January 2025

Dental Charting Software Market (By Type: General Dentistry, Specialized Dentistry, Dental Laboratories; By Size: Solo Practitioners, Group Practitioners, Dental Chains; By Deployment: Cloud-based, Web-based, On-premises) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

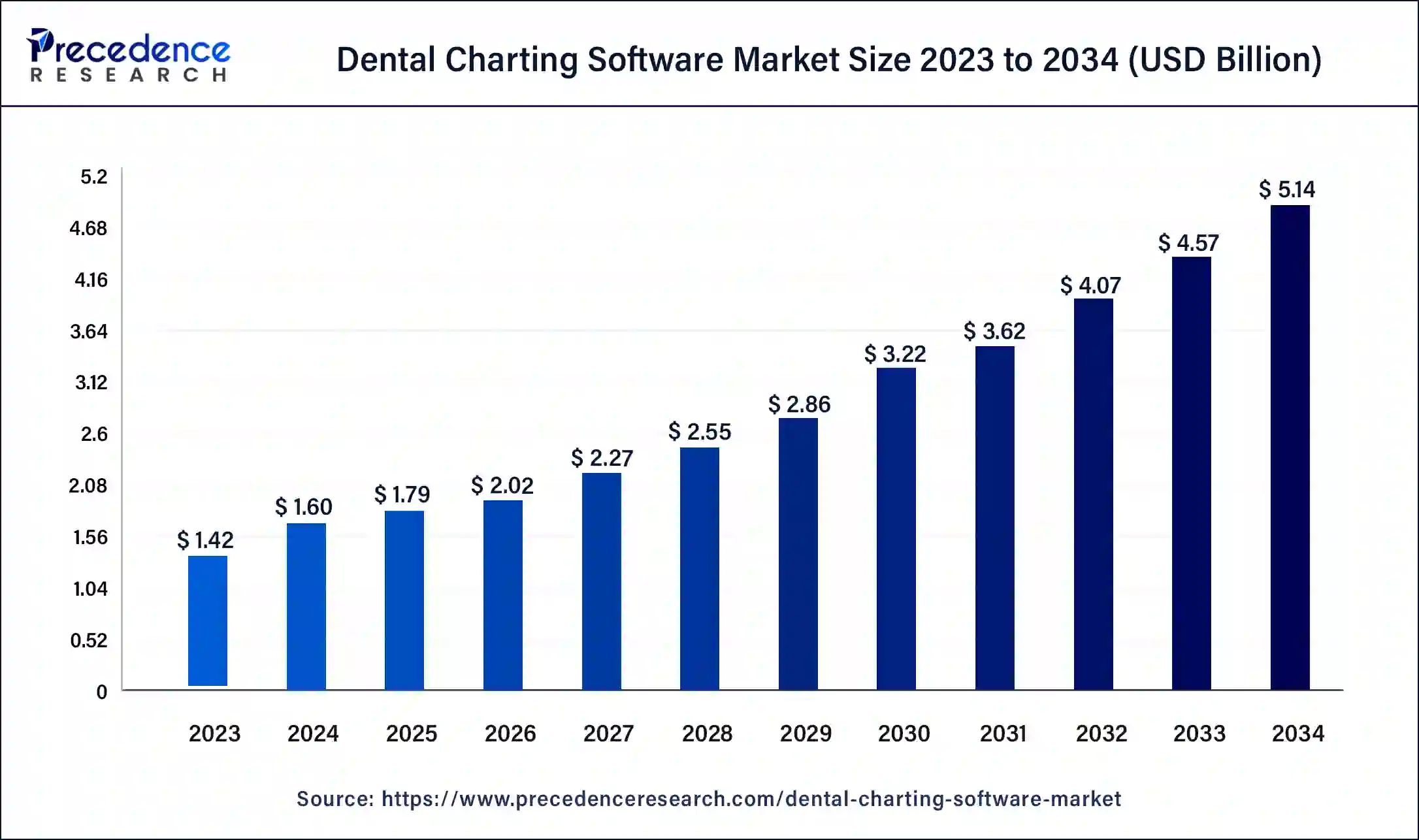

The global dental charting software market size was USD 1.42 billion in 2023, calculated at USD 1.60 billion in 2024 and is expected to reach around USD 5.14 billion by 2034. The market is expanding at a solid CAGR of 12.41% over the forecast period 2024 to 2034. The North America dental charting software market size reached USD 510 million in 2023. The increasing oral health awareness among individuals is fueling the market growth.

