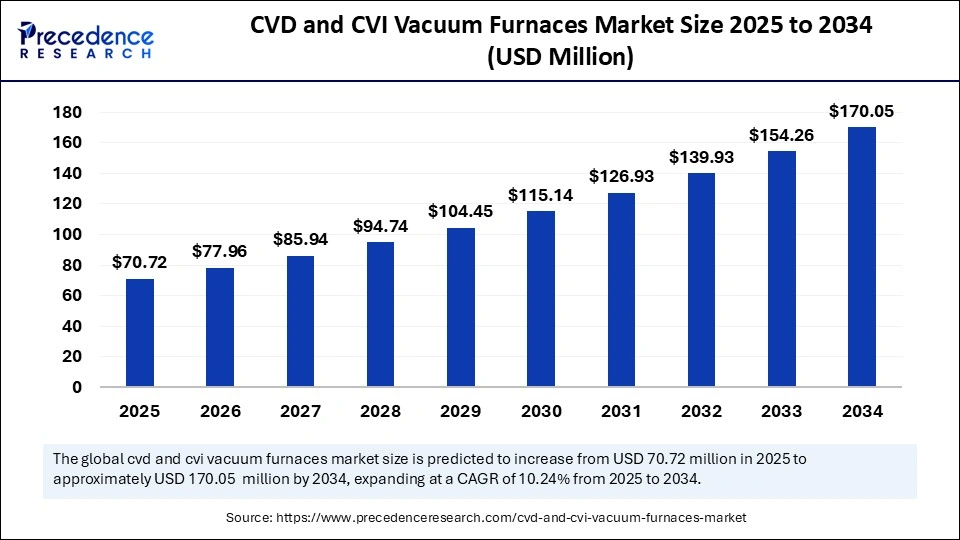

The global CVD and CVI vacuum furnaces market size is calculated at USD 70.72 million in 2025 and is forecasted to reach around USD 170.05 million by 2034, accelerating at a CAGR of 10.24% from 2025 to 2034. The North America market size surpassed USD 25.66 million in 2024 and is expanding at a CAGR of 10.38% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global CVD and CVI vacuum furnaces market size accounted for USD 64.15 million in 2024 and is predicted to increase from USD 70.72 million in 2025 to approximately USD 170.05 million by 2034, expanding at a CAGR of 10.24% from 2025 to 2034. High-tech industries fuel the growth of the market through their increasing requirement for materials with stronger properties and increased resistance to heat, and improved durability.

The introduction of Artificial Intelligence in CVD and CVI vacuum furnaces controls the market by boosting process efficiency as well as precision and automation capabilities. Real-time operations for vacuum furnaces are optimized through AI, which provides smarter control on parameters including temperature, gas flow, pressure, and deposition rates. The use of artificial intelligence in research and development accelerates operations as AI-generated predictive models eliminate the need for physical material experiments. The aerospace, electronics, and automotive industries can achieve high-performance materials requirements through AI-driven furnaces that combine quality performance with manufacturing productivity.

