April 2025

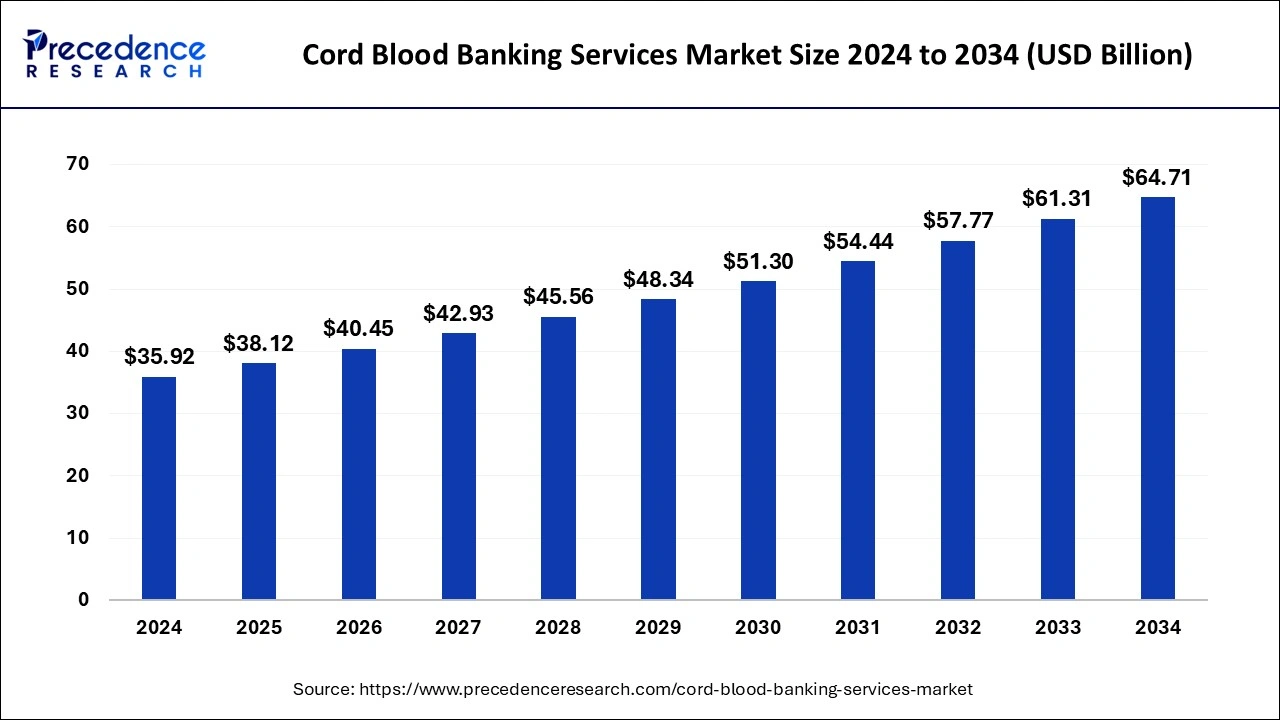

The global cord blood banking services market size is calculated at USD 38.12 billion in 2025 and is forecasted to reach around USD 64.71 billion by 2034, accelerating at a CAGR of 6.06% from 2025 to 2034. The North America cord blood banking services market size surpassed USD 15.80 billion in 2024 and is expanding at a CAGR of 6.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cord blood banking services market size was estimated at USD 35.92 billion in 2024 and is predicted to increase from USD 38.12 billion in 2025 to approximately USD 64.71 billion by 2034, expanding at a CAGR of 6.06% from 2025 to 2034. The simplicity and safety of cord blood for harvesting stem cells are growing the demand for cord blood banking services in the market.

