June 2025

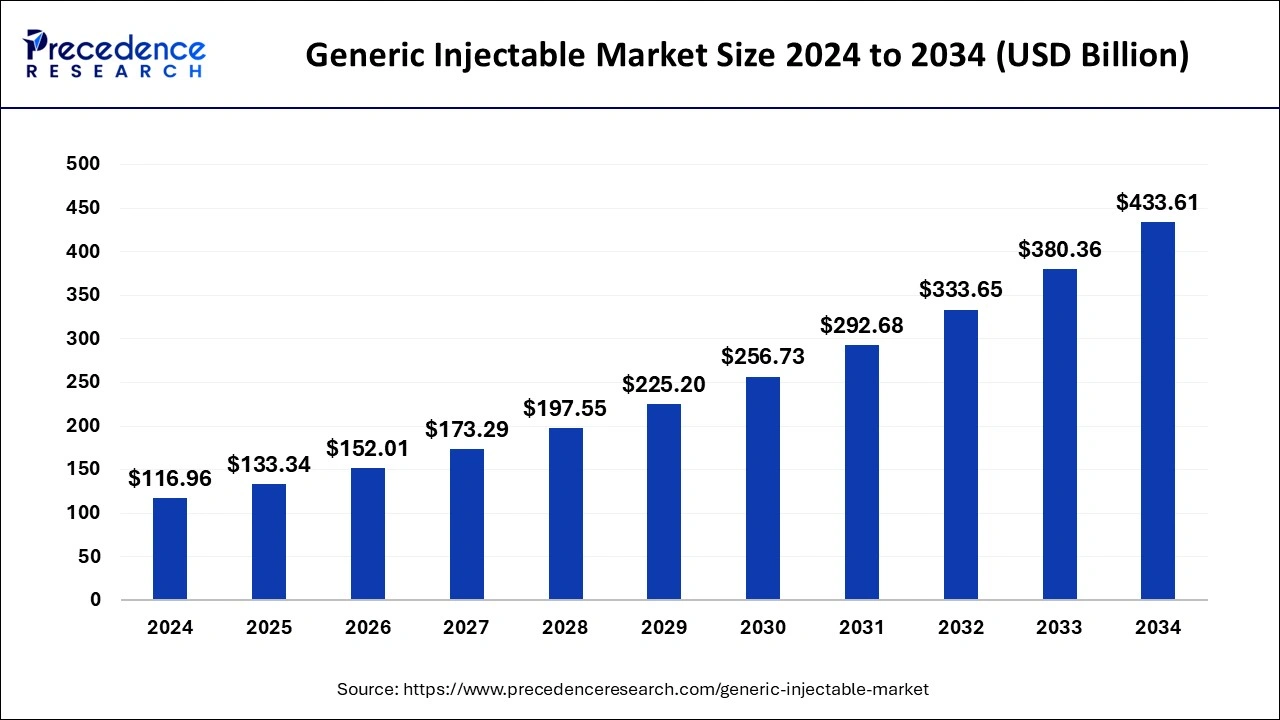

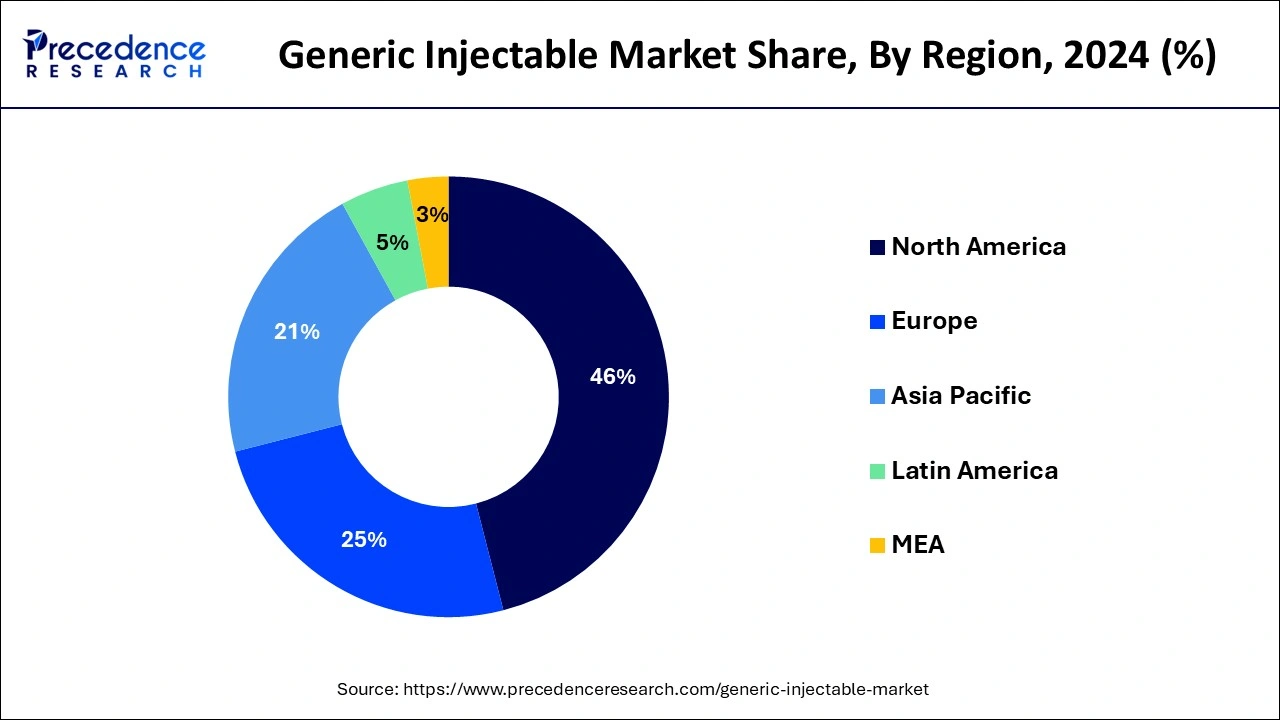

The global generic injectable market size is calculated at USD 133.34 billion in 2025 and is forecasted to reach around USD 433.61 billion by 2034, accelerating at a CAGR of 14% from 2025 to 2034. The North America generic injectable market size surpassed USD 53.80 billion in 2024 and is expanding at a CAGR of 14.12% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global generic injectable market size was calculated at USD 116.96 billion in 2024, and is expected to reach around USD 433.61 billion by 2034. The market is expanding at a solid CAGR of 14% over the forecast period 2025 to 2034. The growth of the generic injectable market is driven by the increasing prevalence of chronic diseases, rising government funding in drug discovery and development, and ongoing technological advancements.

Artificial intelligence (AI) has the potential to accelerate drug development processes. One significant application of AI is the identification of biosimilars, which are biological medical products. AI can streamline this process by analyzing complex biological data, facilitating faster development of effective alternatives to existing therapies. Additionally, AI plays a crucial role in researching drug compound crystal structures. By employing advanced machine learning algorithms, researchers can predict and analyze drug compounds' crystallization behaviors and properties, optimizing formulations for better efficacy and stability. Furthermore, AI can enhance salt and polymorph screening. This involves identifying different forms of a drug compound and understanding how these variations can impact solubility, stability, and bioavailability. Utilizing predictive analytics in this context allows for more efficient exploration of potential drug candidates and helps select the most promising options earlier in the development process.

