What is Artificial Intelligence (AI) in Precision Medicine Market Size?

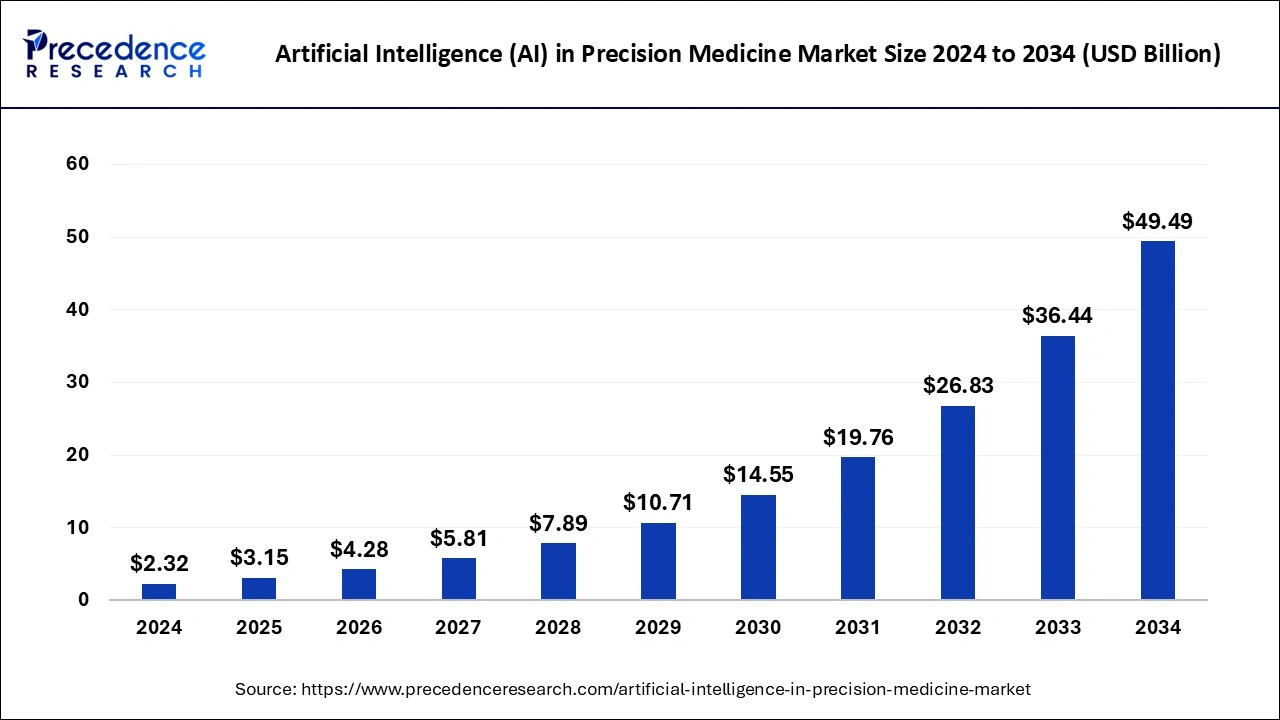

The global artificial intelligence (AI) in precision medicine market size was accounted for USD 3.15 billion in 2025 and is anticipated to reach around USD 60.24 billion by 2035, growing at a CAGR of 34.33% from 2026 to 2035. The artificial intelligence (AI) in precision medicine market is experiencing significant growth due to the increasing demand for personalized treatments. Moreover, the increasing prevalence of various life-threatening diseases and advancements in genomics and multi-omics technologies contribute to market expansion.

