January 2025

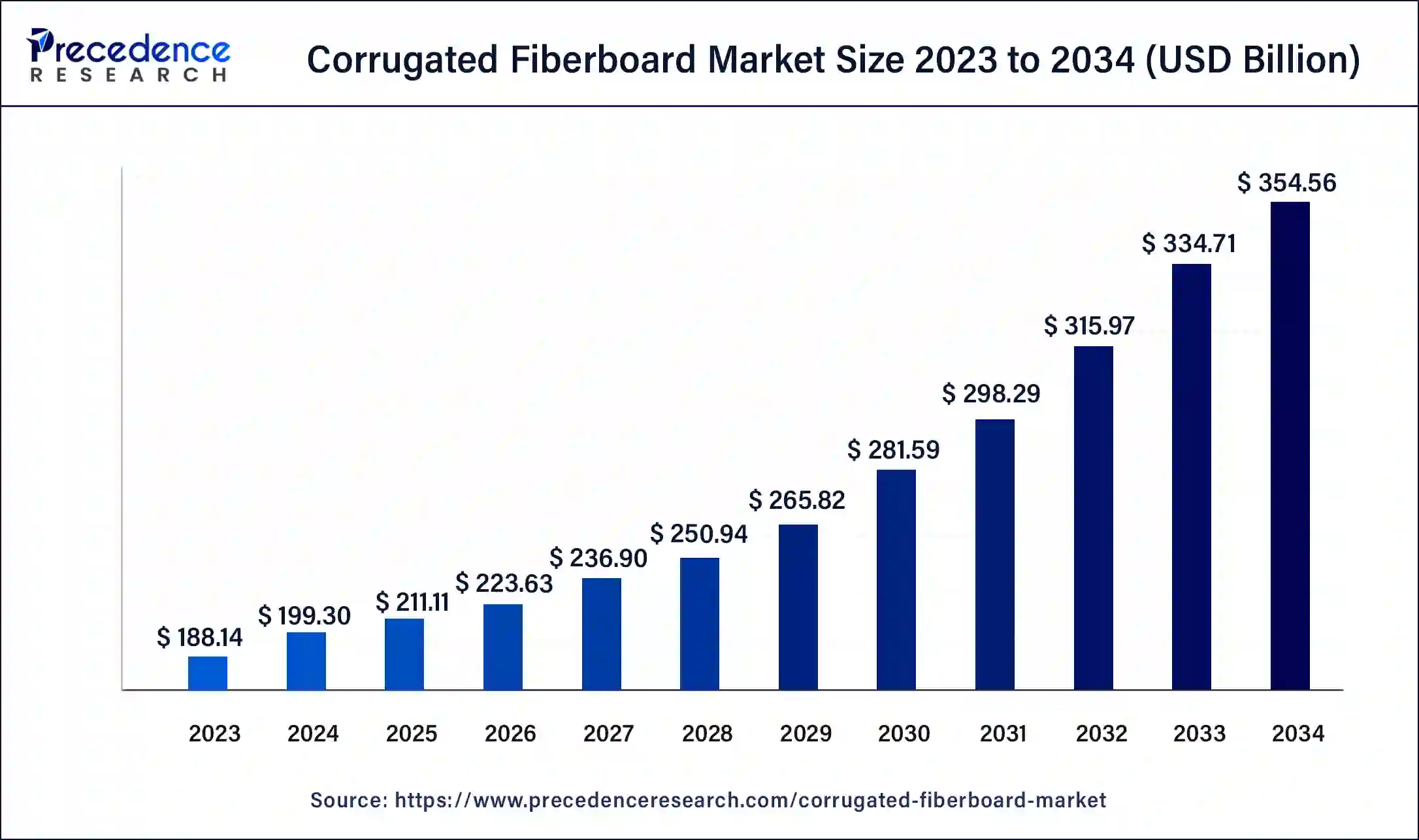

The global corrugated fiberboard market size surpassed USD 188.14 billion in 2023 and is estimated to increase from USD 199.30 billion in 2024 to approximately USD 354.56 billion by 2034. It is projected to grow at a CAGR of 5.93% from 2024 to 2034.

