January 2025

Continence Care Market (By Product: Urinary Catheters, Catheter Maintenance/Care, Urinary Bags; By Application: Diabetes, Strokes, BPH, Alzheimer, Cerebral Palsy, Parkinson, Prostate Cancer, Spinal Cord Injury, Bladder Cancer, Multiple Sclerosis, Spina Bifida, Others; By Bag Usage: Sterile Bags, Non-sterile Bags; By End-use: Home Care Settings, Hospitals, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

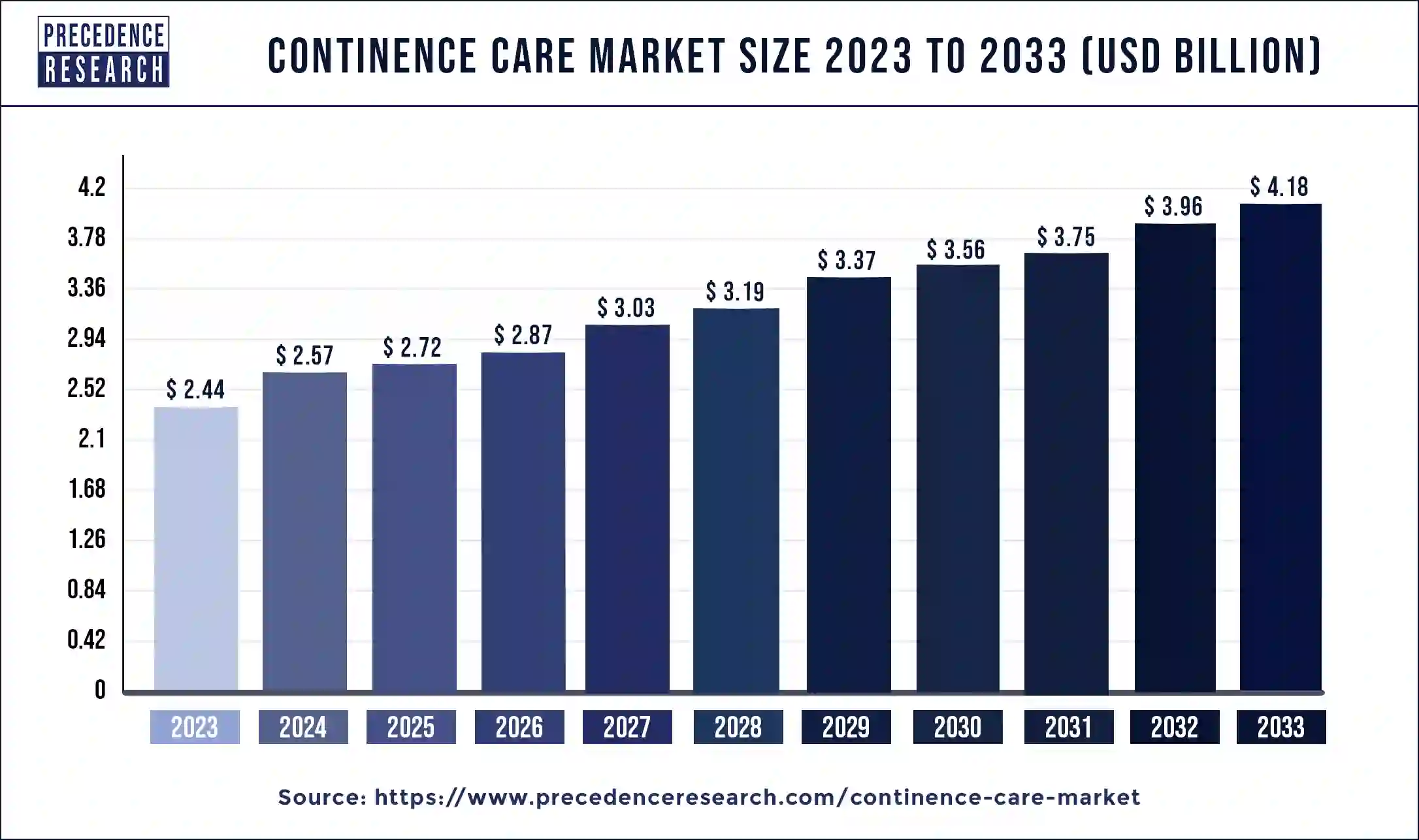

The global continence care market size was valued at USD 2.44 billion in 2023 and is anticipated to reach around USD 4.18 billion by 2033, growing at a CAGR of 5.53% from 2024 to 2033. Urinary incontinence and other bladder-related problems are becoming more common as the world's population ages, this factor is observed to drive the growth of the market.