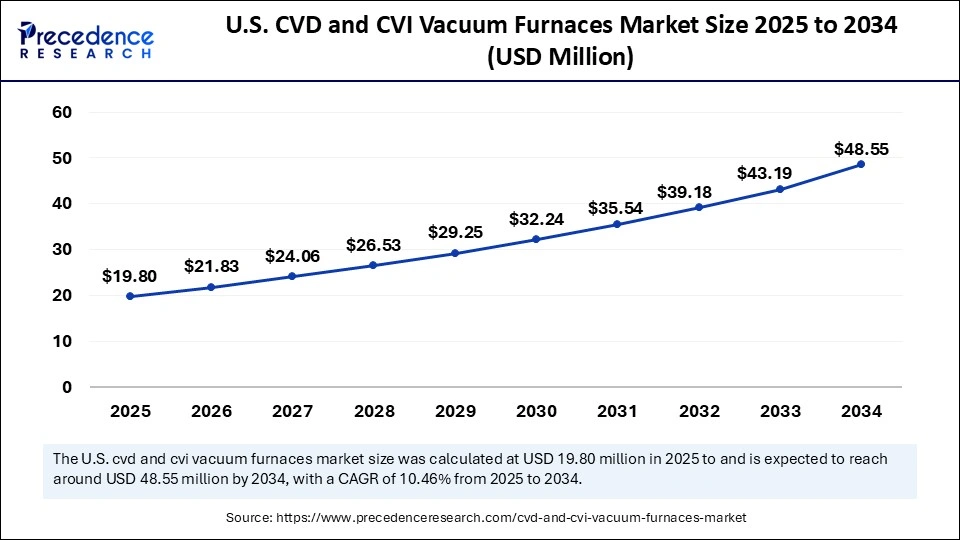

The U.S. CVD and CVI vacuum furnaces market size was exhibited at USD 17.96 million in 2024 and is projected to be worth around USD 48.55 million by 2034, growing at a CAGR of 10.46% from 2025 to 2034.

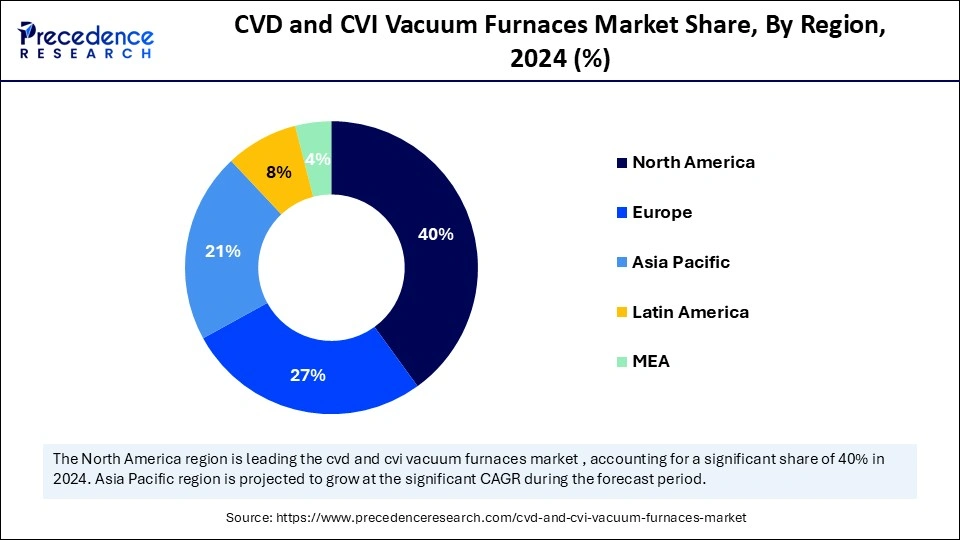

North America accounted for the largest share of the CVD and CVI vacuum furnaces market in 2024, due to its primary role in the production of electronic, automotive, and aerospace equipment. The industry sectors need materials featuring outstanding strength, thermal resistance, and extended durability. The market experiences growing demand because North America implements operational measures focused on energy savings, manufacturing sustainability, and robotic process advancement.

The United States functions as a global center for semiconductor production and electronics manufacturing, which requires CVD furnaces to achieve precise coating and fabrication operations. Manufacturers must purchase advanced vacuum furnace systems because strict regulatory demands and output quality standards force them to adopt equipment that meets exact specifications.

Asia Pacific is anticipated to witness the fastest growth in the CVD and CVI vacuum furnaces market during the forecasted years. Industrialization in China and India drives their companies to devote more resources to creating advanced materials for the aerospace, automotive, electronics, and energy applications sectors.

China’s dedication to sustainable industrial operations and its focus on energy efficiency promote the rapid adoption of environmentally conscious vacuum furnace systems. The “Make in India” initiative by the Indian government and expanding investments in electronics and automotive manufacturing have made the country an important contributor to the industry.

