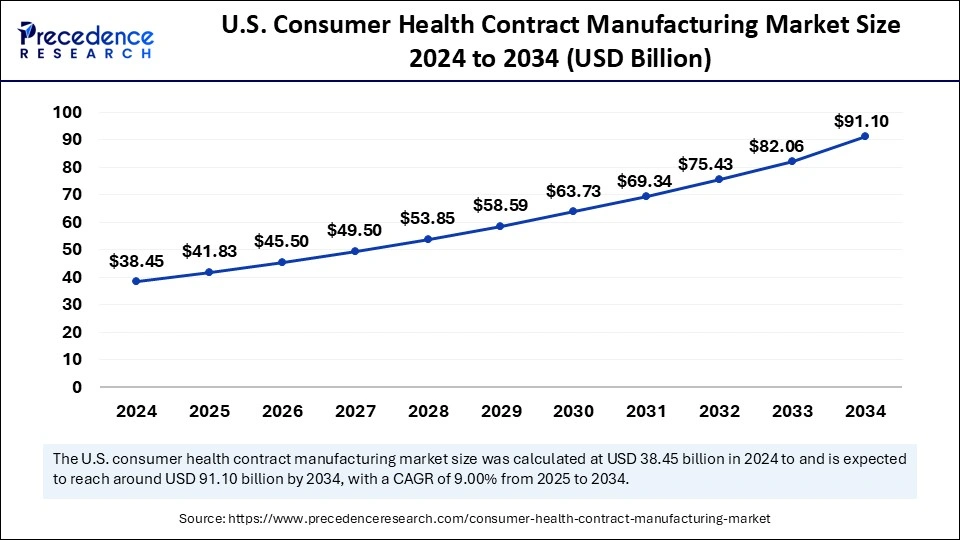

The U.S. consumer health contract manufacturing market size was exhibited at USD 38.45 billion in 2024 and is projected to be worth around USD 91.10 billion by 2034, growing at a CAGR of 9.00% from 2025 to 2034.

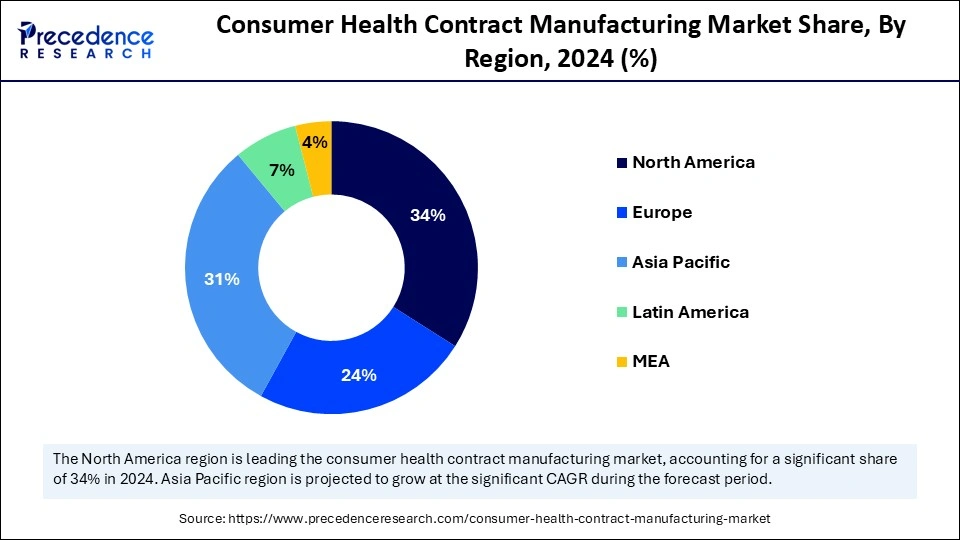

North America registered dominance in the consumer health contract manufacturing market by holding the largest share in 2024. This is primarily due to the presence of well-known contract manufacturing organizations (CMOs). There is a heightened demand for consumer health products, such as OTC drugs, nutritional supplements, and personal care items. Many pharmaceutical and biopharmaceutical companies have shifted their preference toward contract manufacturers to effectively accelerate the production of consumer health products. Moreover, a strong emphasis on personal care routines among consumers supported regional market expansion.