Market Highlights

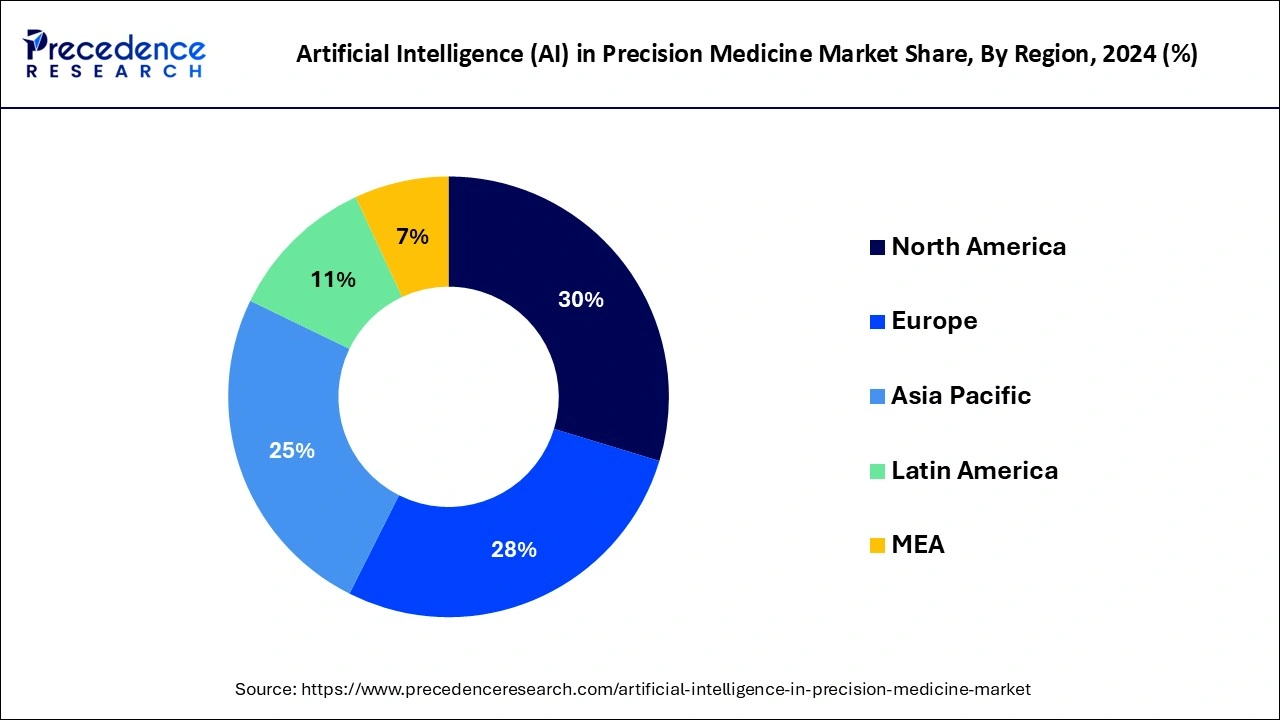

- North America dominated the global artificial intelligence (AI) in precision medicine market with the largest market share of 30% in 2025.

- Europe is predicted to grow at the fastest CAGR of 36.8% during the forecast period

- By technology, the deep learning segment has held a major market share of 35% in 2025.

- By technology, natural language processing segment is expected to expand at a remarkable CAGR of 36.78% during the forecast period.

- By component, the software segment accounted for the highest market share of 42% in 2025.

- By component, the service segment is expected to expand at a significant CAGR between 2026 to 2035

