January 2025

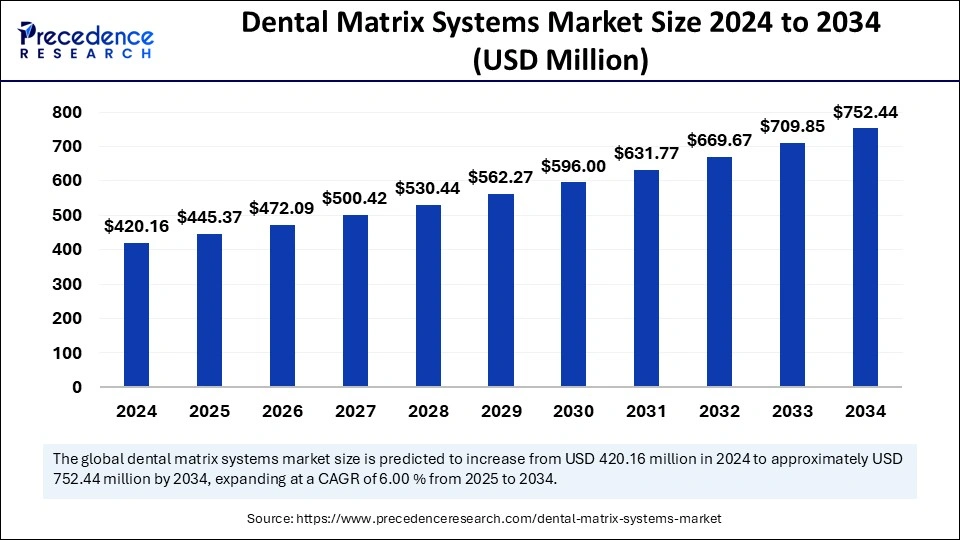

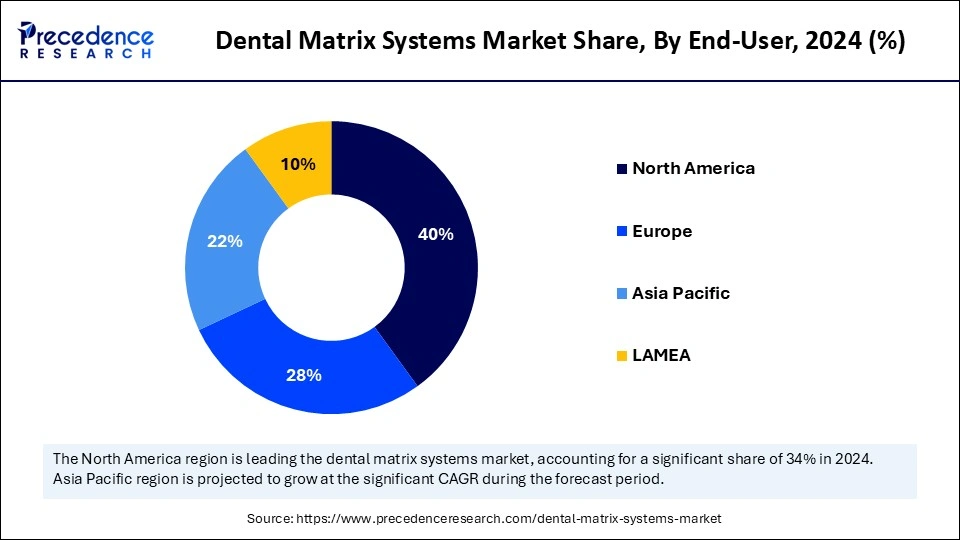

The global dental matrix systems market size is calculated at USD 445.37 million in 2025 and is forecasted to reach around USD 752.44 million by 2034, accelerating at a CAGR of 6% from 2025 to 2034. The North America market size surpassed USD 168.06 million in 2024 and is expanding at a CAGR of 6.13% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental matrix systems market size accounted for USD 420.16 million in 2024 and is predicted to increase from USD 445.37 million in 2025 to approximately USD 752.44 million by 2034, expanding at a CAGR of 6% from 2025 to 2034. The emerging need of people to recreate natural teeth and protect adjacent teeth by improving restoration longevity is expected to boost the growth of the dental matrix systems market during the forecast period.

