January 2025

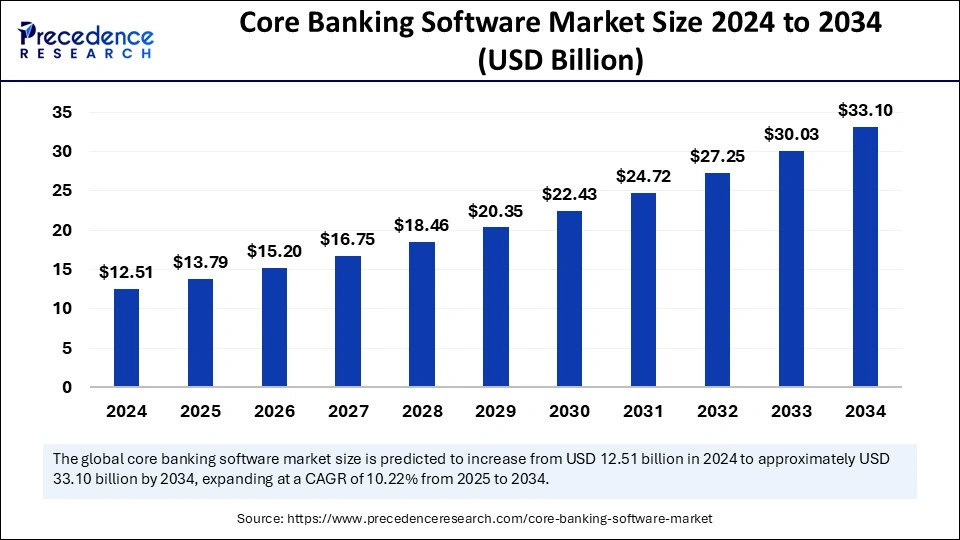

The global core banking software market size is calculated at USD 13.79 billion in 2025 and is forecasted to reach around USD 33.10 billion by 2034, accelerating at a CAGR of 10.22% from 2025 to 2034. The North America market size surpassed USD 3.75 billion in 2024 and is expanding at a CAGR of 10.41% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global core banking software market size was estimated at USD 12.51 billion in 2024 and is predicted to increase from USD 13.79 billion in 2025 to approximately USD 33.10 billion by 2034, expanding at a CAGR of 10.22% from 2025 to 2034. The increasing investments in fintech technologies, rising demand and adoption of core banking software by financial institutions, and rising focus on customer-centric solutions are among several factors boosting the growth of the core banking software market.

In the rapid evolution of digitalization, the integration of artificial intelligence (AI) emerged as a game-changer and significantly revolutionized the financial sector. Integrating AI into core banking software is transforming banking operations around the world by improving security, efficiency, and customer experience. There are various applications of AI in core banking software, including improving customer interaction, streamlining operations, and optimizing client conversations with Natural Language Processing and conversational AI. AI-powered chatbots provide 24/7 customer support, which helps improve compliance and regulatory oversight and enhance customer experience with personalized services and recommendations. Therefore, AI integration into core banking software is paving the innovative way for shaping the future of banking.