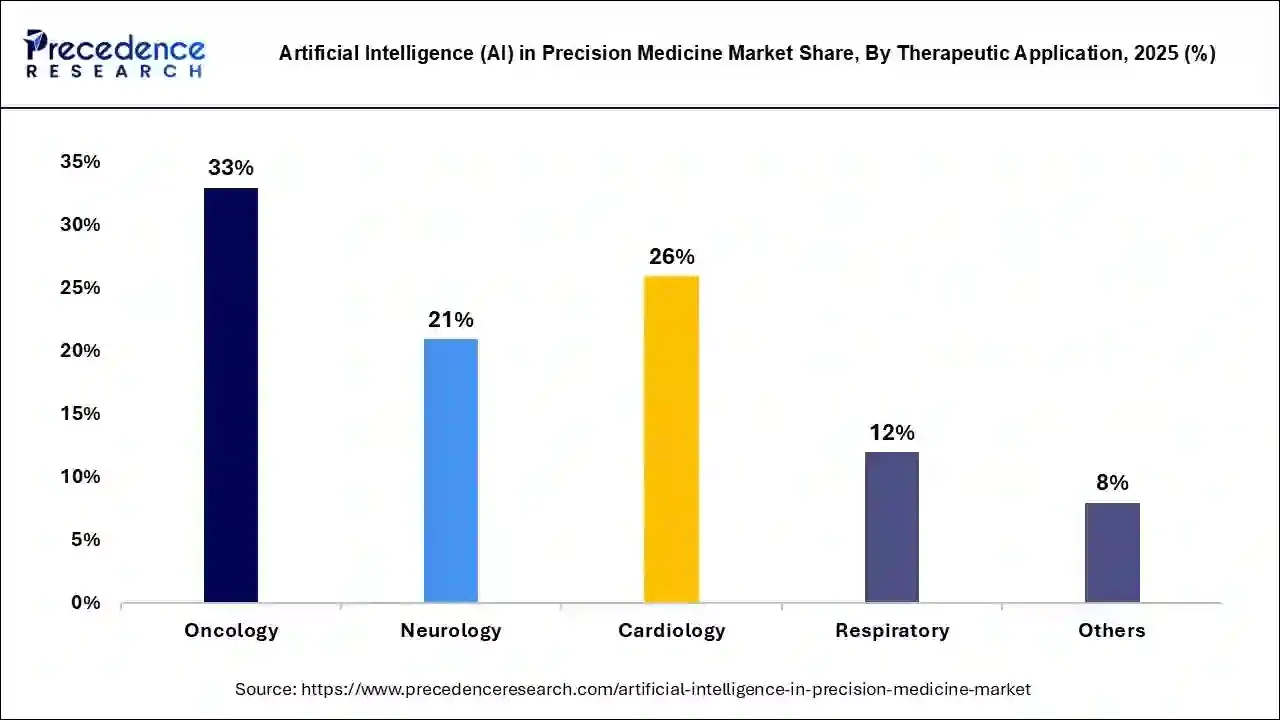

- By therapeutic application, the oncology segment contributed the highest market share of 31% in 2025.

- By therapeutic application, the neurology segment is expected to expand at a double digit CAGR of 36.93% during the forecast period.

Artificial Intelligence (AI) in Precision Medicine: a Tech-Overview

The ever-increasing need and demand for tailored medications, the growing number of people living with various types of diseases such as respiratory illnesses and heart diseases, and rapidly increasing R&D spending globally, combined with the large number of companies that are progressively adopting collaborations and partnerships as key market strategies are key factors driving the global market growth.

Furthermore, the increasing accessibility to digital health-related data and research methodology for data analysis will create tremendous opportunities and development potential for the market in the near future. Cerba announced an arrangement with Taliaz in October 2022 to provide physicians with AI-based psychiatry services. The recently developed test solution assists physicians in making more precise and rapid decisions for their patients, increasing their chances of a fast recovery.

Artificial Intelligence (AI) in Precision Medicine Market Growth Factors

- There is a high demand for personalized treatments among patients, which boosts the growth of the market. Artificial intelligence helps develop tailored treatments by analyzing individual patient's genetic makeup and other health data.

- With the growing burden of chronic diseases worldwide, there is a high demand for targeted treatments. Thus, governments worldwide are investing in research programs to develop innovative medicines.

- The rising adoption of AI technologies in drug discovery and development processes contributes to market expansion.

- Advances in genomics further propel the growth of the market. AI processes a large genomic data set while linking massive data sets from EHRs, wearable devices, and clinical trials, paving the way for targeted therapies.

- The increasing collaborations between pharmaceutical and technology companies accelerate the development of AI-driven solutions in precision medicine.

- The rising adoption of AI-powered diagnostic tools further boosts the market. AI algorithms analyze medical images quickly and precisely, leading to early diagnosis and paving the way for the development of tailored treatments.

Market Outlook

- Start-up Ecosystem : The start-ups heavily expanded in the healthcare sector, mainly when the term ‘precision medicine' came into the demand frame. With the trend of AI, the AI experts explored the particular relevant spots like drug development, chronic disease management, and the oncology field. The extremity calls for accuracy, and so the start-ups accelerated globally through high investments, partnership deals, and acquisitions. The start-ups are introducing new responsible innovation in AI-driven diagnostics and suitable areas where severity demands precision.

