April 2025

Data Monetization Market (By Method: Data as a Service, Insight as a Service, Analytics-enabled Platform as a Service, Embedded Analytics; By Organization Size: Large Enterprises, SMEs; By Vertical: BFSI, E-commerce & Retail, Telecommunications & IT, Manufacturing, Healthcare, Energy & Utilities, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

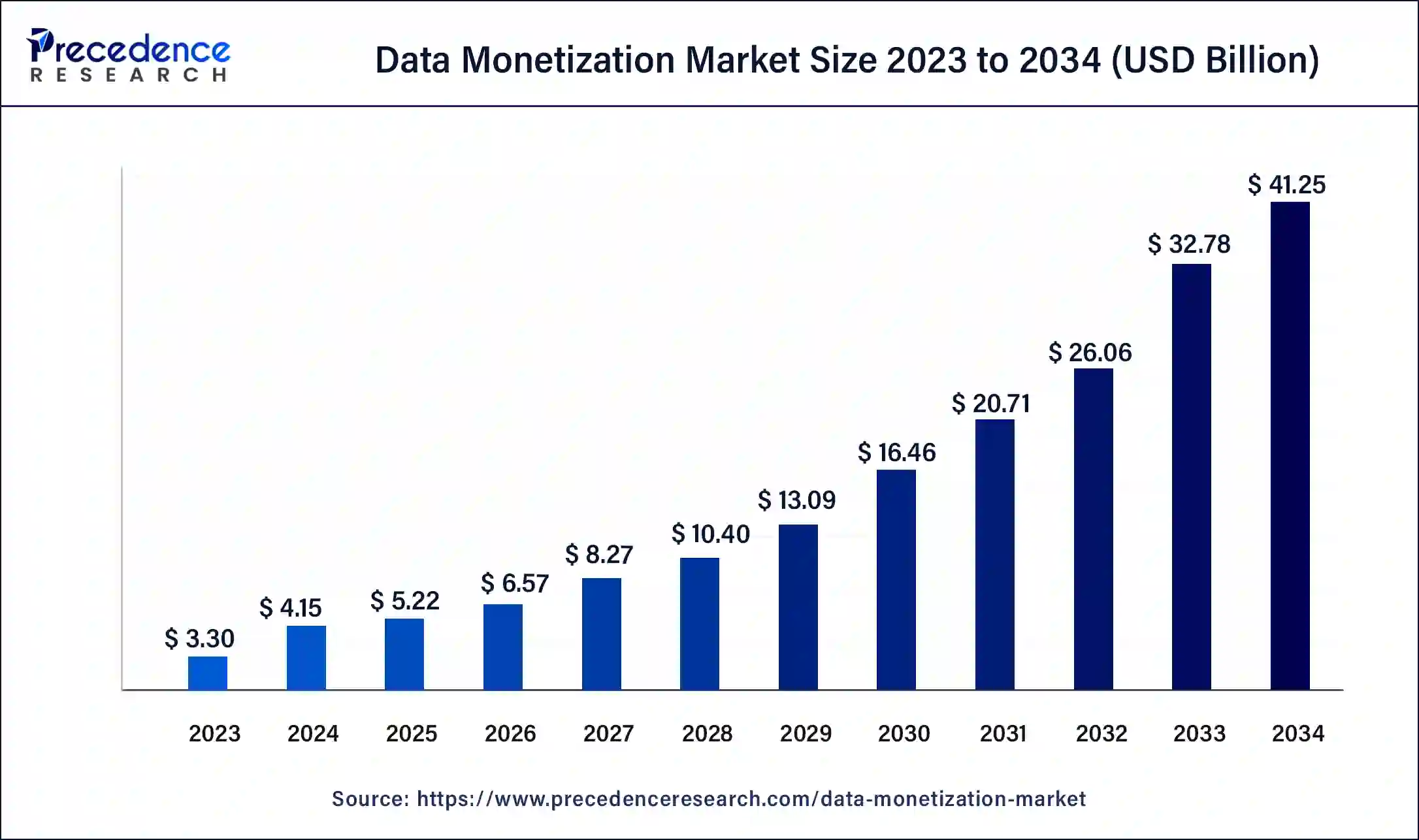

The global data monetization market size was USD 3.30 billion in 2023, calculated at USD 4.15 billion in 2024 and is expected to reach around USD 41.25 billion by 2034. The market is expanding at a solid CAGR of 25.81% over the forecast period 2024 to 2034. The North America data monetization market size reached USD 1.12 billion in 2023. Several commercial companies are increasingly adopting data monetization to create additional revenue streams and strategic collaboration, which accelerates the growth of the market.