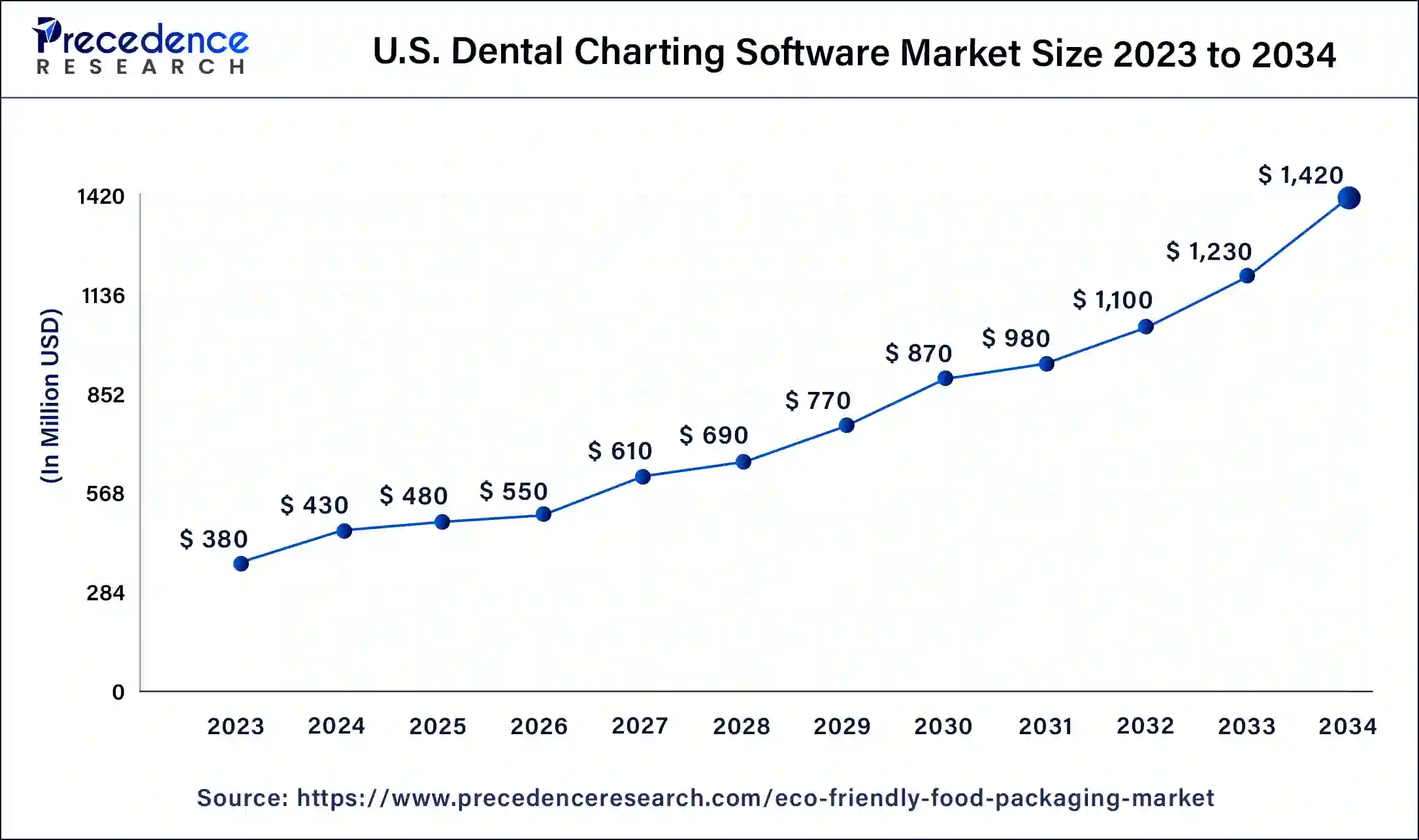

The U.S. dental charting software market size was exhibited at USD 380 million in 2023 and is projected to be worth around USD 1,420 million by 2034, poised to grow at a CAGR of 12.73% from 2024 to 2034.

