November 2024

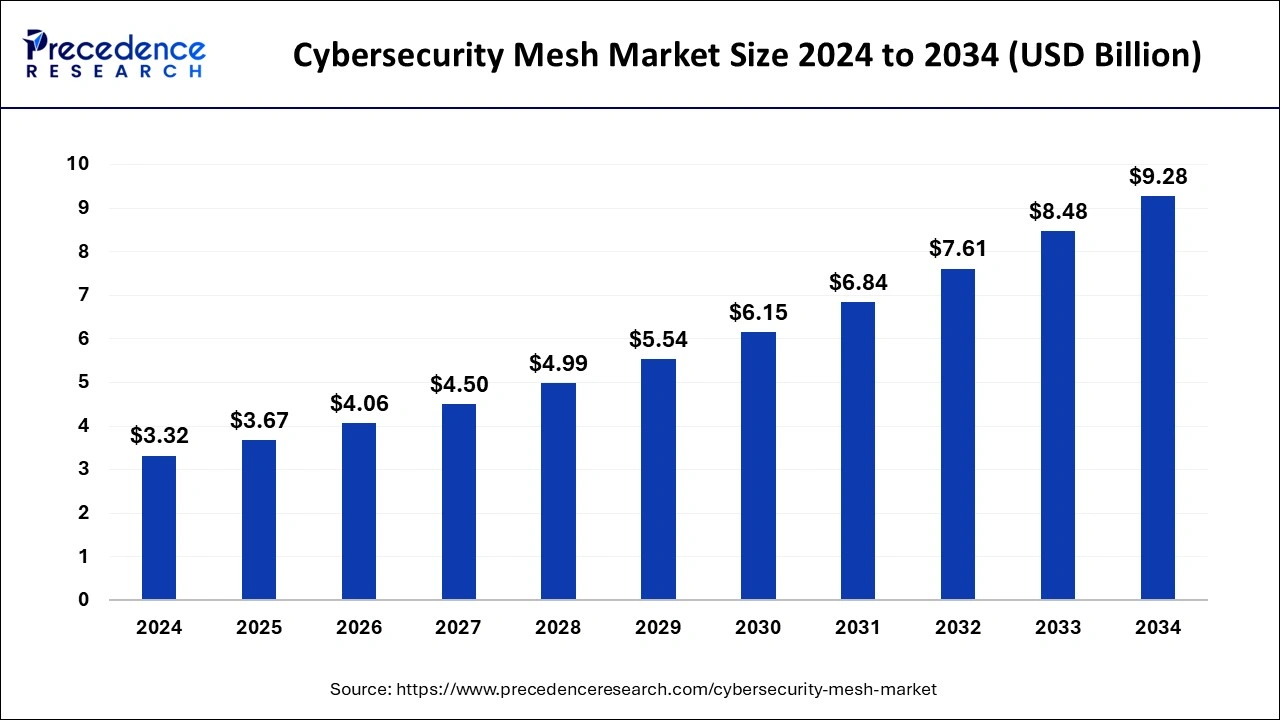

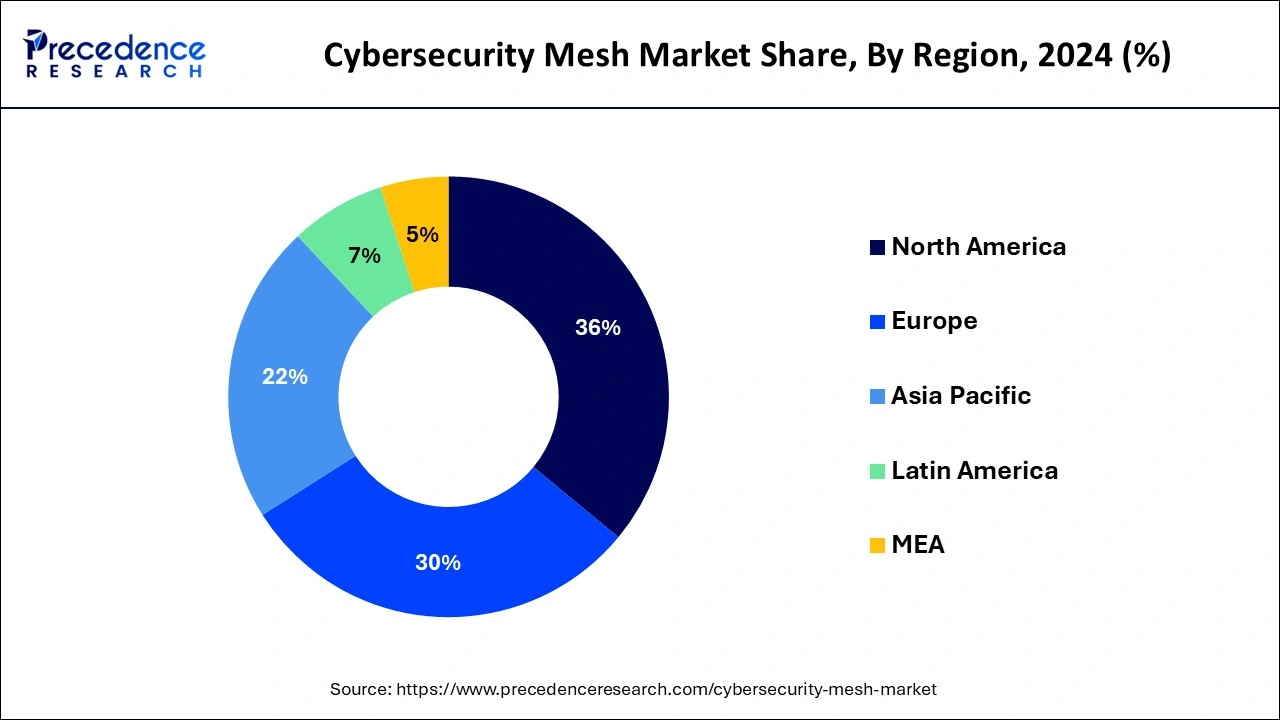

The global cybersecurity mesh market size is calculated at USD 3.67 billion in 2025 and is forecasted to reach around USD 9.28 billion by 2034, accelerating at a CAGR of 10.83% from 2025 to 2034. The North America cybersecurity mesh market size surpassed USD 1.20 billion in 2024 and is expanding at a CAGR of 10.85% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cybersecurity mesh market size was estimated at USD 3.32 billion in 2024 and is predicted to increase from USD 3.67 billion in 2025 to approximately USD 9.28 billion by 2034, expanding at a CAGR of 10.83% from 2025 to 2034.

