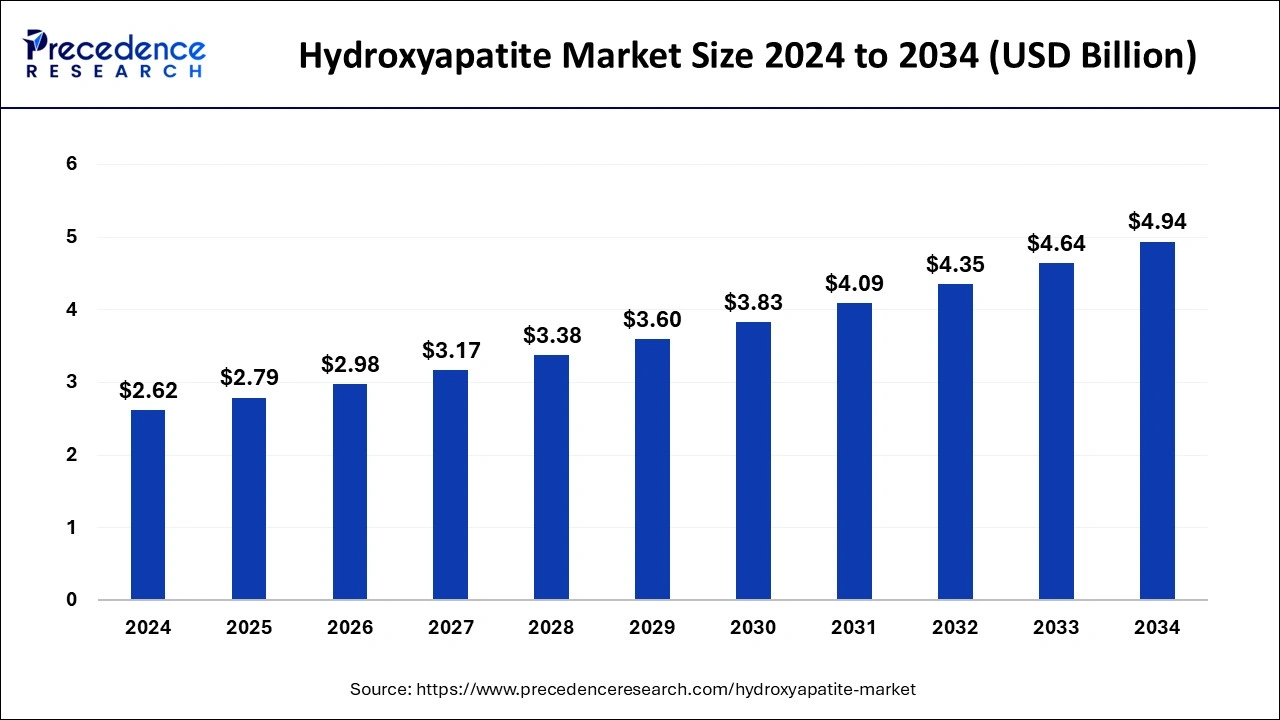

The global hydroxyapatite market size is calculated at USD 2.79 billion in 2025 and is forecasted to reach around USD 4.94 billion by 2034, accelerating at a CAGR of 6.54% from 2025 to 2034. The North America market size surpassed USD 1.00 billion in 2024 and is expanding at a CAGR of 6.62% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hydroxyapatite market size accounted for USD 2.62 billion in 2024 and is expected to exceed around USD 4.94 billion by 2034, growing at a CAGR of 6.54% from 2025 to 2034. The hydroxyapatite market growth is attributed to the increasing demand for biocompatible materials in healthcare applications, particularly in orthopedics, dental care, and regenerative medicine.

Artificial Intelligence affects industries by introducing revolutions with features to advanced materials through the precise demand of estimate, the smart supply chain, and improving materials through the development of new technologies. In the hydroxyapatite market, AI supports optimizing processes linked with manufacturing that occur with less waste, fewer rejections, and more adherence to the customers’ demand. Superior analytical tools are used to process large volumes of data for the purpose of making forecasts for the market and finding applications of the new utilization of the technology in the process. Furthermore, by enabling more knowledgeable processes and decision-making, artificial intelligence increases the efficiency and dynamism of markets.