The U.S. and Canada play a crucial role in the North American consumer health contract manufacturing market. These countries boast some of the world’s leading pharmaceutical, biopharmaceutical, and contract manufacturing organizations. Stringent regulations for consumer health products and the rising prevalence of chronic diseases are supporting market expansion. Moreover, the increasing demand for nutritional supplements and OTC medications contributes to market growth.

The market in Asia Pacific is projected to expand at the highest CAGR in the coming years. This is mainly due to rising healthcare expenditures and increasing awareness about health and wellness. Countries like Japan, China, and India are expected to have a stronghold on the Asia Pacific consumer health contract manufacturing market. This is primarily due to the rapid expansion of the pharmaceutical and biopharmaceutical industries. In addition, governments around the region are promoting the growth of the pharmaceutical industry. For instance, the Indian government is actively fostering the pharmaceutical industry's expansion through incentives and supportive policies, including the Production Linked Incentive (PLI) scheme. The rising production of pharmaceutical products further supports regional market growth.

Europe is seen to grow at a notable rate in the foreseeable future, driven by the increasing prevalence of various diseases, the rising trend of outsourcing services to CMOs for the manufacturing of consumer health products, and a strong emphasis on meeting stringent regulatory requirements. Germany plays a crucial role in the growth of the regional market, thanks to its robust healthcare and pharmaceutical infrastructure. There is a high demand for natural and organic products, boosting the demand for contract manufacturing specializing in these areas. Moreover, stringent regulations regarding consumer health products support regional market growth.

The consumer health contract manufacturing market focuses on outsourcing the production of over-the-counter healthcare products, nutritional supplements, and personal care items by brand owners to third-party manufacturers. This model enables companies that own health brands, such as pharmaceutical giants, private label retailers, and dietary supplement firms, to delegate the intricate manufacturing process to experts equipped with the necessary facilities and regulatory compliance credentials. Contract manufacturers handle all aspects of production, from outsourcing raw materials to packaging and labeling final products. They help pharmaceutical firms and retailers bring their products to market efficiently. They often have specialized expertise, advanced machinery, and specific certifications for distinct product categories. This strategic outsourcing allows brand owners to tap into industry know-how that they may not possess in-house, leading to a more efficient production cycle. Additionally, outsourcing manufacturing operations is a cost-effective solution for brand owners, as it alleviates the significant financial burden associated with developing manufacturing facilities, acquiring specialized equipment, and staffing such units. This enables brand owners to redirect their focus toward other core competencies, including research and development (R&D), marketing strategies, and sales initiatives.

| Report Coverage | Details |

| Market Size by 2034 | USD 295.03 Billion |

| Market Size in 2025 | USD 138.22 Billion |

| Market Size in 2024 | USD 127.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.79% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Service, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Shift Toward Preventive Healthcare Solutions

The rapid shift toward preventive healthcare is a major factor boosting the growth of the consumer health contract manufacturing market. With the growing focus on health and wellness, there is a rapid shift toward preventive healthcare and wellness solutions, boosting the demand for personal care items, supplements, vitamins, and other healthcare products. This trend is further amplified by a growing elderly population, which requires frequent medical attention. As individuals seek to maintain their well-being, they gravitate toward affordable health and wellness products, particularly in developing economies where access to such items is becoming more feasible. In this dynamic market, many consumers are opting for over-the-counter (OTC) remedies as alternatives to traditional pharmaceuticals. This shift is prompting pharmaceutical companies to recognize the needs of an aging demographic alongside the expanding supplement market.

Pharmaceutical and biopharmaceutical companies are greatly focusing on research and development and marketing initiatives, strategically avoiding significant capital expenditure on manufacturing facilities and equipment. They increasingly rely on contract manufacturers with specialized expertise in formulation, production, and packaging. Retailers are also capitalizing on this trend by expanding their own consumer health product lines. Private-label products are gaining traction as they provide consumers with more affordable options without compromising quality.