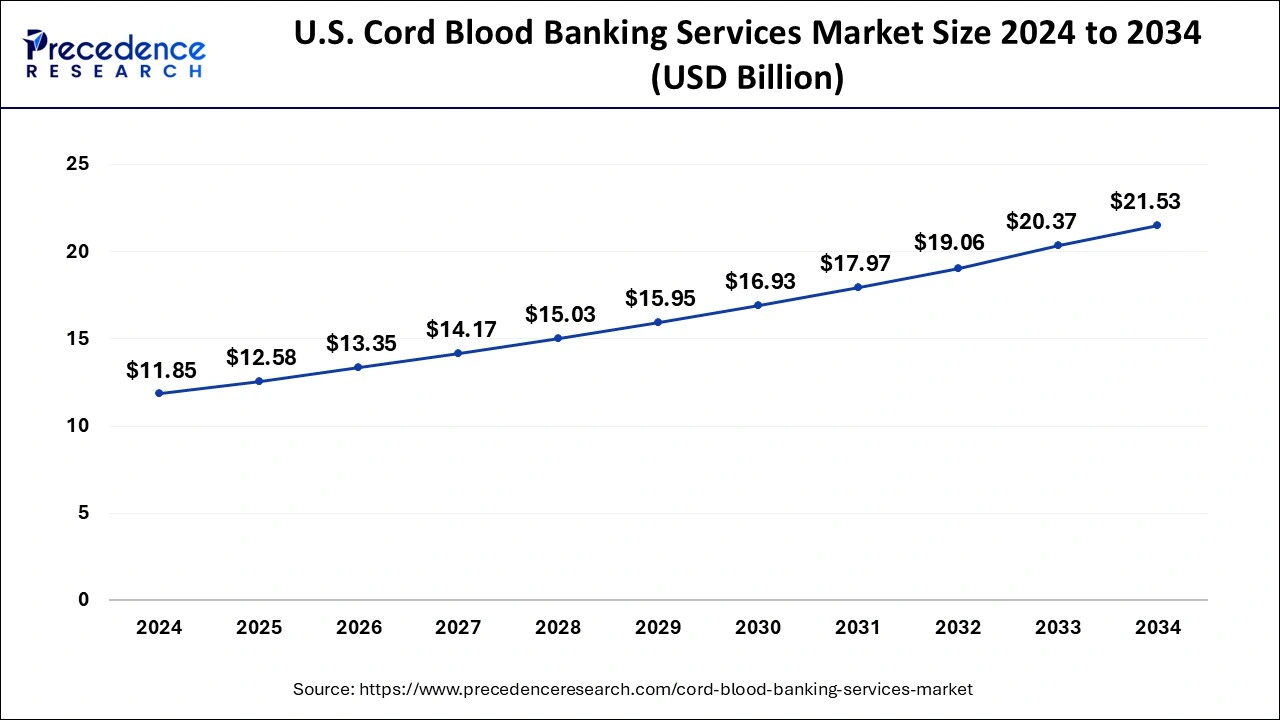

The U.S. cord blood banking services market size was estimated at USD 11.85 billion in 2024 and is predicted to be worth around USD 21.53 billion by 2034 at a CAGR of 6.15% from 2025 to 2034.

