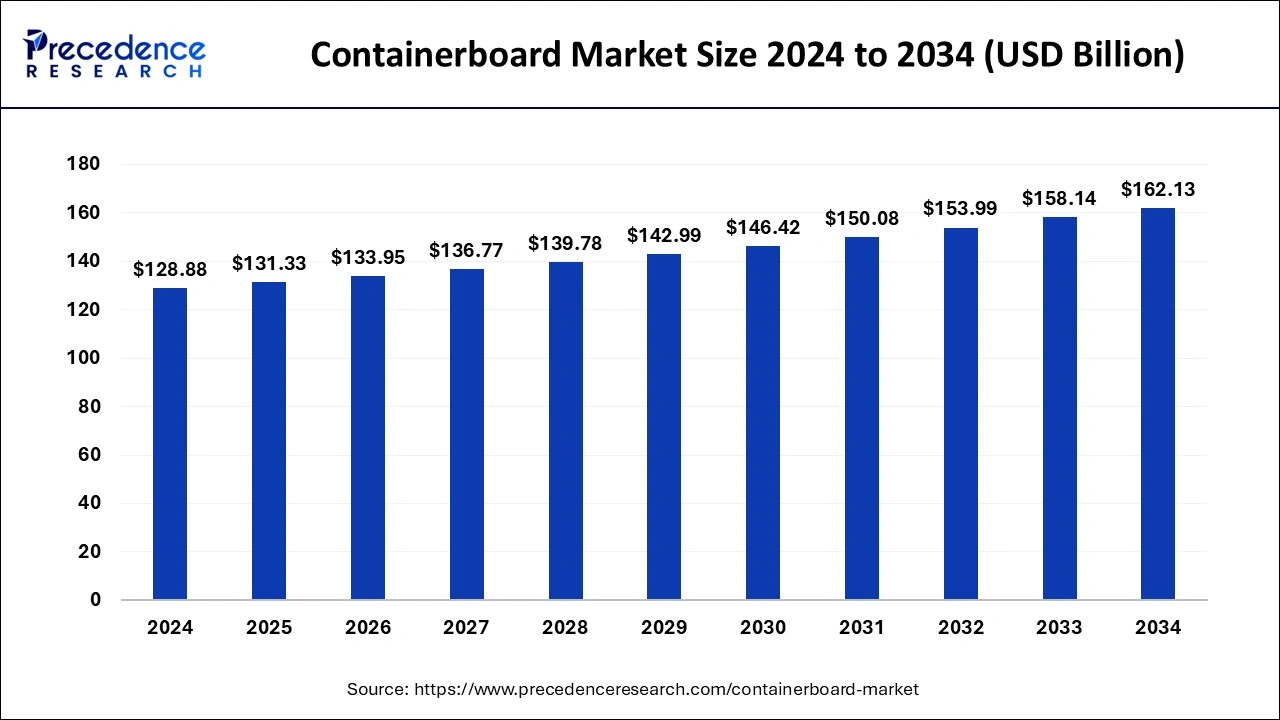

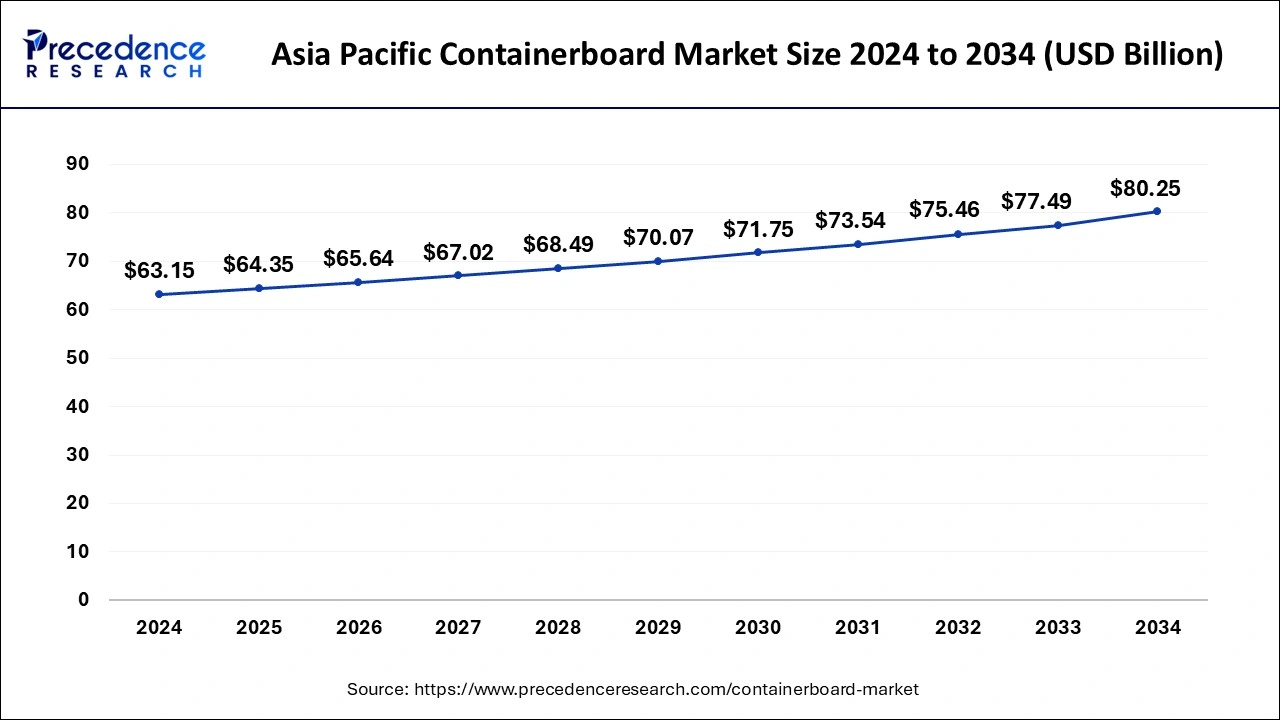

The global containerboard market size is accounted at USD 131.33 billion in 2025 and is forecasted to hit around USD 162.13 billion by 2034, representing a CAGR of 2.32% from 2025 to 2034. The Asia Pacific market size was estimated at USD 63.15 billion in 2024 and is expanding at a CAGR of 2.43% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global containerboard market size was calculated at USD 128.88 billion in 2024 and is predicted to increase from USD 131.33 billion in 2025 to approximately USD 162.13 billion by 2034, expanding at a CAGR of 2.32% from 2025 to 2034.

The Asia Pacific containerboard market size was exhibited at USD 63.15 billion in 2024 and is projected to be worth around USD 80.25 billion by 2034, growing at a CAGR of 2.43% from 2025 to 2034.