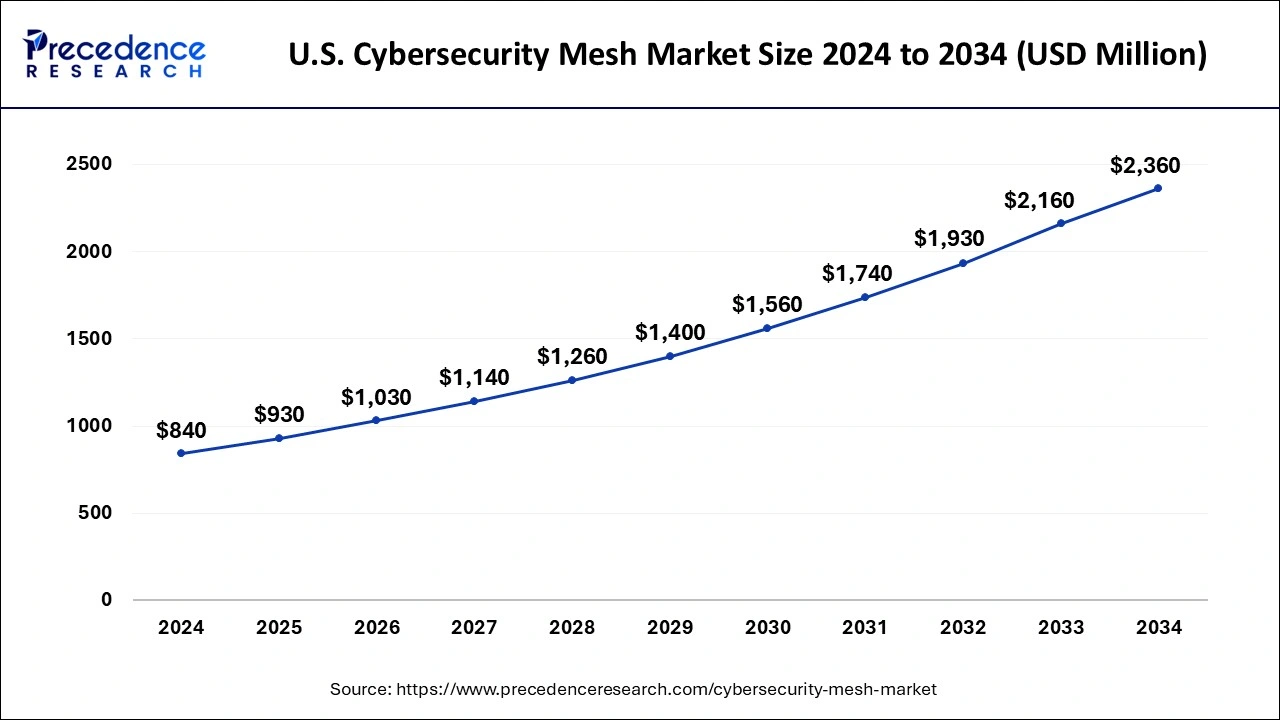

The U.S. cybersecurity Mesh market size was estimated at USD 840 million in 2024 and is anticipated to reach around USD 2360 million by 2034, growing at a CAGR of 10.88% from 2025 to 2034.

North America asserted its dominance with a 36% market share in the cybersecurity mesh market in 2024. The cyber threat landscape in North America is marked by complexity and constant evolution, with attacks targeting critical infrastructure, corporations, government agencies, and individuals through cyberspace. Robust cybersecurity measures are imperative to safeguard sensitive data, vital systems, and infrastructure. The region has witnessed significant data breaches, impacting both corporations and individuals, leading to a heightened focus on data protection and privacy. Cybersecurity mesh solutions play a crucial role in this context, providing organizations in North America with granular security controls and encryption techniques to protect sensitive data, ensure data privacy, and comply with regulatory requirements.

Europe emerged as the fastest-growing regional market over the forecast period. The region faces ongoing challenges from sophisticated cyber threats, including ransomware attacks, data breaches, and targeted assaults. Various entities such as government agencies, healthcare providers, financial organizations, and critical infrastructure are increasingly becoming targets. Cybersecurity mesh solutions offer enhanced security capabilities by providing distributed security controls, facilitating threat intelligence sharing, and coordinating incident response efforts to counteract these evolving threats in Europe.

The cybersecurity mesh market offers a contemporary cyber defense strategy that stands out by independently securing each device with its own perimeter, comprising firewalls and network protection tools. In contrast to traditional security practices that often rely on a single perimeter to safeguard an entire IT environment, a cybersecurity mesh embraces a holistic approach to cybersecurity.

The adoption of this security strategy has gained traction, especially with the surge in remote work arrangements and the widespread use of cloud solutions that distribute devices and machines across diverse locations. The evolving landscape has prompted organizations to reevaluate data access and control policies, leading to the implementation of new technologies. The increasing frequency of cyberattacks targeting organizations in recent years has further emphasized the need for robust cybersecurity measures, driving the growth of the cybersecurity mesh market.

There is a substantial demand for cybersecurity mesh solutions across various industry verticals, including IT & ITeS, BFSI, healthcare, energy and utilities, among others. This growing demand is a testament to the industry's recognition of the effectiveness and relevance of cybersecurity mesh in addressing contemporary cybersecurity challenges.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 10.83% |

| Market Size in 2025 | USD 3.67 Billion |

| Market Size by 2034 | USD 9.28 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Offering, By Deployment, By Enterprise Size, and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rapid expansion and growing sophistication of cyberattacks

The increasing demand for the cybersecurity mesh market is fueled by the rapid expansion and growing sophistication of cyberattacks, coupled with the migration of assets to the hybrid multi-cloud environment. IT managers are increasingly recognizing the need for a scalable and composable cybersecurity mesh design to seamlessly integrate security products into a collaborative ecosystem. The rising adoption of cybersecurity mesh architecture across various industry verticals, aimed at ensuring secure access to unsecured networks and personal devices, is propelling market demand globally.

The COVID-19 pandemic has played a significant role in reshaping the cybersecurity landscape, pushing cyber assets beyond traditional logical and physical security boundaries. In response, businesses are turning to the cybersecurity mesh as a practical and effective solution. This architectural approach allows organizations to establish security parameters around devices and identities, providing a foundation for dependable, adaptable, and scalable cybersecurity safeguards.