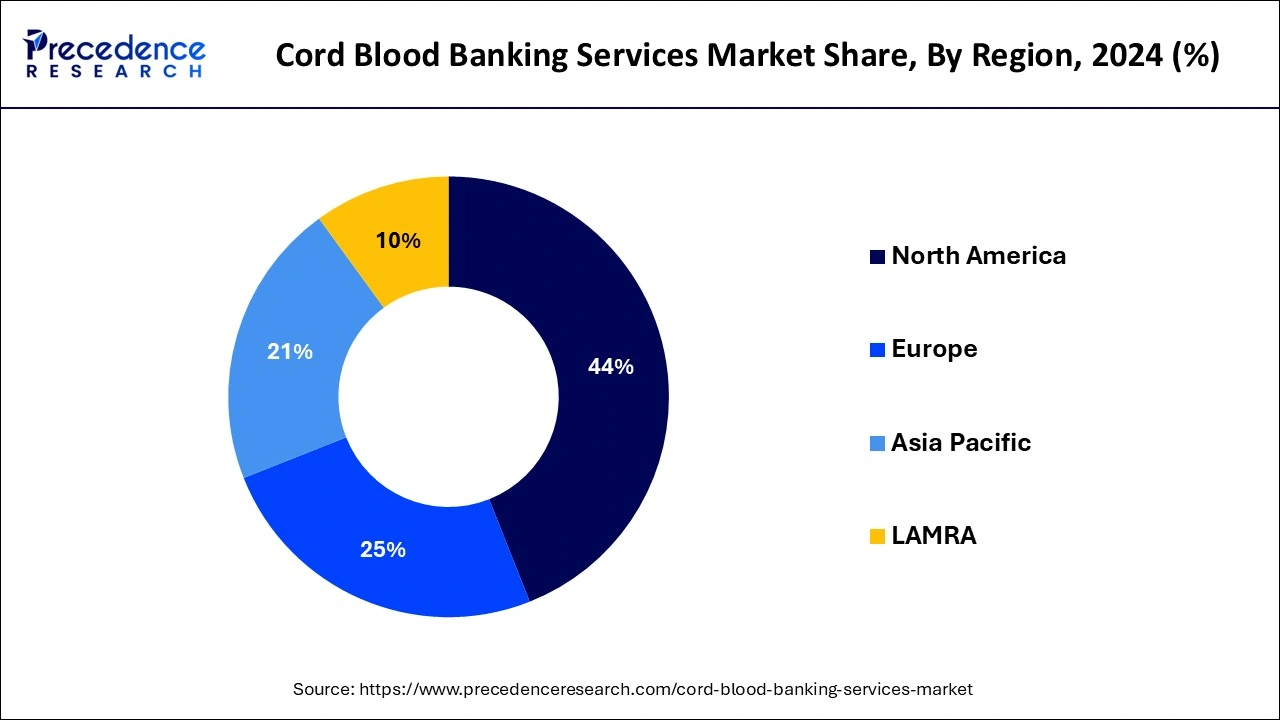

North America dominated the cord blood banking services market by region, in 2024. There is a strong healthcare system in the area, and expectant parents are well-informed about the advantages of cord blood banking. North America is also home to a number of top research institutes, biotechnology firms, and cord blood banks, all of which contribute to the market's expansion. The North American cord blood banking market is mostly driven by sophisticated technology, regulatory backing, and a high birth rate.

Asia Pacific is expected to grow to the highest CAGR in the cord blood banking services market by region during the forecast period. Because of the region's high birth rate and large population, there is a considerable need for cord blood banking services. The market expansion in the area is also being driven by growing awareness of the potential advantages of using cord blood stem cells to treat a range of illnesses and ailments.

The cord blood banking services market refers to the collection and storage for potential medical use through a procedure called cord blood banking. Rich in stem cells, umbilical cord blood can be utilized to treat a wide range of illnesses and conditions, including leukemia, lymphoma, and several genetic abnormalities. Parents can store these priceless stem cells for their kids' or other family members' possible future usage by preserving them through cord blood banking. The market is driven by the simplicity and safety of cord blood in harvesting stem cells and the rising awareness about cord blood banking services.

The cord blood banking services market is fragmented with multiple small-scale and large-scale players, such as California Cryobank Stem Cell Services LLC, Global Cord Blood Corporation, CBR Systems Inc., PerkinElmer Inc. (ViaCord LLC), Cord Blood Foundation (Smart Cells International), Cryo-Cell International, Cordlife Group Limited, AlphaCord LLC, ATCC, CSG-BIO, Singapore Cord Blood Bank, FamiCord.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.06% |

| Market Size in 2025 | USD 38.12 Billion |

| Market Size by 2034 | USD 64.71 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Storage Services, By Component, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Simplicity and safety of cord blood to harvest stem cells

The simplicity and safety of cord blood for harvesting stem cells are growing the demand for cord blood banking services in the market. As a result, it is simple and safe to isolate stem cells from cord blood. The importance of saving their child’s cord blood as a possible source of stem cells for upcoming medical procedures is becoming more known to parents. Because cord blood is a desirable alternative for families desiring to save for their future health, this can grow the cord blood banking services market.

Unawareness of cord blood banking services among clinicians

The unawareness of cord blood banking services among clinicians may slow down the market. Potential consumers might not be aware of the benefits of cord blood banking services. As a result, fewer people choose to bank their cord blood, which lowers the demand for cord blood banking services market.

Rising awareness about cord blood banking services

The rising awareness about cord blood banking services can be the opportunity to boost the cord blood banking services market. As more pregnant parents become aware of the possible advantages for the future health of their unborn child. The demand that rises with knowledge may spur innovation and growth of the market.

