July 2024

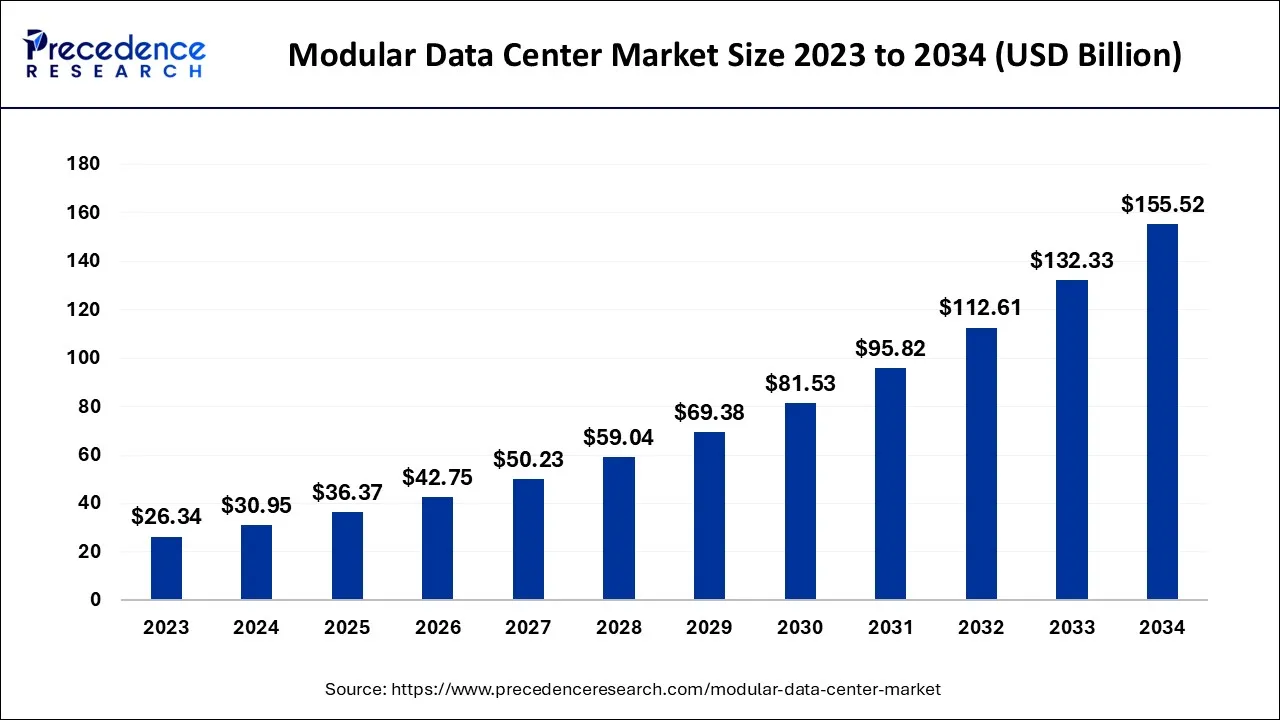

The global modular data center market size accounted for USD 30.95 billion in 2024, grew to USD 36.37 billion in 2025 and is expected to be worth around USD 155.52 billion by 2034, registering a CAGR of 17.52% between 2024 and 2034. The North America modular data center market size is calculated at USD 12.69 billion in 2024 and is estimated to grow at a CAGR of 17.66% during the forecast period.

The global modular data center market size is calculated at USD 30.95 billion in 2024 and is projected to surpass around USD 155.52 billion by 2034, growing at a CAGR of 17.52% from 2024 to 2034.

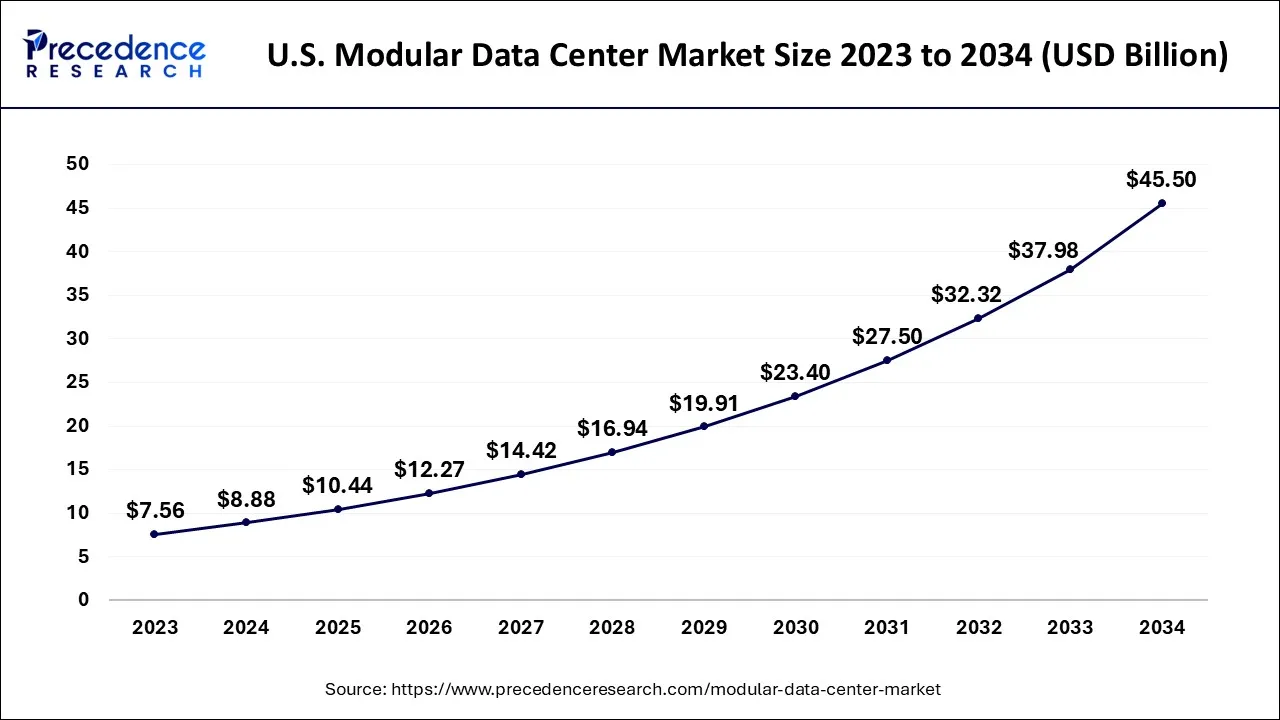

The U.S. modular data center market size is exhibited at USD 8.88 billion in 2024 and is projected to be worth around USD 45.50 billion by 2034, growing at a CAGR of 17.75% from 2024 to 2034.

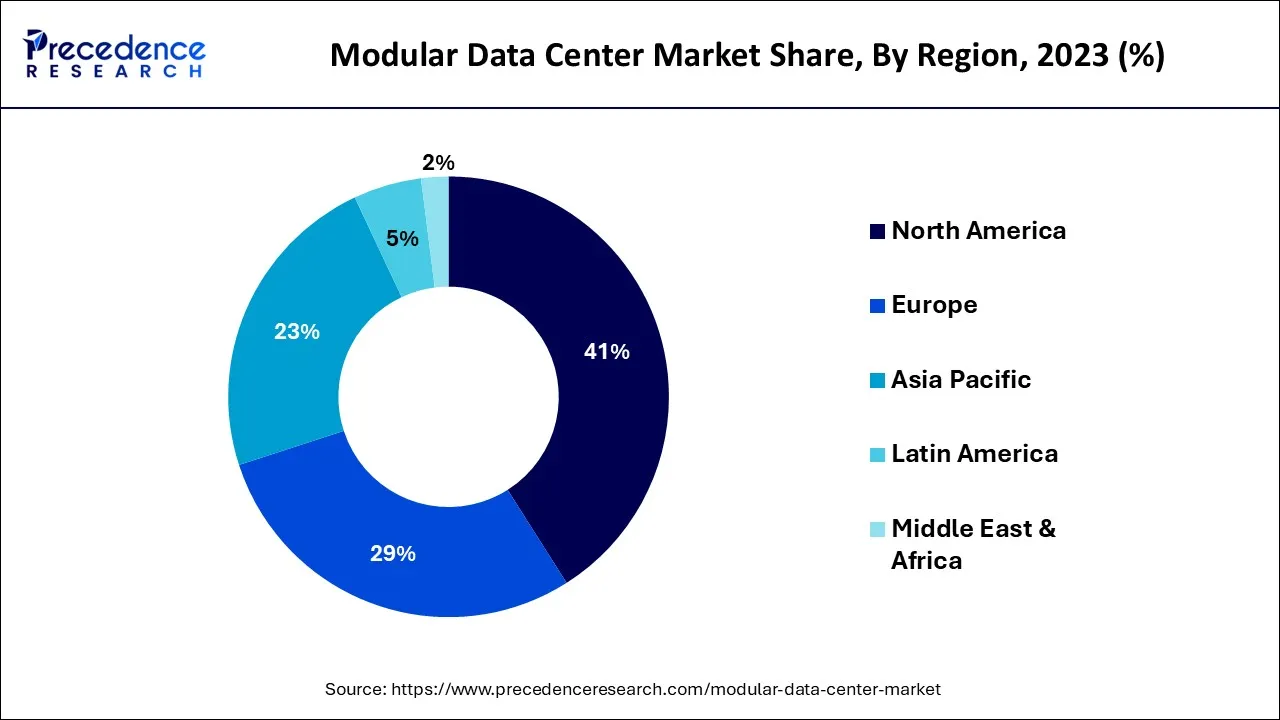

On the basis of geography, North America dominates the market, primarily driven by the mature IT infrastructure and a high adoption rate of cloud computing, big data, and IoT technologies, which are driving the demand for modular data centers. Thus, the North American modular data center market is anticipated to grow, driven by the surging demand for edge computing, high-performance computing, and green data center solutions.

Europe is also a significant market for modular data centers. Countries such as France, Germany, United Kingdom, and the Netherlands have many data centers and cloud service providers, increasingly adopting modular data center solutions. The increasing demand for edge computing and the need for high-performance computing solutions in industries such as BFSI, healthcare, and manufacturing are driving the growth of the European modular data center market.

The region in Asia-Pacific is anticipated to have the greatest CAGR. The Asia-Pacific modular data center market is anticipated to continue growing, driven by the increasing demand for edge computing, high-performance computing, and green data center solutions in the region. China is the largest market for modular data centers in Asia-Pacific, with many cloud service providers and a growing need for edge computing solutions. Japan is also a significant market for modular data centers in Asia-Pacific, with a strong focus on green data center solutions and a growing need for high-performance computing solutions in industries such as manufacturing and automotive.

A modular data center (MDC) is a portable data center that can be deployed anywhere, anytime. It is a self-contained computing environment that includes all the necessary components, such as power and cooling systems, servers, storage, and networking equipment. MDCs are designed to be scalable, flexible, and energy-efficient, and they can be used for various applications, including cloud computing, disaster recovery, edge computing, and mobile computing. The modular data center market is a rapidly surging industry driven by the rising demand for data storage and processing.

Furthermore, The global modular data center market is anticipated to grow considerably, driven by organizations increasingly adopting modular solutions to meet their growing data storage and processing needs. Modular data centers can be rapidly deployed, allowing organizations to respond to business needs and IT demands quickly. This is important in industries such as healthcare, finance, and e-commerce, where downtime can significantly impact operations and revenue.

Modular data centers can be quickly and easily scaled up or down, allowing organizations to adapt to changing business needs and IT requirements. This scalability enables companies to add capacity as needed without building an entire data center, which can be expensive and time-consuming.

However, security concerns, lack of standardization, and complexity of design, build, & management are anticipated to impede the market growth. Modular data centers can be complex to design, build, and manage. This complexity can lead to higher costs and longer deployment times, which may deter some organizations from adopting this technology. While modular data centers are designed to be scalable, their capacity may be limited compared to traditional data centers. This could be a constraint for organizations that require large amounts of computing power or data storage.

The COVID-19 pandemic have accelerated demand for modular data centers. The pandemic has forced several companies to adopt remote work policies, which has led to increased demand for IT infrastructure that can support remote work. Modular data centers are well-suited for this purpose, as they can be quickly deployed in remote locations to support remote workers.

The growing demand for various applications, including cloud computing, disaster recovery, edge computing, and mobile computing, propelled market demand. The various factors are helping to drive the market are:

| Report Coverage | Details |

| Market Size in 2024 | USD 30.95 Billion |

| Market Size by 2034 | USD 155.52 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 17.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Organization Size, Industry Verticals, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Modular data centers are flexible, modular, and scalable to brighten the market prospect

Traditional data centers are typically built as large, monolithic structures that are expensive to scale and inflexible to change. In contrast, modular data centers are designed to be flexible, modular, and scalable, allowing organizations to add capacity as needed without building an entire data center. Modular data centers consist of prefabricated modules assembled on-site, allowing rapid deployment and expansion. These modules can be easily added or removed, allowing organizations to scale their IT infrastructure up or down as required. This flexibility allows organizations to react quickly to changing business needs and IT requirements.

In addition to their scalability and flexibility, modular data centers are also designed to be energy-efficient, reducing operational costs over time. They use advanced cooling and power management technologies to reduce energy consumption, resulting in lower utility bills and a smaller carbon footprint. The scalability and flexibility of modular data centers make them perfect for a various range of applications, including cloud computing, edge computing, mobile computing, and disaster recovery.

They can be deployed in various environments, including remote or harsh locations, where traditional data centers may not be practical. Thus, the demand for modular data centers is driven by their ability to provide flexible, scalable, and energy-efficient IT infrastructure that can be quickly deployed and adapted to meet changing business needs and IT requirements.

Cost-effectiveness

Modular data centers are built off-site and shipped to the deployment location, reducing construction costs compared to traditional data centers typically built on-site. This can result in significant labor, materials, and time savings. Also, these are designed to be scalable, allowing organizations to add capacity as needed without building an entire data center. This can reduce the upfront costs of building a large data center and lower ongoing operating costs by allowing organizations to add capacity gradually as needed.

Furthermore, modular data centers can be quickly deployed, reducing the time-to-market and allowing organizations to start generating revenue sooner. This can be particularly important for businesses that need to rapidly scale their IT infrastructure to support new initiatives or changing market conditions. Moreover, they are designed for easy maintenance, with individual modules that can be easily replaced or repaired.

This can reduce maintenance costs compared to traditional data centers, which may require costly repairs or upgrades to entire facility sections. Thus, the cost-effectiveness of modular data centers is driving demand for this technology as organizations look for ways to optimize their IT infrastructure investments while maintaining scalability, reliability, and performance. As the demand for cloud computing, edge computing, and other data-intensive applications grows, modular data centers will likely become an increasingly popular option for organizations looking to modernize their IT infrastructure.

Security concerns are causing hindrances to the market

Security threats become a major concern as organizations increasingly rely on data centers to process and store sensitive information. Modular data centers are typically located on-site, making them vulnerable to physical security threats such as theft or vandalism. These concerns can be addressed by implementing security measures such as access controls, surveillance systems, and fencing. Also, these modular data center stores and process sensitive information, making them attractive targets for cybercriminals seeking to steal data or disrupt operations. These concerns can be addressed by implementing robust security protocols such as firewalls, intrusion detection systems, and encryption.

Furthermore, modular data centers may need to comply with various regulations and standards governing data security and privacy, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States or the general data protection regulation (GDPR) in the European Union. Weakening to comply with these regulations can result in significant fines and damage to an organization's reputation. Thus, security concerns significantly restrain the demand for modular data centers. Addressing these concerns is essential to ensure that organizations can take benefit of the advantages of modular data centers without compromising the security of their data and operations.

These are the following factor which is likely to create opportunity over the forecast period.

On the basis of component, the modular data center market is divided into solution and services, with the services segment accounting for most of the market because these services are essential for ensuring the optimal performance and smooth operation of a modular data center.

The services include a modular data center's hardware and software components, such as IT infrastructure, power and cooling infrastructure, and physical infrastructure. Providers of modular data center services may also offer training and education programs for customers and may assist in migrating the data center workload to the new environment.

On the basis of the organization size, the modular data center market is divided into large enterprises and small & medium enterprises, with the large enterprises accounting for most of the market. This segment includes large organizations with extensive IT infrastructure requirements. These organizations typically have large data centers and complex IT environments, needing high performance, scalability, and security. They may also have strict compliance requirements that need to be met, such as those related to data privacy or industry regulations.

It may use modular data centers to expand its existing capacity, deploy new applications or services, support disaster recovery and business continuity efforts, and drive demand in this segment.

On the basis of industry verticals, the modular data center market is divided into BFSI, IT & telecom, retail, manufacturing, healthcare, energy, media & entertainment, government, and others, with the BFSI accounting for most of the market because the BFSI sector requires high levels of security, reliability, and availability for their IT infrastructure. Modular data centers can provide a flexible and scalable solution for the BFSI sector, enabling them to quickly deploy and manage their IT infrastructure while maintaining high levels of security and reliability.

Segments Covered in the Report

By Component

By Organization Size

By Industry Verticals

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

April 2025

January 2025

March 2025