Artificial intelligence algorithms help in the analysis of dental images, such as 3D scans and X-rays, and the detection of anomalies to improve diagnosis. AI also helps to analyze electronic medical records and genetic information to predict certain diseases and patient outcomes. AI can also suggest a personalized treatment plan, including the optimal matrix system selection, by analyzing a patient’s medical history and genetic makeup. AI analyzes various compounds and predicts the potential efficacy of drugs to accelerate the drug discovery process. AI assists doctors with real-time recommendations based on medical evidence and guidelines.

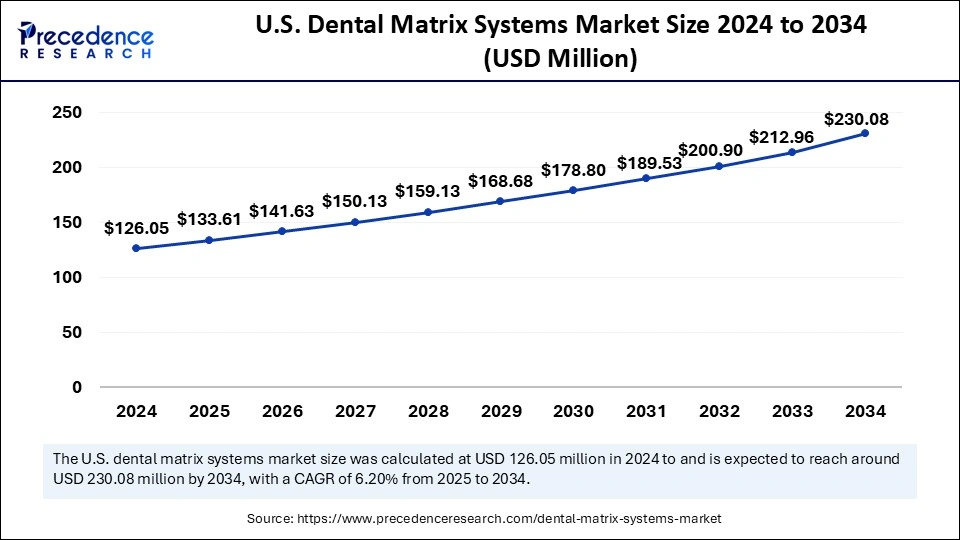

The U.S. dental matrix systems market size was exhibited at USD 126.05 million in 2024 and is projected to be worth around USD 230.08 million by 2034, growing at a CAGR of 6.20% from 2025 to 2034.

North America dominated the dental matrix systems market in 2024. The regional market growth is driven by the heightened adoption of different forms of restorative dentistry. There is a high adoption of dentures among the U.S. population, especially those aged one. According to the statistics by Impressions Dental, around 42.46 million Americans will use dentures by the end of 2025. The growing aging population in the region and increasing instances of tooth loss drive the need for dental matrix systems and other dental care solutions. Moreover, the high consumption of sugar and harmful substances by people led to oral health challenges.

American women are facing more oral and dental health issues than men, which may be due to hormonal changes during pregnancy and menopause. Teenagers are also dealing with tooth loss due to genetic predisposition, contact sports accidents, and worsening oral health. According to the 2024 Oral Health Surveillance Report by the U.S. Centers for Disease Control and Prevention, Mexican American children faced a high incidence of untreated tooth decay, and they had the highest number of filled primary teeth.

The Growing Trend of Teledentistry and Preventive Dental Visits in the U.S.

The American Dental Association (ADA) revealed the 2024 State of Oral Health report and aims to encourage U.S. adults and children to focus on their good oral care habits. It also aims to make them strictly aware of preventive dental visits. According to the Delta Dental Plans Association (DDPA), about 83% of American adults visited dentists with dental insurance coverage, while 58% of adults visited dentists without coverage. The majority of the American and the U.S. population, especially 86% of adults, are aware of the benefits of dental insurance coverage to receive the necessary oral and dental care in 2024. Moreover, there is a wide adoption of teledentistry among the U.S. population, a digital care solution that provides patients with consultations, evaluations, and advice remotely through mobile applications and video calls. Most people encourage others by spreading their word about the importance of preventive checkups in reducing the chances of serious dental issues. The rise in preventive dental visits among adults in 2024 is expected to accelerate the significant growth of the dental matrix systems market.

