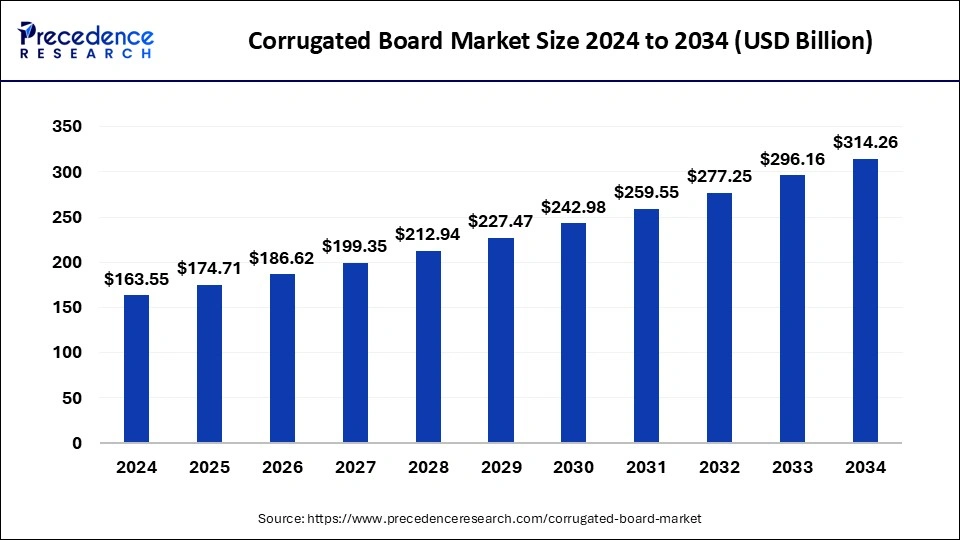

The global corrugated board market size is calculated at USD 174.71 billion in 2025 and is forecasted to reach around USD 314.26 billion by 2034, accelerating at a CAGR of 6.75% from 2025 to 2034. The Asia Pacific corrugated board market size surpassed USD 73.38 billion in 2025 and is expanding at a CAGR of 6.88% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global corrugated board market size was estimated at USD 163.55 billion in 2024 and is predicted to increase from USD 174.71 billion in 2025 to approximately USD 314.26 billion by 2034, expanding at a CAGR of 6.75% from 2025 to 2034. The demand for the corrugated board market is driven by consumers' rising desire for packaging choices that are recyclable and biodegradable.

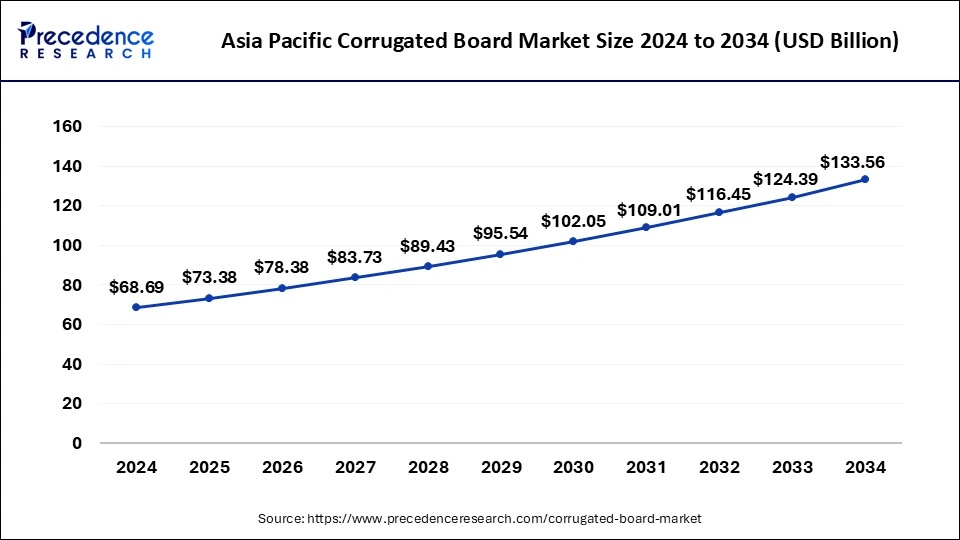

The Asia Pacific corrugated board market size was valued at USD 68.69 billion in 2024 and is expected to be worth around USD 133.56 billion by 2034, at a CAGR of 6.88% from 2025 to 2034.