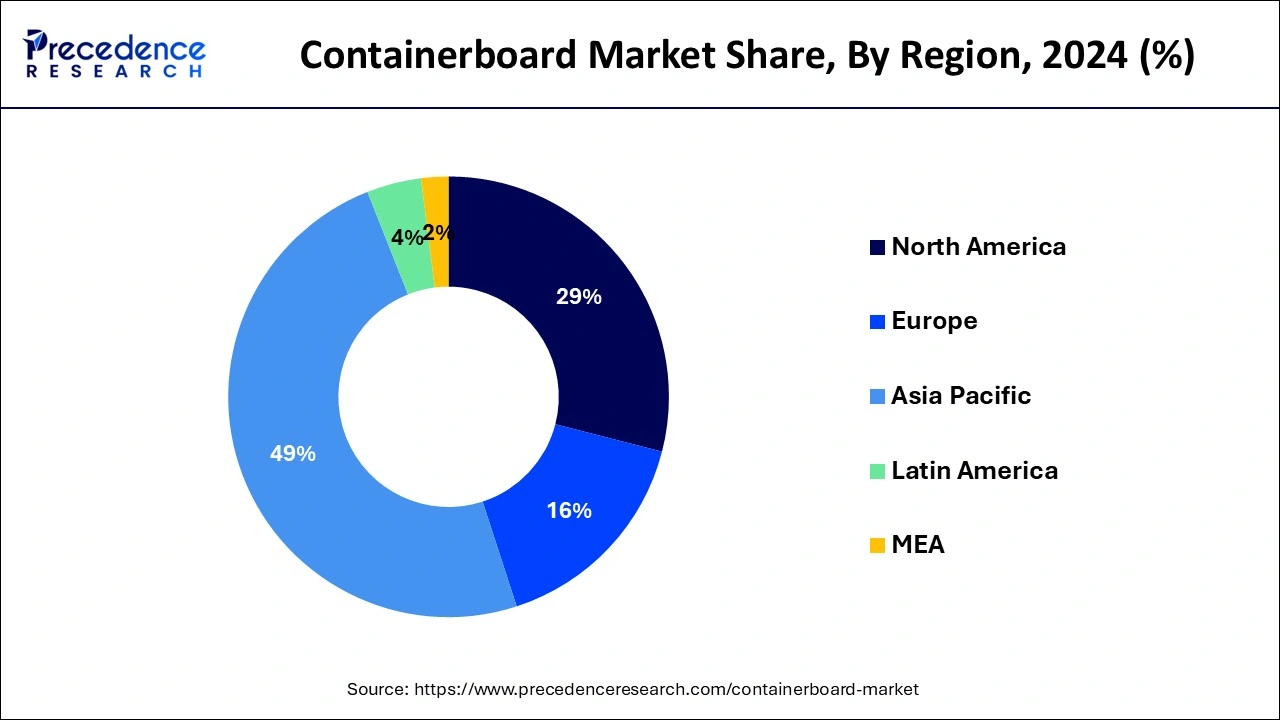

Asia Pacific held a dominating share of 46% in the containerboard market due to a combination of factors. Asia Pacific commands a significant share in the containerboard market due to robust industrialization, expanding e-commerce, and increasing consumer demand for packaged goods. Rapid economic growth in countries like China and India has propelled the manufacturing and packaging sectors, driving the need for containerboard. Additionally, the flourishing e-commerce landscape in the region boosts demand for reliable packaging materials. Asia-Pacific's dominance in the containerboard market is further sustained by a burgeoning middle class with rising purchasing power, fueling the consumption of packaged products.

North America is poised for rapid growth in the containerboard market due to robust construction activities, driven by a surge in infrastructure projects and residential development. The region is experiencing increased demand for sustainable and energy-efficient building solutions, fostering innovation in materials and construction practices. Favorable economic conditions, government initiatives, and a growing focus on modernizing existing structures contribute to the optimistic outlook. With a dynamic market landscape and a heightened emphasis on resilient and eco-friendly construction, North America is positioned for significant expansion in the building materials sector.

On the other hand, Europe is experiencing substantial growth in the containerboard market due to several factors. Increased e-commerce activities, a surge in sustainable packaging demands driven by environmental awareness, and stringent regulations promoting recyclability contribute to the market expansion. Additionally, technological advancements and innovations in manufacturing processes enhance efficiency and product quality. The region's commitment to sustainable practices and the rising need for customized packaging solutions further fuel the growth of the containerboard market in Europe.

Containerboard is a type of paperboard specifically designed for the production of corrugated fiberboard, a crucial material in the packaging industry. Composed of multiple layers, the containerboard typically consists of an inner corrugated medium sandwiched between two flat linerboards. The corrugated medium provides strength and rigidity, while the linerboards offer a smooth surface for printing and additional structural support. Containerboard's unique composition makes it ideal for manufacturing corrugated boxes and packaging materials, widely used for shipping and storing goods.