The global corrugated fiberboard market size is worth around USD 199.30 billion in 2024 and is anticipated to reach around USD 354.56 billion by 2034, growing at a solid CAGR of 5.93% over the forecast period 2024 to 2034. The market is proliferating due to the increasing retail display and packaging business, food and beverages, electronics, and several e-commerce companies that require corrugated fiberboard for packaging. The growing trend of online ordering systems is boosting the corrugated fiberboard market.

Corrugated Fiberboard Market: Reliable Packaging

Corrugated fiberboard market companies play a significant role in the packaging market as it is the most affordable, sustainable, and reliable. These fiberboard boxes are preferred for their versatility and durability, which is the best option for storage and delivery of products of a wide range. This is manufactured by keeping a layer of flute paper in the middle of two liner boards to provide a cushioning effect. This is done to provide extra safety to the fragile products while shifting from one place to another. Its manufacturing quality with an extra cushiony effect makes it the most reliable product in the packaging industry.

How Can AI Improve the Corrugated Fiberboard Market?

Artificial Intelligence is expanding to change the corrugated fiberboard market significantly by manufacturing efficient and innovative fiberboards. It helps to bring unique designs and patterns in the fiberboard industry by analyzing the data of customers and demand for the type of product that is in demand. AI also influences the market by analyzing the potential of the equipment used to manufacture fiberboards and predicting the failure of the equipment. With the potential of market demand for fiberboard in the future, artificial intelligence is beneficial in maintaining the supply chain in the market.

Due to the algorithms of machine learning, it is easy to predict the demand as per the trend and prepare orders to prevent any of the conditions, such as stockouts or overproduction. It helps to analyze the quality of the products, which is beneficial to eliminating defective pieces while producing in bulk. Customization in this industry has boosted the market exponentially, and AI has driven this process to meet the exact demands of customers. The incorporation of AI in the corrugated fiberboard market impacts its growth by analyzing demand to satisfy the requirement.

Major Driving Factors for the Corrugated Fiberboard Market

| Report Coverage | Details |

| Market Size by 2034 | USD 354.56 Billion |

| Market Size in 2023 | USD 188.14 Billion |

| Market Size in 2024 | USD 199.30 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.93% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Flute Type, Board Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising acceptance for sustainable fiberboards

Sustainability is a major concern among people when purchasing anything. Corrugated fiberboards are the sustainable option available in the market for shipping products and manufacturing packaging boxes. These are cost-effective and reliable packaging solutions that can be customized easily. Fiberboards are recyclable and versatile and can be used for several purposes. These advantages of such boxes enhance the market demand. The major corrugated fiberboard market player in the Trident paper box industry, Canpac Trends Pvt. Ltd, TGI Packaging Pvt. Ltd, Deluxe Packaging, and many others are constantly working on developing environmentally friendly fiberboard boxes for packaging usage.

With the growing trend to use sustainable products, the demand for these types of boxes is increasing. Technological advancement in the packaging solutions sector enhances the manufacturing quality of corrugated fiberboards, which boosts the market's growth. Various factors are driving the corrugated fiberboard market, such as the growing e-commerce market, expansion of the global market, and advanced technology. For shipping purposes, lightweight, high-strength, and customized fiberboard boxes are preferred, with better-quality flutes inserted for a cushion effect. The introduction of environment-friendly products drives this market as such packages are recyclable and biodegradable.

Limited capacity to bear load and environmental factors

The corrugated fiberboards are used mainly for packaging and shipping purposes, but they can support up to a certain weight; these boxes are not suitable for transferring very heavy-weighted things. This less weight-carrying capacity restricts it to certain industries and hinders the growth of the corrugated fiberboard market. Strict guidelines for waste disposal and recycling create a challenge for the market players to develop such boxes.

