January 2025

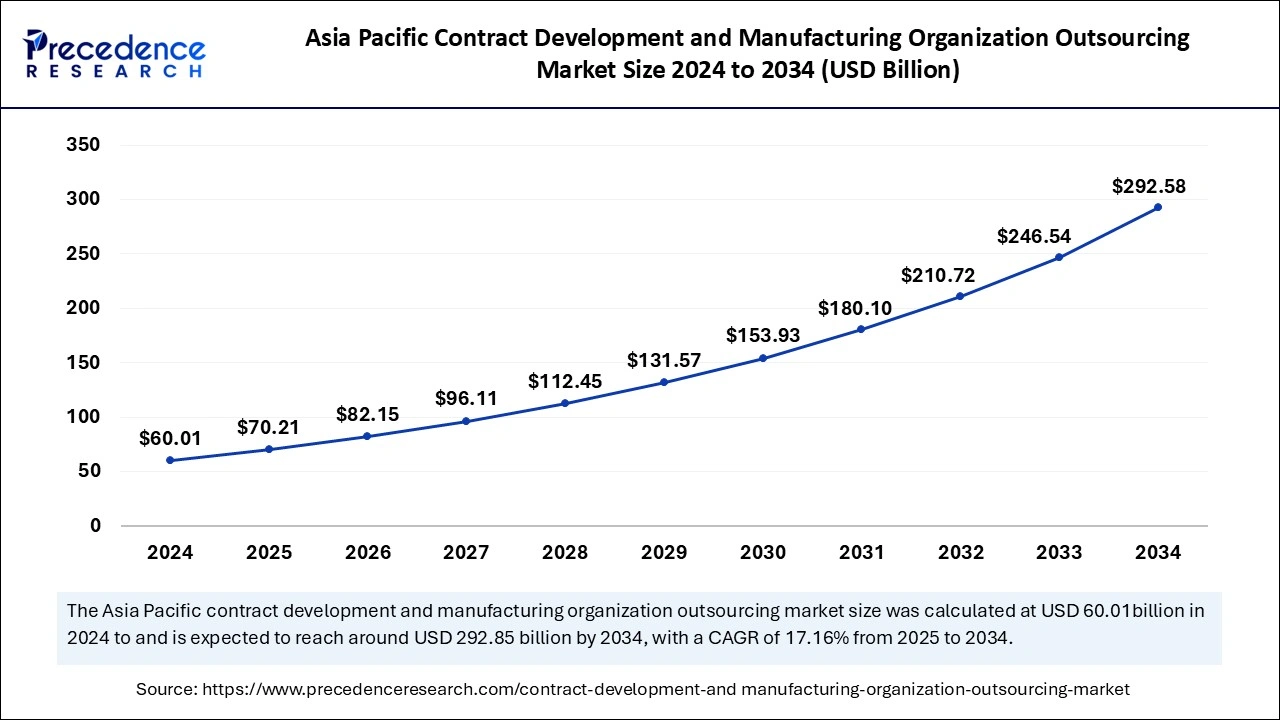

The global contract development manufacturing organization outsourcing market size is calculated at USD 200.60 billion in 2025 and is forecasted to reach around USD 824.16 billion by 2034, accelerating at a CAGR of 17.00% from 2025 to 2034. The Asia Pacific market size surpassed USD 60.01 billion in 2024 and is expanding at a CAGR of 17.16% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global contract development manufacturing organization outsourcing market size was estimated at USD 171.46 billion in 2024 and is predicted to increase from USD 200.60 billion in 2025 to approximately USD 824.16 billion by 2034, expanding at a CAGR of 17.00% from 2025 to 2034. The demand for contract development and manufacturing organization outsourcing market is attributed to the fact that it allows pharmaceutical companies access to specialized expertise, advanced technologies, and manufacturing capabilities.

The integration of artificial intelligence into the contract development manufacturing organization outsourcing market has the potential to improve efficiency, streamline processes, and enhance data analysis by leveraging machine learning algorithms to optimize critical process parameters, make data-driven decisions, and predict potential issues for drug development and manufacturing lifecycles.

In recent times, the incorporation of agentic AI has been popularly noticed. It offers an autonomous analysis of client-provided data and a conclusion based on work completion to data. AI specialists, pharmaceutical firms, and regulatory agencies must collaborate in order to create guidelines and standards for the responsible application of AI in drug development manufacturing.