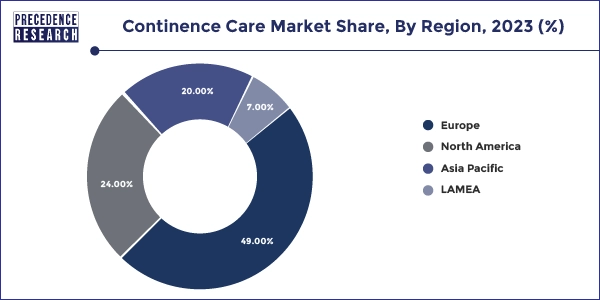

The Europe continence care market size was estimated at USD 1.20 billion in 2023 and is predicted to be worth around USD 2.07 billion by 2033, at a CAGR of 5.60% from 2024 to 2033.

Europe held the largest share of the continence care market in 2023. The region is observed to sustain as a significant shareholder during the forecast period. Europe's population is aging, and a sizable section of older people have problems with their ability to regulate their bowels or bladder. This demographic shift fuels the demand for services and goods related to continence care. Awareness of incontinence problems and the range of goods and therapies available to address them has grown. This awareness results from higher diagnostic rates and greater acceptance of continence care treatments. With its advanced healthcare system, Europe offers access to medicines and goods for continuous care throughout the continent. Furthermore, government initiatives and reimbursement rules help to make continence management systems accessible and affordable.

Asia Pacific is expected to grow at a notable rate during the forecast period in the continence care market. Due to the rising prevalence of urine incontinence, growing consumer knowledge of the availability of continence care products, and improvements in healthcare infrastructure, the continence care market in the Asia Pacific region was witnessing substantial expansion. Products like drainage bags, catheters, and adult diapers are among those sold on the market. The aging population, shifting lifestyles, and improved access to healthcare in emerging nations drive the need for continuous care products in Asia Pacific. Furthermore, governments and healthcare institutions are increasingly stressing how crucial it is to successfully manage incontinence to enhance the quality of life for those affected and lower medical expenses related to difficulties.

The North America continence care market size was calculated at USD 590 million in 2023 and is projected to expand around USD 1,020 million by 2033, poised to grow at a CAGR of 5.62% from 2024 to 2033.

| Year | Market Size (USD Million) |

| 2023 | 590 |

| 2024 | 620 |

| 2025 | 650 |

| 2026 | 690 |

| 2027 | 730 |

| 2028 | 770 |

| 2029 | 810 |

| 2030 | 850 |

| 2031 | 900 |

| 2032 | 950 |

| 2033 | 1,020 |

Continence Care Market Overview

The continence care market is growing steadily, and projections for the upcoming years predict this growth will continue with the rising demand especially for home-health care settings. Catheters (such as intermittent, indwelling, and external catheters), absorbent products (like adult diapers, pads, and liners), and other products (like pelvic floor stimulators, disposable underwear, and drainage bags) make up the market for continence care products. Geographical analysis of the market revealed that the central regions driving continence care market’s expansion were North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Manufacturers in the market are concentrating on creating more sustainable and ecologically friendly products to satisfy the rising demand for eco-friendly solutions. Initiatives to raise consumer and healthcare professional awareness and educate caregivers about the value of continence management, available treatments, and appropriate product selection and use have become increasingly important.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.53% |

| Continence Care Market Size in 2023 | USD 2.44 Billion |

| Continence Care Market Size in 2024 | USD 2.57 Billion |

| Continence Care Market Size by 2033 | USD 4.18 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, By Bag Usage, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver: Rising emphasis on healthcare standards

Innovations in continence care have been made possible by the ongoing technological progress. This covers, among other things, enhanced absorbent materials, wearable monitoring devices, and sophisticated catheters. The importance of teaching patients and caregivers about difficulties related to continence, accessible therapies, and preventive measures has increased. This raised awareness aids in the early diagnosis and treatment of disorders about continence. Creating and applying clinical guidelines and quality standards guarantee that medical professionals provide evidence-based therapy for continence management. Thereby, the rising emphasis on healthcare standards creates a significant driver for the continence care market.