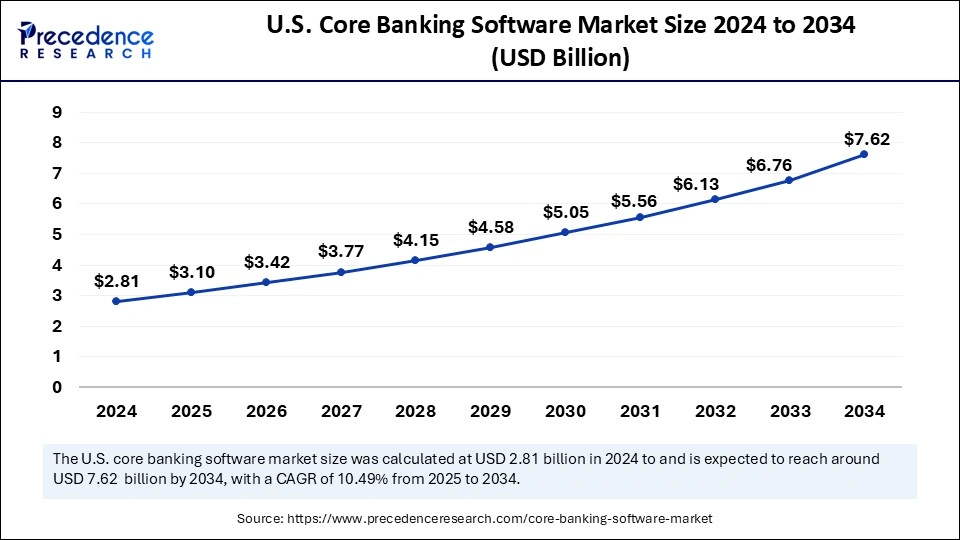

The U.S. core banking software market size was exhibited at USD 2.81 billion in 2024 and is projected to be worth around USD 7.62 billion by 2034, growing at a CAGR of 10.49% from 2025 to 2034.

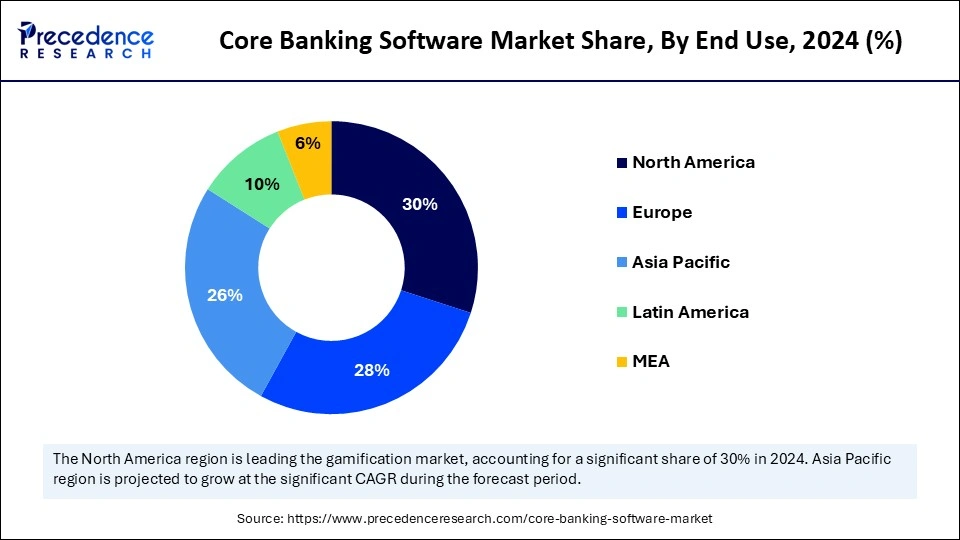

North America dominated the core banking software market with the largest share in 2024. The region has a robust IT infrastructure, which facilitates banks and financial institutions to provide better customer service by effectively utilizing core banking capabilities. There is a heightened acceptance of core banking technology by banks and financial institutions. The rise in the popularity of cloud-based technologies and partnerships or collaborations among solution providers and financial institutions or banks further bolstered the market in the region.

The U.S. and Canada are major contributors to the North American core banking software market. Several market players in these countries are focusing on launching sophisticated banking systems to enhance their product portfolios, supporting market growth.

Asia Pacific is expected to witness the fastest growth in the coming years. The growth of the market in the region is mainly attributed to the increasing investment in IT infrastructure, high penetration of core banking software, increasing acceptance of cloud-based solutions, and growing focus on improving customer experience and satisfaction. Asian countries are heavily investing in modernizing their banks or financial institutions with advanced systems to provide seamless customer experiences and real-time data access.

Countries like China and India can have a stronghold on the Asia Pacific core banking software market. This is mainly due to the rapid digital transformation and increasing partnerships among banks and IT solutions providers. Moreover, rising government initiatives to promote digitization in every sector support market growth.