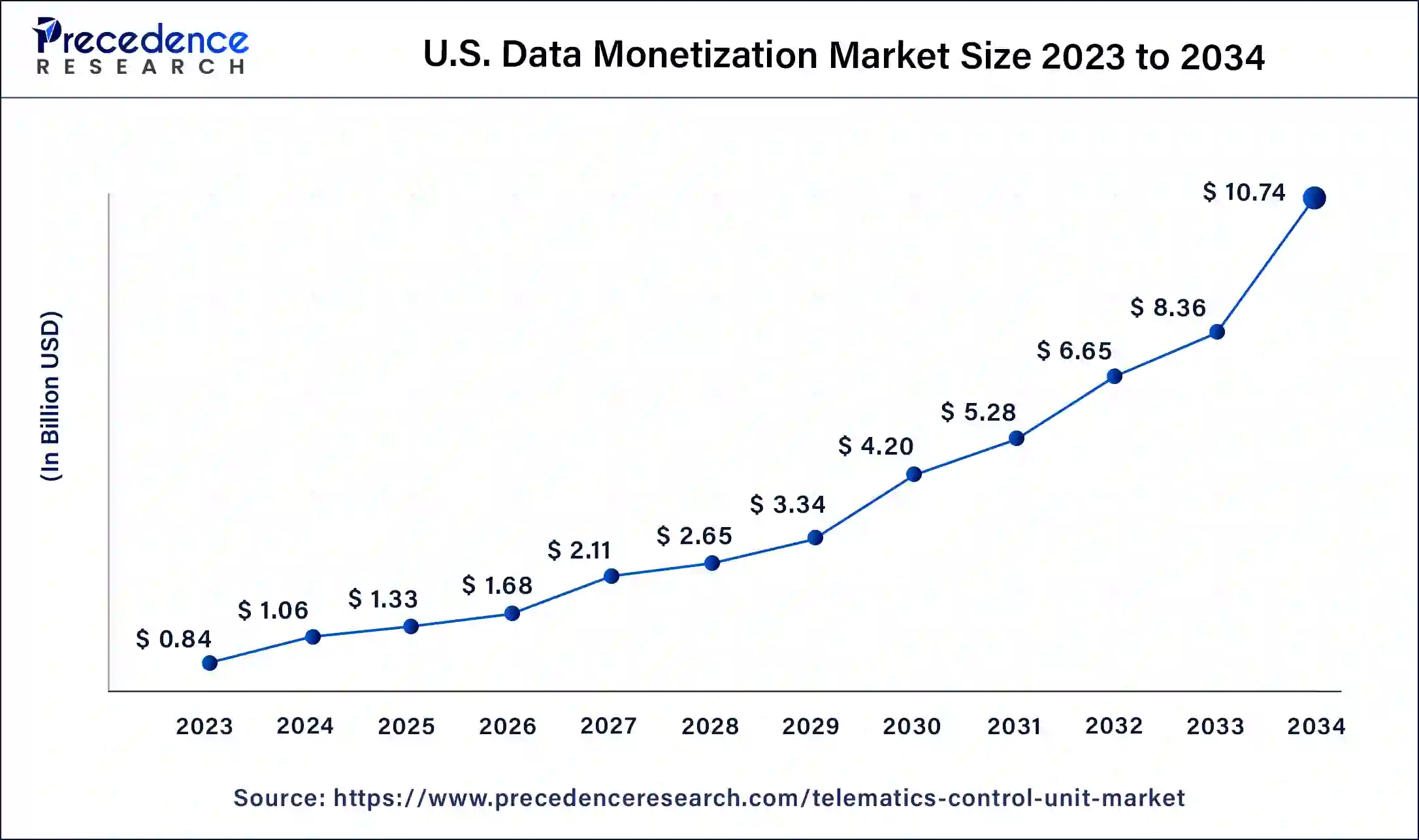

The U.S. data monetization market size accounted for USD 1.06 billion in 2024 and is projected to be worth around USD 10.74 billion by 2034, poised to grow at a CAGR of 26.06% from 2024 to 2034.

