January 2025

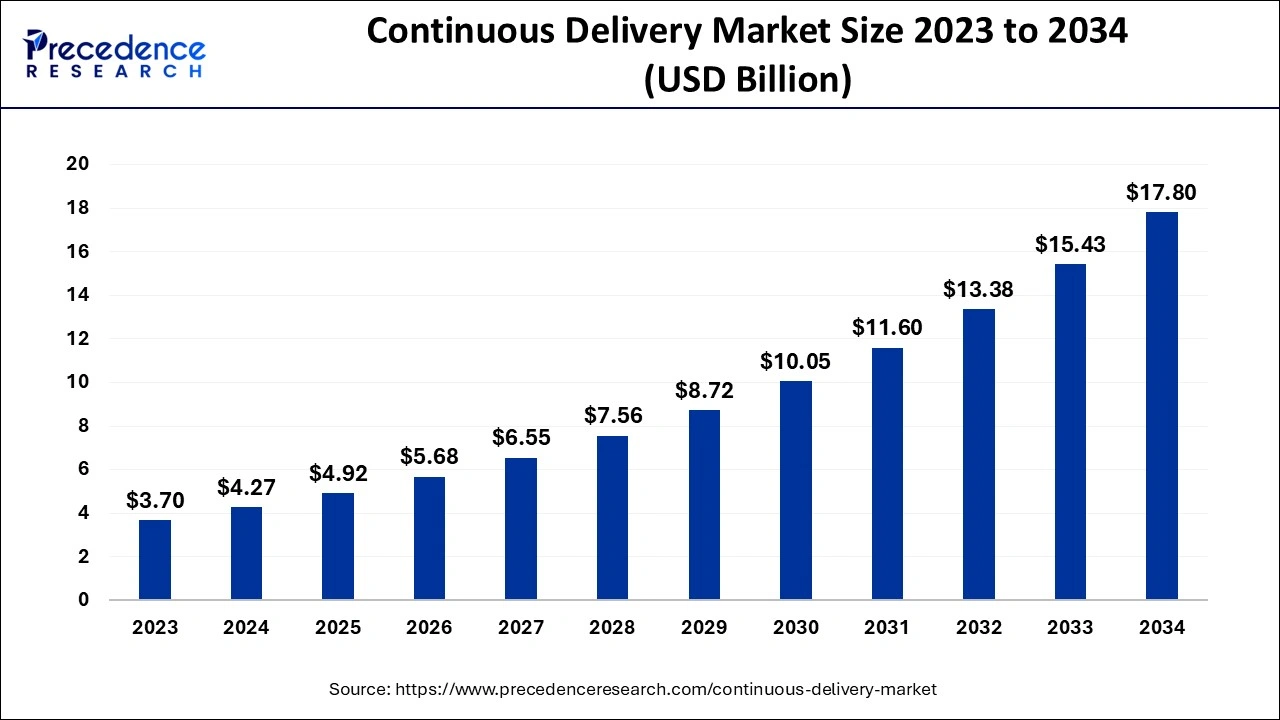

The global continuous delivery market size accounted for USD 4.27 billion in 2024, grew to USD 4.92 billion in 2025 and is expected to be worth around USD 17.8 billion by 2034, registering a healthy CAGR of 15.35% between 2024 and 2034. The U.S. continuous delivery market size is exhibited at USD 1.37 billion in 2024 and is anticipated to reach around USD 5.72 billion by 2034, growing at a CAGR of 15.62% from 2024 to 2034.

The global continuous delivery market size is calculated at USD 4.27 billion in 2024 and is projected to surpass around USD 17.8 billion by 2034, expanding at healthy a CAGR of 15.35 % from 2024 to 2034. The rising demand for the industry's upgrades and the latest innovations in the industrial software platform is accelerating the growth of the continuous delivery market.