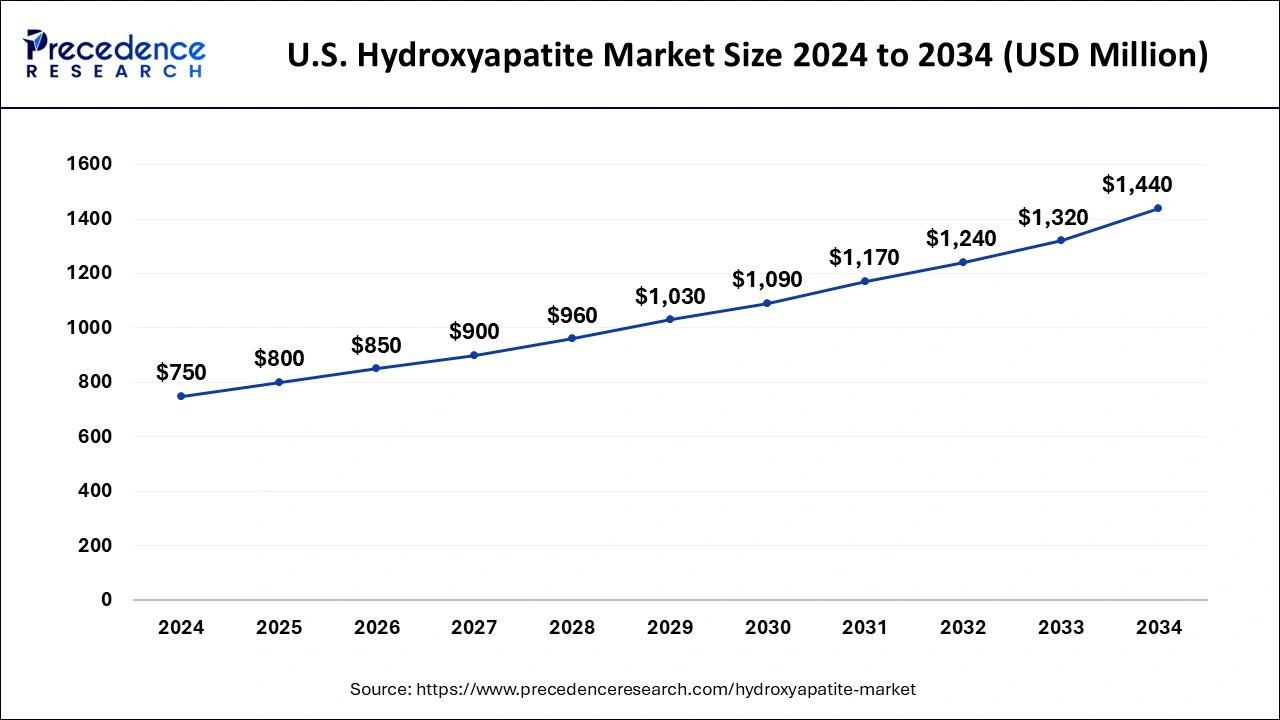

The U.S. hydroxyapatite market size was exhibited at USD 750 million in 2024 and is projected to be worth around USD 1.44 billion by 2034, growing at a CAGR of 6.74% from 2025 to 2034.

