January 2025

Critical Care Devices Market (By Product: Ventilators, Cardiac Monitors, Infusion Pumps, Hemodynamic Monitors, Defibrillators, Intracranial Pressure Monitors, Patient Warmers, Anesthesia Machines, Continuous Renal Replacement Therapy Machines, Electrocardiography Machines; By Application: Cardiology, Neurology, Respiratory Therapy, Trauma Surgery, Renal Care, Neonatology, Oncology Critical Care; By End-user) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

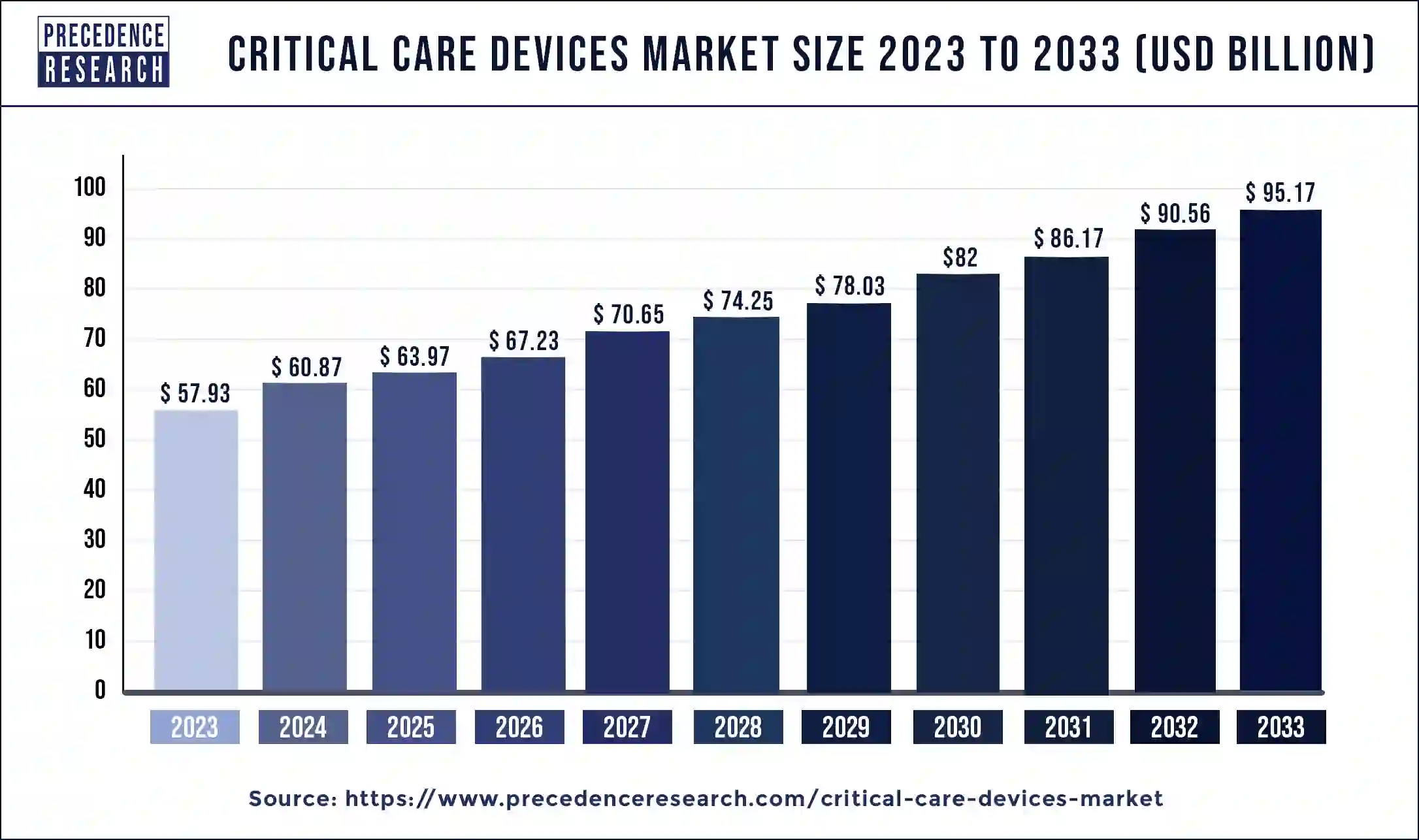

The global critical care devices market size was estimated at USD 57.93 billion in 2023 and is anticipated to reach around USD 95.17 billion by 2033 with a CAGR of 5.09% from 2024 to 2033. Advanced critical care devices enhance patient monitoring, providing real-time data for swift intervention, improving patient outcomes, and reducing medical errors in intensive care settings.

Critical Care Devices Market Overview

Critical care devices are medical instruments designed to monitor and support patients with life-threatening conditions or those in intensive care units (ICUs). These devices encompass a wide range of devices tailored to various critical care needs, including monitoring vital signs, administering medications, and providing life-sustaining therapies. Common critical care devices include ventilators for respiratory support, cardiac monitors for tracking heart activity, infusion pumps for delivering precise medication doses, and hemodynamic monitors for assessing blood circulation. Additionally, devices like defibrillators for cardiac emergencies and intracranial pressure monitors for neurological conditions are vital components of critical care settings.