Asia Pacific is seen to grow at the fastest rate in the dental matrix systems market in the upcoming years. The rising prevalence of dental issues and the rising government investments to improve dental care boost the growth of the market in the region. The Dental Council of India (DCI), the Ministry of Health, and the International Dental Federation (IDF) contribute to dental health and regulations. The Government of India provides funding to the Dental Council of India, which stands strong to regulate the dental education and profession of dentistry all across India. The General Body of the Dental Council of India plays a major role in representing dental colleges, the central government, state governments, universities, etc.

The Indian Dental Association (IDA) focuses on the oral health of communities, oral health products, medical emergencies, dental emergencies, etc. The National Oral Health Program (NOHP) was organized by the Indian Dental Association (IDA), which encompasses several initiatives for the nation. In February 2024, Dr. Mansukh Mandaviya, the Union Minister of Health and Family Welfare, announced the inauguration of the new headquarters of the National Dental Commission (NDC) and laid the foundation in 3 nursing colleges in Andhra Pradesh and 1 in Jammu and Kashmir. He also signed a memorandum of understanding (MoU) between the Dental Council of India and the Quality Council of India for assessing and rating undergraduate dental colleges. Moreover, he also announced the launch of the National Dental Register under the National Health Digital Mission.

Dental and Oral Healthcare Initiatives in Singapore

In October 2024, the National University Centre for Oral Health (NUCOHS) in Singapore announced the launch of a new program that aims to make dental education fun for children. This program makes efforts to engage both parents and children in pediatric dentistry. It also meets the challenges associated with a low awareness of children’s oral hygiene in Singapore. It will assist children in feeling at ease with the dentist while undergoing any dental care treatment. The NUCOHS also launched a dental care initiative for patients at the Viva-University Children's Cancer Centre in January 2023. Personalized oral health guidance is provided by the pediatric dental team of the NUCOHS, which is designed on the basis of age, procedures, and therapies for children.

Europe is seen to grow at a notable rate in the dental matrix systems market in the foreseeable future. The Federation of European Dental Competent Authorities and Regulators (FEDCAR) holds a code of conduct for European dentists to comply with professional rules and fairness towards clients and other team members. The FEDCAR makes efforts to unite councils, European chambers, and public bodies that play a vital role in regulating, registering, and supervising dental practitioners. The growing number of dentists and the changing health workforce in Europe are contributing to dynamic changes in dental care. The various private equity firms are providing dental care in group practices. The increased shift towards more preventive therapies and policies for oral health and dental treatments also drives the European market’s growth significantly. The rising prevalence of dental caries, oral health diseases, and periodontal diseases among most of the European adult population boosts the expansion of the dental matrix systems market in the coming years.

Oral Health Initiatives Became the Basis for Dental Care in the UK

The Oral Health Foundation, based in the UK, aims to reduce the incidence rates of oral health diseases across the country. It also aims to improve access to all oral health information and services, along with improving the dynamic role of those services for people. This foundation encourages people to become healthy to work at workplaces and schools by accessing better policies and trusted information. It protects the population by ensuring and delivering promising and high-quality products. It has set a 5-year strategy aiming at organizing several new oral health initiatives on sugar, alcohol, dementia, smoking, and drug awareness. The ‘Better Oral Health for All’ is a new strategy introduced by the Oral Health Foundation to meet the growing demands regarding the oral health of people.