As cyber threats continue to evolve, deploying a cybersecurity mesh architecture emerges as a practical solution to secure assets and endpoints in the post-COVID age. This approach not only addresses contemporary threats but also offers resilience against sophisticated and evolving cybersecurity challenges. The cybersecurity mesh represents a strategic and forward-looking solution to navigate the dynamic and complex cybersecurity landscape in the modern digital era.

Additionally, the cybersecurity mesh architecture provides a scalable and modular approach to extend security controls, especially for widely dispersed assets. Its versatility makes it well-suited for modular strategies that align with hybrid multi-cloud systems. Cybersecurity Mesh Architecture (CSMA) facilitates a more modular, adaptable, and robust security ecosystem. Unlike traditional siloed approaches, a cybersecurity mesh enables technologies to communicate through various supporting layers, including security intelligence, centralized policy management, and identity fabric. These advantages are anticipated to drive market demand in the coming years.

Shortage of skilled expertise for implementing and utilizing cybersecurity mesh solutions

The cybersecurity industry is grappling with a shortage of skilled expertise, creating a significant challenge for organizations in effectively deploying and utilizing cybersecurity mesh solutions. The increasing complexity of the cybersecurity landscape, coupled with the growing number of entry points for cyber threats, demands a workforce with specialized knowledge and skills. Unfortunately, there is a scarcity of trained cybersecurity professionals capable of comprehending and responding to advanced cyberattacks.

The rising sophistication of cyber threats, including the emergence of new zero-day threats, underscores the importance of deploying cybersecurity mesh solutions for detecting and remediating attacks. However, low awareness about advanced cyber threats and inadequate spending on cybersecurity training contribute to the industry's skill gap. Recognizing the urgency, organizations are seeking to increase their IT and cybersecurity headcount. Cloud security specialists, security operations analysts, security administrators, and architects are among the most sought-after roles in cybersecurity. As organizations deliberately build teams of specialized talent to navigate the complex threat landscape, addressing the skills gap in the cybersecurity sector remains a critical imperative. The deployment of cybersecurity mesh solutions requires a workforce equipped with the right expertise to effectively safeguard against evolving cyber threats.

Growing demand for soundproof transportation

Organizations are increasingly adopting multi-cloud deployments, wherein they leverage services from multiple cloud providers.

In a single-cloud scenario, management is simpler with a unified interface. In contrast, multi-cloud deployments require managing multiple interfaces and understanding each component across various clouds. Additionally, ensuring cost efficiency and compliance becomes complex as assets are dynamically provisioned based on demand. Different cloud providers, such as Alibaba Cloud, Amazon Web Services, Google, and Microsoft Azure, have distinct security methodologies and support varying policies, making it challenging to establish a consistent security posture. Cybersecurity Mesh Architecture (CSMA) serves as the foundation for securely connecting people and machines across hybrid and multi-cloud environments, diverse application generations, and various channels, safeguarding all digital assets of organizations.

The existing identity and security architectures struggle to adapt to the evolving needs of today. Cybersecurity Mesh Architecture (CSMA) addresses this challenge by providing a unified and integrated security framework that can secure assets across on-premises, data centers, and the cloud. CSMA standardizes the way security tools communicate, facilitating collaboration among standalone solutions to strengthen the overall security posture. This approach enables the repositioning of control points closer to the assets being protected and centralizes policy management. These factors are expected to drive the demand for the cybersecurity mesh market globally throughout the forecast period.