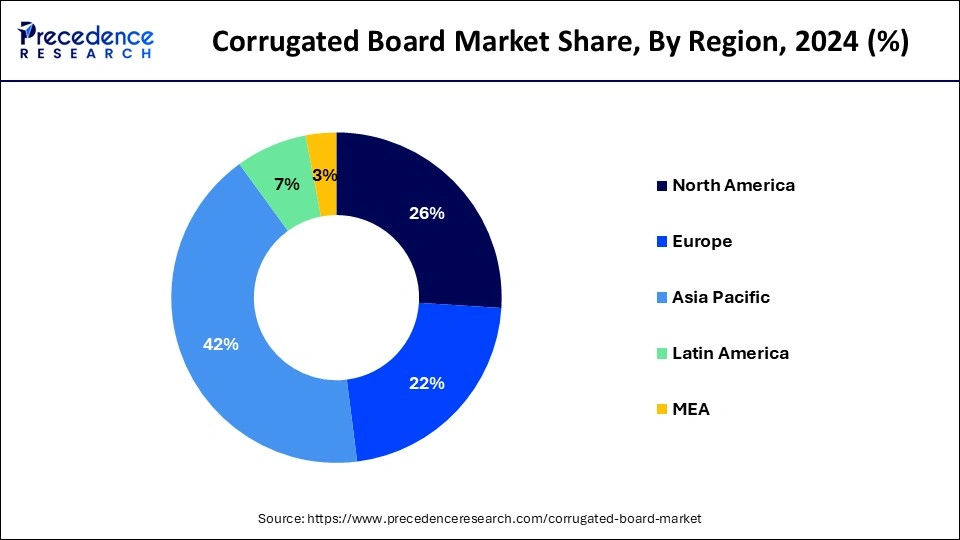

Asia Pacific dominated the corrugated board market in 2024. Asia Pacific is a global manufacturing hub that produces a wide range of goods, from electronics to automotive parts. The robust manufacturing sector requires substantial amounts of corrugated packaging for transportation and storage of products. The accelerating urbanization and industrialization in countries like China. The increased consumer spending and rapid economic growth in many of the region's countries drive demand for packaging solutions across various sectors. The numerous regional governments are funding the expansion of the industrial sector and developing the region's infrastructure. The corrugated board market is growing as a result of investments in logistics and transportation infrastructure as well as policies that promote the packaging sector.

The supermarkets, hypermarkets, and convenience stores are proliferating across Asia Pacific, contributing to the region's increasing retail industry. These retail establishments need corrugated board packaging in order to ship and display their merchandise. The region's corrugated boards are becoming more competitive and aesthetically pleasing due to the increased production efficiency and quality brought about by the packaging industry's embrace of new manufacturing technology and automation. Asia-Pacific nations are important worldwide exporters of products. The market for corrugated boards is driven by the requirement for dependable and sturdy packaging to safeguard goods during long-distance transit.

North America is estimated to grow at the fastest CAGR during the forecast period. The e-commerce industry in North America is among the most advanced globally. Since corrugated board packaging is frequently used for shipping and preserving online purchases, there is a substantial need for it due to the large volume of online shopping. Significant quantities of corrugated packaging are needed for the shipping and storage of different items in the area's highly developed manufacturing sector. Automobile, electronics, and consumer products are examples of such industries.

The established logistics and supply chain infrastructure in North America is advantageous. The corrugated boards and other sturdy packing materials are in more demand as a result of efficient distribution networks, which guarantee the safe delivery of goods. In order to guarantee that goods are delivered securely, efficient distribution networks raise the need for dependable and long-lasting packaging options, such as corrugated boards.

The corrugated board market refers to the manufacturing of corrugated board, additionally referred to as corrugated fibreboard, which is a composite material made up of one or two flat liner boards and a fluted corrugated sheet. It is extensively utilized in the production of packaging and shipping containers. The corrugated board’s structure gives it strength and rigidity, which makes it optimal for securing goods during storage and transportation. Corrugated board is used in packaging, and the rise in e-commerce is significantly promoting the growth of the corrugated board market. In the future, where more and more products are going to be sold online, the need for corrugated boards will increase.

| Report Coverage | Details |

| Market Size by 2034 | USD 314.26 Billion |

| Market Size in 2025 | USD 174.71 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.75% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Flute Type, Board Style, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growth of the food and beverage industry

The corrugated board packaging is widely used by the food and beverage sector to store and convey a variety of goods. The need for corrugated packaging is mostly driven by the sector's expansion. Additionally, for the safe and dependable transportation and storage of medications and medical supplies, the packaging needs of the pharmaceutical and healthcare sectors must be met. Corrugated boards are being utilized more often in these industries because they provide the required protection.

High transport expenses

The high transport expenses may slow down the corrugated board market. The corrugated boards can be expensive to store and transport due to their bulk. These logistical costs can be a major barrier, particularly for distributors and manufacturers trying to streamline their supply chains.

Technological advancements

The quality and efficiency of corrugated board manufacture have increased because of advancements in manufacturing technology. Technological innovations like digital printing and automation allow for greater customization and lower prices, which increases the attractiveness of corrugated packaging.

The C-flute type segment dominated the corrugated board market by flute type in 2024. The C-flute provides an excellent mix of strength and comfort. Because of this, it may be used for a variety of packaging applications, such as retail packaging and shipping boxes. As one of the most widely utilized flute profiles, it has become the industry standard. Because of its extensive use, a large number of producers and packagers are equipped to create and utilize C-flute corrugated boards, which results in economies of scale. The C-flute offers superior protection for items while making optimal use of the material. Because of this balance, many businesses find it to be an affordable solution.

