January 2025

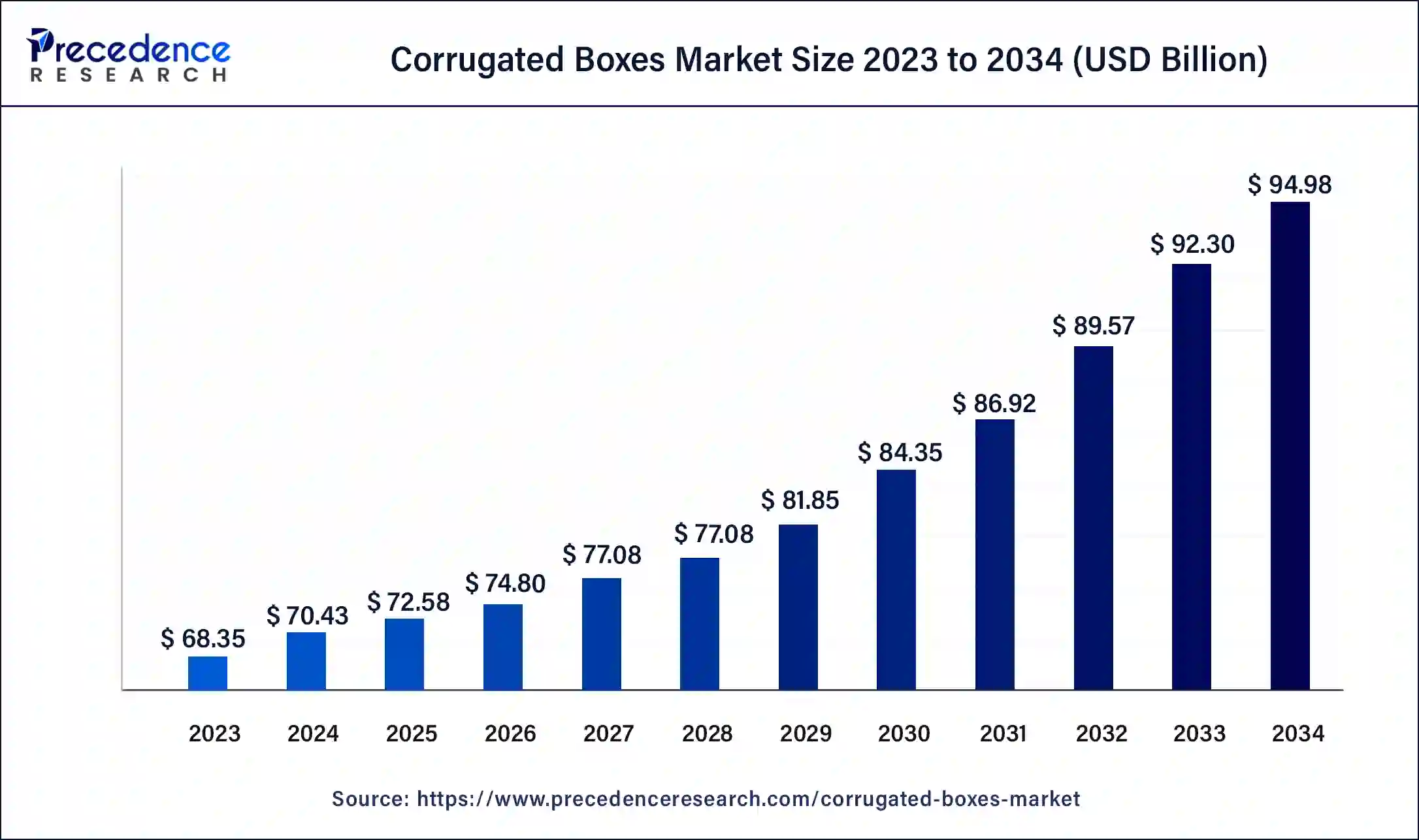

The global corrugated boxes market size was USD 68.35 billion in 2023, estimated at USD 70.43 billion in 2024 and is anticipated to reach around USD 94.98 billion by 2034, expanding at a CAGR of 3% from 2024 to 2034.

The global corrugated boxes market size accounted for USD 70.43 billion in 2023 and is predicted to reach around USD 94.98 billion by 2034, growing at a CAGR of 3% from 2024 to 2034. The boost of the consumables industry, health care, and personal care products are driving market growth.

