January 2025

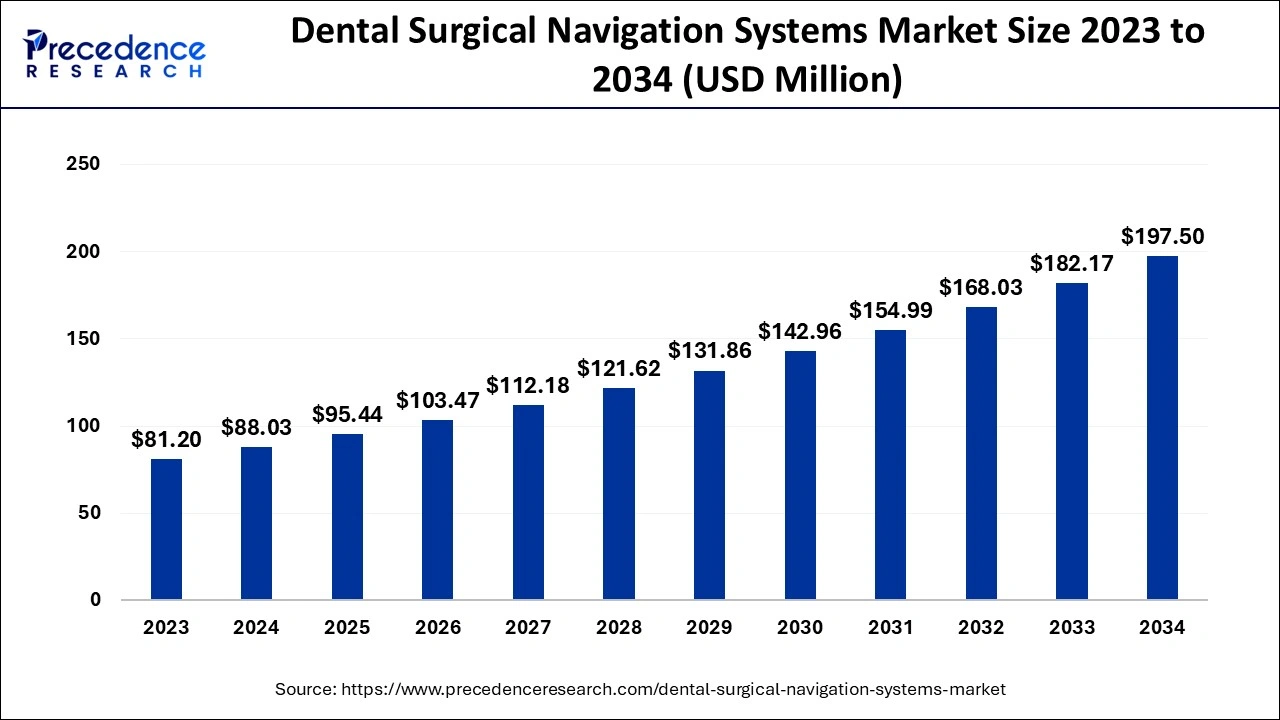

The global dental surgical navigation systems market size is evaluated at USD 88.03 million in 2024, grew to USD 95.44 million in 2025 and is projected to reach around USD 197.5 million by 2034. The market is expanding at a CAGR of 8.41% between 2024 and 2034. The North America dental surgical navigation systems market size is calculated at USD 33.45 million in 2024 and is estimated to grow at a CAGR of 8.47% during the forecast period.

The global dental surgical navigation systems market size accounted for USD 88.03 million in 2024 and is projected to reach around USD 197.5 million by 2034, growing at a CAGR of 8.41% from 2024 to 2034. The dental surgical navigation systems market is driven by the rise in interest in minimally invasive dental procedures.

North America dominated the dental surgical navigation systems market in 2023. Advanced surgical navigation systems are becoming more and more necessary as dental operations become more popular and oral hygiene and preventive care become more important. The best technology is exclusively used in dental procedures due to the strict regulations set by regulatory bodies, which enhances the standing of North American goods. Growing consumer concerns about appearance have led to an increase in the need for cosmetic dental procedures.