- Industry Growth Overview : Industry growth is in the limelight and extended due to the growing prevalence of chronic conditions, lower genomic sequencing cost, and the unification of AI. ML and AI could attract healthcare research and development via governments' support, trust, and investment.

The therapeutics and diagnostics hold a massive share in AI in the precision medicine sector. Hospitals and clinics are the major end users of AI precision medicine. This is a new era for AI to meet the needs of the healthcare sector and patients, ensuring safe and effective results.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.15 Billion |

| Market Size in 2026 | USD 4.28 Billion |

| Market Size by 2035 | USD 60.24 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 34.33% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Technology, By Component and By Therapeutic Application, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising cancer prevalence.

The increasing prevalence of cancer around the world has boosted market growth. According to WHO data, cancer will account for approximately 10 million deaths worldwide in 2020. Rising sedentary lifestyle adoption and high consumption of tobacco and alcohol are two key factors that are favorably impacting cancer prevalence rates. Rising R&D investment is also propelling the market forward.

The African Access Initiative (AAI) is a collaboration of private and public sector organizations that addresses South Africa's cancer crisis by increasing the availability of cancer treatments and diagnosis and establishing technically sophisticated healthcare infrastructure.

Rising prevalence of older people and increasing chronic diseases.

One of the major causes of rising diseases and ailments such as high cholesterol, strokes, CVDs, hypertension, diabetes, aneurysms, and cancer is the rapidly increasing population of the older age group. Aging is considered to be the main factor in cardiac health decline; hence aging population is the primary predictor of market growth.

As per WHO, one in every six individuals will be 60 years or above by 2030. Over the projected period, the abovementioned factors will lead to a rise in the usage of artificial intelligence based precision medicines.

Restraints

Potential security risks

The most obvious disadvantage of artificial intelligence in healthcare is that it results in a data privacy breach. As it grows and develops based on the information gathered, it is also vulnerable to data collected being abused and taken by the criminal. While AI may try and cut expenses while decreasing clinician tension, it may also make some jobs redundant.

This variable may result in the displacement of professionals who have invested time as well as money in healthcare learning, posing equity issues. For instance, in July 2022, OneTouchPoint observed a breach that impacted nearly 2,651,396 people.

Opportunity

Sales of AI in precision medicine are skyrocketing as popular companies seek to maintain their position in the market through collaborations and partnerships. Intel, for example, collaborated with the Perelman School of Medicine at the University of Pennsylvania to develop an AI model that aids in the identification of brain cancer. Penn Medicine worked with 29 international organizations to create this tool, which uses a privacy-preserving technique known as federated learning.

Segment Insights

Technology Insights

The deep learning segment has held a major market share of 35% in 2024. The expansion of the segment is due to high processing power, developments in data center capabilities, as well as the ability to conduct processes without human intervention. The recent deep learning algorithms are able to model and integrate various data from a single individual across time and modalities, which allows better treatment recommendations as well as an increased prediction for each patient.

Natural language processing segment is expected to expand at a remarkable CAGR of 36.78% during the forecast period.Natural Language Processing (NLP) is the study of text and voice in order to derive the meaning of words. NLP is the practice of using computer algorithms to identify key features in a universal language and derive information from unstructured spoken or written data. This technology will be critical in accelerating healthcare decision-making procedures.

The true advantage of developing effective algorithms is based on the accuracy of the data collected. A faster decision-making procedure enables physicians to focus on patient-value-added treatments.

Component Insights

The software segment accounted for the highest market share of 42% in 2024,due to the rapid adoption of artificial intelligence-based software solutions in precision medicine by institutions, healthcare payers, patients, and providers. The growth is also due to the rising use of AI technology in various healthcare applications, such as cybersecurity, reduction of dose error, clinical trials, virtual assistants, telemedicine, fraud detection, and robot-assisted surgery. Furthermore, private and government initiatives propel the growth of the segment.