Europe is expected to grow at a notable rate during the forecast period. The increasing use of digital platforms for financial services, a strong focus of several banks and financial organizations on digital transformation, and the rising availability of solutions delivered by IT firms are expected to drive the growth of the European core banking software market. Additionally, the rising investments by banks and financial institutions to improve existing banking technologies and enhance customer engagement services contribute to regional market growth.

Core banking software (CBS) is one of the integrated technology platforms that effectively manages and automates various banking operations. CBS offers a back-end solution for banking organizations to manage banking services such as payments, transactions, loans, and other financial records effectively. It provides real-time online centralized banking activities to users. Core banking software provides financial institutions and banks with improved income sources and better user experience.

| Report Coverage | Details |

| Market Size by 2034 | USD 33.10 Billion |

| Market Size in 2025 | USD 13.79 Billion |

| Market Size in 2024 | USD 12.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.22% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing Focus on Customer-centric Solutions

A strong emphasis on customer-centric solutions is expected to drive the growth of the core banking software market during the forecast period. In the rapidly evolving financial sector around the world, core banking software plays a crucial role in improving customer experience. Customers can experience the bank as a single entity, regardless of location. Core banking software allows customers to get the flexibility to manage their financial transactions from anywhere, providing more independence to the customers in managing their loans, conducting transactions, and other financial activities.

Rising Privacy Concerns

Core banking software stores the sensitive data of customers. This, in turn, increases privacy concerns, limiting the adoption of core banking software. In addition, there is a lack of awareness regarding fintech technologies, particularly in underdeveloped countries, which hampers the growth of the market.

Growing Popularity of Cloud-based Platforms

The increasing adoption of cloud-based platforms presents lucrative opportunities for the core banking software market. Cloud-based platforms represent a transformative force in how banks and financial entities operate and deliver the best services to their customers. Cloud-based platforms enable banks to track payments, transactions, and other activities. The adoption of cloud-based solutions eliminates financial institutions' investment in on-premises hardware, which reduces initial capital expenditures and operational costs.

By leveraging the pay-as-you-go pricing model of cloud computing, banks can only pay for the resources and services they consume. This approach allows banks to efficiently allocate resources. Moreover, customers receive alerts for credit facilities, system logins, remote transaction locations, and tax-saving strategies driven by the rapid advancement of technology to enhance the banking experience, ensuring it is smoother and more secure.

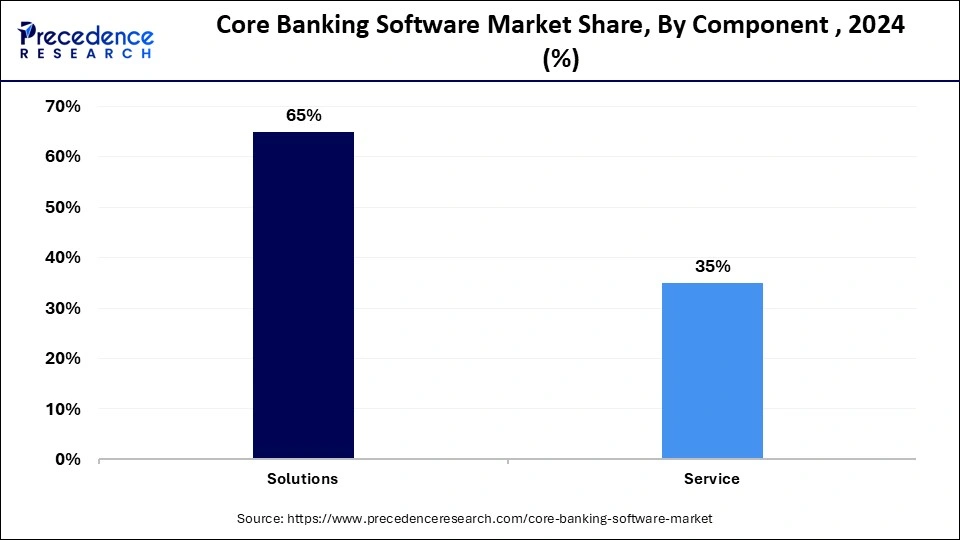

The solutions segment dominated the core banking software market with the largest share in 2024. The growth of the segment is driven by the increase in the number of financial institutions and banks seeking innovative solutions that focus on improving operational capabilities and facilitating uninterrupted customer experiences. Numerous financial organizations and banks are rapidly embracing advanced solutions to improve existing infrastructure and networks. Additionally, the growth of the segment is majorly attributed to the rise in partnerships among prominent financial institutions and technology giants to develop advanced solutions associated with core banking.