The application of critical care devices is essential across various medical specialties, including emergency medicine, cardiology, neurology, and critical care medicine. These devices play a crucial role in stabilizing patients during emergencies, managing complex medical conditions, and optimizing patient outcomes in ICU settings. Overall, critical care devices serve as indispensable tools for healthcare professionals, enabling them to monitor patients’ conditions closely, administer appropriate treatments, and provide life-saving interventions in critical situations. Their continued advancements contribute to improving patient care and enhancing medical outcomes in critical care settings.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.09% |

| Global Market Size in 2023 | USD 57.93 Billion |

| Global Market Size by 2033 | USD 95.17 Billion |

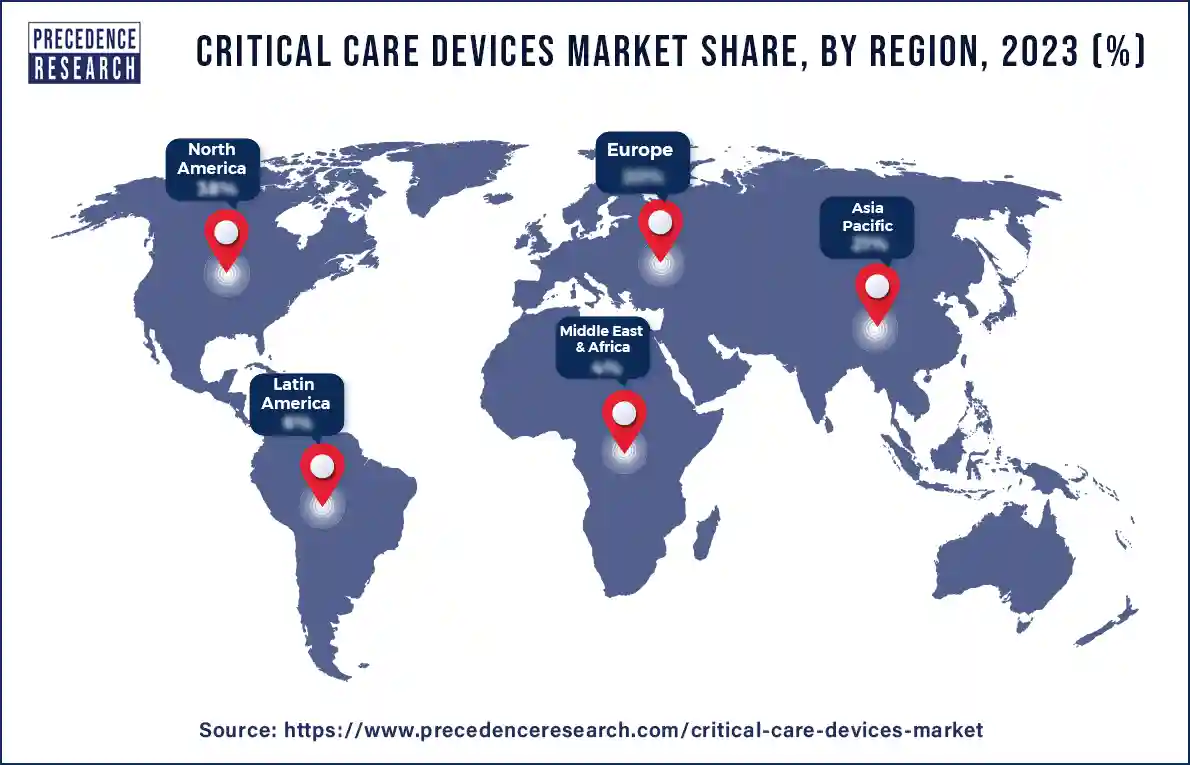

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Rising incidence of chronic diseases

The increasing prevalence of chronic conditions such as cardiovascular diseases, respiratory disorders, and neurological ailments drives the demand for critical care devices. As these conditions often require intensive monitoring and treatment, healthcare facilities invest in advanced devices like ventilators, cardiac monitors, and intracranial pressure monitors to provide optimal care to patients, propelling the growth of the critical care devices market.

Technological advancements and innovation

Ongoing technological advancements, including the integration of artificial intelligence, wireless connectivity, and remote monitoring capabilities, continually enhance the performance and functionality of critical care devices. These innovations improve patient outcomes, streamline workflow efficiency, and reduce healthcare costs, compelling healthcare providers to invest in upgrading their critical care infrastructure, thereby fueling the expansion of the critical care devices market.

Restraints

High initial investment costs

One significant restraint in the adoption of critical care devices is the high initial investment costs associated with purchasing and implementing these advanced medical devices. The sophisticated technology and specialized features incorporated into critical care devices often result in substantial upfront expenses for healthcare facilities. These costs encompass not only the purchase price of the equipment but also installation, training, maintenance, and potential upgrades over time.

