January 2025

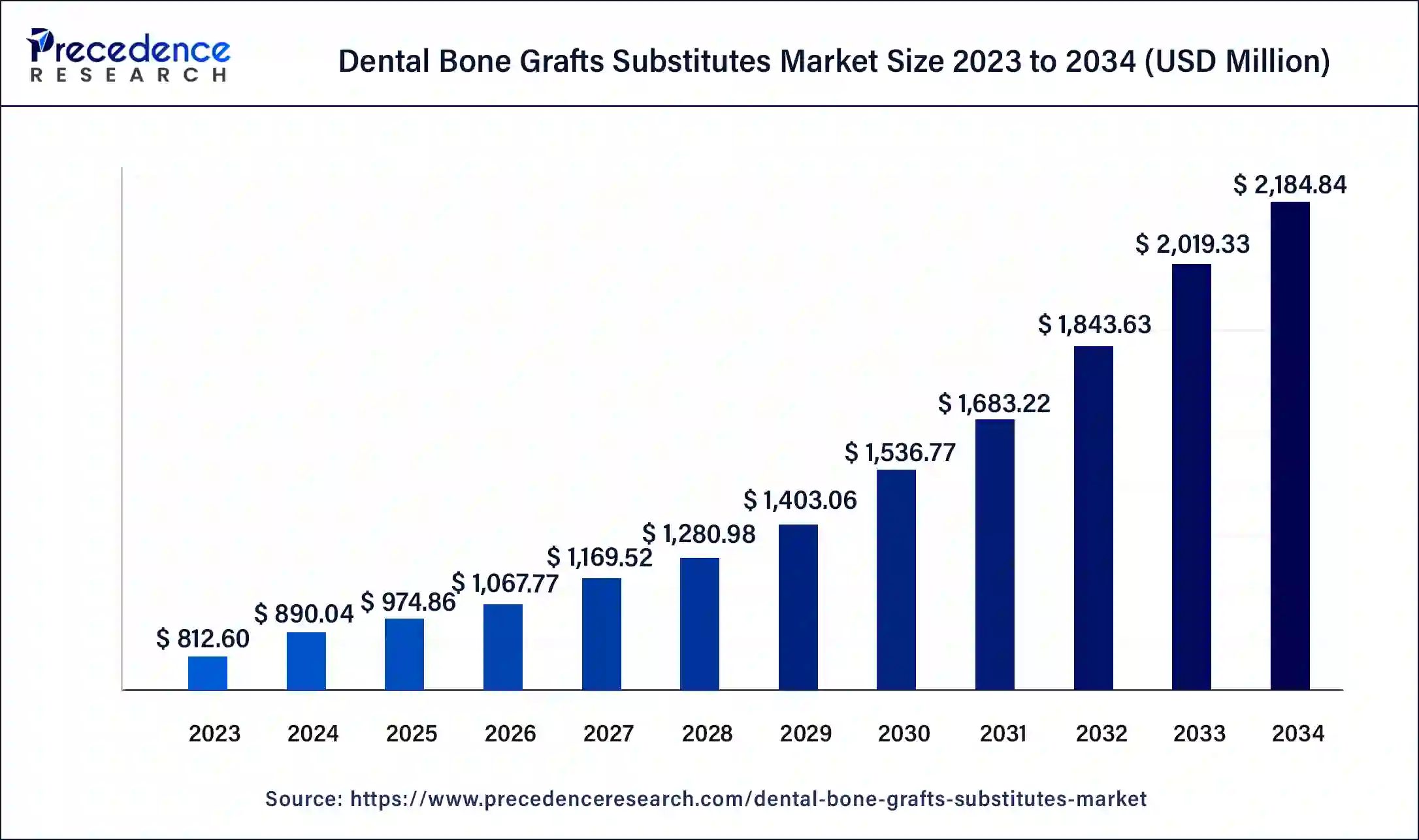

The global dental bone grafts substitutes market size was USD 812.60 million in 2023, estimated at USD 890.04 million in 2024 and is anticipated to reach around USD 2,184.84 million by 2034, expanding at a CAGR of 9.40% from 2024 to 2034.