On the other hand, the services segment is expected to witness the fastest growth during the projection period. Several professional service providers assist banks in customizing the software to meet the evolving business demands. The segment's growth can be attributed to the rising need for support services for software deployment.

The on-premise segment held the largest share of the core banking software market in 2024. On-premises core banking solutions are generally hosted within an internal infrastructure of a bank or financial institution, offering greater control over data and operations. On-premises solutions offer enhanced security and also ensure compliance with stringent regulations by storing customer data within their premises. On-premises solutions generally offer greater customization, allowing banks to tailor their systems to their unique requirements.

Meanwhile, the cloud segment is expected to expand at the highest CAGR in the coming years. Cloud-based solutions generally operate on remote servers and are managed by third-party providers. The adoption of these solutions offers higher Accessibility & Flexibility, cost efficiency, and scalability. Service providers increasingly focus on effectively handling system updates, maintenance, and security patches, significantly minimizing the burden on in-house IT teams.

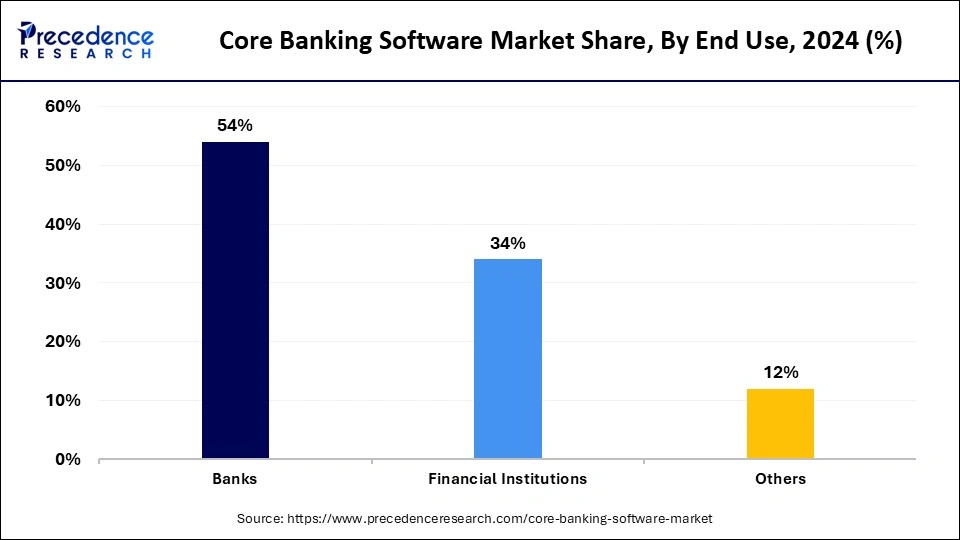

The banks segment led the core banking software market with the largest share in 2024. The growth of the segment is majorly driven by the surging investments in sophisticated IT infrastructure. Core banking software allows banks to gain valuable insights into evolving customer preferences and financial trends, assisting in making data-driven decisions. Moreover, the rising collaboration and partnership between banks with IT companies to develop innovative software is anticipated to sustain the segment’s position.

On the other hand, the financial institutions segment is anticipated to grow at a rapid pace during the forecast period. This is mainly due to the rising focus on digitization. In the modern financial landscape, core banking software helps financial institutions bridge the gap between evolving customer needs and traditional banking operations. These institutes heavily use core banking software to prevent fraud and theft.

By Component

By Deployment

By End Use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

October 2024

February 2025