September 2024

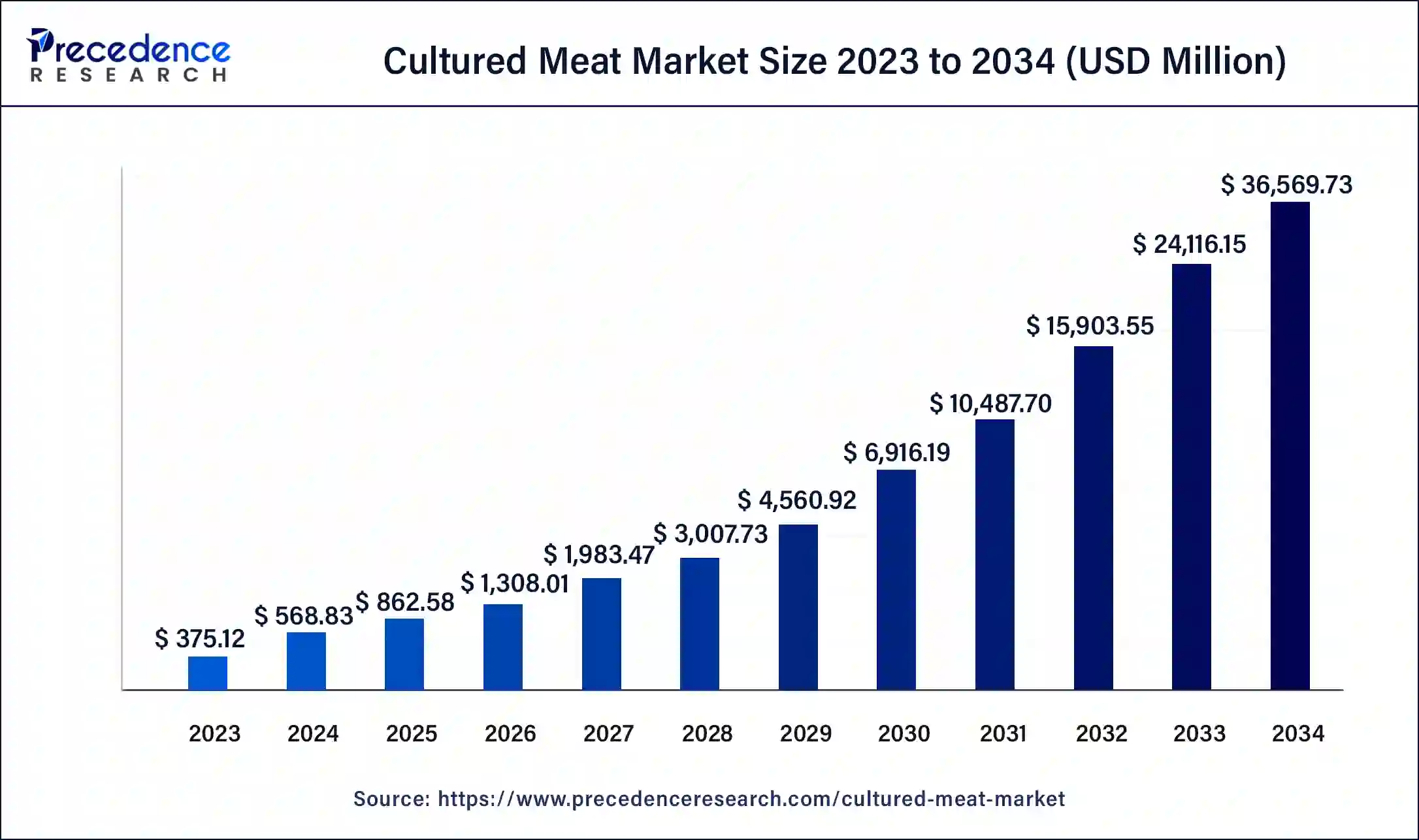

The global cultured meat market size was estimated at USD 375.12 million in 2023, calculated at USD 568.83 million in 2024 and is expected to be worth around USD 36,569.73 million by 2034. The market is slated to expand at 51.64% CAGR from 2024 to 2034.

The global cultured meat market size is projected to reach around USD 36,569.73 million by 2034 increasing from USD 568.83 million in 2024, at a CAGR of 51.64% from 2024 to 2034. The North America cultured meat market size reached USD 138.79 million in 2023. The cultured meat market growth is attributed to rising consumer demand for sustainable and ethical food solutions.

The usage of cultured meat is expanding fast, and production attempts are made continually to further enhance the technique that is being used on a large scale. Cultured meat, also referred to as in vitro meat or cell-based meat, is real meat grown in a laboratory from animal cells without using an animal. In this process, muscle cells are taken from a live animal and are then cultured in growth media.