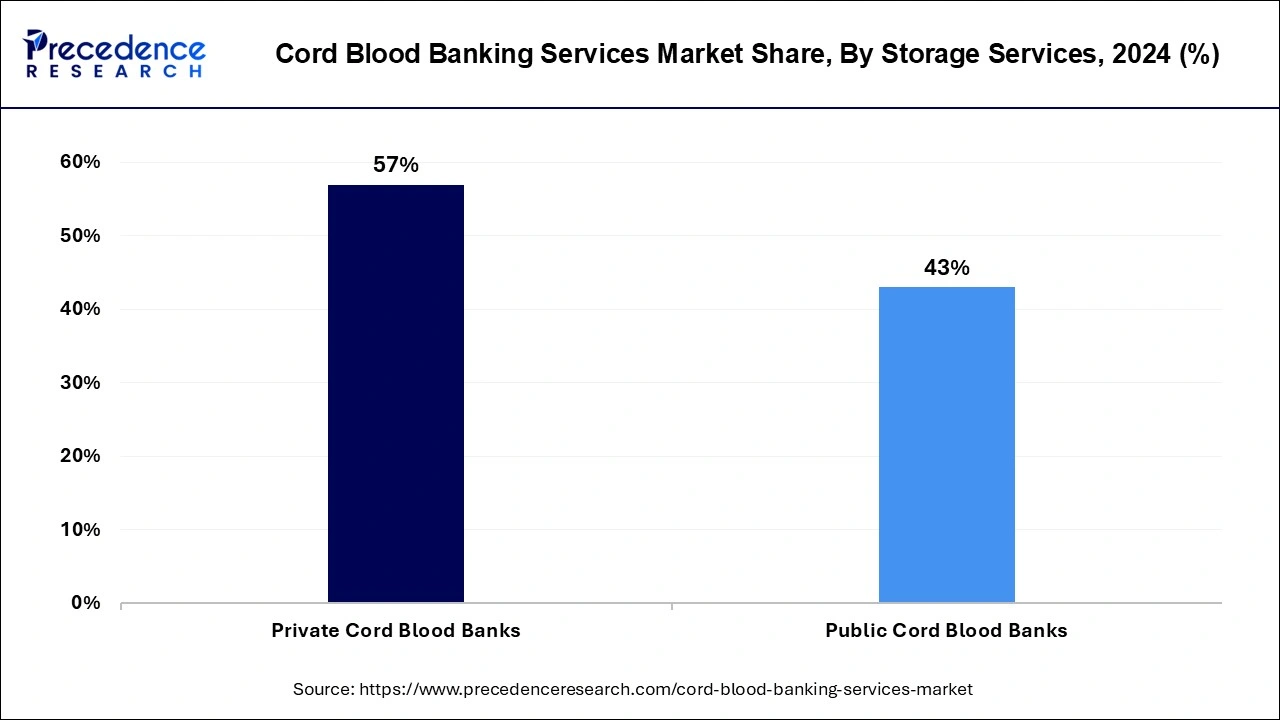

The private cord blood banks segment dominated the cord blood banking services market by storage services in 2024. This is mainly because they offer parents the choice to keep their baby’s cord blood for potential further use. This provides families access to their own stem cells in case they are later required for medical procedures. Additionally, parents who have concerns about the future of their kids may find specialized services and storage alternatives offered by private banks.

The public cord blood banks segment is expected to grow to the highest CAGR in the cord blood banking services market by storage services during the forecast period. The public banks saved their own cord blood, and anybody in need of a stem cell transplant can get donated cord blood units from public banks. Many people who want to improve the health of others find this ethical quality desirable.

The cord tissue segment dominated the cord blood banking services market by component in 2024. Because of its abundant supply of mesenchymal stem cells (MCSs), which have been demonstrated in regenerative medicine for the treatment of a variety of illnesses and injuries, cord tissues have become the leader of the market. Compared to mesenchymal stem cells from other sources, those produced from the cord tissues have the benefit of simple accessibility, immunomodulatory capabilities, and decreased risk of rejection. There will probably be an increase in demand for cord tissue banking as regenerative medicines research.

The cord blood segment is expected to grow to the highest CAGR in the cord blood banking services market by component during the forecast period. Due to developments in stem cell research and regenerative medicine, as well as growing public awareness of the potential advantages of cord blood stem cells in treating a range of illnesses and disorders, the cord blood segment of the market is anticipated to expand. In addition, an increasing number of parents are choosing to bank their child's cord blood in case they require medical attention down the road.

The diabetes segment dominated the cord blood banking services market by application in 2024. There are a number of reasons why the diabetes market dominates the cord blood banking services industry. First, via the use of regenerative medicine techniques, cord blood stem cells have demonstrated encouraging promise in the treatment of diabetes. Second, the need for novel treatment alternatives is being driven by the rising global prevalence of diabetes. The treatment of diabetes with cord blood stem cells has also been the subject of research and clinical studies that have attracted a lot of interest and funding, which has further fueled the expansion of this market.

The cancer disease segment is expected to grow to the highest CAGR in the cord blood banking services market by application during the forecast period. Because cord blood includes stem cells that can be employed in therapies for some forms of cancer, such as stem cell transplants, the rise in cancer disorders may fuel demand for cord blood banking services. The need for these services may rise in tandem with the prevalence of cancer.

By Storage Services

By Component

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

January 2025

August 2024