February 2025

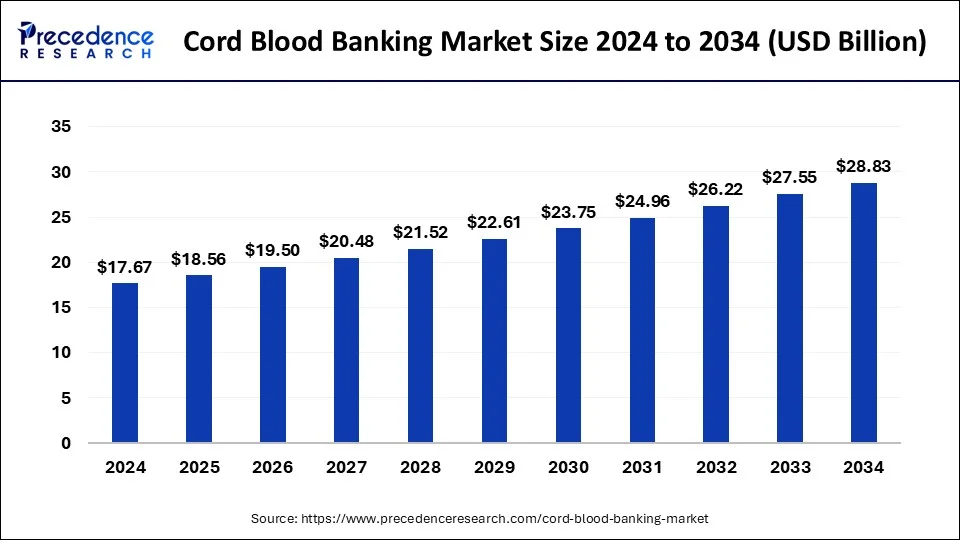

The global cord blood banking market size is calculated at USD 18.56 billion in 2025 and is forecasted to reach around USD 28.83 billion by 2034, accelerating at a CAGR of 5.02% from 2025 to 2034. The North America cord blood banking market size surpassed USD 6.71 billion in 2024 and is expanding at a CAGR of 5.16% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cord blood banking market size was estimated at USD 17.67 billion in 2024 and is predicted to increase from USD 18.56 billion in 2025 to approximately USD 28.83 billion by 2034, expanding at a CAGR of 5.02% from 2025 to 2034. The global cord blood banking market is projected to grow, driven by advancements in therapeutic applications, unexplored opportunities in developing regions, and initiatives to raise awareness.

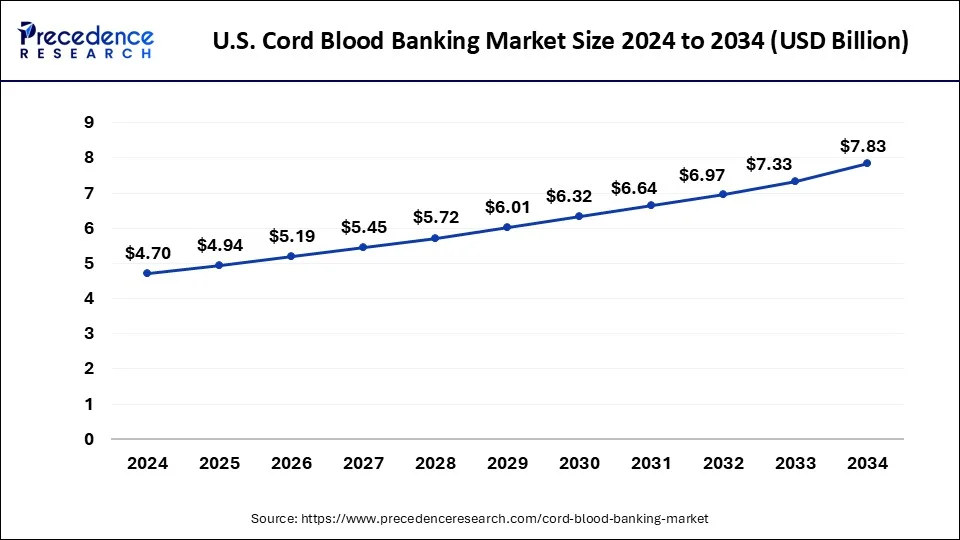

The U.S. cord blood banking market size was estimated at USD 4.70 billion in 2024 and is predicted to be worth around USD 7.83 billion by 2034 at a CAGR of 5.24% from 2025 to 2034.