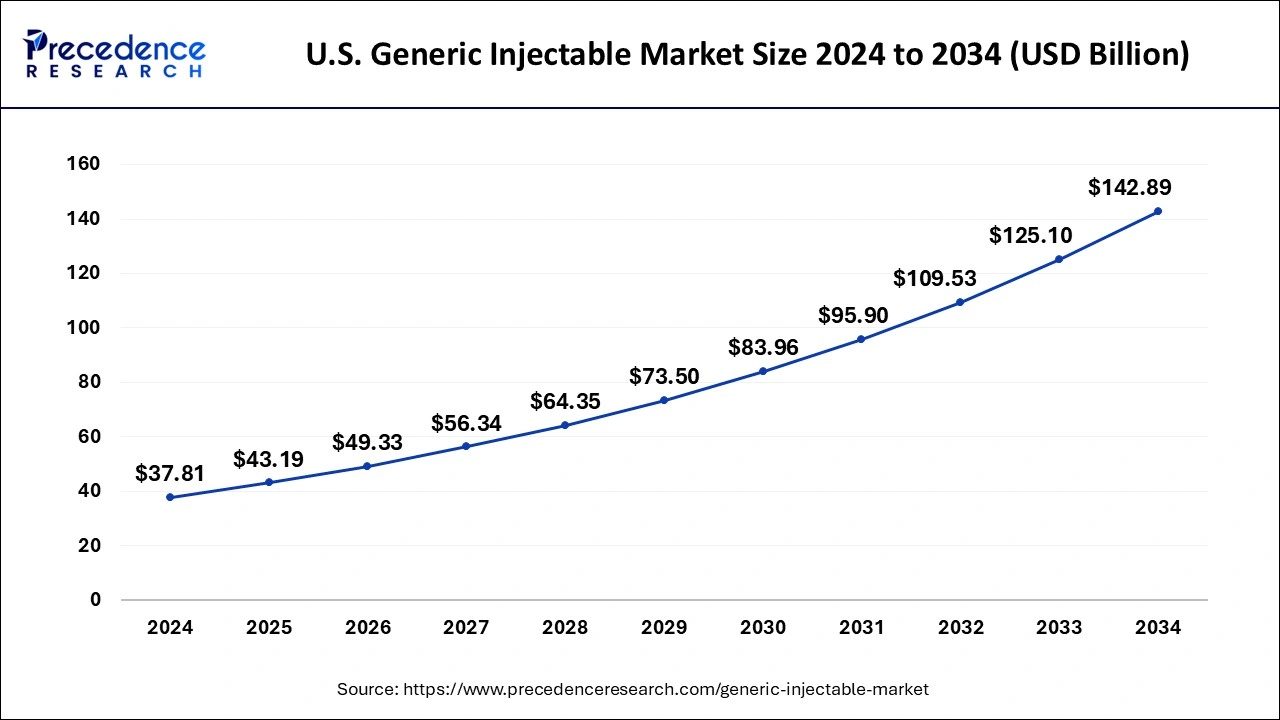

The U.S. generic injectable market size was estimated at USD 37.81 billion in 2024 and is predicted to be worth around USD 142.89 billion by 2034, at a CAGR of 14.2% from 2025 to 2034.

Segmentation of generic injectables based on geography sector North America to be the leading region with highest market growth of the generic injectables with increased development of the generic injectables with increased research and development from the key market players for introducing the generic injectables with increased demand from the health care center due to shortage of the injectable with increased chronic infectious diseases among the population with increased hospitalization rate of the patients.

Asia pacific region also helps to boost the market growth with increased demand from the health care centre for generic injectables with increased chronic diseases increasing due to rising population. Other regions such as Europe, Latin America, Middle East and Africa contributes to increase the market of generic injectables to a larger extend.

The generic injectable drug is the compound having therapeutic characteristics with increased efficiency, potent. Which focus to kill the disease or the chronic infection. The generic drug basically is the chemical substance with increased developments and continuous research have increased the availability of the generic drugs in the market with fast approval of the drug. There are two categorisation involves generic drug and branded drug. Generic drug is basically same with the branded drug with same active pharmaceutical ingredient, with equal safety, quality, strength, efficiency, output of the drug, route of administration is same of both generic and branded drugs.

Therefore, increased focus on producing and manufacturing the generic drug with increased efficiency and decreased adverse drug reactions of the generic drugs. Increased chronic diseases among the population with increased medications enhanced the market of generic injectable drugs. Changing lifestyle of the people with increased diseases strives the market growth. Increased various new launch of the generic drugs as that of branded drugs with expiry of patents which reduced the new launch of the drug. Which helps to boost the market of generic injectable.

| Report Coverage | Details |

| Market Size in 2025 | USD 133.34 Billion |

| Market Size by 2034 | USD 433.61 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 14% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Molecular Type, Application, Administration, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of chronic infectious diseases

Increased population in the regions with increased infectious diseases among the people which led to increased number of patients for hospitalization with increased demand for the generic injectable drugs. Branded drugs come with patent expiry with decreased launch of the new generic injectable drug therefore expanded the demand for the generic injectables with similar efficacy, quality, strength, potent, safety. Which boosts the generic injectable market to a greater extend.