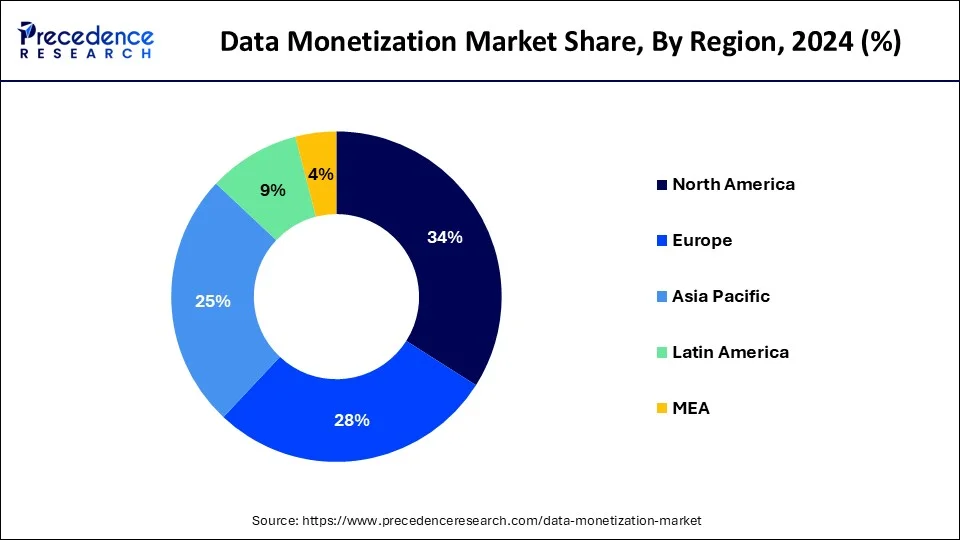

North America dominated the data monetization market with the largest share in 2023. The growth of the market in the region is attributed to the rising industrialization and the number of end-use industries that are driving the number of data are driving the demand for the data monetization market. The presence of the major banking and financial sectors and the telecommunication sector have a higher amount of customer data. The higher adoption of data-driven services and the rising investment in advanced technologies like artificial intelligence, big data, IoT, analytics, and cloud computing by investors in the United States and Canada are contributing to the growth of the data monetization market.

Asia Pacific is expecting the fastest growth during the forecast period. The rising trend in the adoption of advanced technologies such as artificial intelligence, analytics, and cloud computing into several end-use industries such as retail telecommunication, the increasing number of start-ups, and digitization in businesses, and the rise in the IT sectors that drive the data volume that drives the acceptance of the data monetization in the several sectors which contributed in the expansion of the data monetization market in the region.

Data monetization is the process adopted by several companies or enterprises in which company-generated data is used to generate additional valuation for the company or other measurable economic benefits. Data monetization provides additional benefits to companies, such as lower operational costs and higher revenue. Data monetization by the companies also enhanced the new collaboration between companies with enhanced supplier terms. Data monetization provides a competitive edge, creates a new revenue stream, streamlines operations, and creates strategic partnerships, which helps drive the adaptation of data monetization by several companies or enterprises, which drives the growth of the data monetization market.

| Report Coverage | Details |

| Market Size by 2034 | USD 41.25 Billion |

| Market Size in 2023 | USD 3.30 Billion |

| Market Size in 2024 | USD 4.15 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 25.81% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Method, Organization Size, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand from emerging industries

The increasing demand for data monetization systems by emerging industries is due to its beneficial advantages for companies like achieving diversification, avoiding commoditization, creating unique products, reducing production costs, and offering enhanced value to shareholders and customers. Data monetization plays an important role in companies by leveraging the data into the stream of additional valuation. Organizations have great benefits from the use of data that is already accessed.

Advanced technologies like data science, distributed computing, artificial intelligence, and cutting-edge visualization applications make the data asset class. Additionally, rising technological advancements in the companies result in creating a vast amount of data in the companies that drive the demand for the data monetization market.

Security concerns

The rising cases of breaches of data, security concerns, and fraudulent practices on the data platform limit the expansion of the data monetization market. The data is subject to several cyber threats, such as data theft, cyber-attacks, data breaches, abuse, and data loss, that may potentially risk the sensitivity of data. Thus, these factors are restraining the growth of the market.

Data monetization in the retail sector

The retail sector is one of the emerging industries that is adopting data monetization owing to its several offerings. The retail sector has plenty of data from its customer database and loyalty programs. These data are shared via data monetization in accordance with the consumer privacy program, which helps a number of businesses enhance their target customer and consumer experience. With the help of data monetization by the retail sector, businesses such as suppliers can improve inventory planning and pricing. Support and financial companies can offer adjacent customer services such as financing and warranties, and advertisers can perform better on their marketing content. Several retail giants are adopting data monetization, driving the opportunity for market growth.

The analytics-enabled platform as a service segment dominated the data monetization market with the largest share in 2023. The growth of the segment is attributed to the higher adoption of the analytics-enabled platform as a service in data monetization due to its increased offering value to the customers. This method of data monetization provides more flexibility with improved customer value.

BI platform and analytics provide high versatility to customers and scalable data analytics in real-time. The analytics-enabled platform is available in all types of organizational settings, like on-premise and cloud-based data warehouses. It is compatible with all the widest types of data formats. With the expansion in the dependency on data-driven services that drives the growth of the monetization of data.