Regulatory Compliance

Consumer health products are subject to stringent regulations, restraining the growth of the consumer health contract manufacturing market. The constant evolution of good manufacturing practices (GMP), labeling requirements, and safety standards poses significant hurdles. Manufacturers must invest heavily to ensure consistent product quality and compliance with regulatory standards, which can be both challenging and costly. Regulatory audits can disrupt operations, and maintaining high-quality benchmarks throughout the manufacturing process is critical. Additionally, sourcing raw materials and components from diverse suppliers adds complexity to achieving quality and safety. Manufacturing companies often seek cost-effective manufacturing solutions to mitigate financial pressures, which can compromise quality standards.

Ethical Sourcing and Technological Advancements

Despite the challenges, the market is ripe with opportunities. The rising consumer interest in sustainable and ethically sourced products creates immense opportunities in the consumer health contract manufacturing market. There is an increasing preference for natural and organic ingredients that can support the production of customized health solutions. Furthermore, the adoption of advanced manufacturing technologies, including artificial intelligence (AI) and data analytics, presents a significant opportunity for enhancing production efficiency and product quality. Companies increasingly seek services beyond manufacturing, such as formulation development, packaging, and labeling. This trend is particularly beneficial for smaller firms and new entrants to the market, as it helps them navigate the complexities of the health and wellness industry more effectively.

The over-the-counter (OTC) drugs segment dominated the consumer health contract manufacturing market by capturing the largest share in 2024. This is mainly due to the rapid expansion of the pharmaceutical industry and heightened awareness among consumers about self-care. The increased accessibility to OTC medications, combined with rising disposable incomes and urbanization, further bolstered the segmental growth. The increased awareness about the benefits of self-medication has increased the demand for OTC drugs.

The nutritional supplements segment is anticipated to witness the fastest growth during the forecast period. The segment growth is attributed to the rising consumer preference for nutritional supplements that address various dietary, physical, and mental health needs. Additionally, the rising disposable income levels and an aging population contribute to the growth trajectory of this segment. As the disposable income of consumers rises, healthcare spending also rises, leading to the increased demand for nutritional supplements.

The API manufacturing segment held the largest share of the consumer health contract manufacturing market in 2024. This is mainly due to increased demand for high-quality, cost-effective drug components. Outsourcing API manufacturing to contract manufacturing organizations enable pharmaceutical companies to concentrate on their core competencies while relying on these contract manufacturers for efficient production. Contract manufacturers are pivotal in ensuring compliance with regulatory standards and providing scalable production capabilities. The increased trend of outsourcing API manufacturing to accelerate the production of biopharmaceuticals and generic drugs further augmented the segment.

The packaging and labeling segment is projected to experience significant growth during the projection period. This is mainly due to the increasing integration of advanced technologies in the manufacturing and packaging processes of consumer health products. Outsourcing packaging and labeling services to contract manufacturing streamline packaging and labeling operations, which results in significant cost reduction and improved operational effectiveness.

The pharmaceutical & biopharmaceutical companies segment led the consumer health contract manufacturing market with the largest share in 2024. This segment's growth can be attributed to the rising preference for contract manufacturing organizations (CMOs). Outsourcing services to CMOs enables pharmaceutical and biopharmaceutical companies to focus on other core activities, like R&D. The allure of advanced manufacturing processes and technology, coupled with the increasing production of customized pharmaceuticals, including specialty OTC drugs and nutraceuticals, enables these companies to meet the diverse and evolving needs of consumers effectively.

The nutraceutical companies segment is expected to witness the fastest growth over the studied period. The increasing consumer demand for nutraceuticals stems from their health benefits that extend beyond basic nutrition. These products, including vitamins, minerals, dietary supplements, functional foods, and herbal products, are integral to promoting overall well-being and disease prevention. Outsourcing nutraceutical manufacturing to CMOs enables nutraceutical companies to bring the final product to the market as soon as possible.

By Product

By Service

By End-use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

January 2025

September 2024