Its versatility and durability make containerboard a key component in the packaging supply chain, providing a cost-effective and environmentally friendly solution for various industries that rely on efficient and protective packaging solutions.

| Report Coverage | Details |

| Market Size in 2025 | USD 131.33 Billion |

| Market Size by 2034 | USD 162.13 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End-use and Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Global packaging consumption

The rise in global packaging consumption is a key driver propelling the demand for the containerboard market. As consumer preferences shift toward more packaged goods globally, there is a significant increase in the use of containerboard. This is evident in the expected annual growth rate of 5.6% in global packaging consumption. Containerboard, with its resilient and versatile packaging capabilities, is becoming increasingly favored by industries seeking reliable solutions to protect products during transportation. With the increasing demand for packaged goods, industries are turning to containerboard for its versatile and reliable packaging capabilities.

Containerboard's ability to safeguard products during transit, coupled with its sustainability features, positions it as a preferred choice in meeting the heightened requirements of a packaging-intensive global market. The burgeoning demand for containerboard is intricately linked to the escalating need for effective and sustainable packaging solutions in response to the expanding landscape of global packaging consumption.

Digitalization impact on paper usage

The increasing trend toward digitalization poses a restraint on the market demand for the containerboard industry. As more aspects of communication and documentation transition to digital platforms, there is a consequential decrease in the demand for traditional paper usage. Businesses and consumers alike are adopting digital alternatives for various purposes, such as online advertising, electronic communication, and document storage. This shift in preference towards digital mediums diminishes the demand for printed materials and, consequently, impacts the requirement for containerboard in packaging applications.

The containerboard market faces the challenge of adapting to changing consumer habits influenced by digitalization. While packaging remains crucial, especially for e-commerce, the overall reduction in traditional paper usage due to the rise of digital platforms can hinder the growth of the containerboard market. Industry players must navigate this trend by exploring innovations, emphasizing the sustainability of paper-based packaging, and diversifying product offerings to remain resilient in the evolving market landscape.

Rising middle-class consumers

The growing number of middle-class consumers worldwide is opening doors for the containerboard market. As more people join the middle-income group, their increased purchasing power leads to a rise in buying packaged goods. This surge in consumer demand, particularly in emerging markets, provides a prime opportunity for the containerboard industry to cater to the packaging requirements of a growing middle-class population.

The Containerboard industry can capitalize on this opportunity by offering packaging solutions that align with the preferences of middle-class consumers, such as aesthetically pleasing and functional packaging. Additionally, the demand for packaged goods extends beyond basic necessities, encompassing a variety of consumer products, further driving the need for innovative and versatile packaging materials like containerboard to meet the evolving demands of this expanding demographic.

The food & beverage segment had the highest market share of 32% in 2024. In the containerboard market, the food and beverage segment refers to the utilization of containerboard in packaging materials for the food and beverage industry. This includes corrugated boxes and cartons designed to safeguard and transport food products. A notable trend in this segment is the increasing demand for sustainable and eco-friendly packaging solutions, aligning with consumer preferences. Containerboard, with its recyclable and biodegradable properties, meets these demands, making it a popular choice for environmentally conscious food and beverage manufacturers aiming for sustainable packaging practices.

The personal care & cosmetics segment is anticipated to expand at a significant CAGR of 3.9% during the projected period. The personal care and cosmetics segment in the containerboard market refers to the packaging of beauty and grooming products. This includes items like skincare, haircare, and cosmetic products. A notable trend in this segment involves the increasing demand for sustainable and aesthetically pleasing packaging. Manufacturers are adopting eco-friendly containerboard options and incorporating innovative designs to enhance the visual appeal of personal care and cosmetic products. This aligns with consumer preferences for environmentally conscious choices and visually attractive packaging in the beauty and grooming industry.