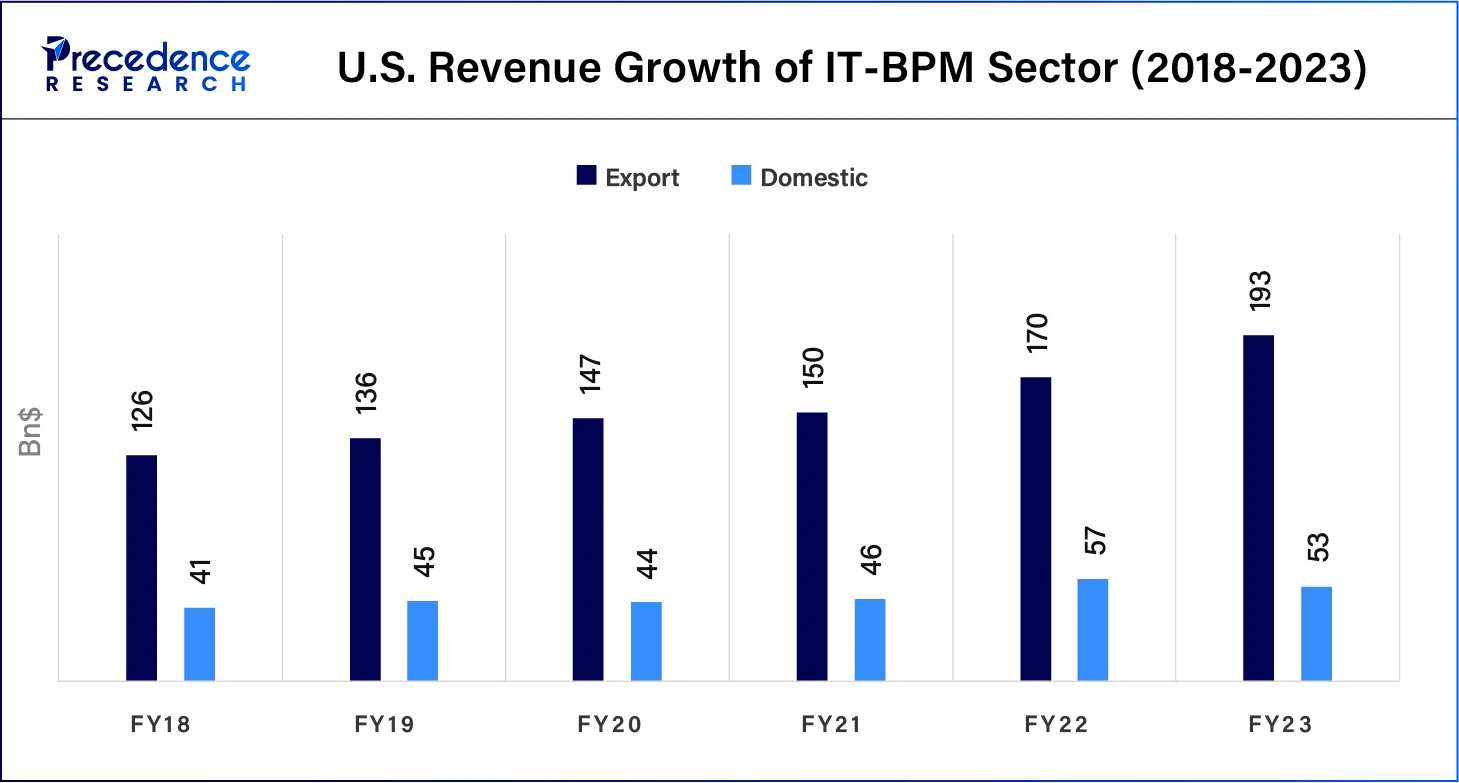

North America dominated the continuous delivery market in 2023. The growth of the market is attributed to the rising adoption of technologies in different industries, and countries like the United States are the early adopters of the technologies that are collectively driving the growth of continuous delivery by industries. The increasing adoption of cloud-based services in the organization and the shifting preference of the industries in the cloud platforms such as Google Cloud, Microsoft Azure, and AWS for supporting the continuous delivery process. The availability of technology giants like Google, Microsoft, Amazon, and others is accelerating the growth of the region's market.