Restraint: Stigma and societal taboos

Because incontinence is such a delicate condition, discretion and dignity are frequently highlighted in creating and promoting continence care products. To reduce customer shame or discomfort, companies in this industry heavily spend on making discrete, comfortable, and effective devices. The views of healthcare professionals may also influence the stigma associated with incontinence in the continence care market. Underdiagnosis and undertreatment may result from people who do not prioritize the issue during medical consultations or who do not take it seriously. Social taboos and stigmas can impact how innovatively continuous care items are developed. Businesses may be reluctant to spend money on R&D in this field because they believe there is little market potential or worry about how well-received by consumers.

Opportunity: Telemedicine and digital health solutions

Telemedicine dispenses with the requirement for in-person consultations by enabling patients to consult with medical professionals remotely. Patients can use video conferencing or messaging services to discuss their continence problems, get advice, and even have virtual examinations. All-inclusive digital health platforms provide options for managing continence. These platforms might include telemedicine consultations, tailored care plans, instructional materials, and symptom tracking.

To receive ongoing support and have their treatment plans modified, patients can keep track of their progress over time and connect with medical specialists. Advanced analytics methods used for this data analysis can assist in spotting trends, forecasting exacerbations or consequences, and customizing interventions to meet the needs of specific patients. The administration of continence care is made more effective by this data-driven strategy.

The urinary catheters segment held the largest share in the continence care market. The market for urinary catheters makes up a sizeable portion of the continence care sector, which also includes goods and services for treating disorders such as urine incontinence. Medical devices called urinary catheters are used to remove urine from the bladder when a patient cannot do it on their own because of various illnesses or surgeries. Numerous kinds of urinary catheters can be used, such as suprapubic, indwelling (Foley), external (condom), and intermittent catheters. Every kind is made to fit a particular patient's demands and circumstances. Due to several causes, including an aging population, an increase in the prevalence of urine incontinence, technological breakthroughs in catheter design, and increased awareness of continence management, the continence care market, including urinary catheters, has grown significantly.

Urinary catheter technology has advanced, creating more user-friendly, cozy, and infection-resistant devices. Hydrophilic-coated catheters, for instance, lessen friction during insertion and withdrawal, improving patient comfort. Urinary catheters that are simple to use and maintain at home are in greater demand as home healthcare services become more prevalent. For example, individuals who support their bladder function at home frequently utilize intermittent catheters. Catheter use is connected with a substantial risk of urinary tract infections (UTIs). To lower the risk of infections, there is a rising focus on designing catheters with antimicrobial coatings or materials.

The diabetes segment led the continence care market in 2023. Diabetes is a widespread chronic condition affecting millions globally. As the number of individuals with diabetes increases, the prevalence of associated complications, such as urinary incontinence and neuropathy, also rises. These complications often necessitate the use of continence care products. One common complication of diabetes is diabetic neuropathy, which can lead to bladder dysfunction. This condition often results in urinary incontinence, making continence care products essential for many diabetic patients. Modern lifestyles, characterized by poor diet and lack of exercise, contribute to the rising incidence of diabetes. This, in turn, boosts the need for continence care as complications arise from poorly managed diabetes.

The spinal cord injury segment is expected to grow at a notable rate in the continence care market during the forecast period. Technological advancements and improvements in the design and functionality of continence care products have made it easier for SCI patients to manage their condition. Innovations such as intermittent catheters, hydrophilic catheters, and advanced drainage systems enhance the quality of life for these individuals, driving market growth. A significant proportion of individuals with spinal cord injuries experience bladder dysfunction. Neurogenic bladder, a common condition following SCI, leads to issues such as urinary incontinence, retention, and frequent urinary tract infections, necessitating the use of continence care products like catheters, drainage bags, and other related devices.

