November 2024

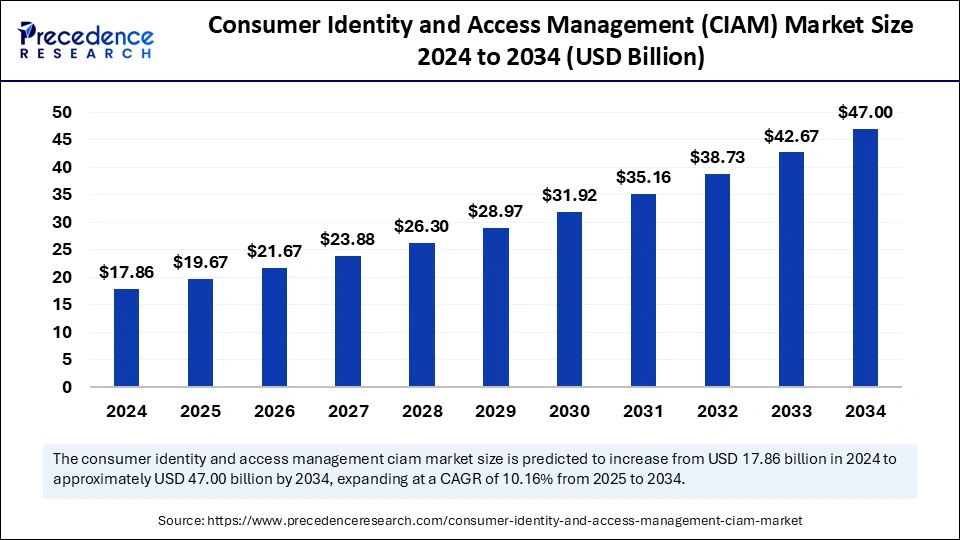

The global consumer identity and access management (CIAM) market size is calculated at USD 19.67 billion in 2025 and is forecasted to reach around USD 47 billion by 2034, accelerating at a CAGR of 10.16% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global consumer identity and access management (CIAM) market size was calculated at USD 17.86 billion in 2024 and is predicted to increase from USD 19.67 billion in 2025 to approximately USD 47 billion by 2034, expanding at a CAGR of 10.16% from 2025 to 2034. The increasing demand for secure, seamless, and personalized digital experiences across multiple platforms is expected to boost the growth of the market during the forecast period.

Artificial intelligence (AI) enhances efficiency, security, personalization, and user experiences. Real-time detection of odd behavior patterns by intelligent algorithms reduces fraud and allows for early threat detection. Continuously learning supported behavior-based authentication improves user convenience and security. Additionally, using biometric scans, document verification, and facial recognition streamlines onboarding and increases security and speed of access. By examining user interactions, AI-driven CIAM systems provide adaptive authentication and lessen bogus login attempts. Intelligent identity tools are becoming increasingly necessary to provide seamless and secure user experiences in increasingly complex digital ecosystems.

Prominent businesses are incorporating AI into their CIAM products. For example, Ping Identity provides AI-driven risk assessments to personalized authentication flows, while Okta leverages behavior analytics to facilitate adaptive access. To identify threats instantly, IBM Security Verify integrates identity governance and machine learning. These developments are improving user trust and regulatory compliance across industries while assisting businesses in meeting growing security demands.

The consumer identity and access management (CIAM) market is experiencing significant growth due to the rising need for secure, user-friendly authentication methods in the rapidly evolving digital world. Businesses are prioritizing CIAM solutions to improve customer experience, enhance data privacy, and adhere to strict regulations such as the CCPA and GDPR. The growth in online services, e-commerce, and mobile applications supports market growth. While guaranteeing scalability and enabling enterprises to manage user identities, these solutions offer single sign-on on multi-factor authentication and consent management. Industry adoption of CIAM is growing as customer expectations for easy and safe access increase.

| Report Coverage | Details |

| Market Size by 2034 | USD 47 Billion |

| Market Size by 2025 | USD 19.67 Billion |

| Market Size by 2024 | USD 17.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.16% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Authentication Method, Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing Focus on Data Privacy and Security

The increasing sophistication and frequency of cyberattacks have made protecting customer data a top concern for businesses. This, in turn, is boosting the adoption of CIAM solutions. Multi-factor authentication, encryption, and real-time threat detection are examples of advanced security features offered by CIAM solutions. By preventing unwanted access to these features, companies assist in safeguarding private client data. Additionally, CIAM assists in managing user preferences and data consent by international privacy standards. Improved data security not only lowers risk but also increases customer loyalty and trust.

Consumers are becoming increasingly aware of the safety of their data, raising demand for data control and transparency. Users can control their own data with the help of CIAM solutions’ consent, management, and privacy dashboard features. This not only guarantees legal compliance but also improves consumer confidence and brand reputation.