The Asia Pacific contract development manufacturing organization outsourcing market size was exhibited at USD 60.01 billion in 2024 and is projected to be worth around USD 292.58 billion by 2034, growing at a CAGR of 17.16% from 2025 to 2034.

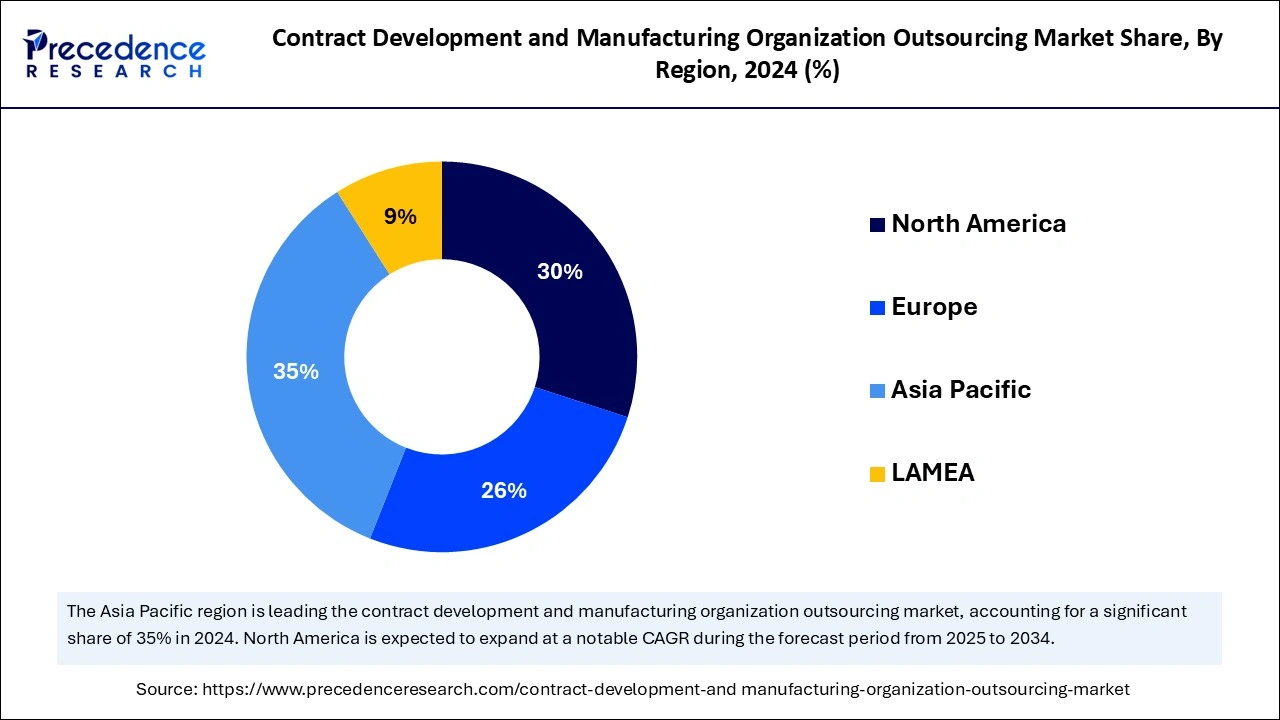

North America is observed to be the fastest growing region in the global contract development manufacturing organization outsourcing market during the forecast period The growth of this region is primarily driven by the strong key leaders, which include Catalent, Lonza, Thermos Fisher Scientific, Boehringer Ingelheim Pfizer CentreOne, and many more. These companies have made significant progress and are established in a wide range of services such as drug discovery, preclinical and clinical trials, API manufacturing, and many more. The United States is the largest pharmaceutical manufacturing nation in the world, producing medicine for about USD 516 billion. The are almost 30 pharmaceutical CDMOs supporting the industry. Moreover, the rising investments in the production of precision medicine across the region is observe to support the growth of the market.

Asia Pacific held the largest share of the contract development manufacturing organization outsourcing market in 2024 and is seen to sustain the growth during the forecast period till 2034. The dominance of this region is particularly noticeable due to the increasing demand for pharmaceuticals and healthcare expenditures. The countries in Asia Pacific which show dominance in the region are China, India, and South Korea. They produce drugs at low cost while emphasizing research and development activities with their own companies. The extensive government support for the pharmaceutical industry offered multiple factors for the region to dominate.