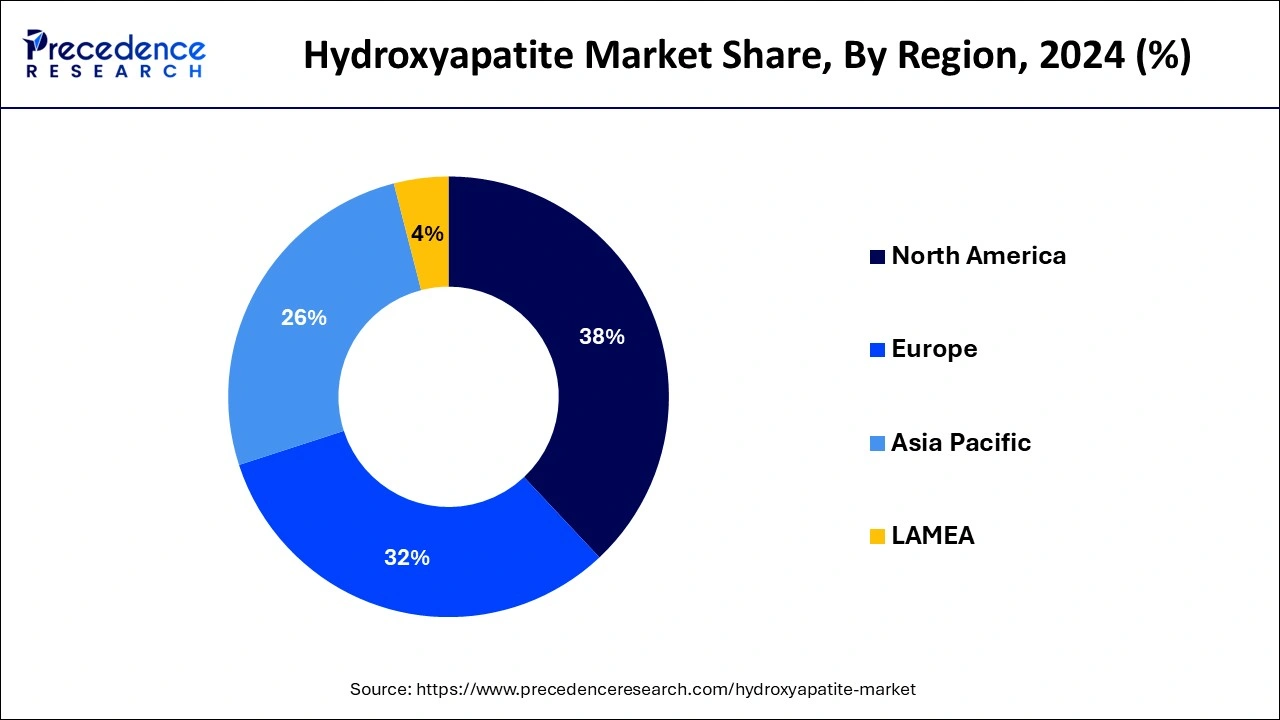

North America held the largest share of the hydroxyapatite market in 2024 due to advanced healthcare facilities, high healthcare consumption, and emphasis on research and development in the medical fraternity. The United States is expected to have the most compounded annual growth rate in the use of advanced biomaterials for orthopedic and dental applications owing to the already developed medical device industry in the country.

Asia Pacific is projected to host the fastest-growing hydroxyapatite market in the coming years, owing to the region's growing healthcare industry, the growing population of elderly people, and rising cases of bone disease. The increasing need for orthopedic or dental treatments across emerging economies such as China and India has also fostered the growth of the market.

The rising use of bioactive ceramics in applications to the medical field, especially in orthopedic and dental care is driving the use of the hydroxyapatite market. One of the uses of hydroxyapatite is in bone grafts, coating implants, and dental implantation, as it is biocompatible with human bone tissue. These factors are the aging population globally and the increased incidence of disorders relating to bones, which enhance the consumption of hydroxyapatite-based products.

| Report Coverage | Details |

| Market Size by 2024 | USD 2.62 Billion |

| Market Size in 2025 | USD 2.79 Billion |

| Market Size in 2034 | USD 4.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for biocompatible materials in healthcare