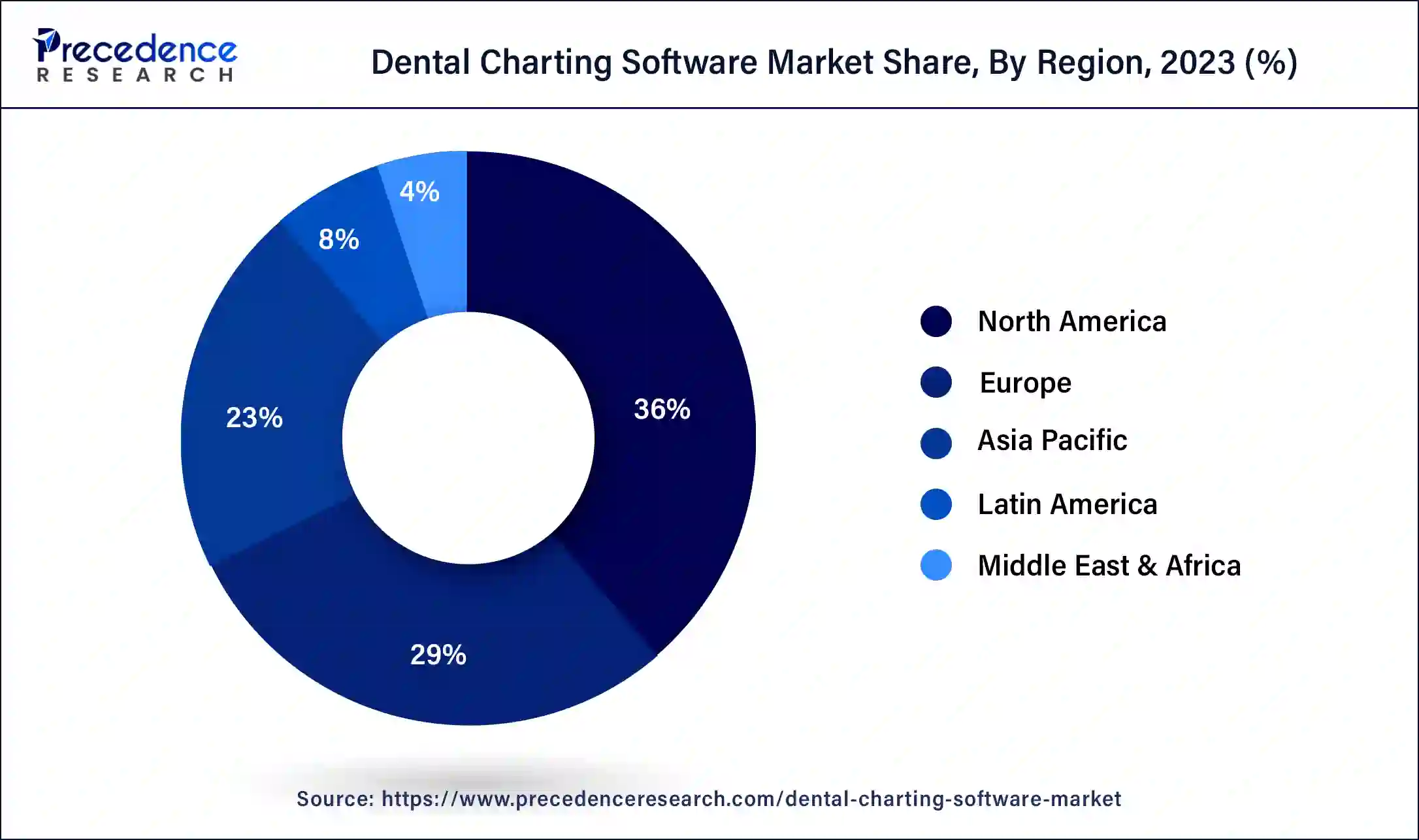

North America dominated the global dental charting software market in 2023. The growth of the region is attributed to the well-established infrastructure in countries like the United States and Canada. Access to the latest technologies in the region allows dental professionals to practice specialized dental services. Regulations like the Health Insurance Portability and Accountability Act HIPAA in the United States protect the health information of patients and ensure the safety of all confidential data and agreements.

The use of advanced technologies is increasing the awareness of dental charting software, which helps in providing more specialized services and patient care. Additionally, the rising prevalence of common dental issues is contributing to the growth of the dental charting software market in North America.

The European dental charting software market is characterized by steady growth driven by advancements in digital dentistry and the increasing adoption of electronic health records (EHRs) within dental practices. This market segment is poised for expansion as dental offices across Europe transition towards more efficient and paperless operations.

Asia Pacific is projected to register the fastest growth in the market from 2024 to 2033. The increasing growth of the region is attributed to the increasing demand for digital dental services in countries like India and Japan. The rising disposable incomes in the developing regions of China, India, and Japan are leading to the increasing demand for specialized dental services. The increasing government initiatives towards dental health are expected to drive the growth of the dental charting software market in the upcoming years.

The LAMEA dental charting software market is experiencing growth driven by increasing adoption of digital health solutions and advancements in dental technology across Latin America, the Middle East, and Africa. This market segment is poised for expansion as dental practices in the region prioritize efficiency, patient care, and compliance with healthcare regulations.