Cost effectivity of the generic injectables

Key Market Opportunities

Monoclonal antibodies to hold the highest market share with increased revenue during the forecast period of generic injectables.

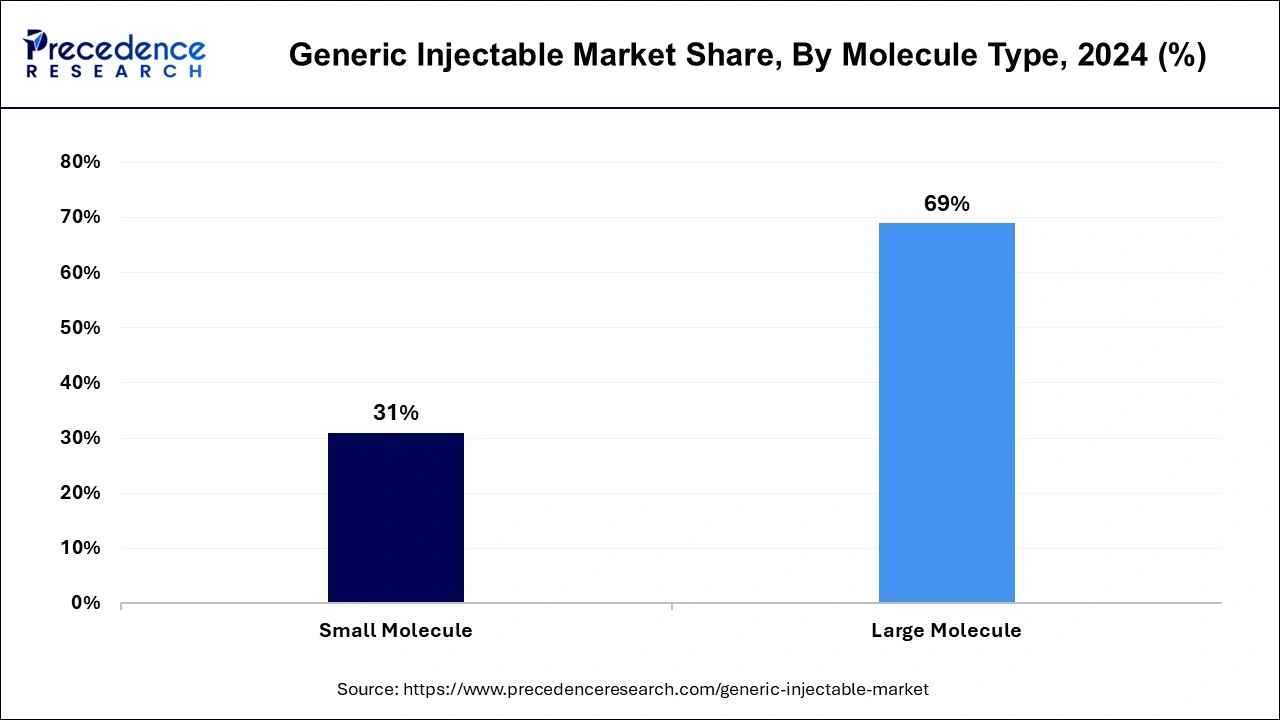

The large molecule segment has held a major market share of 69% in 2024. Increased research and development in large molecules for developing the generic injectables with increased opportunity and increased share in the market. Which helps to increase the market of generic injectables. However, the small molecule segment hold a second largest position with a 31% of market share in 2024.

Increased growth of the diabetes disease with increased life style and dietary supplements with high rate of patients among the population due to the previous family or increased obesity. Which led to increase of the diabetes with increased demand for the generic injectables. Oncology is also rising from the year 2023 with increased chemotherapies and generic injectables with high demand for the medication from the health care centre. However, the diabetes segment is growing at the strongest CAGR from 2025 to 2034.

Segmentation of generic injectables based on distribution channel involves Hospital pharmacy, retail pharmacy, drug stores and online pharmacy. Due to increased chronic infectious diseases with enlargement of the hospitals with their own hospital pharmacy increase growth of the hospital across the regions. Hospital pharmacy to hold the largest market.

By Product Type

By Molecular Type

By Application

By Administration

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2025

April 2024

June 2025

February 2025