The high-quality printing may be done on the surface of C-flute corrugated boards, which is advantageous for branding and marketing initiatives. This makes it a desirable option for businesses looking to blend visual appeal with power. C-flute's dominance in the corrugated board market is a result of the continuous need for robust and adaptable packaging solutions across a range of sectors, including food and beverage, electronics, and consumer products. The recyclability and sustainability of corrugated boards, particularly C-flute, have grown more significantly as consumers and businesses are more concerned about the environment. The material qualities of C-flute encourage its ongoing dominance since they are in line with these environmental tendencies.

The A-flute type segment is expected to grow at the highest CAGR in the corrugated board market by flute type during the forecast period. The larger flutes of the A-flute offer superior protection and cushioning as compared to other flute varieties. Because of this, it's perfect for packing valuable and fragile things, which is becoming more and more crucial as e-commerce expands and customers want more shipping protection. The rise in e-commerce has increased demand for durable packaging options that can safeguard goods while they are being shipped. Because of its exceptional strength and cushioning qualities, A-flute corrugated boards are a good fit for this requirement. Large electronics, furniture, and automobile industries are among those that profit from A-flute corrugated boards' strong stacking capacity. The increasing demand for A-flute is partly due to the expansion of transportation for bulk commodities.

The A-flute corrugated boards, with their flat surface that allows for superior printing, are becoming more and more common in branded packaging. Businesses looking to improve the way their brand is presented through packaging probably prefer A-flute boards because of their eye-catching appearance and sturdy design. A-flute boards fit nicely with the expanding trend of environmentally friendly packaging options because they are recyclable and constructed of recycled materials. The recyclability of A-flute becomes a key benefit when customer tastes, and governmental constraints change towards environmentally friendly solutions.

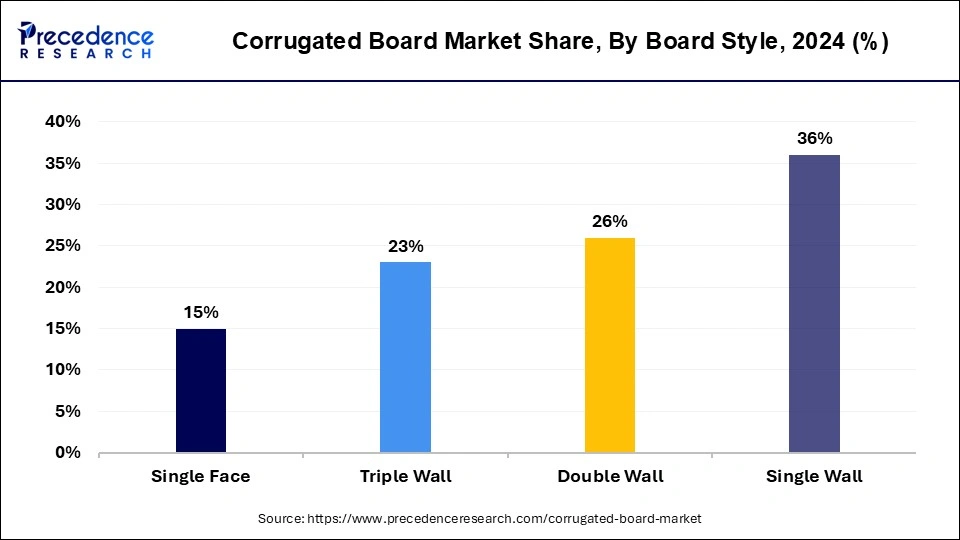

The single wall segment dominated the corrugated board market by board type in 2024. The cost of producing single-wall corrugated boards is lower than that of double and triple-wall boards. Their cost-effectiveness renders them a desirable choice for several enterprises seeking to reduce their packaging expenditures. The single-wall corrugated boards offer adequate protection for a variety of items during handling and transportation. They provide a decent mix of strength and cushioning for objects weighing from light to medium weight.

The need for cost-effective and safe packaging solutions has grown dramatically with the rise of e-commerce. Single-wall corrugated boards are a mainstay in the e-commerce sector and are frequently utilized for the transportation of an extensive range of consumer items. The single wall boards are adaptable and have a wide range of uses, including transport containers and retail packaging.

The triple wall segment is expected to grow at the highest CAGR in the corrugated board market by board type during the forecast period. The strongest and most durable corrugated board kind is a triple wall corrugated board. They are a perfect fit for robust uses and packing bulky, heavy, or delicate things that need the highest level of protection is due to.

Robust packaging solutions are becoming more and more necessary for industries including bulk commodities, industrial machinery, and automobiles. Because of their extraordinary strength and capacity to support a large amount of weight and strain, triple-wall corrugated boards are ideal for various applications. The strong packing solution that can safeguard goods during long-distance transit is becoming increasingly important as e-commerce and global logistics networks grow. Corrugated boards with triple walls offer essential protection for heavy and valuable items, lowering the possibility of damage occurring during transportation.

By Flute Type

By Board Style

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client