Collaboration among major market players

Planned partnerships with several e-commerce businesses enlarge the potential of the corrugated fiberboard market. It expands the reach of manufacturing companies and updates the rising demand for it. The major reason for the continuously rising demand is the production of sustainable boxes, which most packaging companies prefer. Some of the major market players are Multipack Industries, Aaradhya Enterprise, and TGI Packaging Pvt. Ltd, and many others collaborating to bring innovative manufacturing methods for corrugated fiberboards and different raw materials that can enhance the quality of the packaging boxes.

A wide range of businesses such as electronics, food & beverages, e-commerce, pharmaceuticals, automotive, textile, cosmetics, and many others are progressively investing in this market to grow and develop innovative packaging solutions. The rising e-commerce industry increases the demand for packaging with more durability and flexibility. Product sustainability is trending, and the corrugated fiberboard market is being boosted to enhance its potential.

The flute A segment dominated the corrugated fiberboard market in 2023. Flute A is considered the most-demand box used in the packaging and delivery sector. It is considered to be the original and thickest corrugated flute design, which provides a cushiony effect to the products. Its double-wall combination can carry heavy loads and deliver safely to fragile objects.

It is preferred by a wider range of businesses as it provides resistance against jerk due to its thickness. This is one of the best packaging options as it is an affordable solution for the storage and transport of goods from retailers. It is majorly driven by producing environmentally friendly boxes and recyclable and sustainable products.

| Flute | Flute Height* mm | Number of Flutes per m Length of the Corrugated Board |

| A | 4.8 | 150 |

| B | 2.4 | 150 |

| C | 3.6 | 130 |

| E | 1.2 | 290 |

| F, G, N | 0.5-0.8 | 400-550 |

The single wall segment is expected to grow at a significant rate in the corrugated fiberboard market during the forecast period. Such types of corrugated fiberboards are available in a single layer of corrugated medium inserted between two liners. This pattern provides a balance between flexibility and strength. These single-wall fiberboard boxes are extensively used for retail packaging and shipping as they allow cushion-type protection by absorbing shock developed and giving the boxes a proper structure. This market is majorly driven by the e-commerce industry, as the demand for packaging materials is high.

The food & beverage segment dominated the corrugated fiberboard market in 2023. With the expansion of online shopping among people, these businesses require more high-quality packaging boxes for the safe delivery of products. Corrugated fiberboards are well-known for their protection and durability due to the raw materials and manufacturing process of such boxes. As e-commerce services are growing, the demand for cost-effective packaging materials is also rising. Due to various advancements in the quality of corrugated fiberboard, such as cushioning effect, easy customization facility, rough handling capacity, and many others, the packaging industry prefers these boxes over any other.

Asia Pacific dominated the corrugated fibreboard market in 2023. The rising packaged food culture in food and beverage companies plays a significant role in the growth of the market. With the evolution of this food and beverage market the demand for corrugated fiberboard boxes increases. The surge in consumption of packaged food has ultimately raised the demand for good quality fiberboard boxes for packaging purposes. The food and beverages sector always prefers the usage of eco-friendly sustainable packaging products for safe and secure packaging.

Europe is expected to grow at a significant rate in the corrugated fiberboard market during the forecast period. Sustainable fiberboards are attracting massive attention from people worldwide as consciousness among all is rising towards using eco-friendly. Commercial leaders and customers are looking for eco-friendly goods, so there is a massive demand for such packaging products. Ecological and decomposable corrugated fiberboards are extremely in demand for sustainable packaging purposes.

Some of the main strategies related to packaging industries in this area increase the manufacture of sustainable corrugated fiberboard packaging. Some major corrugated fiberboard market players, such as MM PACKAGING GmbH, DS Smith Packaging France, LACAUX Freres, Gascogne Papier, and many others, are continuously developing enhanced quality corrugated fiberboards.

By Flute Type

By Board Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

August 2024

June 2024