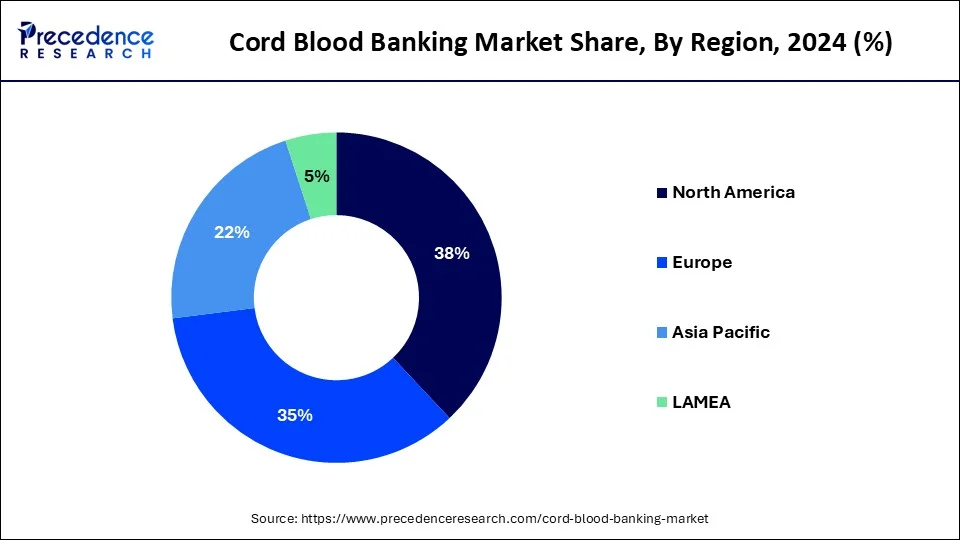

North America held the largest market share of 38% in 2024 and is projected to sustain the position during the forecast period. Increased awareness of the benefits of banking cord blood and cells, especially with advancing therapeutic applications, contributes to the growth. Expansion of the stem cell banking services network, ongoing approval of stem cell lines for disease treatment, technological advancements in collection and preservation techniques, and substantial public-private investments in stem cell research are key factors driving the expansion of the North American stem cell banking market. Government funding for research and development initiatives, particularly in clinical trials involving cord blood stem cells, further supports this growth.

Europe is the fastest-growing region for the cord blood banking market during the projected period. The recommendations outlined in the UK Stem Cell Strategic Forum report are set to be implemented with substantial government funding to improve stem cell services in the UK. The government is actively working toward establishing a cost-effective and strategic approach to achieve its goal of a cord blood bank with 50,000 units. Moreover, the rising number of solid organ transplant recipients facing long-term immunosuppression and post-transplant lymphoproliferative diseases is pressuring the government to enhance healthcare services, further supporting the growth of cord blood banking services in the European region.

The cord blood banking market revolves around offerings that involve extracting stem cells and immune system cells from the umbilical cord and preserving them through cryogenic storage for potential medical applications. Despite its small volume, cord blood is a rich source of stem cells, presenting a promising treatment option for over 80 hereditary diseases such as cancer, blood disorders, diabetes, and immunological conditions. Collected from hospitals and nursing homes, these cells are stored in cord blood banks, ensuring their viability for an average of 20-25 years to meet future medical needs. The interest and investment from healthcare businesses in cord blood stem cell therapies have increased due to government support for research and clinical trials, leading to the establishment of both private and public cord blood banks.