The cells are further propagated in bioreactors. The proven product is akin to the normal meat product but developed in a more environmentally friendly and humane way using PSC. Technological developments in cellular agriculture and biotechnology are improving production processes and reducing costs, thereby boosting the cultured meat market.

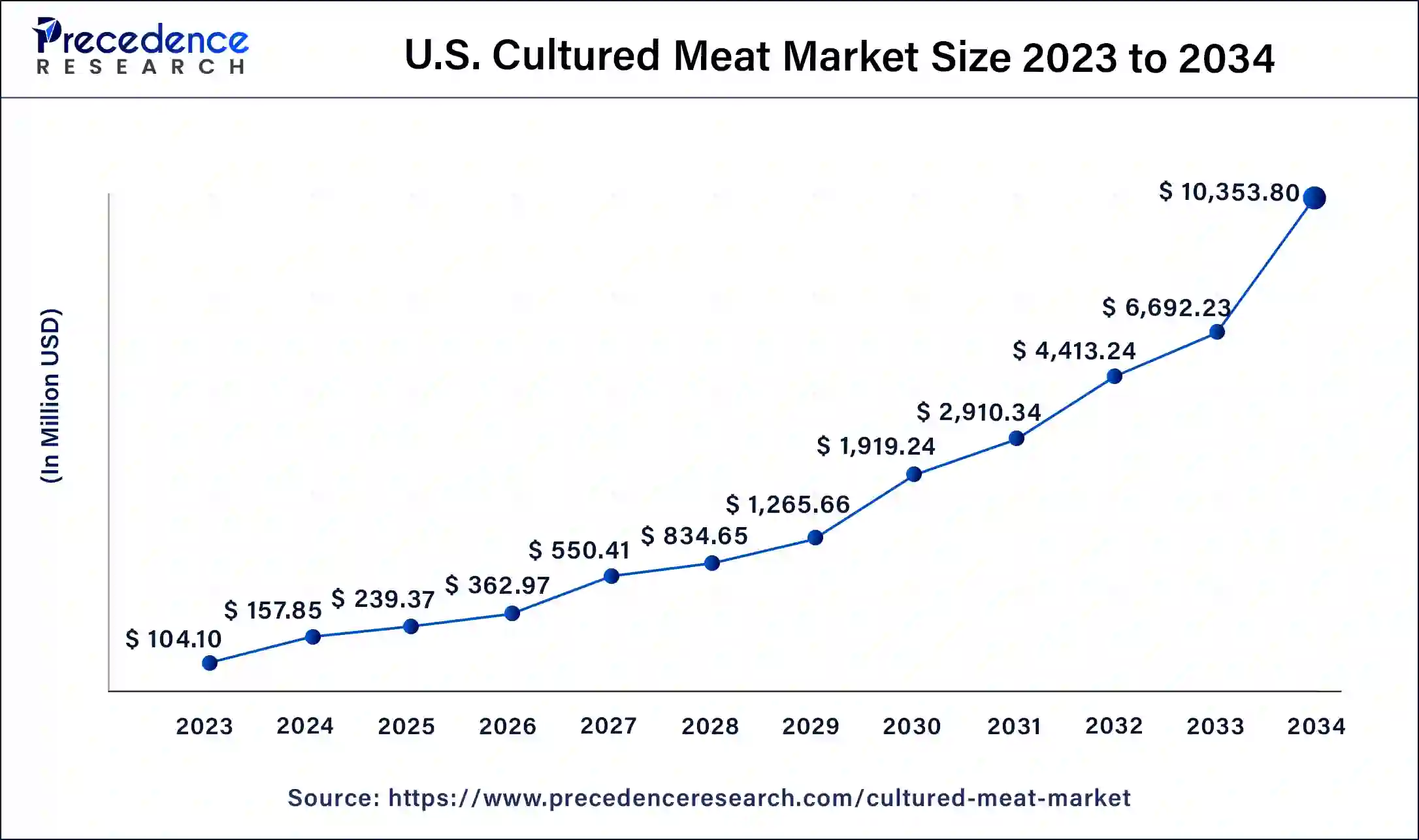

The U.S. cultured meat market size was exhibited at USD 104.10 million in 2023 and is projected to be worth around USD 10,353.80 million by 2034, poised to grow at a CAGR of 51.91% from 2024 to 2034.