Asia Pacific is observed to host the fastest-growing dental surgical navigation systems market during the forecast period. There is a noticeable increase in consumer awareness of dental health, which is driving up the need for regular dental examinations and operations. A number of governments are in favor of dental health programs and the construction of additional dental facilities that are outfitted with cutting-edge equipment. Access to cutting-edge dental procedures and technologies is also made easier by the expansion of private healthcare.

The dental surgical navigation systems market is a subset of the healthcare industry that focuses on systems and technologies designed to assist dental practitioners in performing surgical procedures with more accuracy and precision. With precise location data from dental surgical navigation systems, surgeons can perform more exact incisions and placements, potentially improving patient outcomes. Dental navigation systems' capabilities are constantly being improved by imaging technologies and software advances, propelling the market's continued expansion.

How is AI helping the Dental Surgical Navigation Systems Market Grow?

Devices with artificial intelligence capabilities can combine information from multiple sources, including medical records, intraoral scanning, and 3D imaging. This integration in the dental surgical navigation systems market facilitates surgical preparation and navigation by offering a thorough perspective of the patient's anatomy. Furthermore, by providing individualized information regarding treatments, healing, and results, AI-driven solutions can improve patient involvement and education. As a result, customer satisfaction and confidence in dental care may increase.

| Report Coverage | Details |

| Market Size by 2034 | USD 197.5 Million |

| Market Size in 2024 | USD 88.03 Million |

| Market Size in 2025 | USD 95.44 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.41% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing preference for minimally invasive surgeries in dentistry

By speeding minimally invasive treatments and providing precise navigation and real-time imaging during surgeries, this technology helps dentists conduct difficult procedures with more accuracy, minimizing the need for large incisions and improving patient outcomes. Patients choose dental procedures that minimize pain and expedite healing at a growing rate, and these alternatives typically result in less tissue damage, which enhances patient comfort during surgery and speeds up the healing process.

Regulatory challenge

Diverse nations and areas have very diverse regulations for the dental surgical navigation systems market. Businesses that conduct business abroad must manage several regulatory frameworks, which adds to the complexity and expense of compliance. Investment in emerging technology may be discouraged by this unpredictability. Manufacturers may operate risk-averse because of fear of regulatory scrutiny. Businesses may place more emphasis on modest advancements than radical breakthroughs, which might stall the expansion of the market and develop technology. Due to the high expense of compliance, larger companies may be more inclined to combine or acquire, which would lessen competition and possibly drive up the cost of dental surgical navigation systems.

Incorporation of artificial intelligence (AI)

Artificial Intelligence in the dental surgical navigation systems market has the potential to process enormous volumes of data from imaging devices (such as MRIs and CT scans) to produce accurate 3D representations of anatomical structures in patients. With complex instances like implants or surgeries involving many anatomical elements, these models help dental surgeons plan procedures effectively. Artificial intelligence can help dental professionals with their simulation training by offering realistic environments for practicing surgical techniques. Prior to using these techniques on real patients, this training can improve abilities and confidence.

The optical segment dominated the dental surgical navigation systems market in 2023. Optical navigation systems utilize modern imaging technology, such as digital cameras, to track instruments and guide dental procedures. Compared to the conventional techniques, these solutions provide greater navigational accuracy. Because optical navigation systems are more precise during surgery, less stress is placed on the surrounding tissues, which speeds up recovery and decreases pain for patients after surgery. Because of their shorter recovery times and decreased issues, optical navigation systems are ultimately a more affordable solution for dental clinics, even with their initial high cost.

The electromagnetic segment will witness significant growth in the dental surgical navigation systems market during the forecast period. Systems that use electromagnetic navigation allow for the real-time tracking of dental equipment. This reduces the possibility of mistakes and improves patient outcomes by increasing accuracy and precision when implant placement and surgical procedures are carried out. Insurance companies may offer more favorable payment policies for procedures carried out using electromagnetic guiding as they become aware of the advantages of modern surgical navigation, which would encourage dental professionals to use these technologies.