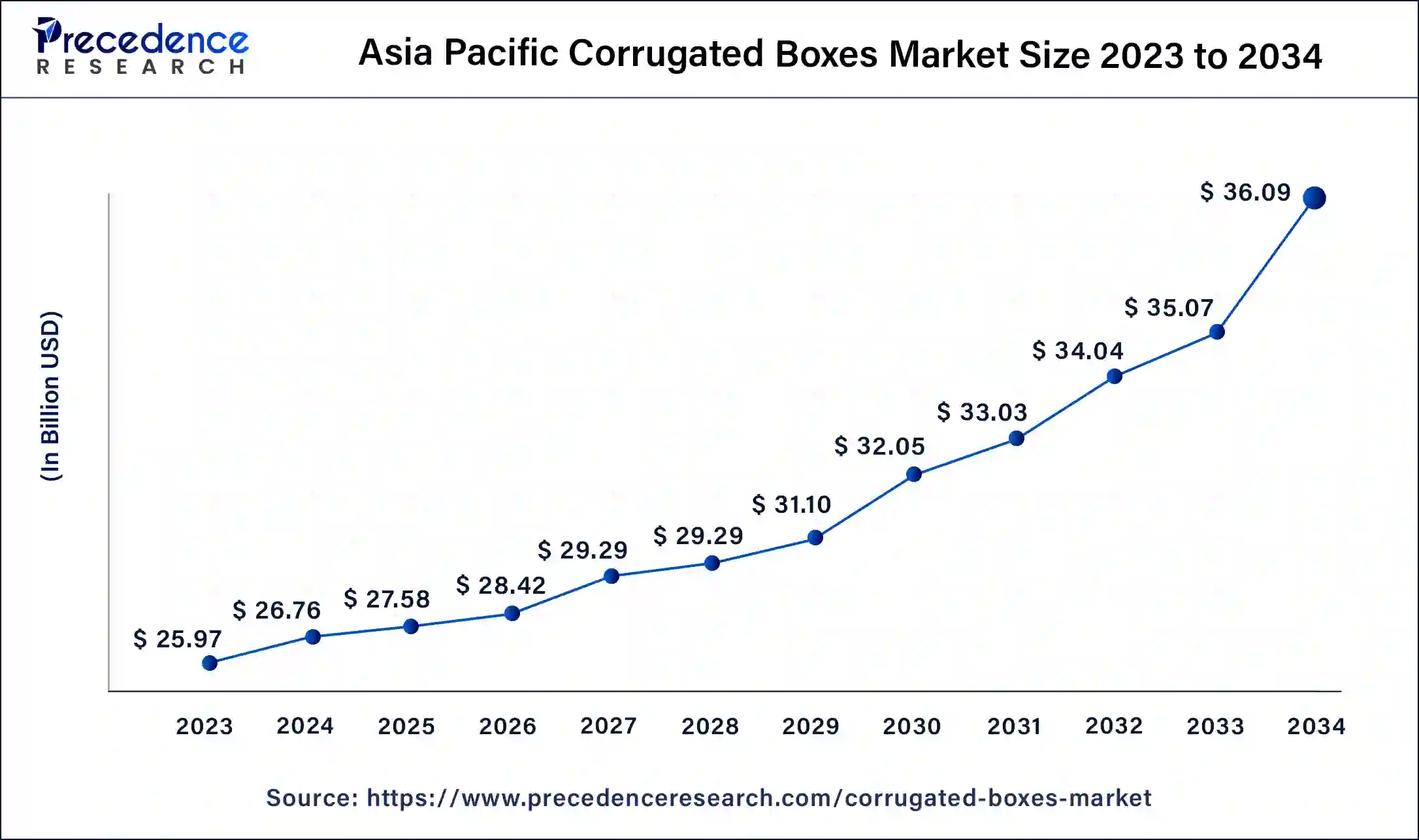

The Asia Pacific corrugated boxes market size was estimated at USD 25.97 billion in 2023 and is predicted to be worth around USD 36.09 billion by 2034 at a CAGR of 3.40% from 2024 to 2034.