Dental charting software is a digital tool that helps dental professionals track and manage patients' dental health information. It has been considered a quintessential replacement for the traditional paper or handwritten methods used to note patient information. The dental charting software provides features like periodontal charting and oral charting, and it also enables the tracking of the patient's previous medical history. The software helps to create a visual representation of the gums and teeth, which allows dental professionals to design and plan the procedures and treatment options for the patient according to their oral conditions. These features provide better and enhanced communication between the professionals, allowing them to act according to the previous data.

The dental charting software market is experiencing rapid growth due to the increasing prevalence of dental issues especially in young children like cavities and other oral infections. These rising prevalences are increasing the demand for more accurate and efficient data and solutions. The increasing digitalization in the overall health sector is expected to be the biggest growth contributor to the dental charting software market.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.14 Billion |

| Market Size in 2023 | USD 1.42 Billion |

| Market Size in 2024 | USD 1.60 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 12.41% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Size, Deployment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Rising dental awareness

The constant campaigns through social media are spreading awareness of dental health, which increases the need for dental charting software as they provide multiple tools that help in providing an enhanced experience to the patient. This growing awareness is increasing the number of regular oral checkups, which also leads to the overall growth and increasing demand for dental professionals. The aging population is considered to be one of the major growth factors in the dental charting software market.

Improving workflow accuracy

The emergence of dental charting software has provided many improvements in data storing and patient handling over the traditional paper-based method. The software has reduced the risk of errors while practicing dental operations, and it has gained the significant trust of individuals all over the world. Further, the focus on catering to people's demands is playing a major role in the development of the dental charting software market.