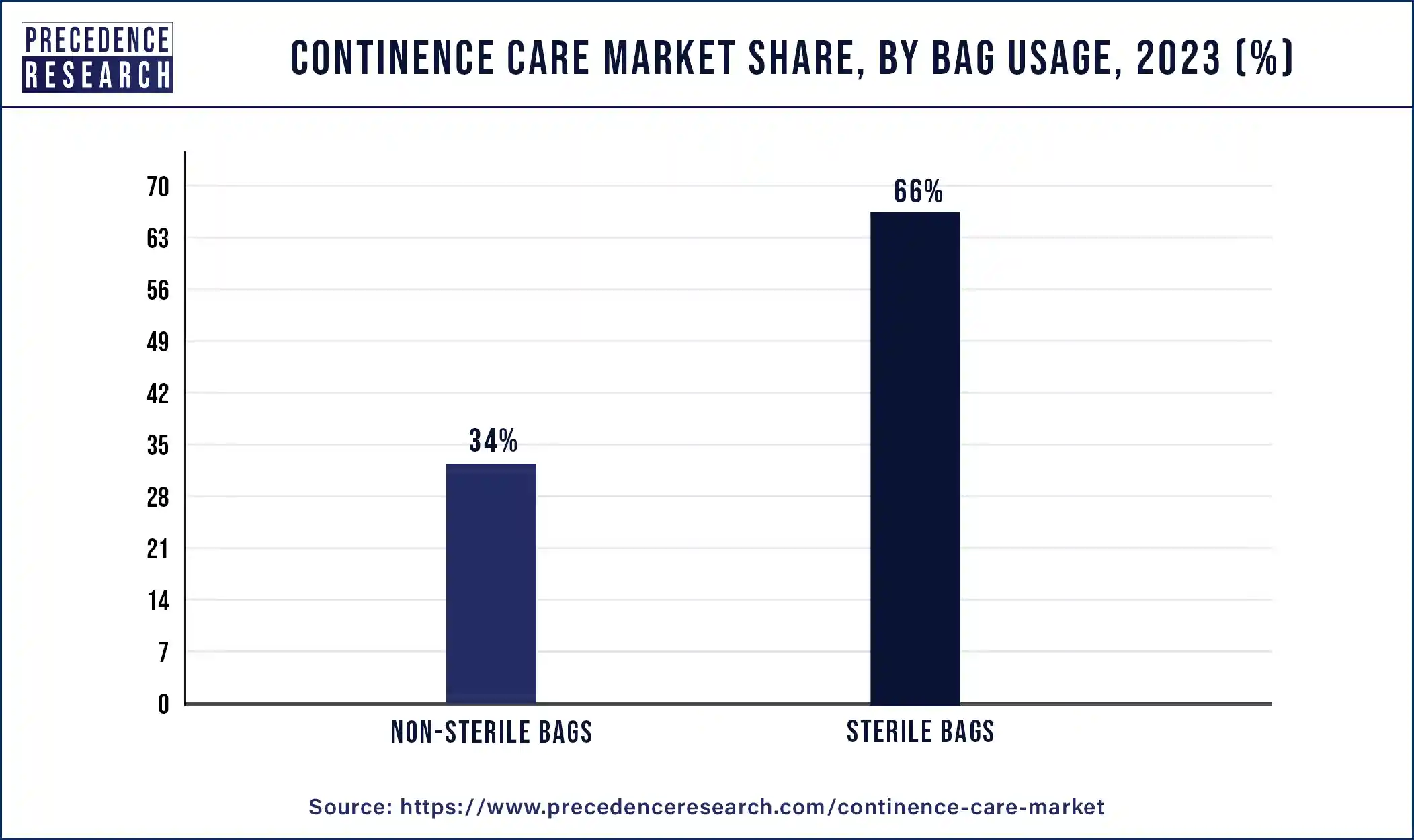

The sterile bag-usage segment dominated the continence care market in 2023. Sterile bags are crucial in preventing infections, a significant concern for individuals requiring continence care. These bags are designed to maintain a sterile environment, reducing the risk of urinary tract infections (UTIs) and other complications, which is a major priority in healthcare settings.

Sterile bags are typically user-friendly, making them a convenient option for both healthcare providers and patients. Their design often includes features that facilitate easy and hygienic handling, reducing the complexity of continence care.