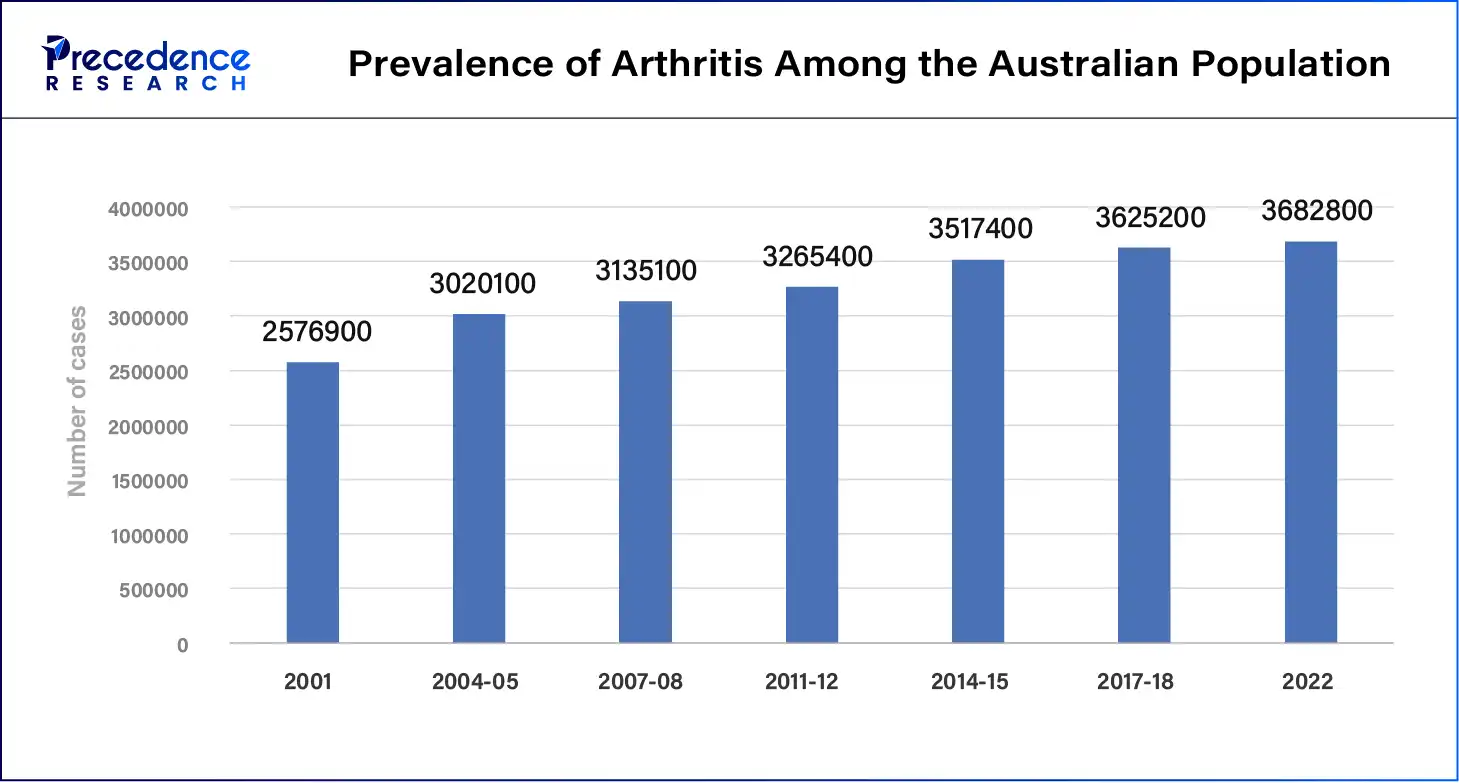

Increasing demand for biocompatible materials in healthcare is anticipated to drive the hydroxyapatite market in the coming years. Surgeons and medical researchers prefer hydroxyapatite for its nature as a biocompatible substance, which has a chemical composition closely resembling human bone mineral. Hydroxyapatite is normally used in orthopedic implants, dental fillers, and bone grafts. This increasing number of patients makes the use of hydroxyapatite in reconstructive surgeries and joint replacement more popular. Elevated incidence of osteoporosis and arthritis, especially in aged individuals, fuels global demand.

Volatility in raw material prices

Volatility in raw material prices is anticipated to hinder the hydroxyapatite market. Some of the challenges that manufacturers face owing to the nature of demand include pricing strategies; some of the cost factors include fluctuations in the cost of raw materials like calcium and phosphate compounds. Such fluctuations owe their existence to conditions such as disruption in the supply chain, conflicts of national interest, and variations in the demand for related products. Manufacturers who import raw materials experience an extra cost in the form of currency exchange rate vagaries, which is indicative of extra pressure on cost control and realizations.

Spurring investments in emerging economies

Spurring investments in emerging economies are likely to create immense opportunities for the hydroxyapatite market growth, especially in Asia Pacific and Latin America. Governments and private organizations in these regions are improving healthcare facilities and encouraging the domestic production of medical and dental instruments. Moreover, technological adoption policies in biomedical applications drive the penetration of hydroxyapatite into new emerging markets.