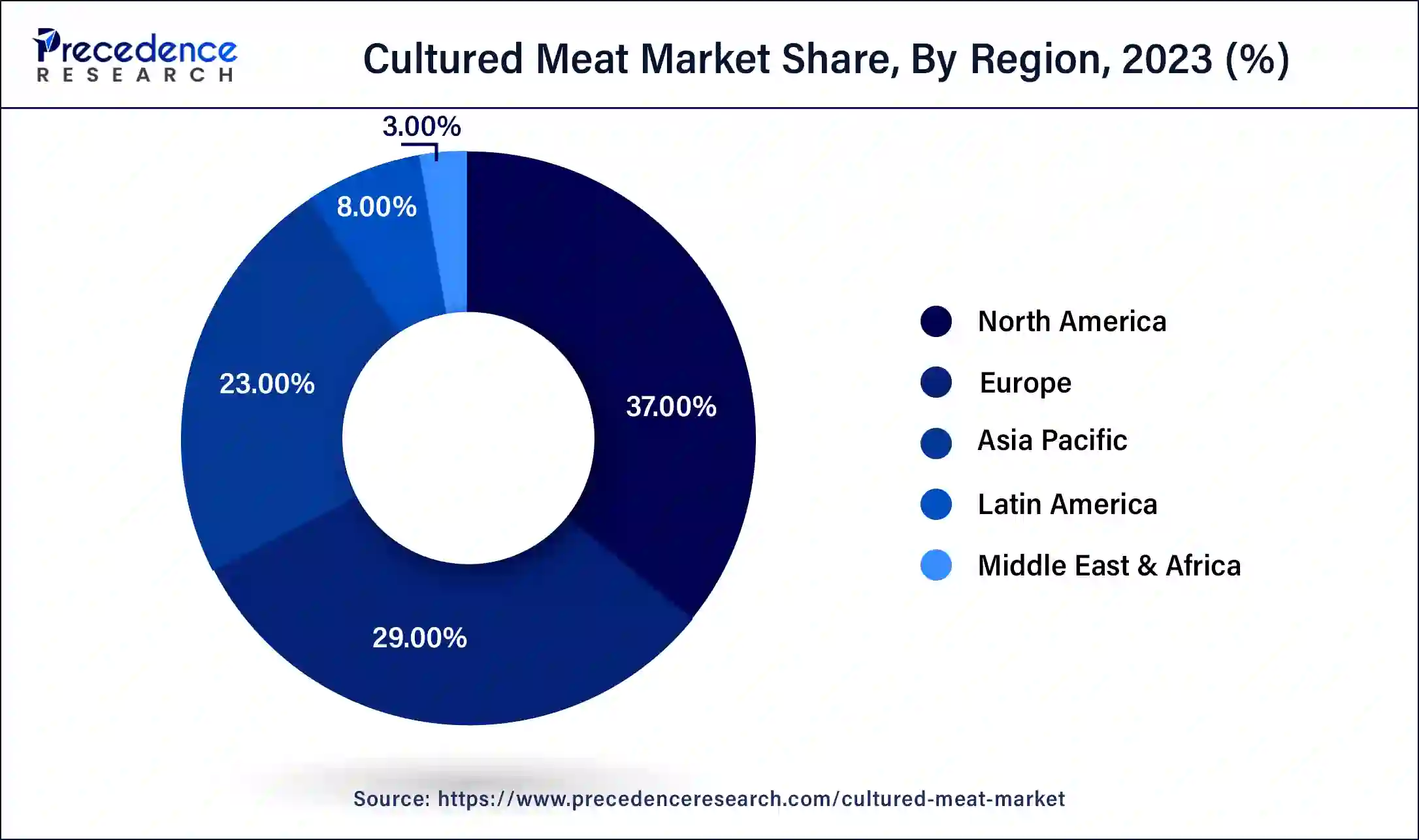

North America dominated the cultured meat market in 2023 due to the high research and development and countable consumers’ concern about the sustainability of food alternatives. The level of technology development in the region and relevant support from both private and public entities accelerate the development and mainstreaming of cultured meat products. This region's consumers show great interest in the next-gen proteins, which substantially fuels its market growth. Furthermore, the strong distribution channels and growing interest in adopting and developing cultured meats further boost the market in the region.

Asia Pacific is expected to grow with the fastest CAGR in the cultured meat market during the forecast period. The increase in consumers requirement for environmentally and ethically friendly food solutions is due to stringent environmental standards and food security concerns. Asian countries are currently on the frontline in encouraging the use of green technologies and minimizing carbon emissions. Additionally, supportive regulation and funding in emerging countries are expected to enhance market growth. The pragmatic and cultural differences in the population's eating habits and the nutritional value and emphasis on food quality and sustainability further create demand for cultured meats in this region.