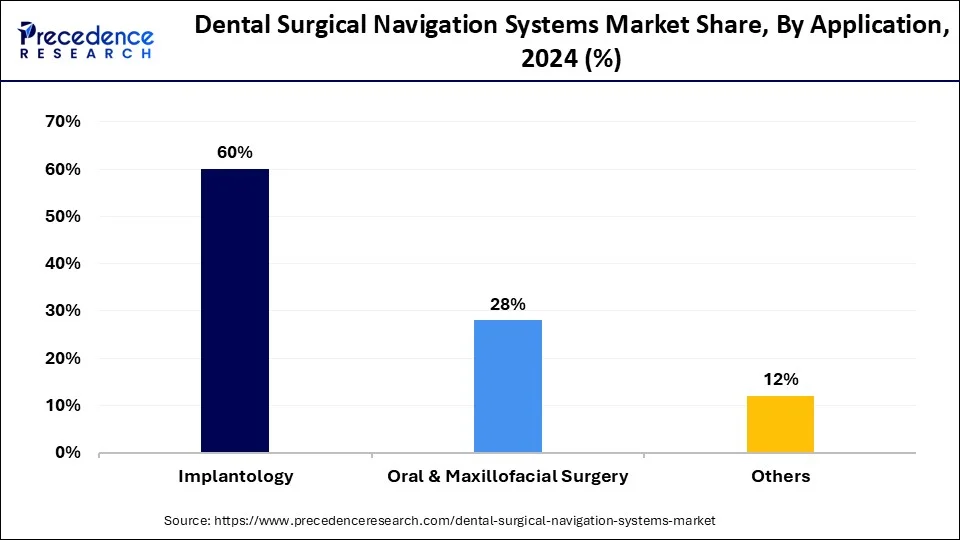

The implantology segment led the global dental surgical navigation systems market in 2023. There is an increasing need for dental implants as a preferred restorative option due to the rising occurrence of dental problems, such as tooth loss from decay, accident, or periodontal disease. Minimally invasive implant insertion is made possible by navigation systems, which eliminates risks associated with older procedures, expedites recovery, and lessens patient discomfort. Manufacturers encourage dental practitioners to adopt dental surgical navigation systems, who frequently hold workshops and seminars to showcase their devices and encourage participation.

The oral surgery segment is projected to witness rapid expansion in the dental surgical navigation systems market during the forecast period. Patients increasingly prefer less invasive surgical procedures that will need shorter recovery periods and lower the risk of problems after surgery. These operations are made easier by navigation devices, which enable more accurate incisions and less tissue damage while operating. Surgeons are becoming more aware of and proficient with modern surgical navigation systems as a result of increased training programs, which is driving up adoption rates.

The solo practices segment held the largest share of the dental surgical navigation systems market in 2023. Modern dentistry practices are using them more often on their own to differentiate their services and improve patient care. Dental surgical navigation systems are vital instruments that can provide improved results for intricate dental surgeries like implant placements. They provide precise, real-time tracking throughout procedures. By reducing the amount of time needed for each surgery, surgical navigation systems enable solo practitioners to serve more patients each day.

The DSO/group segment is observed to witness the fastest growth in the dental surgical navigation systems market during the forecast period. Economies of scale help large group practices by enabling them to buy cutting-edge surgical technologies dispersed among several locations at a lower cost. This financial benefit expedites the deployment of dental surgical navigation systems by increasing their accessibility for DSOs. Because they have a larger patient base and infrastructure, group practices, especially those operating under DSOs, are more likely to invest in expensive surgical instruments. Advanced technologies such as navigation systems can be made financially feasible by DSOs through their purchasing power and the standardization of care across several offices.

Segments Covered in the Report

By Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023