Due to budget constraints and financial limitations, many healthcare institutions may find it challenging to afford the upfront investment required to procure critical care equipment in the critical care devices market. Additionally, smaller healthcare facilities or those in resource-limited settings may face even greater barriers in acquiring these expensive devices. Consequently, the high initial investment costs serve as a significant deterrent to the widespread adoption of critical care equipment, hindering accessibility to advanced critical care technologies and potentially impacting patient care outcomes.

Opportunities

Remote monitoring integration

One opportunity lies in the integration of remote monitoring capabilities into the critical care devices market. Advancements in telemedicine and remote patient monitoring technologies present an opportunity to enhance critical care delivery by allowing healthcare professionals to monitor patients’ vital signs and device parameters from a distance.

Future critical care devices could incorporate features such as wireless connectivity and cloud-based data storage, enabling real-time transmission of patient data to healthcare providers. This remote monitoring capability would facilitate early detection of clinical deterioration, timely intervention, and improved patient outcomes, particularly in scenarios where on-site medical expertise is limited or when managing patients in remote or underserved areas.

Personalized medicine integration

Another opportunity lies in the integration of personalized medicine approaches into critical care devices. With advances in genomics, pharmacogenomics, and precision medicine, there is growing recognition of the importance of tailoring medical treatments to individual patient characteristics. Future critical care equipment could leverage patient-specific data, such as genetic profiles, biomarkers, and responses to therapies, to optimize treatment strategies and improve clinical outcomes.

This personalized approach could involve the development of smart algorithms and decision support systems within critical care devices to assist healthcare providers in selecting the most effective interventions for each patient based on their unique physiological and genetic makeup. By incorporating personalized medicine principles, future critical care equipment has the potential to revolutionize patient care by delivering more targeted and efficient treatments, ultimately leading to better outcomes and reduced healthcare costs.

The ventilators segment held the largest share of the critical care devices market in 2023. With the recent COVID-19 pandemic, ventilators have been in high demand for providing respiratory support to patients with severe cases of the virus. These critical care devices deliver oxygen to the lungs and help patients breathe when they are unable to do so on their own. The advanced features of modern ventilators, such as adjustable parameters and modes tailored to different patient needs, make them essential in managing respiratory distress and improving patient outcomes.

The continuous renal replacement therapy (CRRT) machines segment is expected to show the fastest growth in the critical care devices market during the forecast period. CRRT machines have seen increased use in critical care settings for patients with acute kidney injury or severe renal dysfunction. These machines perform continuous removal of waste products and excess fluids from the blood, mimicking the function of the kidneys. They are vital in maintaining fluid and electrolyte balance, managing metabolic imbalances, and preventing complications in critically ill patients with compromised renal function.

The cardiology devices segment dominated the critical care devices market in 2023. Cardiology remains a dominant field due to the close relationship between renal function and cardiovascular health. Many cardiac patients suffer from comorbidities such as hypertension and heart failure, which can significantly impact renal function. Cardiologists closely monitor renal function in these patients as part of comprehensive cardiac care, often requiring frequent assessments and interventions to manage renal complications.

The renal care segment shows notable growth in the critical care devices market during the forecast period. Unsurprisingly, renal care stands out as another dominant segment for renal function applications. This field is specifically focused on managing kidney health and treating conditions such as chronic kidney disease (CKD) and acute kidney injury (AKI). Renal care facilities heavily rely on renal function assessments to diagnose and monitor kidney diseases, adjust treatment regimens, and optimize patient outcomes. Given the increasing prevalence of kidney-related disorders globally, the demand for renal care and associated critical care devices continues to rise steadily.

The hospitals segment dominated the critical care devices market in 2023. Hospitals remain the primary users of critical care, offering comprehensive medical services and accommodating patients with various critical conditions. They require a wide range of equipment, including ventilators, cardiac monitors, and infusion pumps, to support intensive care units (ICUs) and emergency departments.

The home healthcare settings segment is expected to witness notable growth in the critical care devices market during the forecast period. With the increasing trend towards home-based care, critical care devices are increasingly utilized in home healthcare settings. Devices like portable ventilators, oxygen concentrators, and vital signs monitors enable patients to receive critical care services in the comfort of their homes, promoting patient comfort and reducing healthcare costs.

North America led the biggest share of the critical care devices market in 2023. North America’s dominance reflects its advanced healthcare infrastructure, high healthcare spending, and robust research and development capabilities. The region boasts a large number of established medical device manufacturers and leading healthcare institutions, driving innovation and adoption of advanced critical care technologies. Moreover, factors such as an aging population, high prevalence of chronic diseases, and stringent regulatory standards contribute to the strong demand for critical care devices in North America.

Asia-Pacific is expected to witness growth at a significant rate in the critical care devices market during the forecast period of 2024-2033. The emergence of Asia Pacific as an important market signifies shifting global healthcare dynamics. Rapid economic growth, increasing healthcare investments, and expanding healthcare access in countries like China, India, and Japan are driving the demand for critical care devices. Additionally, rising healthcare awareness, growing middle-class populations, and increasing government initiatives to improve healthcare infrastructure are fueling market growth in the region.

Segments Covered in the Report

By Product

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

October 2024

January 2025