Europe plays an important role in the growth of the global CVD and CVI vacuum furnaces market. The region witnesses continuous growth because different industries, including aerospace, automotive, and electronics, need high-performance materials that demand vacuum furnaces. Europeans focus on sustainability; their stringent environmental regulations motivate manufacturers to invest in low-emission furnace technologies that use less energy. The region will intensify investments in sustainable manufacturing and innovative activities.

CVD delves into gas reactions to make thin films, whereas CVI enables the filling of porous materials for creating dense composites. Industrial manufacturing depends heavily on these two complementary technologies for creating materials that must resist heat while maintaining excellent structures and extended surface lifespans. CVD and CVI vacuum furnaces play an essential role in industry development through their ability to generate outstanding high-performance results.

The CVD and CVI vacuum furnaces market expands because manufacturing sectors seek components of minimal weight, heat-insensitive properties, and chemical corrosion resistance for aerospace and automotive operations. Semiconductor manufacturers rely on ultra-thin and uniform coatings to meet performance requirements in their devices, thus fueling growth within the electronic sector. The market growth also results from expanding electric vehicle production, renewable energy systems, and defense technology developments, which all raise the demand for quality components.

| Report Coverage | Details |

| Market Size by 2034 | USD 170.05 Million |

| Market Size in 2025 | USD 70.72 Million |

| Market Size in 2024 | USD 64.15 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.24% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, orientation, operation, end-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising Demand for High-Performance Materials

The CVD and CVI vacuum furnaces market experiences growth because industries repeatedly demand advanced materials. The focus is on processing components that require resistance to extreme conditions such as high temperatures, corrosion, and mechanical stress in aerospace, automotive, and electronic sectors. The advanced coatings and composite materials with improved thermal resistance and enhanced strength and durability become possible through CVD and CVI vacuum furnace technology. The continuous expansion of industrial boundaries in performance, efficiency, and miniaturization drives rapid growth in the high-spec materials market.

High Initial Investment and Operational Costs

Manufacturers in the CVD and CVI vacuum furnaces market must incur high initial expenses to obtain advanced vacuum furnaces because they require exact control features and automatic gas systems. Advanced vacuum furnaces demand excessive operating costs, which include substantial power usage and maintenance expenditures, as well as specific gas expenses, most notably in high-temperature applications or industrial systems operating continuously. The capital expenses required for managing these conditions prevent small and mid-sized production facilities within emerging economies from expanding their business operations.

Rising Adoption of Electric Vehicles

Electric Vehicles and growing interest in renewable energy technologies represent a substantial business opportunity for CVD and CVI vacuum furnaces manufacturing. The sustainability demands of the global market have led industries to invest in superior materials that enhance their energy conservation capabilities, operational performance, and product longevity. The shift toward sustainable clean energy approaches and improved transportation methods will sustainably grow the CVD and CVI vacuum furnaces market.