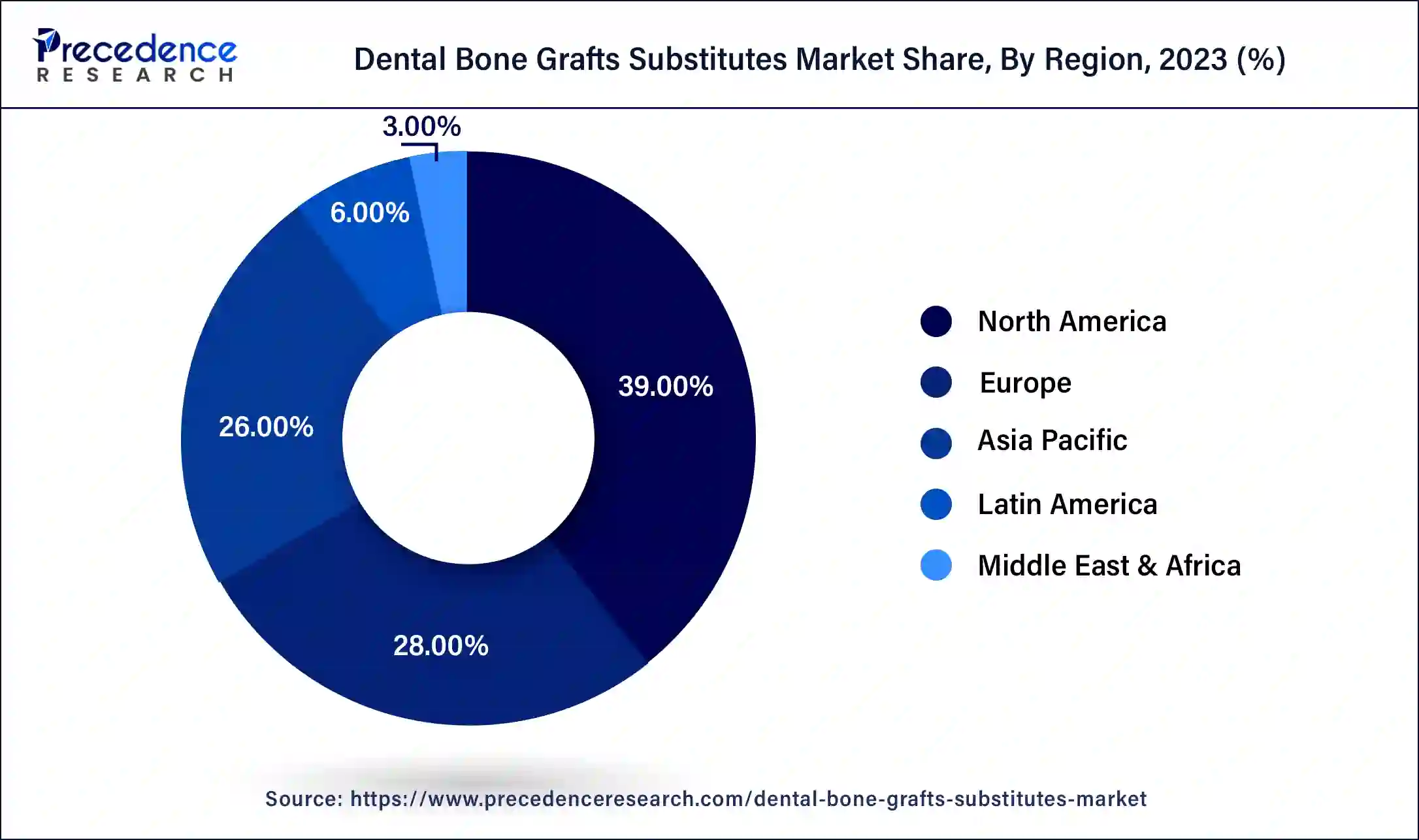

The global dental bone grafts substitutes market size accounted for USD 890.04 million in 2024 and is predicted to reach around USD 2,184.84 million by 2034, growing a notable CAGR of 9.40% from 2024 to 2034. The North America dental bone grafts substitutes market size reached USD 316.91 million in 2023. Increasing the use of bone grafts in density and a growing number of dental implant surgeries are propelling the revenue.

