January 2025

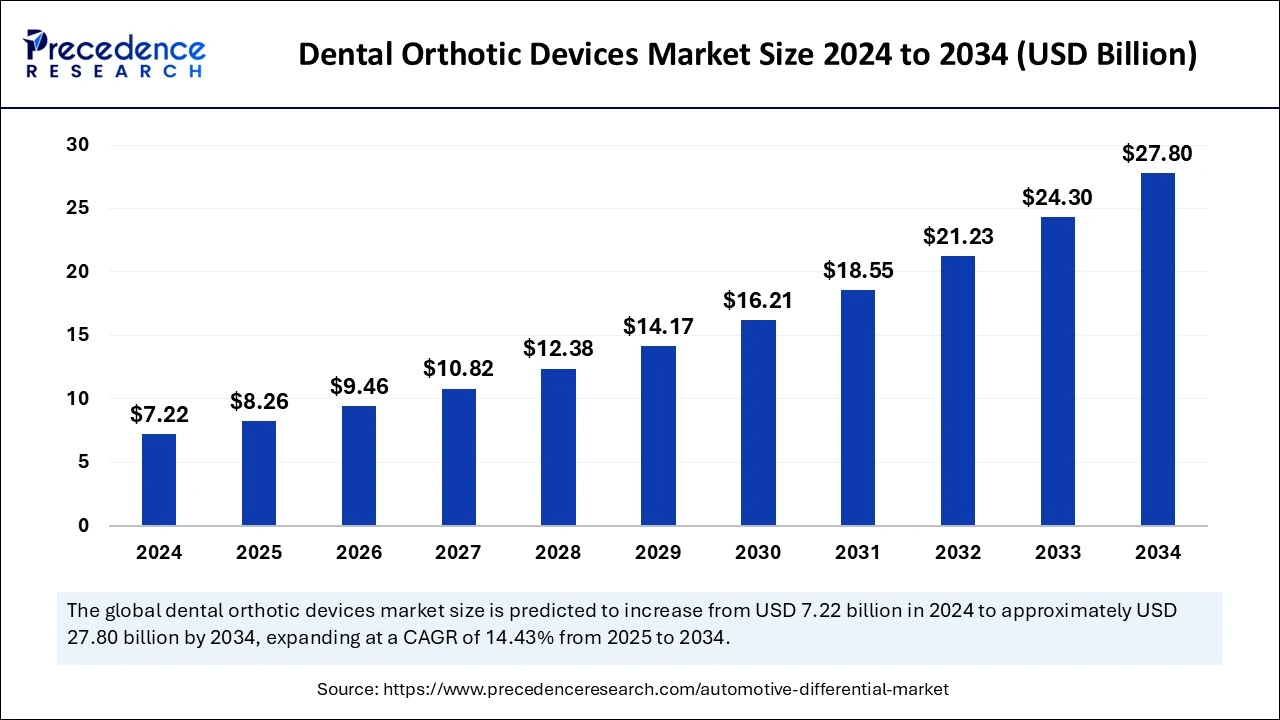

The global dental orthotic devices market size is calculated at USD 8.26 billion in 2025 and is forecasted to reach around USD 27.80 billion by 2034, accelerating at a CAGR of 14.43% from 2025 to 2034.

The global dental orthotic devices market size accounted for USD 7.22 billion in 2024 and is expected to exceed USD 27.80 billion by 2034, growing at a CAGR of 14.43% from 2025 to 2034. The dental orthotic devices market is driven by increasing dental disorders, technology, awareness, aesthetics, dental treatment involving cosmetics, the aging population, insurance facilities, and personalized treatments.

Artificial intelligence and machine learning have been supporting healthcare professionals to offer better analysis and efficacy in treatment. Technological advancements continue to be a major driver of the dental orthotic devices market, with innovations in AI, automation, and IoT enhancing operational efficiency and product offerings. Such advancements enable organizations to enhance the effectiveness of their functioning, minimize expenses, and satisfy customers’ emerging needs. These AI systems can identify diseases such as tooth decay, bone fractures, and tumor growth and thus help dentists make more accurate predictions of potential diseases, thus enhancing patients’ experience.

Dental orthotics are removable devices that fit over teeth to treat bite misalignments and other conditions. Dental orthotic devices, also known as occlusal splints, are mouth guards that are specially created for individuals with temporomandibular joints (TMJ), and teeth-grinding habits. It can be used in the management of temporomandibular joint disorder, sleep apnea, and bruxism. In TMJ conditions, dental orthotic devices support jaw strength, improve jaw-supporting muscle function, and shield teeth from wear and tear.