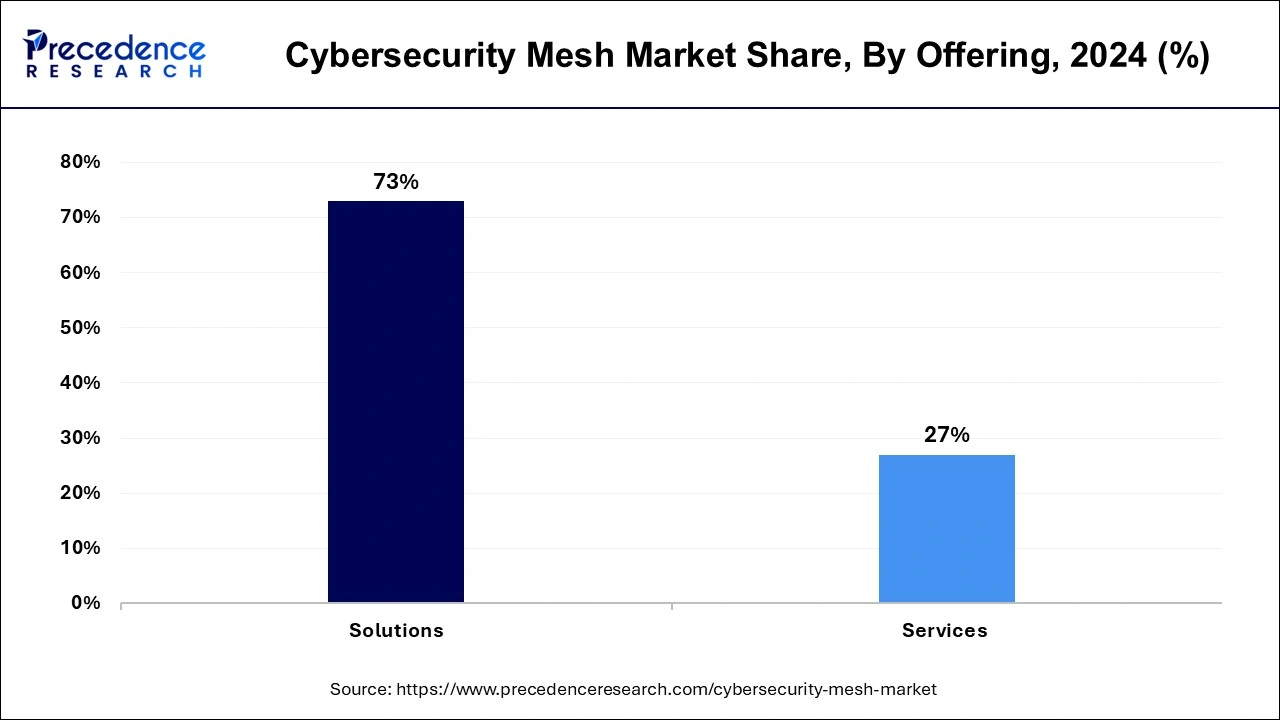

The solutions segment held the largest share of 73% in 2024. The advent of technologies such as edge computing, machine learning, and artificial intelligence has facilitated the development of cybersecurity mesh solutions. These technologies enhance overall security posture by enabling intelligent threat detection, behavior analytics, and automated responses at the edge. Many businesses are subject to strict regulatory and compliance standards regarding data security and privacy. Cybersecurity mesh solutions, by implementing security controls at the device level, allow organizations to demonstrate compliance more thoroughly and granularly, thereby driving demand from end-use industries.

The services segment is anticipated to experience the fastest CAGR of 14.8% during the forecast period. The shift toward a zero-trust architecture has influenced the adoption of cybersecurity mesh services. Zero trust emphasizes the verification and authorization of every person and device, irrespective of their location or network. Cybersecurity mesh services reduce reliance on network-level security by providing security protections at the individual device level, aligning with the principles of zero trust. This is expected to contribute to the rapid expansion of the services segment.

The cloud segment dominated the market, holding the largest market share of 67% in 2024 The widespread adoption of cloud computing by businesses is attributed to its scalability, flexibility, and cost-effectiveness. As more critical corporate operations and data are migrated to the cloud, the need for robust security measures becomes increasingly crucial. Cybersecurity mesh in the cloud facilitates the distributed and scalable securing of cloud environments, ensuring uniform application of security measures across all cloud resources.

The on-premise segment is expected to witness growth in its CAGR of 10.8% during the forecast period. Many organizations store critical resources and sensitive data in on-premises environments. It is imperative to protect these assets from unauthorized access, data breaches, and insider threats. The deployment of cybersecurity mesh in on-premises environments allows businesses to directly apply security rules to specific endpoints and devices, providing granular protection for vital assets and mitigating risks.