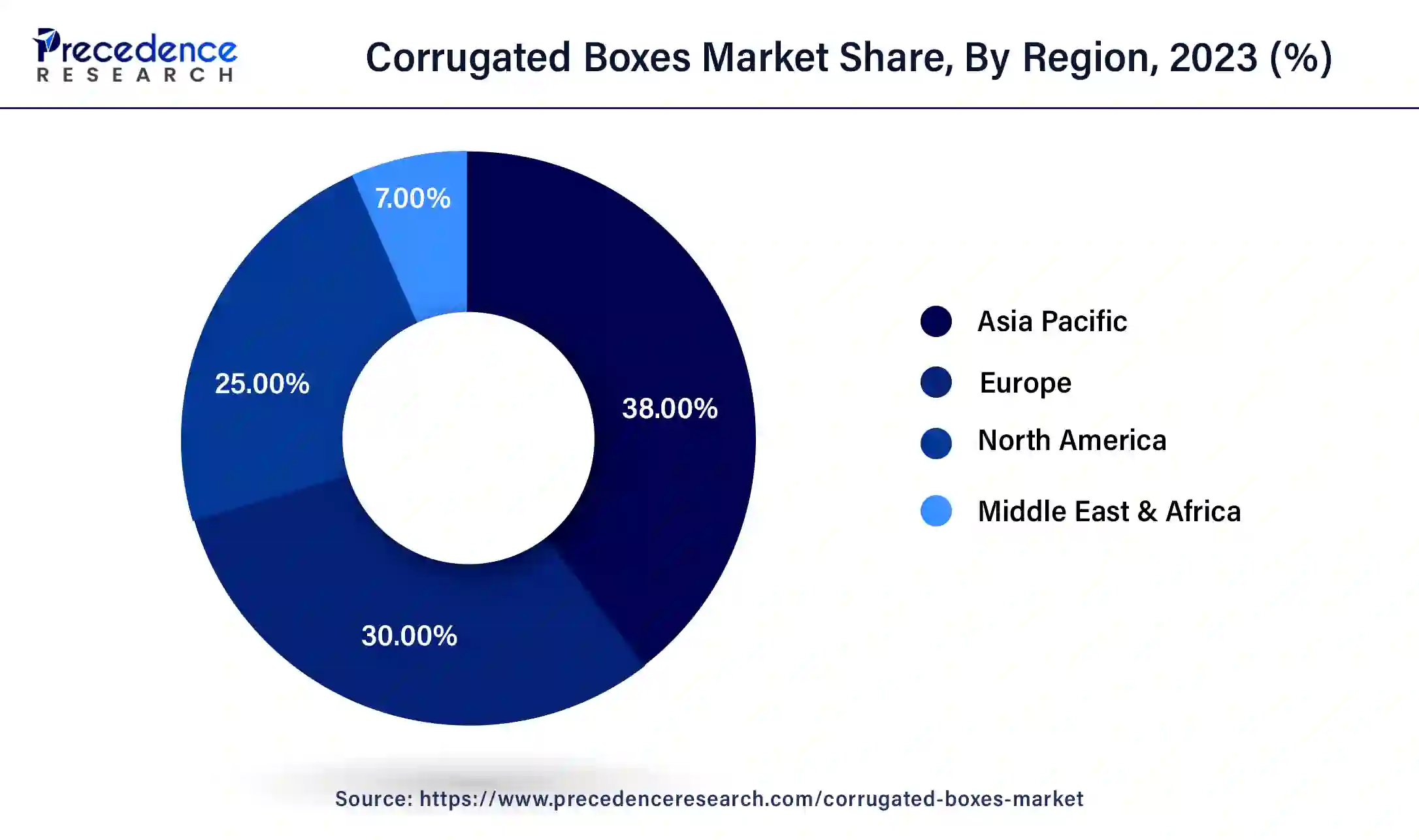

Asia Pacific dominated the corrugated boxes market in 2023. The market is benefiting from the growing need for high-speed and affordable internet access. Also, the expanding application of the product across various industries like electronics, automotive, home care, and personal care is driving market growth. Furthermore, rapid urbanization in Asia Pacific is fostering the development of modern infrastructure, including logistics networks, warehouses, and transportation systems, which is fueling demand for the product in the region.

North America is expected to experience significant expansion in the global corrugated boxes market over the projected period. Due to the increased demand in the healthcare sector, the corrugated boxes industry in North America is expected to grow at a significant CAGR during the forecast period. The industry has witnessed growth in response to a rise in emergencies and government support for healthcare systems in the United States. Increasing healthcare expenses and consumer awareness further contribute to the promising growth prospects for the corrugated industry.