Data and privacy concerns

The emerging technologies have significantly boosted the demand for dental charting software, but the issues related to data security could be a potential threat to the growth of the dental charting software market. Controlling and handling huge amounts of sensitive data can lead to cyber-attacks and other data breaches, which would leak the oral health data of the company and the patients. Major contributors to the market are currently focusing on the implementation of robust security, which might help tackle these issues.

Emergence of Artificial Intelligence

The emergence of artificial intelligence (AI) has drastically changed the workflow in the overall health industry. AI can analyze dental images and also work with the data which would help in scheduling appointments and carrying out further operations. This enhances the overall dental services which improve the procedures and provide a smooth experience to the patients.

Rising Investments and partnerships

The increasing need for digital health solutions in developing regions is leading to the increasing demand for health infrastructure and access to the latest technologies. Many governments promote the expansion of health infrastructure through partnerships to enhance the services for individuals in the dental charting software market.

The general dentistry segment held the largest share of the market in 2023. General dentistry practitioners offer regular checkups, gap filling, regular cleanings, and many more. These services cover a large audience as many people usually visit dental professionals for these issues. These services are considered to be the main reason behind such a high demand for general dentistry practitioners.

Due to the increasing demand, the number of general practitioners has been rapidly increasing in developed and developing regions. Individuals usually refer these professionals in case of any dental service needs due to their availability. The rising number of common dental issues is leading to a greater increase in the demand for this software, which plays an important role in the development of the dental charting software market.

Zumax, a leading manufacturer of dental surgical magnification devices, is expanding its focus from endodontics to general practice by promoting oral microscopy technology, enhancing training for private clinics, and broadening its scope to various dental specialties.

The specialized dentistry segment is expected to register the fastest growth in the dental charting software market during the forecast period. The increasing influence of social media has been playing a vital role in attracting more audience due to the rising trend for aesthetics. Dental professionals have many specializations like orthodontics, periodontics, endodontics, prosthodontics, and many more.

The ongoing technological advancements in dental health solutions are also leading to higher expectations from individuals. Specialized dentists use advanced methods like digital scanners, 3D scanning, laser dentistry, and many more to cure patients. These tools and methods stand out as reliable methods to individuals due to the enhanced results they provide. Indirectly, the growth of the specialized segments is attributed to the technologies that help provide unique solutions to consumer preferences.

The solo practitioner's segment dominated the market in 2023. The customer preference towards solo practitioners has increased due to their strong demand over the past few years. Solo practitioners tend to build strong relationships with their patients over time, which creates a strong public relations PR and helps them gain more popularity. Individuals have preferred solo practitioners over time due to the ease of medical processes without any significant complications. This has widely increased the solo dental clinic setups all over the world. The patients also get a proper attention-based service, which makes the process more efficient. These convenient dental services provided by solo practitioners have played a key role in the growth of the dental charting software market.

The dental chains segment is expected to register the fastest growth in the market from 2024 to 2033. Dental chains have more access to new technologies due to their higher investment capabilities. These chains are attracting a significant customer base with their brand name and value. The chains make bulk purchases in their setups, which costs less than the solo; this could also have a positive effect on the service charges. Many chains are increasing the adoption of multiple services, which helps in attracting a wider customer base. The growing significant interest in dental chains could play a key role in the development of the dental charting software market.