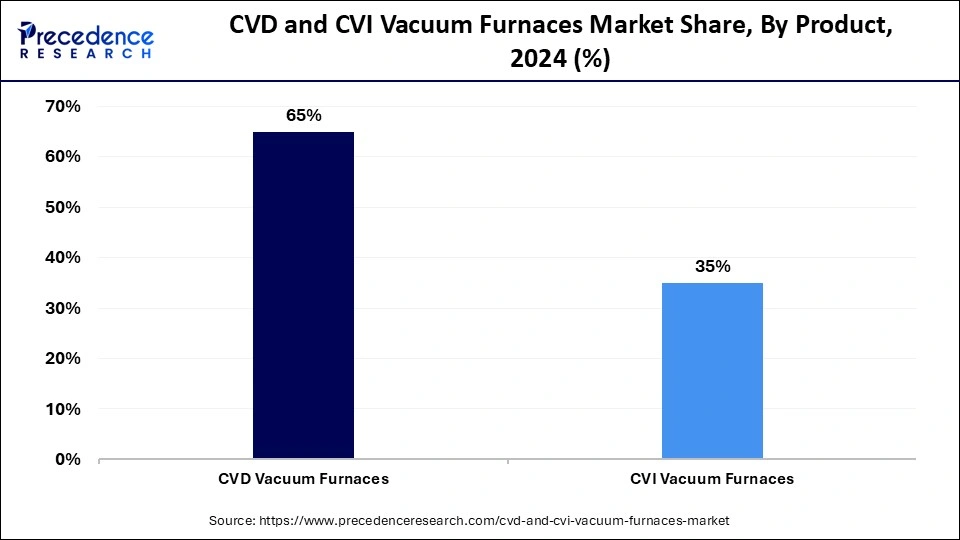

The CVD vacuum furnaces segment held a significant CVD and CVI vacuum furnaces market share in 2024.. Specialized vacuum-based systems known as furnaces generate thin film and coating deposits, which occur by gas precursor chemical reactions in vacuum conditions. CVD vacuum furnaces execute their procedure via complete management of temperature, vacuum conditions, and gas flow controls so chemical reactions can happen precisely. Industry sectors, including semiconductors and aerospace, with solar energy, drive the market demand for CVD vacuum furnaces because of their fundamental importance for thin-film material production techniques.

The CVI vacuum furnaces segment is anticipated to show considerable growth in the market over the forecast period. The production of advanced composite materials, particularly ceramic matrix composites (CMCs), depends heavily on CVI furnaces within modern industries. Substrate infiltration occurs during CVI processing through controlled vacuum conditions with determined temperatures, which promote the gradual formation of solid material inside porous spaces. The market expands because sectors like aerospace, defense, and automotive use CMCs to produce turbine blades, heat shields, and high-performance brakes, therefore driving market expansion.

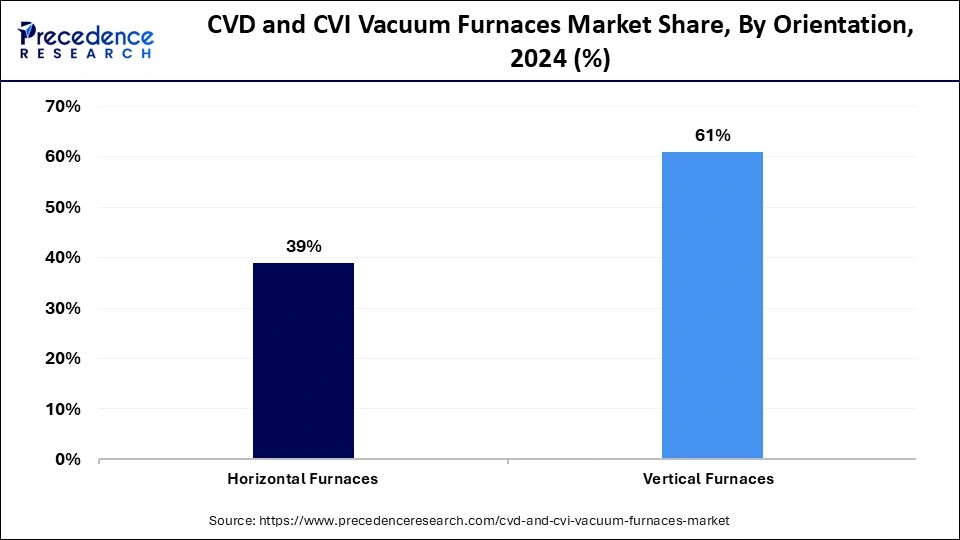

The vertical furnaces segment captured the biggest CVD and CVI vacuum furnaces market share in 2024. The semiconductor industry, with advanced material producers, prefers vertical furnaces for their compact design capability and their precise control features over deposition processes. Vertical systems deliver their best results when used for making thin film layers with precise control and minimal process contamination. The vertical vacuum furnace market demand will sustain steady growth because manufacturers constantly require better system performance, reduced size, and enhanced reliability.

The horizontal furnaces segment is expected to grow at the fastest during the forecast period. The simple design of horizontal furnaces and their operational efficiency make material handling operations easy, which suits production lines that need high volume throughput. The main benefit of horizontal furnaces is their ability to achieve simultaneous uniform heating across all parts of the substrate surface, which leads to homogeneous deposition or infiltration results. Horizontal vacuum furnaces will gain increased adoption because industries require better, durable, high-strength materials and cost-effective, scalable production systems.