| Report Coverage | Details |

| Market Size by 2034 | USD 28.83 Billion |

| Market Size in 2025 | USD 18.56 Billion |

| Market Size in 2024 | USD 17.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.02% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Bank, Services, Application, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing awareness of stem cell therapeutics

Global awareness of the therapeutic potential of stem cells is on the rise, supported by a growing body of clinical evidence. Stem cells have proven effective in treating over 80 diseases and conditions, including cancer, immunodeficiency diseases, metabolic disorders, and degenerative neuromuscular disorders. Over the forecast period, an increase in public awareness and adoption of stem cell therapies and banking services is expected, driven by rising per capita disposable income in developing countries and anticipated cost reductions associated with these treatments.

Cord blood banking market has expanded rapidly in developed nations like the U.S. and Europe, driven by increased awareness among expectant parents. However, customers need help with high prices and complex banking procedures. Various public and private organizations are launching awareness campaigns in Brazil, China, and India to address this.

Stringent rules & regulations and high cost

Cord blood banking is known for painless procedures for both mothers and children, the expenses factor associated with the procedures acts as a major restraint for the cord blood banking market. Strict regulations associated with cord blood banking services also create a significant hampering factor for businesses to expand. Moreover, the approval process for establishing stem cell banks is critical. Thereby, the factor is observed to limit the growth of the cord blood baking market.

Rise in government funding

Cord blood banking services are primarily utilized for treating hereditary diseases, particularly various cancers. The market is expected to expand due to the increasing incidence of cancers like lymphoma, leukemia, immune disorders, and sarcoma in countries such as the United States, China, India, and Europe. The World Health Organization reports many new cases and deaths related to non-Hodgkin lymphoma. The rising demand for cord blood banking services is directly linked to the growing number of cancer patients. Additionally, increased government funding, such as the thirty-eight million dollars invested by the National Institutes of Health in cord blood cell research, is a crucial factor driving growth of the cord blood banking market during the anticipated period.

Rising emphasis on treating hematological disorders

The growth of the cord blood banking market in the forecast period is driven by factors such as government funding, increased investments in public storage, a rise in fatal chronic disease incidences, ongoing research for diverse cord blood applications, and growing public awareness of advanced therapeutics. Hematological disorders related to blood and blood-producing organs, including Sickle cell anemia, thalassemia, leukemia, lymphoma, hemophilia, and others. Are on the rise globally. The increasing incidence of leukemia contributes to the demand for cord blood cells.

The private bank segment in the cord blood banking market is expected to grow at a significant rate during the forecast period. Agents are charged a substantial fee for collecting and storing cord blood (CB) units, contributing to the dominance of the private banking service segment in the global market. Private players attract more customers through effective marketing strategies. Factors expected to boost public banks' growth include increased chances of finding a compatible match for patients' blood and the potential risk of stored blood units in private banks being unusable.

The processing segment dominated the cord blood banking market in 2024. Cord blood processing involves separating and extracting stem cells from red blood cells. This process utilizes automated systems and technicians employing sedimentation and centrifugation methods. The dominance of the processing segment is attributed to the growing clinical trials and research on cord blood, coupled with an increase in the prevalence of hematological disorders, contributing to industry revenue growth.

The cancer segment significantly contributed to the cord blood banking market and is anticipated to grow at a significant rate during the forecast period. Cord blood stem cell transplants have proven effective in treating adult and pediatric cancer patients, with over 35,000 global transplants conducted. Most of these transplants have been performed to address conditions like leukemia and other blood abnormalities. It's important to note that donors other than the child's cord blood are utilized for cord blood transplants in children with leukemia or blood disorders.

The hospital segment dominated the cord blood banking market in 2024. The increasing awareness of the applications of cord blood banking is expected to boost the demand for cord blood banking processing in hospitals, thereby driving market expansion. The development of the storage infrastructure for cord blood in public and private healthcare settings is slated to accelerate the industry value.

By Type of Bank

By Services

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

April 2025

January 2025

August 2024