Corrugated boxes are a commonly used packaging solution in the shipping and storage sector. They are crafted from corrugated cardboard, a material comprising three layers: two outer flat liner boards and a wavy fluted layer in between. This unique design offers robustness and protection to the boxes, making them ideal for safeguarding delicate items like electronics and glassware during handling and transportation. Their cushioning properties absorb shocks and impacts, minimizing the risk of damage. Additionally, corrugated boxes come in various sizes and shapes, including customized options tailored to specific needs, ensuring efficient use of space and optimal product protection. With the global growth of the personal care and cosmetics industry, the demand for corrugated boxes is expected to rise in the coming years.

| Report Coverage | Details |

| Market Size in 2023 | USD 68.35 Billion |

| Market Size in 2024 | USD 70.43 Billion |

| Market Size by 2034 | USD 94.98 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Box Layer, Technology, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Online shopping and the food service industry

The surge in e-commerce activities and the shift towards online shopping platforms are driving the demand for the corrugated boxes market. Manufacturers can leverage advanced printing techniques to display lifelike images, enhancing brand visibility and product promotion. Moreover, the increasing preference for sustainable packaging materials presents growth opportunities for industry players.

The perception of corrugated boxes as reliable packaging solutions and the rising demand for food and beverage products are boosting sales in both developed and developing nations. Crafted from three layers of cardboard, these boxes offer robust support and safeguard fragile items effectively. Key attributes such as versatility, durability, eco-friendliness, and lightweight nature make them attractive to various industries.

In September 2022, Stora Enso acquired De Jong Packaging Group to increase the production of corrugated packaging. The acquisition, made at an enterprise value of approximately EUR 1,020 million, is also expected to advance Stora Enso’s strategic direction and accelerate revenue growth. The resultant corrugated boxes and trays are set to package products in fresh produce, e-commerce, and industrial packaging.

Labor shortages can affect production efficiency and timelines

Rising transportation expenses can drive up product prices or shrink profit margins for businesses, potentially prompting consumers to spend less and alter their purchasing habits. To counterbalance these costs, companies might implement cost-saving measures like compromising product quality or operational efficiency, impacting their competitiveness and customer satisfaction. Labor shortages also disrupt production efficiency and timelines, causing delays and reducing output. This scarcity of skilled workers intensifies competition and may lead to increased wages, driving up production expenses. Consumers may face higher prices or diminished business profitability, which can affect the stability of the corrugated boxes market.

Sustainable packaging solution

Organized retailing, or modern retailing, involves licensed retailers offering a wide range of products under one roof. These products are packaged to maintain freshness and preserve nutritional value. There's a growing demand for eco-friendly packaging materials, which organized retail outlets fulfill using corrugated boxes. Additionally, companies are producing lightweight, high-performance container boxes to cut costs, enhance functionality, and promote sustainability. As a result, the corrugated boxes market is expected to expand significantly in the forecast period.

The flexography printing segment dominated the corrugated boxes market in 2023. Flexography printing is a cost-effective option with lower per-unit printing costs and tool expenses compared to other methods. It accommodates both water and oil-based inks, making it versatile for various printing needs. Because of these advantages, flexography printing is widely adopted in the market. Its superior qualities make it an appealing choice over other printing technologies, leading to increased utilization in the market during the forecast period.

In the corrugated boxes market, the digital printing segment is expected to witness the fastest growth over the forecast period. Digital printing was designed to make the graphics, printing process, and product development easier, faster, and more efficient for the corrugated industry. It has found success in areas like samples, mock-ups, displays, and very short production runs, where traditional methods needed improvement.

The food & beverage segment dominated the corrugated boxes market in 2023. In the food and beverage industry, packaging plays a crucial role in handling, storing, and transporting various products, including non-perishable goods, processed foods, and organic vegetables. Corrugated cardboard boxes are essential for delivering these items, especially perishable goods and fragile items, as they provide reliable protection during shipping and storage. Corrugated boxes are ideal for packaging and storing food for extended periods because they do not react with food substances. Choosing appropriate packaging materials that are visually appealing and convey safety is important, especially for ready-to-eat products, making corrugated boxes a preferred choice for packaging in the food industry.

The electronics goods segment is projected to witness rapid growth in the corrugated boxes market during the forecast period. As electronic devices evolve with innovative materials and technologies, there's a growing need for more precise and intricate electronic components. This requires enhanced protection against electrostatic, mechanical, and moisture-related damage during packaging and handling. Additionally, various environmental factors such as online shopping trends, logistics, environmental regulations, cultural design preferences, and consumer attitudes have significantly influenced the consumer electronics industry in recent years.

Segments Covered in the Report

By Type

By Box Layer

By Technology

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

June 2024

September 2024