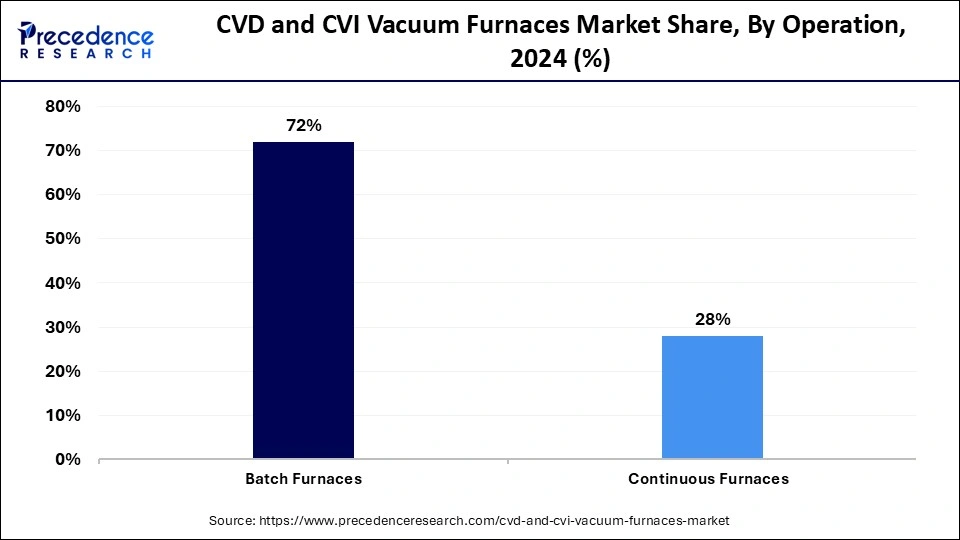

The batch furnaces segment captured the biggest CVD and CVI vacuum furnaces market share in 2024. The design of batch furnaces allows engineers to work with materials in separate triggering periods, which enables precise control of processing parameters and flexible use. Batch furnaces function as excellent material processing units because they support multiple substances and operational prerequisites through the same equipment, keeping customized variations steady. Specialized and high-performance component manufacturers choose batch furnaces to fulfill their CVD and CVI requirements since these systems provide processing versatility and manufacturing precision.

The continuous furnaces segment is expected to grow rapidly during the forecast period. These systems suit industries that require vital functions such as efficiency, scalability, and uniformity production, which includes automotive industries as well as electronics and renewable energy sectors. Continuous furnaces operate at high efficiency, minimizing production stops between cycles, thus reducing expenses per manufactured product while maintaining fast output speed. Continuous furnaces serve numerous industries operating CVD and CVI processes because they enable reliable, prolonged process stability.

The aerospace segment dominated with the largest CVD and CVI vacuum furnaces market share in 2024. High-performance aerospace components such as turbine blades, thermal barrier coatings, and advanced composites require these furnaces for their production. These furnaces remain essential due to their capability to deliver exact control of furnace temperature, vacuum levels, and gas compounds precisely as needed by the aerospace industry for its rigorous safety standards. CVD and CVI vacuum furnaces will maintain their essential role for aerospace standards because they provide crucial manufacturing solutions to produce reliable components that serve next-generation propulsion systems and hypersonic technologies.

The automotive segment is anticipated to show considerable growth over the forecast period. The production of brake systems, engine parts, exhaust coatings, and lightweight structural elements heavily depends on these furnaces for material development. By employing CVD and CVI processing, manufacturers can create strong layers with both resistance to wear and high-temperature operation that improve the operational period and performance of important automotive elements. The market demand for advanced processing solutions increases because electric and hybrid vehicle technologies drive material development for powertrain and battery components, on which CVD and CVI furnaces play a critical role.

By product

By orientation

By operation

By end-use

By region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client