Growing Number of Digital Identities

The number of customer touchpoints, apps, websites, and smart devices keeps growing as the digital economy grows, driving the growth of the consumer identity and access management (CIAM) market. Secure and easy identity management is necessary for every digital interaction. To manage millions of customers identified effectively and securely, CIAM offers centralized control. Additionally, it guarantees a single view of users across all channels, which is essential for reliable service. The market is growing as a direct result of the increasing demand for scalable identity systems.

Users must establish and maintain multiple digital identities as more services move online from social media and e-commerce to banking and healthcare. Inconsistent users experience password fatigue and security flaws can result from this fragmentation. CIAM platforms provide features like identify management and single sign-on that aid in the consolidation of these identities. By centralizing identity data and simplifying access, companies can improve security, simplify operations, and provide a cohesive digital experience. Given the growing global number of digital users and devices per user, this consolidation is especially important.

Complex Integration with Legacy Systems

A major obstacle that organizations encounter when putting CIAM solutions into practice is the intricacy of integrating with their current legacy IT infrastructure, which limits the growth of the consumer identity and access management (CIAM) market. A lot of companies, particularly big ones, use fragmented databases or antiquated identity systems that are incompatible with contemporary CIAM platforms. It can take a lot of time and resources to migrate data, ensure system interoperability, and maintain business continuity during integration. This intricacy frequently results in internal IT teams resisting higher expenses and delayed deployments.

Divergent identity formats, authentication procedures, and user access guidelines among legacy systems further complicate standardization. Businesses risk interrupted workflows, security flaws, and a subpar user experience if they don't have a smooth integration strategy. A shortage of qualified staff exacerbates the issue of overseeing and maintaining integrated environments. Because of this, companies might be reluctant to fully implement CIAM despite its possible advantages, which limit market growth.

Privacy Concerns and Data Mismanagement Risks

Paradoxically, even though CIAM seeks to improve data privacy, there are risks associated with handling and storing large amounts of personal data. Data breaches consent to mismanagement, and unauthorized access can result from poorly managed CIAM implementations, particularly if security protocols are inadequate or incorrectly configured. Errors in managing private user data can lead to legal repercussions, harm to one's reputation, and a decline in customer confidence, all of which negate the goal of CIAM implementations.

Global data privacy laws like the CCPA and GDPR also mandate that user consent data minimization and transparent data practices be strictly followed. CIAM systems must meet these various regionally specific legal requirements. Heavy fines and penalties may follow noncompliance even if it occurs accidentally. Businesses must, therefore, spend money on professional compliance oversight, which raises expenses and complicated implementations.

Growth in Direct-to-Consumer and E-commerce Models

The explosion of D2C and e-commerce has made it imperative for companies to provide smooth, safe, and customized customer experiences. CIAM systems facilitate safe payment processing, simplify access, and lower complexities from account creation to checkout. Single-sign password-less authentication and progressive profiling are examples of features that improve the user experience while lowering entry barriers. CIAM becomes crucial for increasing conversion rates, decreasing cart abandonment, and bolstering omnichannel strategies as more companies place a higher priority on digital-first operations.

Additionally, first-party customer data is gathered and managed by CIAM platforms, which aids brands in customizing their products and advertising tactics. When handled responsibly and securely, this data allows for accurate segmentation and customer insights that increase lifetime value and loyalty. Brands gain a competitive edge by controlling and managing direct customer data through CIAM as privacy requirements but also enhance engagement and personalization over time.

Rising Demand for Decentralized Identity Solutions

The increasing concern about privacy violations and data breaches around the world is driving interest in decentralized identity models, which creates immense opportunities in the consumer identity and access management (CIAM) market. With the use of technologies like blockchain, users can selectively control and share their personal information in contrast to traditional systems that store data centrally. Important issues regarding data ownership portability and resilience against cyberattacks CIAM providers can give customers greater control while lowering the risks involved in keeping a lot of sensitive data.

Furthermore, decentralized identity is becoming more widely accepted due to the development of web3 digital wallets and verifiable credentials. Businesses and governments are looking into DID to provide safe access to financial services, educational resources, and public services. Decentralized identity integration into CIAM platforms improves security and trust while supporting international efforts for digital identity. Including DID support in CIAM solutions could help identity vendors stand out from the competition as users' concerns about privacy grow.

The solutions segment dominated the consumer identity and access management (CIAM) market with the largest share in 2024. This is mainly due to the rising demand for efficient solutions among organizations to prevent data breaches. CIAM solutions offer features like password management, multi-factor authentication, and data encryption to protect user data. These solutions enable businesses to detect and prevent unauthorized access. The rise in the number of instances of data breaches in the last few years further bolstered the segment.