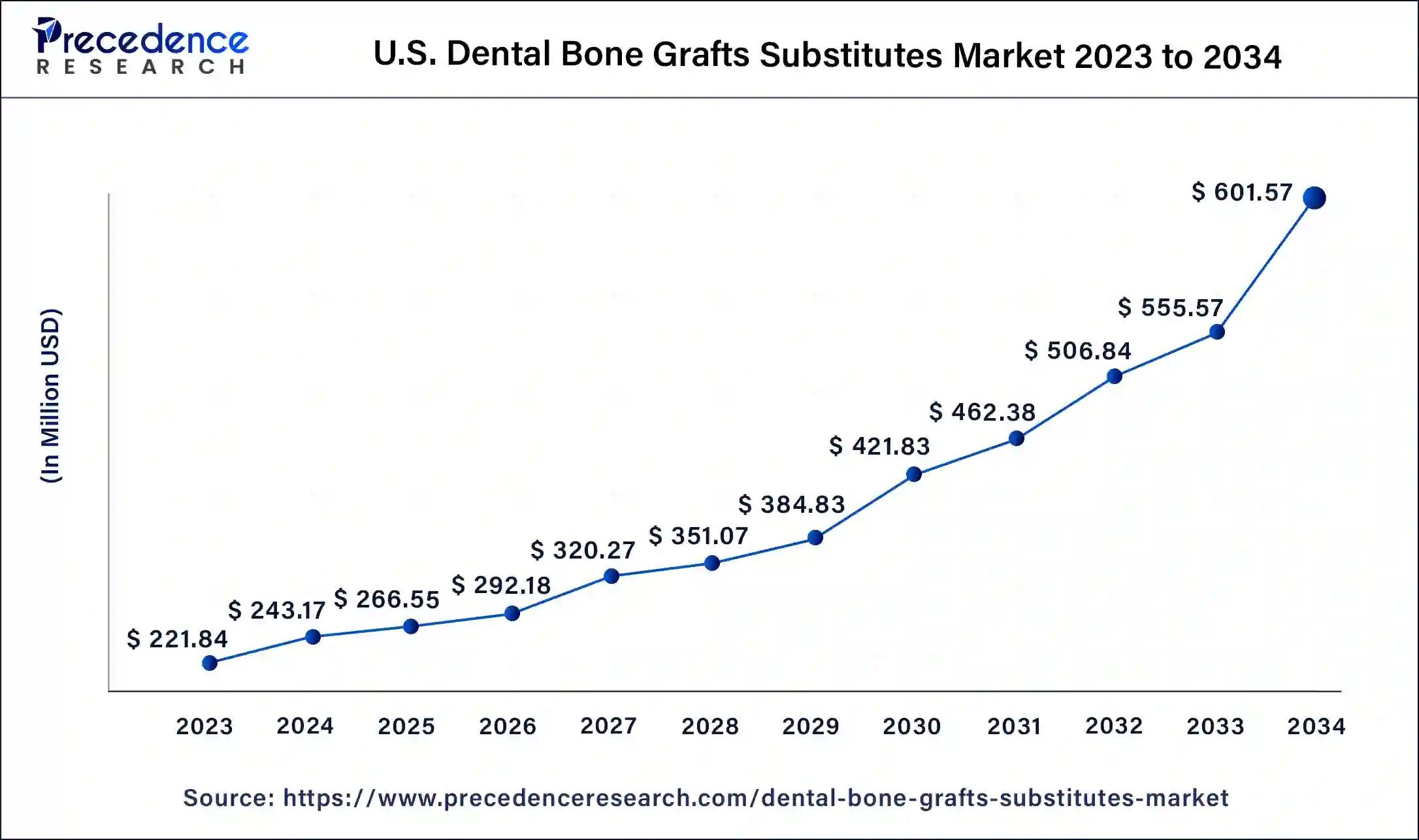

The U.S. dental bone grafts substitutes market size was valued at USD 221.84 million in 2023 and is expected to be worth around USD 601.57 million by 2034, at a CAGR of 9.48% from 2024 to 2034.

North America dominated the global dental bone grafts substitutes market in 2023. This was propelled by factors such as a growing population in need of dental implants and increasing awareness of advanced dental products. Moreover, factors like rising healthcare expenses and the accessibility of advanced healthcare facilities contributed to the region's growth. Additionally, the increasing prevalence of dental diseases played a significant role in driving market expansion.

Asia Pacific is projected to experience the highest growth during the forecast period. This growth can be attributed to factors such as the increasing popularity of medical tourism and government initiatives. Furthermore, the region's aging population is contributing to a higher risk of dental issues. However, stringent regulatory guidelines in some countries may limit growth opportunities. In South Korea, products must be approved by the Korean Food and Drug Administration before being marketed, while in Australia, graft products are regulated by the Therapeutic Goods Administration. These strict regulations pose challenges for foreign players looking to enter the market.