Orthotic devices provide the correct positioning of the teeth. People are paying attention to cosmetic dentistry, which has become an added advantage for the dental orthotic devices market. Consumers are focusing on enhancing the appearance of their oral structures, leading to a heightened need for special devices that provide both functional and cosmetic benefits.

| Report Coverage | Details |

| Market Size by 2024 | USD 7.22 Billion |

| Market Size in 2025 | USD 8.26 Billion |

| Market Size in 2034 | USD 27.80 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.43% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing awareness among consumers regarding oral hygiene

The growing consciousness of consumers toward oral care creates a positive impact on the dental orthotic devices market. People's growing focus on beauty has compelled them to look for prostheses, technological advancements, and product innovations, which have boosted the market. The evolution of technology for the enhancement of surgical treatment is expected to bring opportunities to the market. The importance of personal hygiene has led to an increase in demand for orthodontic surgeries and dental appliances such as orthotics. Therefore, it contributes to the enhanced treatment and efficient way of dental surgery.

Expenses associated with dental orthotic devices

The major limiting factor experienced in the dental orthotic devices market is the cost factor they come with. Since they are specially designed from costly materials and they are constructed by experts, they are expensive for the majority of people. This high price makes the devices exclusive, for the people. Consequently, the growth of the market is hampered since the majority of people may not be able to afford these products. In addition, a lack of awareness in some regions reduces the global acceptance of dental orthotic devices.

Increasing technological advancement

Advancements in materials, strategies for production, and materials utilized in digital dentistry play a significant role in creating enhanced and comfortable orthotic goods. The technological innovations associated with dental orthotic devices include 3D printing technology, intraoral scanning technology, and smart bracket technology. It is possible to deliver dental care with high accuracy and efficiency and also to personalize treatment. Additionally, the surge in demand involves the use of minimally invasive procedures. These lasers are applied in surgical procedures like gum raising and surgery to whiten teeth without causing blood loss and problems of pain in the patients.

The anterior repositioning dental orthotic devices segment noted the largest dental orthotic devices market share in 2024. The anterior repositioning splint is a dental appliance that is used in the management of TMJ disorders. It is also known as an orthopedic repositioning appliance. An anterior repositioning appliance permits the healing of the methodical tissues, redistributes forces within the complex, and supports condylar remodeling. Such appliances have been applied by practitioners to treat anterior displacement with or without reduction, tension headaches, and various intracapsular conditions.

The anterior bite plane dental orthotic devices segment is projected to witness the fastest growth during the forecast period. An anterior bite plane (ABP) is a removable orthodontic appliance that is worn over the upper anterior teeth to prevent the back teeth from touching. It is utilized to address a range of problems, such as teeth clenching, facial pain, and TMJD problems. The anterior bite plane splints are employed to search for centric relation because the muscles of mastication are deactivated with the device, this enables the jaw to fit in the joint space with ease. It can aid with reducing tooth wear due to grinding, Reducing muscle pain and tension, Diagnosing muscle and joint pain issues, and disabling deep overbite, and temporomandibular joint (TMJ) disorders.

The hospital pharmacies segment led the global dental orthotic devices market in 2024, owing to their established positioning in delivering various forms of dental orthotic products. Patients prefer to purchase their devices from hospital pharmacies, as these outlets offer quality products and consulting, especially if the buyers need some specific equipment for chronic diseases, injuries, or surgeries. The use of dental orthotics within hospital facilities enhances their role in the market.

The online pharmacies segment is projected to witness the fastest growth during the forecast period due to growing consumer preference for comfort and the opportunity to buy dental orthotic devices without leaving home. Internet shops provide consumers with several products, and at a lower price compared to real shops, thus making their services appealing to everyone. Furthermore, improved technology such as e-commerce platforms, and rapid delivery of the products have contributed to the growth of online pharmacies.

North America accounted for the largest share of the dental orthotic devices market in 2024 due to the growing geriatric population, advancement in technologies in market segments such as dental care, and the presence of large manufacturers. Most companies in this region engage in the direct selling of products that enhance their market position. The investment in research and development is capable of producing remarkable results. The United States and Canada are ranked as the biggest consumers of the online market and have great demand for products in various sectors, including improved technology.

Asia Pacific is anticipated to witness the fastest growth in the dental orthotic devices market during the forecasted years. Asia Pacific is expected to grow significantly higher due to the concentration of population, worsening dental health state, and use of dentistry procedures. Market development is facilitated by the higher penetration of advanced technologies and continuous investments in infrastructures and manufacturing. The increasing middle-class population and surging consumer demand for innovative solutions also accelerate growth.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023