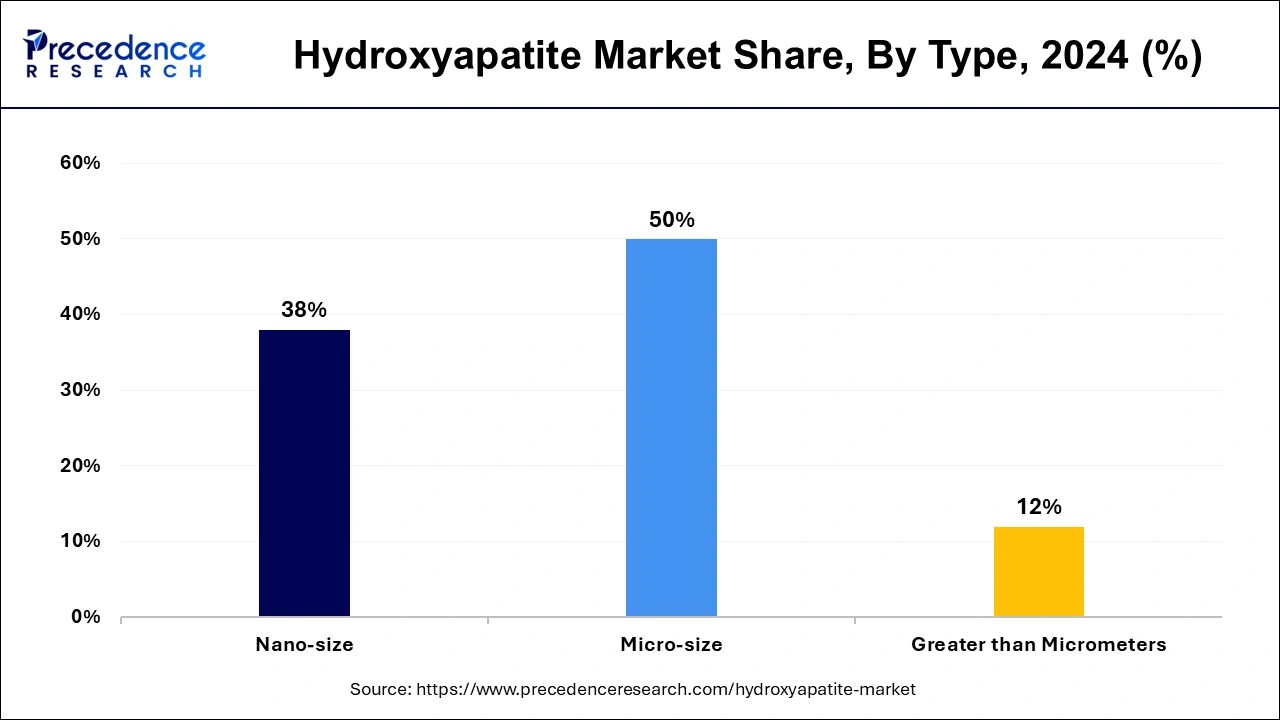

The micro-sized segment held the largest share of the hydroxyapatite market in 2024. Micro-hydroxyapatite particles, with a size range of 1 to 100 micrometers, have the proper mechanical strength and biocompatibility properties required for orthopedic implants. Due to its favorable mechanical properties and high durability, micro-hydroxyapatite is preferred in these applications, and due to compatibility with natural bone, the authors assert that the use of micro-hydroxyapatite in bone tissue helps patient recovery. Moreover, developments in the fields of sintering and powder metallurgy manufacturing have made micro-hydroxyapatite affordable.

The nano-sized segment is observed to be the fastest growing in the hydroxyapatite market during the predicted timeframe owing to its emerging features in biomedical uses. According to multiple researches, nano-hydroxyapatite is more biocompatible faster than other hydroxyapatite. In the bulk density test, the surface area of nano-sized hydroxyapatite appears to be between fifty-two one hundred and two m²/g. This feature is observed to increase the material’s performance in terms of bone regeneration and dental implant applications.

The orthopedic segment accounted for a considerable share of the hydroxyapatite market in 2024 due to its application in bone grafts, coating of implants, and bone filler. In such applications, hydroxyapatite is preferred on the basis of its bio-compatibility since it has properties resembling the natural bone and thus heals faster and is least likely to be rejected by the body. The increase in the aging population across the world and the increase in the incidence of bone-related diseases.

The dental care segment is anticipated to grow with the highest CAGR in the hydroxyapatite market during the studied years, owing to its ability to restructure the surface of enamel with a strengthening effect on teeth. These factors are attributed to the rise in the consciousness of oral health and the burgeoning of cosmetic dentistry procedures. Additionally, a survey from the 2023 report reveals that approximately 5 million dental implants are placed annually in the U.S., driving the demand for hydroxyapatite-based dental care solutions.

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client