Asia Pacific has anticipated significant growth during the forecast period. The growth of the market is attributed to the rising adoption of the technologies, and the leading public and private firms are shifting towards cloud deployment and advanced technologies. The rising investment in the development of IT infrastructure in countries like India, China, and Japan, as well as government intervention in the development of technologies, are boosting the growth of the continuous delivery market.

Continuous delivery is a technological advancement in software development programs; it is the practice of using automation to speed up the release of new code. Continuous delivery is the process of rapid software delivery that automates the changes in the app development stages. Continuous delivery is the ongoing deployment or delivery that helps automate the further stages of the software development pipeline. The continuous delivery pipeline is the stage in which the latest version of the software is delivered.

How Can AI Impact the Continuous Delivery Market?

The integration of artificial intelligence in continuous delivery helps increase accuracy, automate key processes, enhance testing accuracy, and enable real-time insights in the deployment pipeline. AI in continuous delivery increases the quality and testing accuracy and reduces manual tasks by automating repetitive tasks. AI reduces errors, improves the overall quality, and increases release cycles. AI helps in continuous delivery and deployment processes such as orchestration of test environments, execution of various tasks, performance monitoring of release candidate artifacts, and automation of policies for artifact acceptance.

| Report Coverage | Details |

| Market Size by 2034 | USD 17.8 Billion |

| Market Size in 2024 | USD 4.27 Billion |

| Market Size in 2025 | USD 4.92 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 15.35% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Deployment, Enterprise Size, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The awareness about the benefits associated with the continuous delivery

The increasing awareness about continuous delivery in the industries efficiently helps developers deliver software programs and the latest updates. It enables benefits that include increasing developer productivity, automating the process, delivering updates, and enhancing code quality. Continuous delivery helps deliver updates that enhance the customer experience. It reduces the risk of failure and helps people easily recover and identify problems. It decreases the cost of operations, releases the code frequently, helps to improve operational confidence, and enhances teamwork, which collectively drives the growth of the continuous delivery market.

Risks associated with the continuous delivery

The risks associated with continuous delivery, such as deploying faulty code, incomplete implementation, security issues, and others, are limiting the growth of the continuous delivery market.

Rise in mobile applications

The rising penetration of the internet and smartphones is driving the expansion of the mobile app market. The rising investment in the demand for various mobile applications and services is causing an increasing number of developments in mobile applications. Continuous delivery adds value in the development of mobile apps as it helps in faster release by keeping code ready for deployment, enhances the code quality, detects bugs in the early stage, increases visibility and transparency, reduces the cost of operation, and helps in monitoring and analyzing processes.