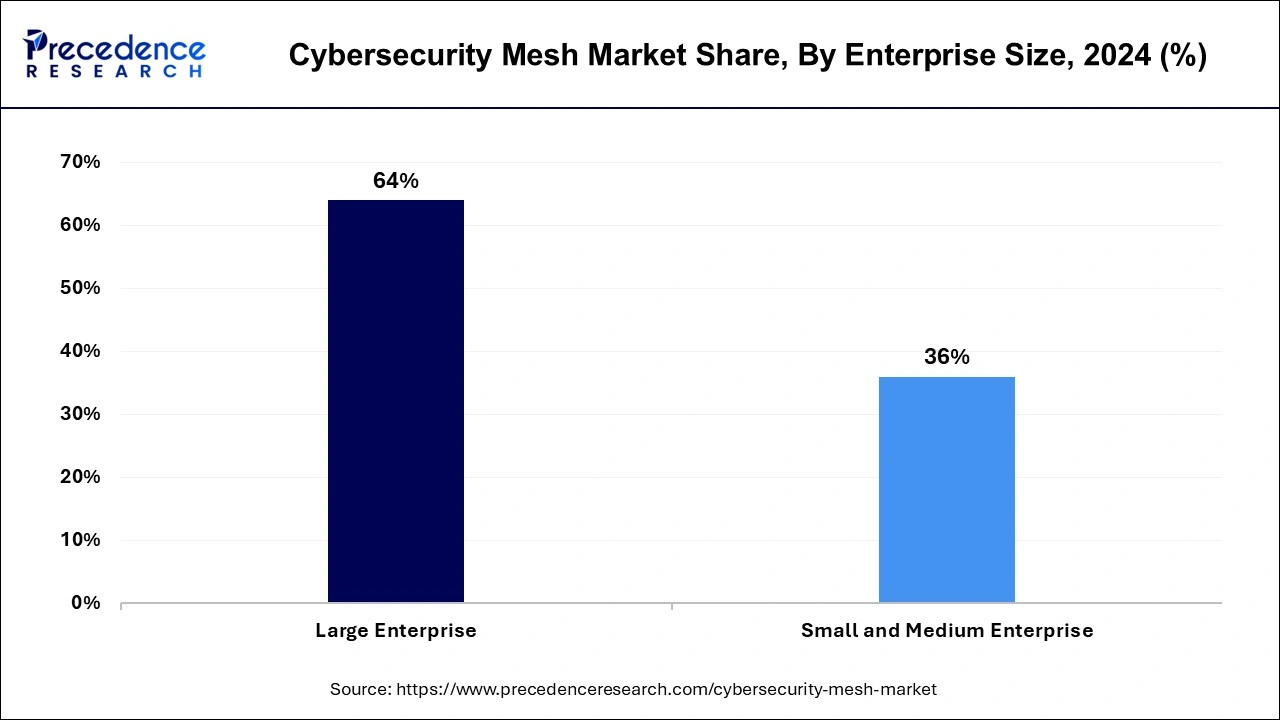

The large enterprise segment currently dominating the market and holding the largest market share of 64% in 2024. Large businesses are often targeted in cyber attacks due to the substantial amount of data and resources they possess. To counter the growing complexity and sophistication of cyber threats, enterprises need advanced security measures. Cybersecurity mesh systems enhance security by implementing controls directly on individual devices, allowing for real-time threat detection, response, and containment.

The Small & Medium Enterprise (SME) segment is anticipated to experience a significant CAGR. Small and Medium-sized Enterprises (SMEs) are not immune to cyber-attacks and are frequently singled out, as it is assumed they may have less robust security measures compared to larger companies. Recognizing the increasing frequency and sophistication of cyber threats such as ransomware, phishing, and data breaches, SMEs now acknowledge the necessity for robust cybersecurity measures. Cybersecurity mesh solutions offer SMEs advanced security capabilities to protect their digital assets and sensitive data.

The IT and telecom segment held the largest market share of 29% in 2024 for the cybersecurity mesh market. The IT and telecom sectors have rapidly embraced cloud computing and virtualization technologies to enhance agility, scalability, and cost-effectiveness. However, these technologies introduce specific security challenges, such as data privacy concerns, multi-tenancy issues, and vulnerabilities in virtual machines. Cybersecurity mesh solutions present an integrated security framework for the IT & Telecom sector, covering virtualized infrastructure and cloud environments. This allows for consistent security controls and policies to protect data and applications, driving increased demand for the cyber security mesh market within the IT and telecom sector.

The healthcare segment is expected to witness a fastest CAGR of 13.6% over the forecast period. This growth is attributed to the critical need to secure patient health records and the healthcare industry's susceptibility to cyberattacks. Increasing cyber threats, including ransomware, data breaches, and targeted attacks, underscore the importance of robust security measures in the healthcare sector. Organizations in healthcare recognize the significance of implementing strong security measures to safeguard patient information, critical infrastructure, and ensure uninterrupted treatment. Cybersecurity mesh solutions offer an adaptive and distributed security approach to mitigate the growing risks in the healthcare industry.

By Offering

By Deployment

By Enterprise Size

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025

July 2024

June 2025