The dental matrix systems provide adherence to the surface of the restored tooth and replicate its anatomical features, which deliver dentition support, arrangement, balance, and care. These are excellent options among several procedures and materials when treating missing tooth structures. The growing concerns related to the reconstruction of lost tooth structure caused by injury, caries, and erosion are being resolved by the progress of the dental matrix systems. In June 2024, Dentsply Sirona and Siemens Healthineers presented a scale model of the first dental-dedicated Magnetic Resonance Imaging device. The growing demand for cosmetic repair and a minimally invasive restorative technique also fosters the growth of the dental matrix systems market. Furthermore, the ideal characteristics of dental matrices include rigidity, flexibility, stability, compatibility, minimal thickness, and optimal transmittance boosts their adoption.

| Report Coverage | Details |

| Market Size by 2034 | USD 752.44 Million |

| Market Size in 2025 | USD 445.37 Million |

| Market Size in 2024 | USD 420.16 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End -User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising Need for Restorative Dentistry

The growing trend of restorative dentistry and the rising dental tourism are driving the growth of the dental matrix systems market. The adoption of technologically advanced products and dentistry solutions has increased, especially in developing economies. These technological advances raised the effectiveness of dentistry services. The rising incidence of dental problems and the growing awareness about oral or dental care are further boosting the growth of the market. The prevalence of tooth decay, dental caries, and gum diseases is increasing worldwide, boosting the demand for dental treatment options, including restorative dentistry. The rapid expansion of well-equipped healthcare facilities across the world upholds the importance of dental matrix systems.

Concerns Associated with Technical Glitches

There are growing concerns about the precise delivery of treatments, products, and services. Technical problems hamper the growth of the market by introducing unexpected outcomes. Moreover, choosing the right matrix system from a wide array of matrix systems is crucial but challenging for dentists. The post-restoration complications can also cause problems like sensitivity and inflammation. The dentists may face challenges in placing the optimal contacts during matrix placement, and there can be poor wedge placements leading to undesired outcomes.

Expanding Oral and Dental Healthcare Programs

The rising number of government-led oral and healthcare programs to spread awareness among the population about health and well-being creates immense opportunities in the dental matrix systems market. As people become more aware, hospital visits for regular dental checkups rise, which further boosts the demand for dental matrix systems. The great accessibility to routine checkups such as root canals, crowns, maxillofacial procedures, fillings, and bonding treatments is anticipated to fuel the market. The availability of several product types and their adoption by different end-users significantly upholds the market’s growth. The Government of India initiated the National Oral Health Program, which aims to reduce morbidity from oral diseases, improve oral health, integrate oral healthcare services, and encourage public-private partnerships. The dental unit established by the Government of India is well-equipped with manpower, consumables, and equipment. The National Oral Health Cell (NOHC) plays a vital role in implementing and monitoring the progress of the National Oral Health Program.