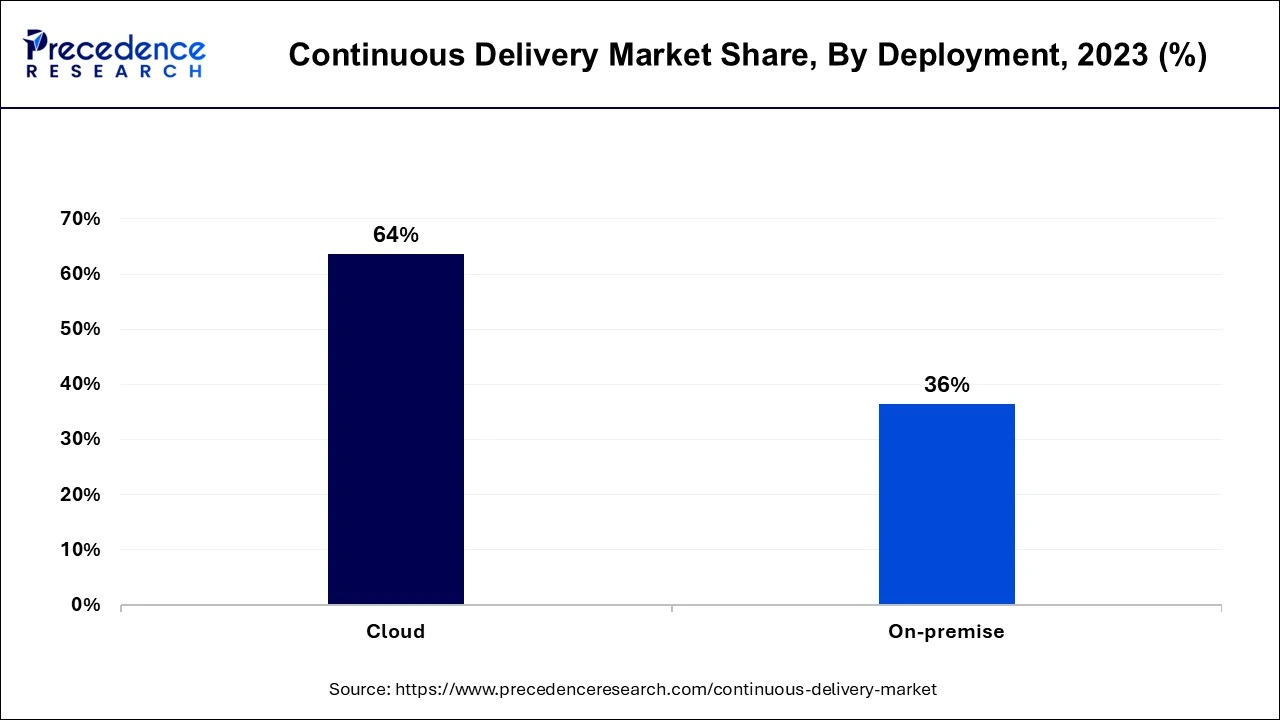

The cloud segment dominated the continuous delivery market in 2023. The rising adoption of cloud services by several software companies is due to their better production efficiency. Businesses continuously use cloud services to streamline operational workloads, system reliability, and vendor lock-in. There are several benefits associated with cloud deployment in continuous delivery, such as automating replication and designing multiple testing environments. The cloud can enable the easy one-step promotion and rollback of releases through the CLI, web console, and API. Cloud deployment can efficiently manage and streamline continuous delivery.

The on-premise segment is expected to experience substantial growth in the continuous delivery market during the predicted period. The increasing concern for data security and privacy is driving the adoption of the on-premise deployment. The on-premise deployment is the safest platform that can fully manage the on-premise employees and maintain the integrity and safety of the secured data from the public cloud environment. There are several businesses or organizations that want to keep their data private, and within the enterprise environment, such as banking, healthcare, and government, are driving the adoption of the use of the on-premise segment.