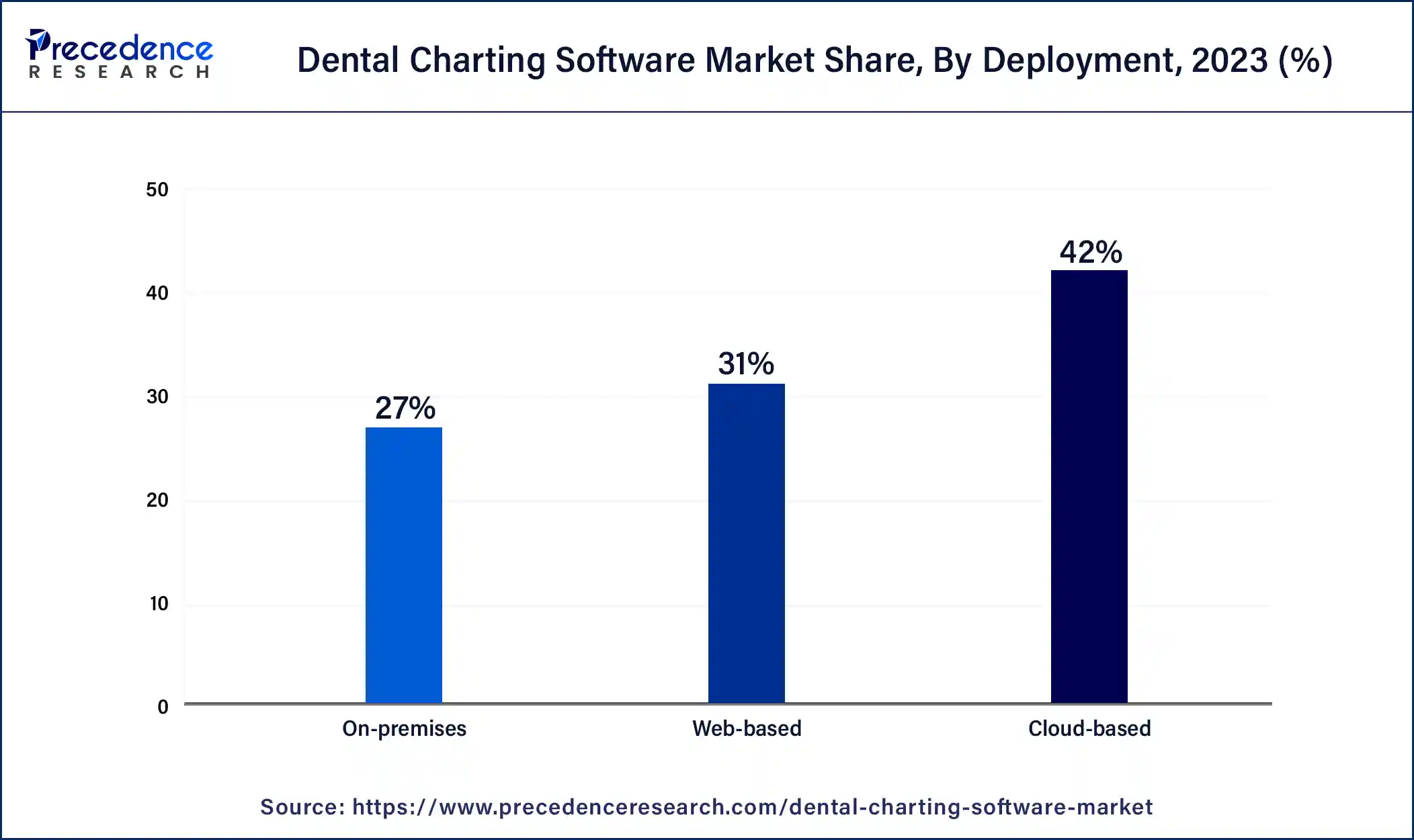

The cloud-based segment held the largest share of the market in 2023. The growth of cloud-based services is attributed to the accessibility provided by these servers. Cloud-based servers don’t require an established infrastructure, which reduces the initial costs. The dental staff can access the patient data from anywhere, which eliminates the need for a geographical dental setup. These servers are maintained regularly to ensure the safety of the patient's sensitive medical data and history. The flexibility of these services is driving significant attention, fueling the growth of the dental charting software market.

The web-based segment is expected to grow at the fastest rate in the dental charting software market over the forecast period. The dental staff can access all the information through web browsers with any device. This allows the user to access the data with ease and without any physical presence. The rising number of high-speed internet connections is one of the major contributors to the increasing popularity of web-based services.

Segments Covered in the Report

By Type

By Size

By Deployment

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023