Artificial Intelligence's Impact on the Cultured Meat Market

In the cultured meat market, intelligent solutions enhance the approaches to the design of growth media and conditions for culturing cells and thus reduce production expenses. Artificial intelligence and machine learning methods analyze huge amounts of data in order to forecast trends, enhance product specifications, and shorten the time to launch new products. The utilization of AI also helps in creating a client-oriented experience, where the company offers new nutritional values that are specifically adapted to individual clients’ needs.

| Report Coverage | Details |

| Market Size by 2034 | USD 36,569.73 Million |

| Market Size in 2023 | USD 375.12 Million |

| Market Size in 2024 | USD 568.83 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 51.64% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Source, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Environmental concerns

Increasing environmental concerns are expected to drive the growth of the cultured meat market. The environmental cost of conventional meat processing and its contribution to factors such as greenhouse gas emissions, deforestation, and water consumption is making consumers and clients look for meat produced through more sustainable methods. Compared to conventional meat, cultured meat has a much lower impact on these aspects as it requires less area and water and does not emit greenhouse gases.

The desire for sustainable foods corresponds with the fight against climate change, thus making cultured meat acceptable to conscious consumers and firms. Environmental organizations and policymakers are paying attention to the cultured meat market as it has declared its interest in minimizing carbon footprints and improving resource efficiency. Additionally, the increased consumer demand and institutions will further boost the market in the coming years.

Healthier living trends

Rising consumer demand for healthier and ethical food options is projected to boost the adoption of the cultured meat market. Customers are paying attention to nutritional value and social responsibility and choose products with a proper attitude. The prospects of using fewer antibiotics and hormones are also appreciated by the health-conscious population, which results in higher market demand and subsequently supports its growth. Moreover, the awareness of the ecological consequences of regular meat production affects consumers’ decisions.

Since cultured meat lessens the carbon footprint with minimal resource utilization, it appeals to conscious consumers. Advances in plant-based diets and the adoption of flexitarian lifestyles also foster the cultured meat market since people are seeking a variety of types of protein. Further expansion of cultured meat products is due to a rise in their consumption in retail outlets and food service industries, as well as supportive marketing and education campaigns.

High production costs restrict

High production costs are anticipated to restrain the expansion of the cultured meat market. Cultivation of cells is a technical process that involves multiple complicated equipment, expensive growth media, and bioreactors, which also increase production costs. Such expenses make it difficult to price cultured meat to market standards and still compete with other conventional meat products. Research and development are required to continue improving the approaches to production to drive costs up. Small-scale operations presently also pose a threat to lowering unit production costs. Moreover, the high capital investment it calls for in setting up modern production facilities puts a lot of pressure on the company’s finances, and it becomes hard for the new entrant firms to compete effectively.

Growing investment

An increase in research and development funding presents favorable opportunities for developing cultured meat technology, which further boosts the overall cultured meat market. Venture capital funding, government grants, and collaboration with industries enhance innovation in production techniques and product quality. This financial support helps to advance such solutions and find ways to reduce the costs of applying cultured meat solutions to become more marketable.

Investment in crucial R&D nowadays improves the search for new production methods, which leads to enhancements in efficiency and stem cell quality. Expenditure in raising consumer awareness and coming up with campaigns also improves market acceptance as people are equipped with knowledge of the advantages of cultured meat. Furthermore, funding helps to finance partnerships with universities and research institutes, which contribute to enhancing innovative research, increasing the use of cultured meat, and further boosting the cultured meat market.

The poultry segment dominated the cultured meat market during the forecasting period due to their lower cost of production than beef and pork. The growth cycle of poultry cells is relatively shorter when compared to large animals, and this helps in faster production of the product. Furthermore, consumers’ interest in poultry products is high since the products are flexible and cheaper to use than other meats. These advantages make it easier to invest in and research the improvement of poultry-based cultured meat, thus boosting the segment.

The beef segment is projected to grow rapidly in the cultured meat market in the future years owing to the customers’ growing demand for beef products and the negative effects on the environment of conventional types of beef rearing. Beef is widely popular as a source of protein for its texture and taste of the meat remain high on consumers’ preference. This contributes to companies' focus on cultured beef meat production. Additionally, continuous advancement in cellular agriculture is positively impacting beef production by increasing scalability and cutting costs. All these factors contribute to further fuelling the segment in the coming years.