Dental bone grafts create new bone that acts as a reservoir for minerals. Various substitutes for dental bone grafts include materials like bio-Oss, which is derived from bovine bone and like human bone, ceramic-based substitutes like calcium sulfate, and polymer-based substitutes like Healos. Synthetic bone grafts use materials like hydroxyapatite to mimic the mechanical properties of bone and facilitate bone growth for dental implants. Most studies use either allografts or xenografts as bone substitutes, which can be demineralized or mineralized freeze-dried bone allografts. Biomaterials used in dentistry include bone grafts and barrier membranes. The advancement of technology in biomaterials, driven by initiatives from key players and novel product launches, is expected to propel the dental bone grafts substitutes market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 9.40% |

| Global Market Size in 2023 | USD 812.60 Million |

| Global Market Size in 2024 | USD 890.04 Million |

| Global Market Size by 2034 | USD 2184.84 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material Type, Application, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing prevalence of dental disorders

Many oral health issues, like gum disease, tooth loss, tooth decay, and oral cancers, are largely preventable and can be treated, especially when addressed early in life. Factors such as inadequate fluoride exposure, easy access to sugary foods, and limited access to dental care contribute to these conditions. Moreover, conditions like orofacial clefts, Noma, and dental trauma are of significant public health concern. Consumption of sugary foods and drinks, tobacco and alcohol, further exacerbates oral health problems and other non-communicable diseases. This increasing prevalence of dental disorders is expected to drive the demand for the dental bone grafts substitutes market.

Expensive method of treatment

Bone grafts and substitute procedures can be costly, which may make them inaccessible to some patients, hence can limit the market growth. Certain healthcare systems have restrictive reimbursement policies for these procedures, making it challenging for patients, especially those with inadequate insurance coverage, to afford them. Furthermore, potential risks like infection, rejection, and nerve damage associated with these procedures also hinder the dental bone grafts substitutes market expansion.

Lucrative opportunities in developing countries

The dental bone grafts substitutes market is poised for growth, especially in emerging economies, driven by factors like improved healthcare infrastructure, rising demand for bone grafting procedures, and increasing prevalence of spinal disorders. Emerging economies are witnessing significant development in their healthcare sectors, fueled by government investments and the rise of medical tourism. This trend isn't limited to developed nations; countries like China, Brazil, and India are also experiencing a surge in demand for bone grafts and substitutes. Globally, there's a rising incidence of bone disorders such as osteoporosis and bone cancer, driving the need for these treatments to alleviate associated symptoms, which can create market opportunities in the future.

The xenograft product segment dominated the dental bone grafts substitutes market in 2023. Xenografts, sourced from pigs or cows, undergo sterilization and meticulous preparation before being implanted into humans. In dentistry, deproteinized bovine bone is commonly used for xenograft materials. Additionally, strategic initiatives by market players are contributing to the market's growth.

In the dental bone grafts substitutes market, the synthetic segment is expected to grow at the fastest rate over the forecast period. The growth of synthetic grafts can be credited to their superior osteoconductive, hardness, and higher acceptance rates. In the market, there are several types of synthetic materials available, including ceramic, polymer-based, and BMPs (bone morphogenetic proteins). Synthetic grafting carries a lower risk of disease transmission compared to xenografts and allografts, which further enhances its growth. There's a rising demand to develop biocompatible grafts to minimize adverse reactions, which is propelling this segment's expansion.

The socket preservation segment dominated the dental bone grafts substitutes market in 2023. This method aims to reduce bone loss that occurs after tooth extraction by filling the socket in the jawbone. The segment is growing due to the rising number of dental implant surgeries and increased awareness about oral health care among the population.

In the dental bone grafts substitutes market, the sinus lift segment is the fastest-growing segment during the projected period. This market is growing because more people are undergoing dental implant surgeries and becoming more aware of the significance of oral health care. Moreover, there's a growing burden of dental diseases, and advancements in dental technology are further fueling the growth of this segment.