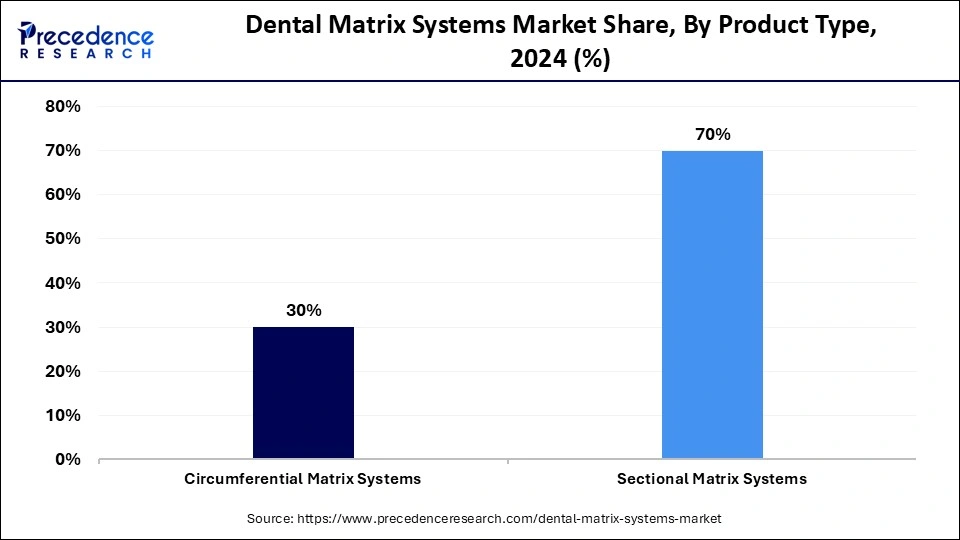

The sectional matrix systems segment dominated the dental matrix systems market in 2024. The potential role played by these systems, irrespective of situations such as difficult restorations, wide cavities, and missing cusps, boosts their demand among dental professionals. The exceptional stability due to nickel titanium retaining rings also proves their significance in the market. They enable healthcare professionals to maintain a sterile working environment by preventing contamination through optimal isolation. They can replicate natural contours due to the presence of anatomically shaped matrix bands. Dentsply Sirona recently developed its sectional matrix system named Palodent V3 that ensures natural contours and consistent outcomes.

The circumferential matrix systems segment is expected to grow at the fastest rate during the forecast period. These systems offer various advantages, such as the creation of tight and optimally positioned contact points. Moreover, the versatility, ease of usage, and reversible positioning options offered by these systems boost their demand among dental practitioners. These systems enhance patient comfort and experience. Moreover, they offer optimized access to instruments and a clearer view of the operating field. A single-use eliminates cross-infection risk and drives the significance of these systems.

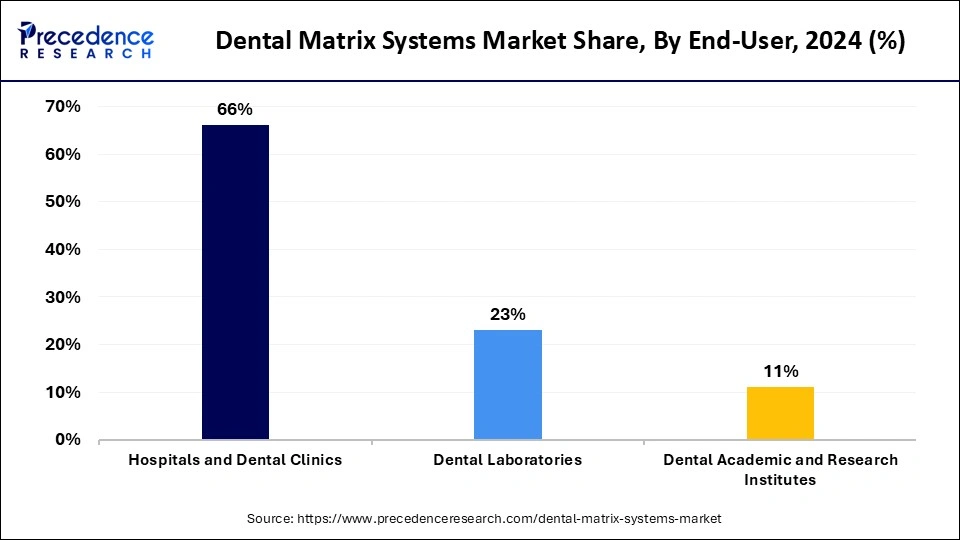

The hospitals and dental clinics segment dominated the dental matrix systems market in 2024. The growth of the segment is driven by the rise in patient volumes in these settings. The preventive care and early detection of dental or oral problems offered by hospitals and dental clinics are increasing patient volumes. Hospitals and dental clinics are often well-equipped with advanced technologies, such as laser treatments, digital X-rays, and 3D imaging, ensuring diagnostic accuracy and treatment outcomes. Professional experts, such as dentists, hygienists, and specialists in dental clinics and hospitals, help provide expert care and advice. These settings offer a wide range of services, including routine examinations, cleanings, fillings, and extractions, further supporting segmental growth.

The dental laboratories segment is observed to grow at the fastest rate during the predicted timeframe. Streamlined communication between the dental team and the laboratory technician helps to minimize errors and offer timely treatment. Quality control in laboratories ensures rigorous quality standards throughout production. Dental laboratories also provide customized solutions, enabling patients to actively participate in the design process, ensuring perfect final results. The enhanced collaboration between the dental team and laboratories boosts real-time feedback and a more coordinated treatment process. The high investments in quality materials by dental laboratories enhance the aesthetic appeal of the final result.

By Product Type

By End-User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023