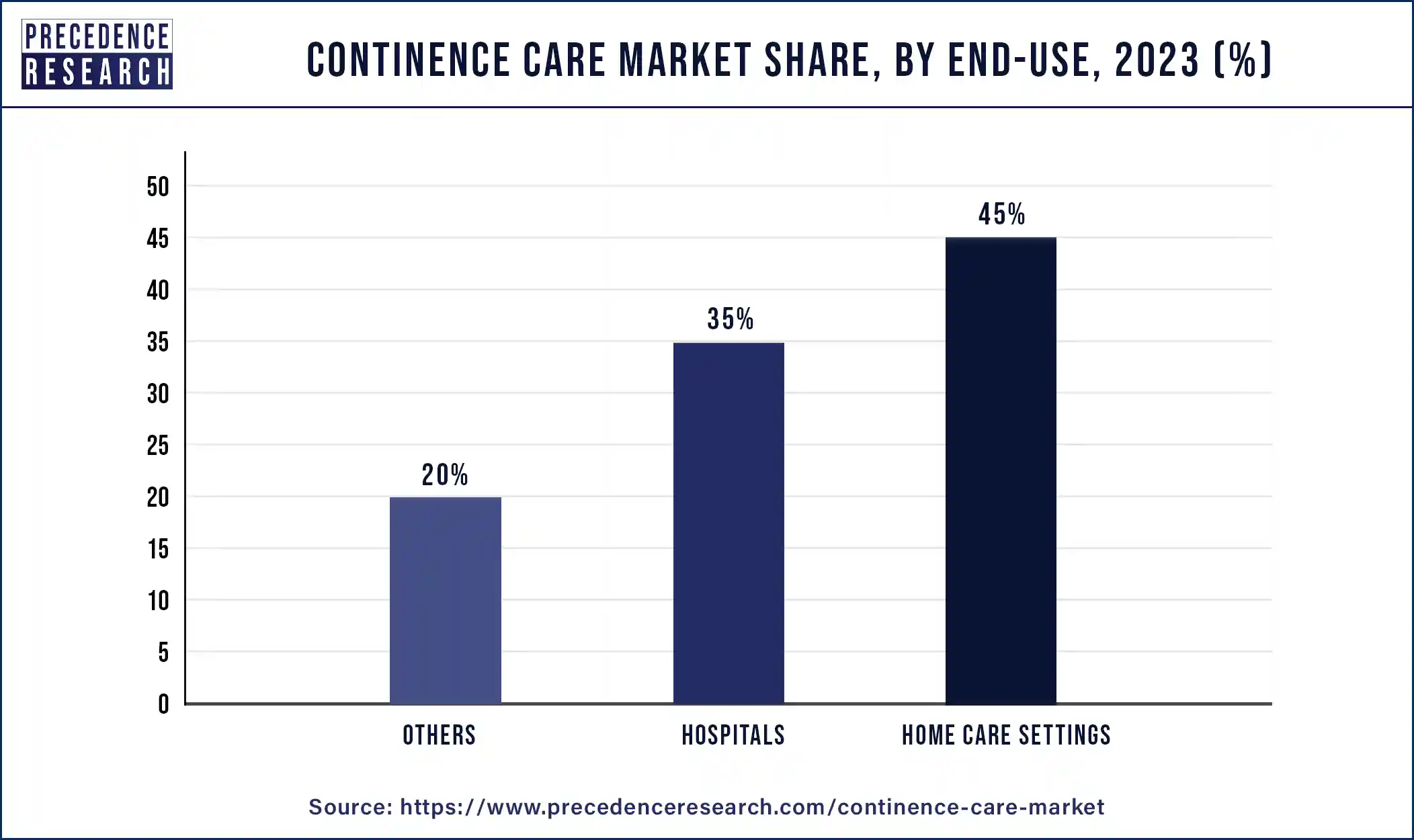

The home care settings segment led the continence care market in 2023. Many individuals with incontinence issues prefer the privacy and comfort of their homes for managing their condition. Home care settings offer a more dignified and personalized approach to continence care, which is a significant factor driving this market segment.

There has been an expansion of home healthcare services that provide support for individuals with incontinence. These services include nurse visits, telemedicine consultations, and the delivery of continence care products, making home care a viable and attractive option.

Segment Covered in the Report

By Product

By Application

By Bag Usage

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2024

September 2024

January 2025