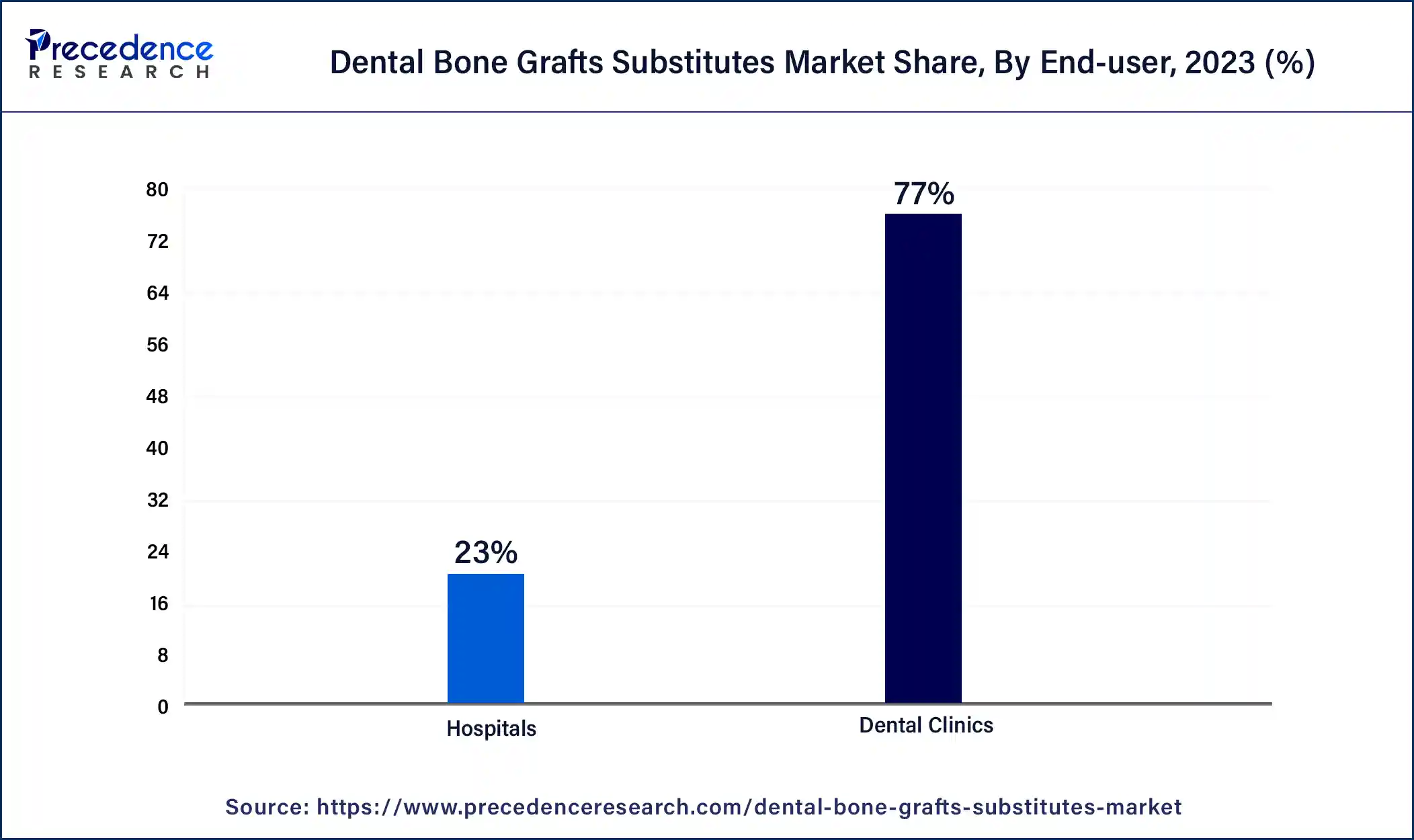

The dental clinic segment dominated the dental bone grafts substitutes market in 2023. This segment's growth is driven by an increasing number of dental clinics and the growing occurrence of dental issues. Dental clinics are gaining popularity due to their convenience and the availability of skilled surgeons, leading to a rise in the number of dental graft surgeries performed annually.

The hospital segment is the fastest-growing segment during the studied period. Hospitals see many patients, some of whom need orthopedic and dental procedures involving bone graft substitutes. This demand is significant due to the diverse medical services hospitals provide, including surgeries. Procedures like spinal fusion, joint replacements, and dental implants are commonly performed in hospitals, contributing substantially to the market for dental bone graft substitutes.

Segments Covered in the Report

By Material Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023