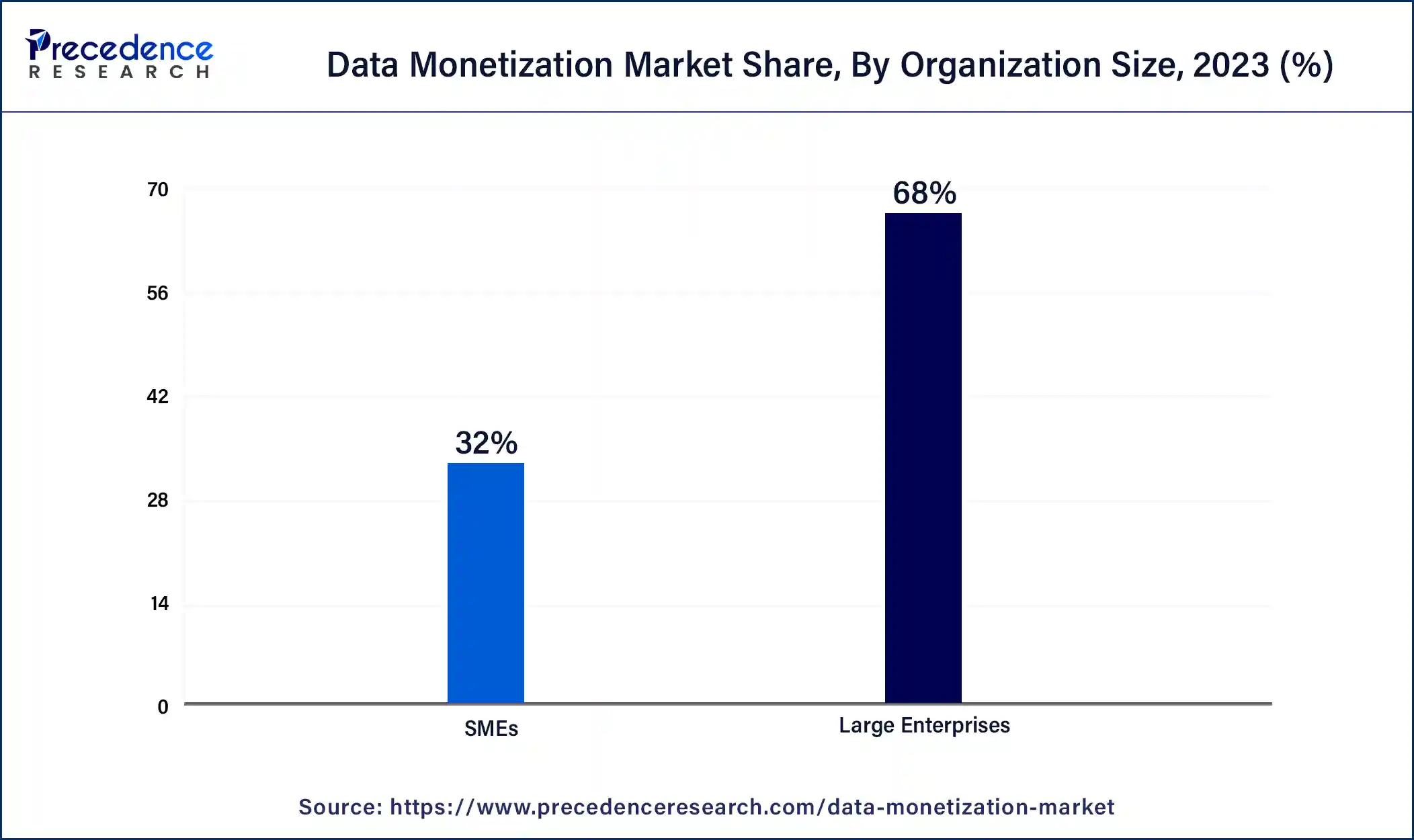

The large enterprise segment dominated the data monetization market in 2023. The growth of the segment is attributed to the increased adoption of data monetization by large enterprises due to the increased availability of data. Data monetization mainly includes companies with a robust presence in the BFSI, retail, and telecommunication verticals. Large enterprises require data-driven results that are gathered by operationalizing and discovering data management.

Larger enterprises are having the large number of customer base across the globe. Large enterprises are able to afford technological advancements like artificial intelligence, IoT, and cloud computing in data monetization operations. Thus, the increased number of customer data and cost affordability drives the adoption rate of data monetization in the large enterprise segment.

The BFSI segment dominated the data monetization market with the largest market share in 2023. The growth of the market is attributed to the rising demand for data monetization by the BFSI segment due to the higher availability of the customer base. The banking sector is considered to be the most data-rich business. Data monetization in banking does not only include revenue generation; it works in the many streams of working as it consults their internal data for developing financial products personalized for their customers.

The banking sector accounts for a large amount of data from different sources, such as customer interaction, transactions, market trends, and demographics. Banking data can be monetized through various strategic initiatives to benefit financial institutes and improve customer loyalty and satisfaction.

Segments Covered in the Report

By Method

By Organization Size

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

March 2025

January 2025