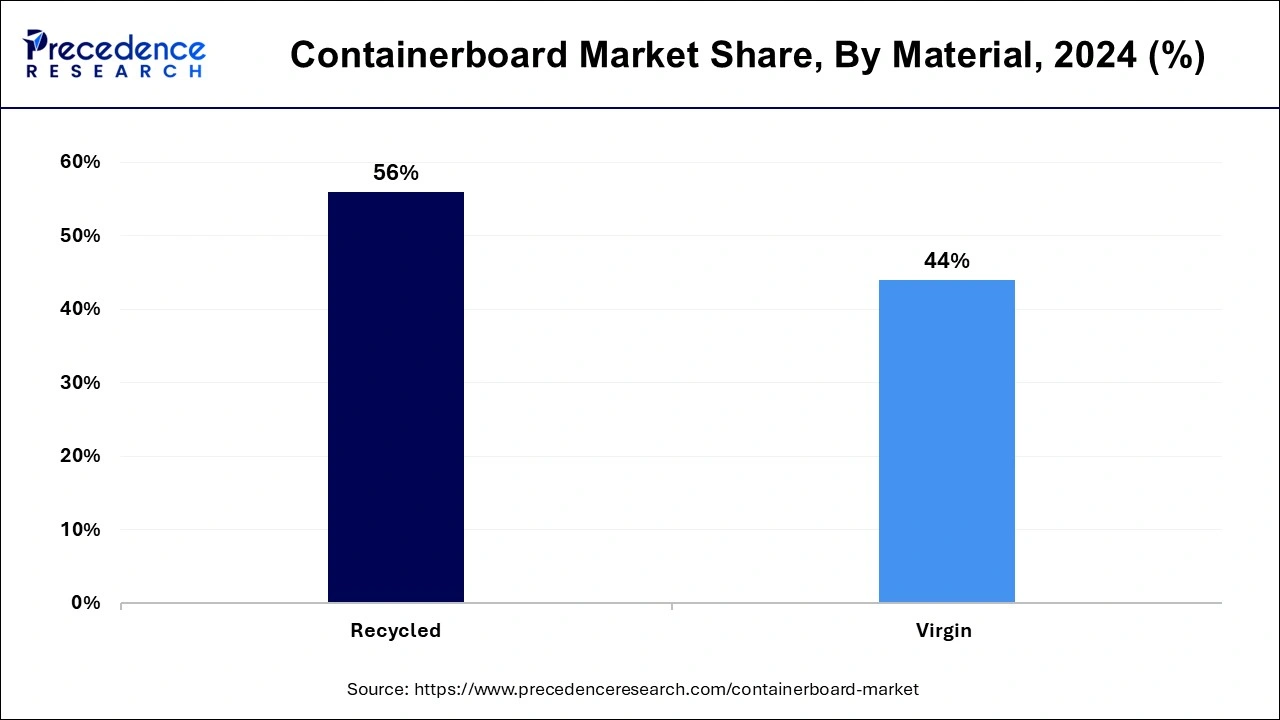

The recycled segment held a 56.45% revenue share in 2024. In the containerboard market, the recycled segment refers to containerboard products manufactured using recovered paper fibers. This sustainable approach aims to reduce environmental impact by utilizing recycled content in packaging. A notable trend in the recycled segment involves an increasing preference for eco-friendly packaging solutions. Businesses are opting for recycled containerboard to align with sustainability goals and respond to growing consumer awareness. This trend reflects a broader industry shift towards incorporating recycled materials, contributing to the environmentally responsible evolution of the containerboard market.

The virgin segment is anticipated to expand fastest over the projected period. In the containerboard market, the virgin segment refers to containerboard produced using entirely new and unused paper fibers. This segment emphasizes high-quality packaging materials, offering enhanced strength and printability. Current trends in the virgin segment include a focus on sustainability through responsible sourcing of raw materials and eco-friendly production processes. As consumer preferences shift towards environmentally conscious products, containerboard manufacturers in the virgin segment are increasingly adopting practices that align with sustainability goals, contributing to the overall evolution of the containerboard market.

By End-use

By Material

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client