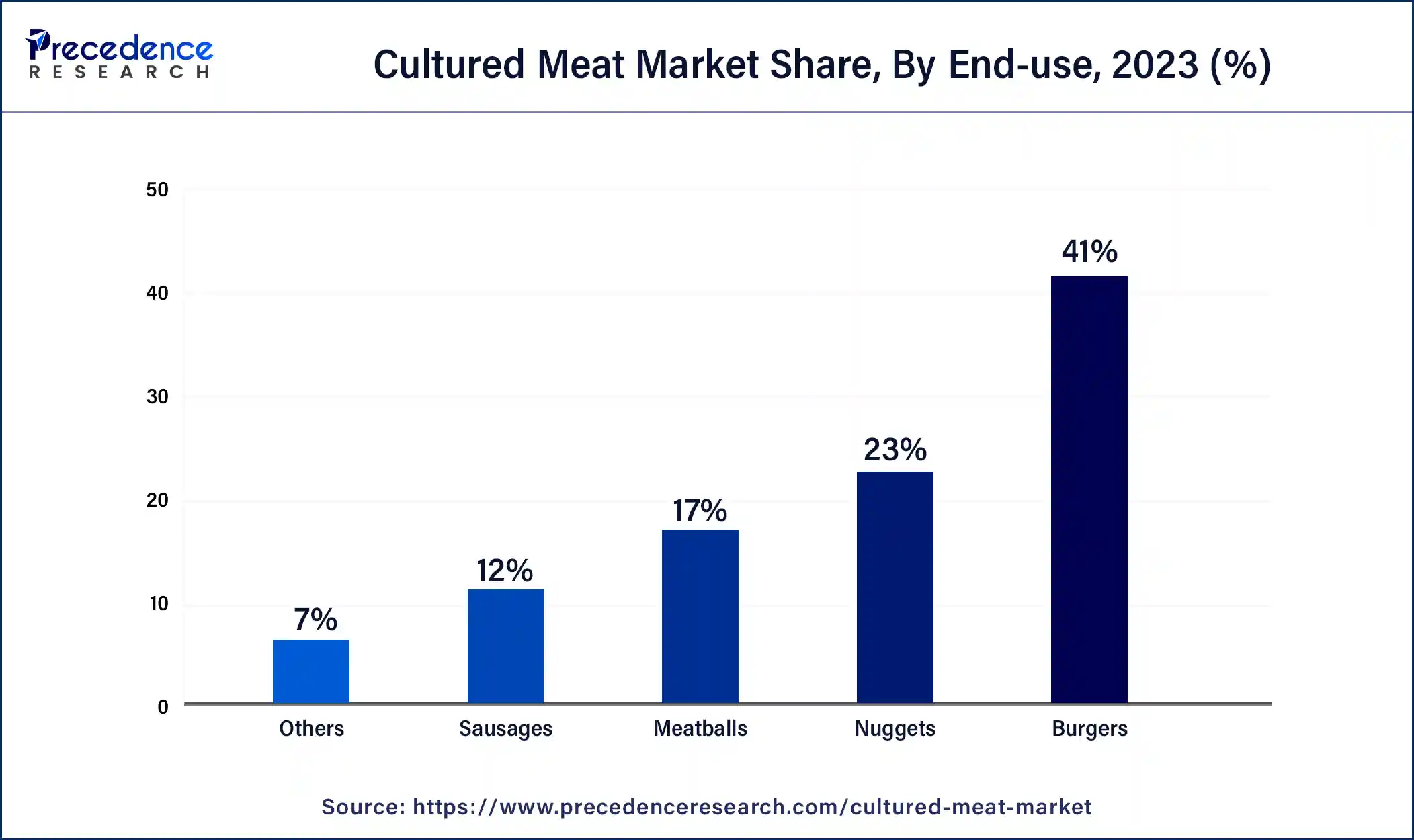

The burgers segment led the global cultured meat market in 2023, as burgers are one of the most demanded food products both in the fast-food format and in establishments of the highest gastronomic level. Burgers are a popular food item that facilitates companies to work with the cultured meat, texture, and quality that consumers desire. The improvement in technology, therefore, means that it is possible to prepare quality cultured meat burgers at a cheaper cost. Furthermore, the increasing awareness of customers concerning sustainable and ethical food products further boosts the market.

The meatballs segment is expected to grow at the fastest rate in the cultured meat market in the future years, owing to the high consumer demand for ready-to-eat meat foods. Cultured meatballs fit well into this requirement as they are something that even the children quickly recognize due to their ease of production but with all the qualities resembling regular chicken meatballs. Moreover, meatballs are relatively cheaper to produce in large quantities, thus making them easily available to a wider audience. All these factors contribute to fuelling the segment in the coming years.

Segments Covered in the Report

By Source

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

February 2025

August 2024