Due to the introduction of innovative startups and entrepreneurship, which provide innovative cancer diagnosis and treatment as well as prediction solutions, the service sector is anticipated to expand at a remarkable CAGR during the projected period. Some players offer software services that use an ML method based on extensive knowledge of scientific prediction to estimate cancer progression, assisting in accurately predicting cancer progression as a response to therapy.

Therapeutic Application Insights

The oncology segment contributed the highest market share of 31% in 2024. The application of Artificial Intelligence in oncology helps in more accurate and faster cancer diagnosis, which results in enhanced patient income and is anticipated to propel the sector expansion over the predicted period. The most significant factor expected to propel the oncology sector is the growing prevalence of cancer as well as the rising development of medical infrastructure.

Moreover, a severe shortage of healthcare personnel in hospital facilities, such as physicians and nurses, is expected to increase the demand for technology. Since these experts are in short supply, AI is anticipated to have a significant role in patient care. AI has numerous applications in oncology. CanAssist Breast (CAB) helps women with breast cancer personalize their treatment. CAB uses AI to forecast the probability of cancer relapse for each patient, which clinicians use to plan treatment.

The neurology segment is expected to expand at a double digit CAGR of 36.93% during the forecast period.The growing incidence of neurological disorders like epilepsy, dementia, migraines, Alzheimer and brain tumor, is anticipated to propel segmental growth. The demand for early detection of neurological diseases as well as advancements in technologies is also driving the sector expansion. Artificial intelligence is able to treat patients affected by strokes by providing precision treatment. AI improves intra-operative, postoperative, and pre-operative stages of brain surgery.

Regional Insights

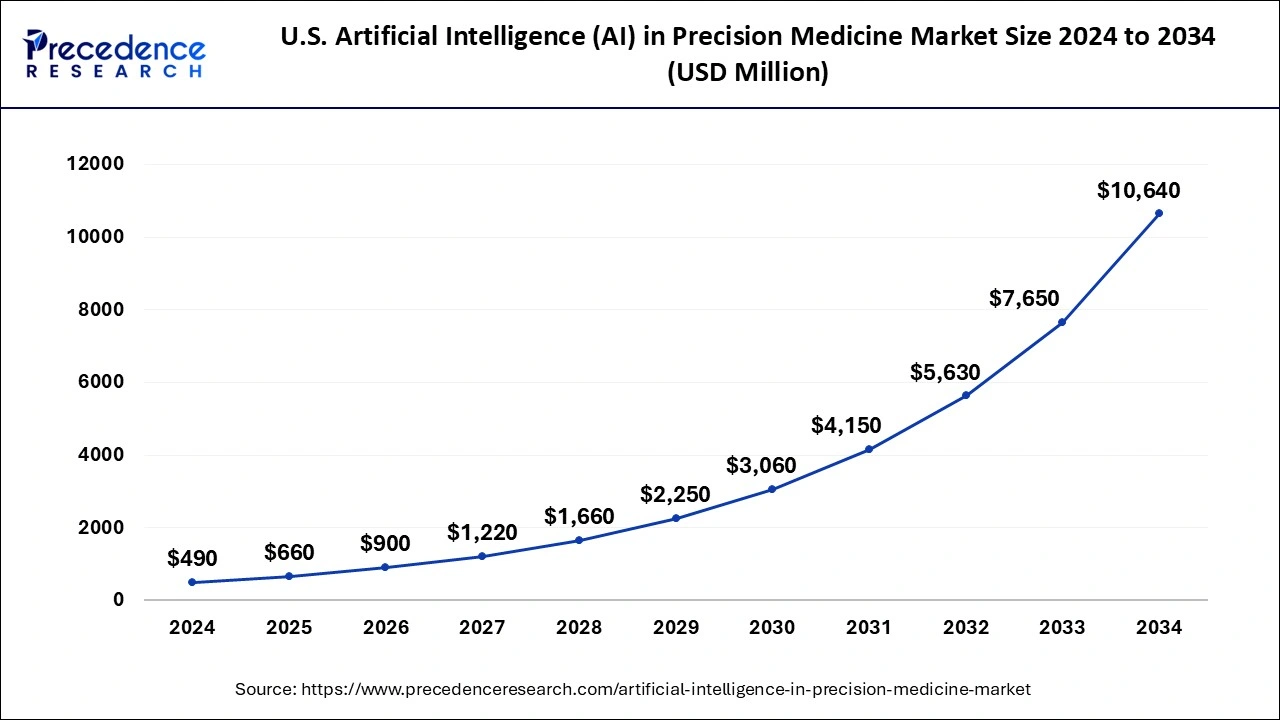

U.S. Artificial Intelligence (AI) in Precision Medicine Market Size and Growth 2026 to 2035