The services segment is expected to grow at the fastest rate during the forecast period. Service-based models are becoming more and more popular in emerging economies because they offer greater operational flexibility and less initial investment. The need for managed services is rising to ensure compliance, data management, and workflow optimization. Moreover, CIAM solutions are becoming increasingly complex, requiring specialized services from expertise.

The on-premises segment led the consumer identity and access management (CIAM) market with the largest share in 2024. This is mainly due to the increased concerns regarding data security. The on-premises deployment offers organizations greater control over their data. Many medical facilities favor on-site deployment to maintain total control over patient data and guarantee adherence to legal requirements. Large hospitals and diagnostic labs with specialized IT and maintenance staff especially like it. On-premises deployments provide faster response times and greater customization. Institutions with strict data governance guidelines and large testing volumes are a good fit for this deployment model.

The cloud segment is expected to grow at the highest CAGR during the forecast period. The segment growth can be attributed to the enhanced scalability and flexibility offered by cloud-based CIAM solutions. Cloud solutions are more cost-effective and can be accessible from a distance. Real-time data sharing, quicker software updates, and cross-location integration with digital health records are all made possible by cloud-based platforms. They are becoming more and more popular among startups, smaller labs, and clinics looking for adaptable and low-maintenance solutions. Additionally, the demand for cloud deployment is increasing due to the growth of telehealth and decentralized diagnostics in the healthcare sector.

The single sign-on (SSO) segment held the largest share of the consumer identity and access management (CIAM) market in 2024. This is mainly because of its centralized access control and improved user convenience. Healthcare workers can use a single set of credentials to access multiple systems, increasing workflow efficiency and decreasing login fatigue. This technique reduces the number of passwords needed, which further improves data security. SSO is extensively used in diagnostic labs and large hospitals where integrated systems are essential for accessing patient data and performing real-time diagnostics. It aids in lowering administrative costs associated with password management and promotes adherence to health data regulations. The SSO segment's dominance is further reinforced by the rising demand for efficient and secure system access.

The passwordless authentication segment is expected to grow at the fastest rate in the coming years. This is mainly because of its ease of use, cost-effectiveness, and suitability at all user levels. In remote healthcare settings and small to medium-sized diagnostic labs where sophisticated IT infrastructure might not be available, this authentication is frequently utilized. Many facilities choose passwordless authentication because it is simple to set up and requires little training. Organizations are increasingly using passwordless authentication as it reduces the frequent need for password resets. The rising demand for user-friendly features further supports segmental growth.

The BFSI segment dominated the consumer identity and access management (CIAM) market in 2024. The segment growth is driven by the increased concerns about data security and fraud. This sector has been at the forefront of implementing sophisticated authentication techniques because it has prioritized data security, legal compliance, and safe user access. The need for secure transaction systems and high investment capabilities have fueled early and extensive deployment. The BFSI sector is now at the forefront of safe data environments by combining technologies like multi-factor authentication, SSO, and biometrics. The rise in the demand for a proactive approach to real-time monitoring of cybersecurity and quick response to changing threats further bolstered the segment.

The healthcare segment is expected to grow at the fastest rate during the studied period. The segment growth can be attributed to the rising digitization and increasing adoption of electronic health records. The need for seamless and safe access control systems is growing as telemedicine and cloud-based diagnostic solutions become more popular. Protecting sensitive patient data is a greater priority for healthcare providers. Hospitals and labs are also being pressurized to upgrade their security infrastructure due to government regulations such as HIPAA and the growing number of healthcare data breaches.

North America dominated the consumer identity and access management (CIAM) market in 2024 by capturing the largest share. This is mainly due to its robust digital economy, boosting the demand for secure CIAM solutions. Due to the increasing concerns about cyberattacks and data breaches, there is a high adoption of CIAM solutions in various sectors, including BFSI, e-commerce, healthcare, and education. Moreover, stringent regulations regarding data safety and privacy have boosted the adoption of CIAM Solutions. The U.S. is a major contributor to the regional market growth. This is mainly due to the presence of leading tech giants in the country, leading to innovations in CIAM solutions.

Asia Pacific is expected to witness the fastest growth during the forecast period. The growth of the consumer identity and access management (CIAM) market in the region can be attributed to the rising digitization in every sector. With the growing digital infrastructure, the demand for digital identity management solutions is rising in the region. Stringent regulations regarding consumer data security are encouraging businesses to adopt CIAM solutions. Moreover, the rapid expansion of the fintech and e-commerce sectors and the growing online shopping and transaction activities contribute to regional market growth.

By Component

By Deployment

By Authentication Method

By Industry

By Regional

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

November 2024

February 2025

April 2025