CDMO (contract development and manufacturing organization) outsourcing is a practice followed by pharmaceutical or biotechnology companies, which hire CDMOs to handle their drug development and manufacturing processes. When a company is looking to partner with a CDMO to manufacture a new drug, it verily means the company is planning to outsource the manufacturing process to a CDMO. Several pharmaceutical companies transfer a portion of their work to outside suppliers to reduce costs. The contract development manufacturing organization outsourcing market services involves research and development, manufacturing, clinical trial, packaging, and sales and marketing.

| Report Coverage | Details |

| Market Size in 2024 | USD 171.46 Billion |

| Market Size in 2025 | USD 200.60 Billion |

| Market Size by 2034 | USD 824.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.00% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Service, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising production of generic injectables and biologics

The increase in the production of biosimilars is predominantly driven by the expiration of the patent on branded drugs. This allows manufacturers to enter the contract development manufacturing organization outsourcing market with low-cost alternatives, rising competition, and significant growth. Sterile injection is particularly popular due to its growing demand for affordability and advanced manufacturing technology. FDA has established clear guidelines for approving biosimilar or generic injectables and biologics, which increases the availability of generic options. The availability improves easy access to patients for critical medication. Furthermore, the rise in automation and robotics is expected to witness in injectable production.

Regulatory standards

Pharmaceutical regulation compliance is hindering the contract development manufacturing organization outsourcing market. Regulatory bodies such as the FDA and EMA imply strict rules to ensure drug safety and efficiency. Significant resources and expertise are required for adherence, which keeps updating and has established bonds with regulatory agencies. By partnering with CDMOs, a company gains access to knowledge and experience, reducing the risk of non-compliance. Regulations are mandatory for the business to grow, but the restriction from regulatory agencies creates obstacles that retrain the market to some extent.

Support from pharmaceutical and biotech companies

The contract development manufacturing organization outsourcing market is evolving with adaptive, technologically advanced, and global connections. The continuous and constant support from pharmaceutical and biotechnology companies in contract development and manufacturing organizations is anticipated to be witnessed in the coming future. There will be an exception growing to emphasize the biopharmaceutical industry.

CDMOs are expected to receive a great deal of investment in facilities that help in the production of biologics and other therapies. The advancing manufacturing techniques in the contract development manufacturing organization outsourcing market are expected to bring production efficiency, reduce waste, and enable fast scaling for drug products. Witnessable expansion towards personalized medicines is increasing the adoption of CDMOs for flexible production models that encourage small-batch manufacturing, which is a crucial component of individual therapies.

The biologics segment held the largest contract development manufacturing organization outsourcing market share in 2024. The expansion of this segment is observed due to its ability to offer innovative development and manufacturing services and technologies from the last stage of drug discovery into CDMO. Biologics products include vaccines, allergenic, blood, and blood components, gene therapy, somatic cells, and recombinant therapeutic proteins. This segment is highly driven by the rising need for biological medicinal products and small-molecule drugs.

The small molecules segment is anticipated to grow at a remarkable CAGR during the forecast period. CDMOs offer formulation and development of small molecule drugs, ensuring optimal bioavailability and stability. They provided advanced formulation services tailored to the specific needs of every drug. The common application of small molecules includes ibuprofen, aspirin, and metformin. These are widely used to treat pain, inflammation, and type 2 diabetes.

The drug product manufacturing segment captured the biggest share of the contract development manufacturing organization outsourcing market in 2024. The dominance of this segment is noted as drug product manufacturing facilitates CDMO outsourcing in researching the drug safety profile, identifying errors, and formulating development, which includes tables, capsules, liquids, and injectables. Analytical testing ensures the drug product’s quality and consistency, as well as clinical trials, which offer investigational medical products (IMP) and documentation for clinical trials. Several pharmaceutical companies outsource drug manufacturing to CDMOs as they offer access to capacity or technologies.

On the other hand, the API/Bulk Drugs segment is predicted to grow at the greatest CAGR from 2025 to 2034. Api refers to active pharmaceutical ingredients, which are key compounds that provide therapeutic effects. This segment is particularly demanding when there is a requirement to manufacture large quantities of formulated final drug products such as tablets or injections. There is a gradual and slow growth of bulk drugs as they need extremely careful protection during storage and transport.

By Product

By Service

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

January 2025

December 2024