The U.S. artificial intelligence (AI) in precision medicine market size was evaluated at USD 660 million in 2025 and is predicted to be worth around USD 12,983 million by 2035, rising at a CAGR of 34.7% from 2026 to 2035

North America dominated the global artificial intelligence (AI) in precision medicine market with the largest market share of 30% in 2024. The growth of the market in this region is due to the rising R&D expenditure as well as the increasing need for personalized medicine. Moreover, collaboration among significant companies is fostering growth. For instance, in August 2022, Atomwise and Sanofi signed a USD 20 million contract.

Europe is predicted to grow at the fastest CAGR of 36.8% during the forecast period. The growing incidence of chronic diseases as well as the increasing elderly population, contribute to the rise in the need for improving and diagnosing infections in the initial phases. Various companies are implementing strategies to hold a competitive advantage over others. For instance, Nuclear and Merck KGaA Darmstadt announced a partnership to use image analysis and discover abiomarker platform.

Asia Pacific's Expansion in Artificial Intelligence (AI) in Precision Medicine

Asia Pacific believes in taking responsibility for the growing expansion of AI in precision medicine. The expansion is spurring with immense genomic data initiatives and governments' financial support. As of now, in the healthcare sector, AI is a safe trend accepted by the Oncology field, for better women's health.

The AI startups, platforms, and existing companies' collaborative initiatives have lessened the diagnostic errors in medical imaging. From drug discovery to genomic analysis, the regional AI-sponsored movements are accelerating the growth of AI in the precision medicine sector.

Latin America's Artificial Intelligence (AI) in Precision Medicine Edition

Latin America's AI in precision medicine edition is about research consortia, educational hubs, and private sector involvement and interest in AI. AI's role in various applications has developed a certain level of accuracy. The genomic research initiatives, such as Project Jaguar and LatinCells, prepares AI ready data bundles with the help of admixed and indigenous cohorts.

This further generates a people-based reference group or panel. Whereas in oncology, the AI is utilised for diversified indications in liquid biopsies for radiomics and to check early-stage lung cancer. This helps to differentiate the healthy and active good tissues from tumors with more precision.

Artificial Intelligence (AI) in Precision Medicine Market Companies

- Novo Nordisk A/S

- GE Healthcare

- Intel Corporation

- NVIDIA Corporation

- Microsoft Corporation

- Alphabet Inc.

- IBM Corporation

- BioXcel Therapeutics Inc.

- Enlitic Inc.

- AstraZeneca

- Sanofi

- Zephyr AI

- Sensely Inc.

- Tempus

- Berg LLC

- Insilico Medicine

- Modernizing Medicine Inc.

- Atomwise Inc

Recent Developments

- In October 2024, the leading AI precision medicine company Ataraxis AI emerged from stealth with USD 4 million in seed funding co-led by Giant Ventures and Obvious Ventures. The funding, raised in 2023, enabled Ataraxis to develop groundbreaking AI-driven diagnostic tests that significantly enhance the prediction of patient outcomes and enable more precise, personalized treatments.

- In May 2023, at the Bio-IT World Conference, Google Cloud announced two new AI-powered life sciences solutions, Target and Lead Identification Suite and Multiomics Suite. These solutions accelerate drug discovery and the development of precision medicine.

Segments Covered in the Report

By Technology

- Machine Learning

- Querying Method

- Deep Learning

- Context-Aware Processing

- Natural Language Processing

By Component

- Hardware

- Software

- Service

By Therapeutic Application

- Oncology

- Neurology

- Cardiology

- Respiratory

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting