April 2025

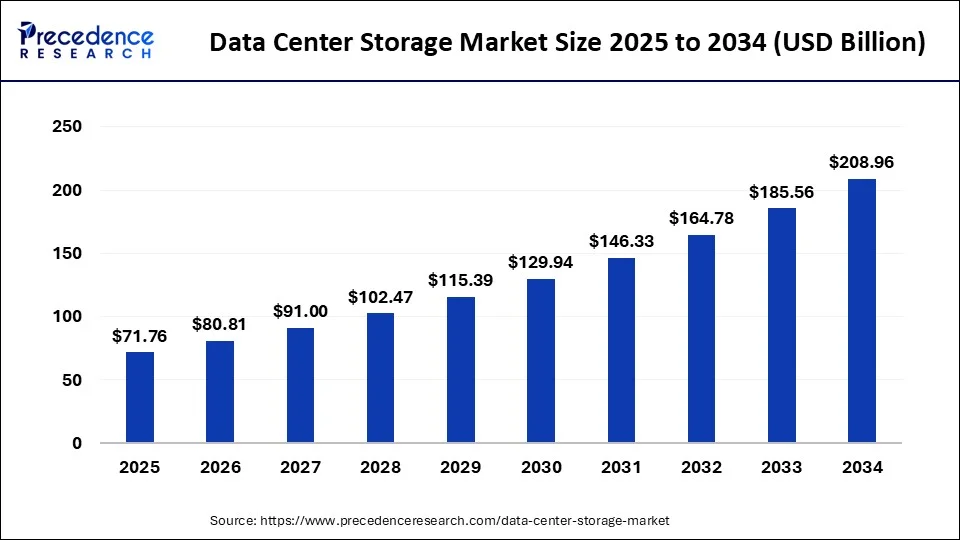

The global data center storage market size is calculated at USD 63.72 billion in 2024, grew to USD 71.76 billion in 2025 and is predicted to reach around USD 208.96 billion by 2034. The market is expanding at a CAGR of 12.61% between 2024 and 2034.

The global data center storage market size accounted for USD 63.72 billion in 2024 and is projected to surpass around USD 208.96 billion by 2034, growing at a CAGR of 12.61% from 2024 to 2034. Increasing digitalization across various industries generates huge amounts of data, which further creates the need to manage the data securely owing to the stringent government regulations for data privacy, fuelling the demand for the data center storage market on a global scale.

The global data center storage market is proliferating due to the increasing demand for robust IT infrastructure in different sectors, including media and entertainment, IT and telecommunications, and cloud computing. To meet the IT load capacity and its increasing requirement, the traditional storage systems fall short of meeting expectations; therefore, advanced systems take over and are used in many organizations. The advanced storage systems are known as all-flash storage and hybrid storage. As local data security plays an important role, SMEs and the public sector also invest and rely on data center storage, which further ensures the compilation of the government's regulations for security and data privacy.

In the advanced data center storage market, the flash storage is driving due to the digital services and data intensive technologies and expansion of the data centre in the global market. Data traffics increasing due to the mobile data usage, adoption of the 5G networks in economically evolving countries like India, China including hyperscale facilities further fuelling the demand for the data centre storage.

Important updates on the global data storage solutions.

Artificial Intelligence (AI) Impact on the Data Centre Storage Market

Artificial Intelligence (AI) is significantly impacting the market by creating a requirement for data-intensive applications across various fields. AI and machine learning need a huge dataset to train the models, which is the major reason driving the market's demand on a global scale for high-capacity storage solutions. Also, real-time data processing is demanded in the market on consumer demand, and with the help of analytics, it is further propelling the data center storage market on a wider scale. Also, the increasing adoption of AI and ML in various sectors requires advanced storage space that is able to handle complex tasks and huge datasets.

| Report Coverage | Details |

| Market Size by 2034 | USD 208.96 Billion |

| Market Size in 2024 | USD 63.72 Billion |

| Market Size in 2025 | USD 71.76 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 12.61% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Deployment, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Manage the vast amount of digital information

The major driving factor for the data center storage market is to manage the vast amount of digital information since many industries are adopting the expansion of digital platforms for businesses. The increasing volume of data variety is also a major driving factor in the global market. Consumers are also seeking solutions to interact with real-time data.

The volume of data, which is generated by a huge number of digital platforms like social media is increasing beyond certain limits generated even in the terabyte volume, which needs to be managed securely to gain insights from it. This trend is acknowledged by marketers, and they trade on this increasing demand and storage necessities of the data, expanding the data center storage market.

Data center consolidation

The major restraining factor that negatively affects the data center storage market is the increasing data center consolidation. The market is witnessing significant transformation owing to the adoption of various technologies along with different strategies to achieve optimization in the facilities of the data centers at different locations. Moreover, digital information is expanding unprecedently due to the increasing rate of digitalization in every sector across the globe, which creates a need to manage the data skillfully to avoid data leakage and unauthorized access.

Major emphasis on IoT-based devices

The significant opportunity that the data center storage market holds is the rising penetration of IoT-based devices in various sectors. The expansion of digital platforms across different sectors creates huge amounts of data, particularly due to interconnected devices like Internet of Things (IoT) devices, generating a huge volume of datasets. Such huge voluminous data requires high-performance data arrays and storage area networks like FC SAN and FCoE technology.

To manage the Data collaboratively and effectively, marketers are investing intentionally in skilled professionals to train them with updated tools that primarily manage the volume of the data, creating lucrative opportunities in the global market, along with the increasing demand for servers and network infrastructures. Additionally, the adoption of cloud computing and edge computing is also fuelling the data center storage market. Various sectors like BFSI, education, and teleconferencing are major contributors to the global market.

The SAN segment dominated the global data center storage market in 2023. The market is experiencing a substantial growth rate due to the rising surge in the IT and telecommunication infrastructure, media and entertainment industries, cloud computing, and governments' stringent regulations, including local data security concerns.

The IT & telecommunication segment accounted for the largest share of the data center storage market. The market is further divided into the BFSI, government, healthcare, and others. The growth of IT and telecommunication is due to the rapid growth of voluminous datasets generated due to digital transformation and the need for robust infrastructure as it requires highly scalable solutions for the IT and telecommunication sectors.

The BFSI segment is expected to witness the fastest growth in the market over the studied period. BFSI handles sensitive data, which is needed to secure it from unauthorized access; thus, it requires a reliable storage system to handle such huge and sensitive data.

North America accounted for the largest share of the global data centre storage market in 2023. The growth of this region is due to the high adoption rate of cutting-edge solutions for the data storage system and advanced technological infrastructure.

Country-wise, the most influential market player is the U.S. due to its extensive network of data centers and huge investments in storage technologies, which have further accelerated the region's growth. The significant expansion of cloud computing services and the rising need for managing voluminous data in various sectors like BFSI and IT have further accelerated North America's dominance.

Asia Pacific will host the fastest-growing data center storage market in the forecasted years. The growth of this segment is due to the increasing economic development and ongoing demand for data management solutions. Economically evolving countries like China, India, and Japan are the major contributors to the expanding IT infrastructure and rising investment in data center facilities.

The increasing initiative for digitalization by key countries like India and the growing adoption of edge and cloud computing across various industries like IT and telecommunication, healthcare, and the government sector are again fuelling the growth of the market on a global scale. Moreover, the expansion of IoT devices and the adoption of 5G technology fuelled the need to manage huge datasets generated by the interconnected devices and the digital platform, creating a lucrative opportunity for the data center storage market and its adoption in the Asia Pacific.

Segments Covered in the Report

By Deployment

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

March 2025

January 2025