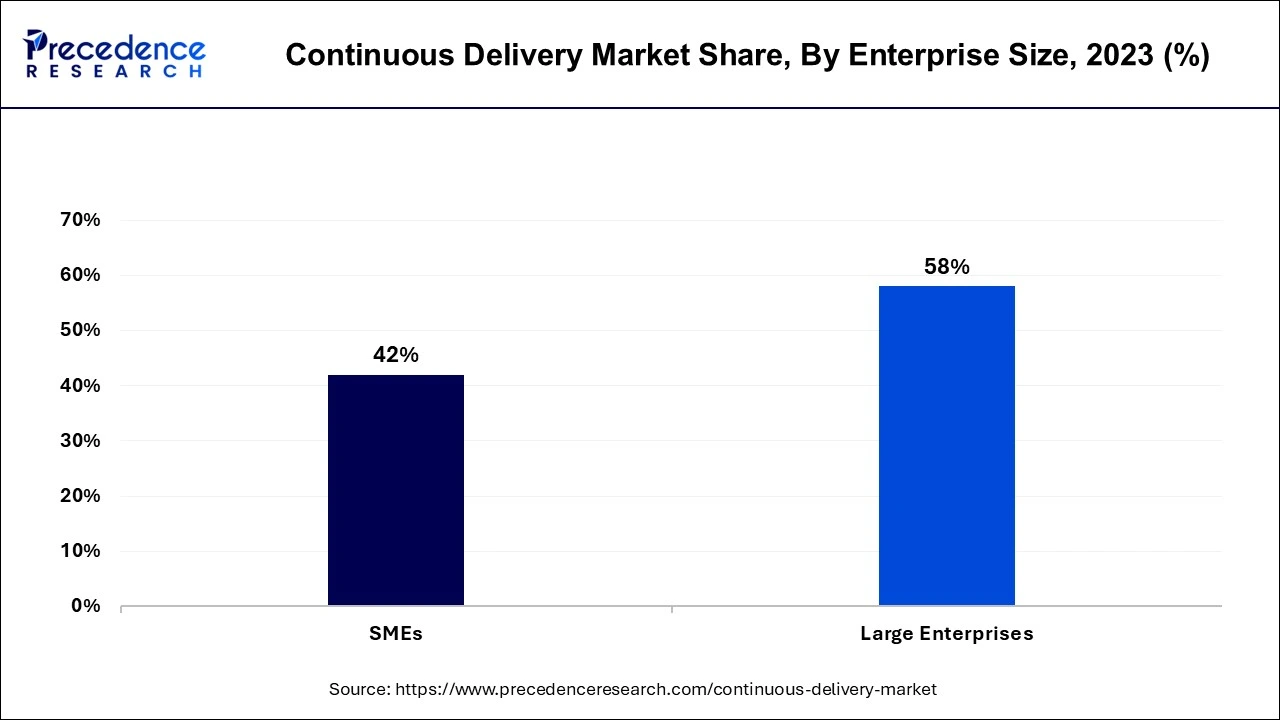

The large enterprise segment held a dominant presence in the continuous delivery market in 2023. Several leading enterprises, whether public or private, are adopting continuous delivery software to maintain regularity and compliance standards in the organization. Most public or private enterprises are in sectors like healthcare, finance, automobile, government, and others, which create the increased demand for strict regulation and control over software development programs that drive the demand for continuous delivery by large enterprises.

The SMEs segment will gain a significant share of the continuous delivery market over the studied period of 2023 to 2034. There is an increasing demand for continuous delivery from small and medium enterprises to increase productivity, respond to changes in the market, reduce the manual labor force, and provide several other benefits. It helps create codes rapidly at different times, which helps with faster iteration. The continuous delivery helps meet consumer demand, reduces risk, saves personnel costs, and provides superior software quality.

The BFSI segment registered its dominance over the continuous delivery market in 2023. The continuous delivery in the BFSI sector efficiently manages the automation process, safety, and efficiency, accelerates the speed, and enhances user feedback. In the banking and financial sector, some important stages are included in the deployment of continuous delivery, such as reviewing and building stages that include the units, integration and end-to-end tests, availability of traces, logs, and metrics pre-production stage, and analyzing the impacts of the rollback and production process. The pre-production stage includes the trial running smoke tests in the fresh environment for testing, the use of pre-production environments with realistic scenarios, and alignment alerts, metrics, and pre-production tests. The production stage is further used to reduce the risk. The continuous delivery in the banking sector is further used for mobile banking apps, online banking platforms, and other software development programs.

The education segment is predicted to witness significant growth in the market over the forecast period. The rising technological adoption in the educational sector and the rise in the online education platform are driving the demand for the continuous delivery market. The continuous delivery helps improve the teaching capabilities in online courses and efficiently connects students and teachers.

Segments Covered in the Report

By Deployment

By Enterprise Size

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

July 2024

September 2024